Press release

National Tax Debt Offers Help Amidst IRS Collections

Image: https://www.getnews.info/wp-content/uploads/2024/08/1724781499.pngThe Internal Revenue Service (IRS) is gearing up to intensify tax collections after a temporary lull during the COVID-19 pandemic. This heightened focus is largely due to increased funding from the Inflation Reduction Act, which has enabled the IRS to expand its workforce and enhance its collection capabilities.

IRS Collections Resuming

Taxpayers who owe back taxes should be aware that the IRS is becoming more aggressive in its collection efforts. This means an increased likelihood of audits, levies, and wage garnishments for those who have outstanding tax liabilities.

The Impact of the Inflation Reduction Act

A key factor driving the IRS's renewed focus on collections is the additional funding provided by the Inflation Reduction Act. These funds have allowed the agency to hire more agents and staff, bolstering its capacity to pursue delinquent taxpayers. As a result, taxpayers can expect to see a more assertive IRS in the coming months and years.

Available Relief Options

While the IRS is ramping up collections, there are still options available for taxpayers facing financial difficulties. One such option is an Offer in Compromise (OIC), which allows qualified taxpayers to settle their tax debt for less than the full amount owed.

Additionally, taxpayers experiencing significant financial hardship may qualify for Currently Non-Collectible (CNC) status. This designation prevents the IRS from taking collection actions, such as levies or wage garnishments, while the taxpayer is enrolled in the CNC program.

Seeking Professional Help

Navigating the complex world of tax debt can be overwhelming. Taxpayers facing IRS issues may benefit from seeking professional assistance from a qualified tax resolution firm. Such firms have the expertise to assess individual situations and recommend appropriate strategies to resolve tax problems.

National Tax Debt: A Trusted Partner

National Tax Debt is a company dedicated to helping individuals and businesses overcome their tax challenges. With over 80 years of combined experience, their team of CPAs and certified tax professionals has a proven track record of success in resolving IRS issues.

Whether you're dealing with unfiled tax returns, levies, or wage garnishments, National Tax Debt can provide the guidance and support you need. Their commitment to client satisfaction and their ability to work with taxpayers facing various financial circumstances make them a reliable partner in navigating the tax resolution process.

Conclusion

The resurgence of IRS collections underscores the importance of staying current with tax obligations. While the situation may seem daunting, taxpayers should be aware of the available relief options and consider seeking professional assistance if needed. By taking proactive steps, individuals and businesses can protect their financial well-being and minimize the impact of IRS collections.

About National Tax Debt

National Tax Debt is a tax resolution firm specializing in helping clients resolve their IRS tax problems. With a team of experienced CPAs and certified tax professionals, the company offers comprehensive solutions tailored to individual needs.

Media Contact

Company Name: National Tax Debt

Contact Person: Diana Winfrey

Email: Send Email [http://www.universalpressrelease.com/?pr=national-tax-debt-offers-help-amidst-irs-collections]

Phone: 866-362-6469

Country: United States

Website: http://www.nationaltaxdebt.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release National Tax Debt Offers Help Amidst IRS Collections here

News-ID: 3638168 • Views: …

More Releases from Getnews

The Construction Expert of Florida Emerges as One of South Florida's Fastest Gro …

Image: https://www.globalnewslines.com/uploads/2026/02/16fb37d10ebb215fa7b142d74253390d.jpg

South Florida, FL - In one of the most competitive roofing markets in the country, The Construction Expert of Florida is quickly becoming recognized as one of South Florida's fastest growing roofing companies, setting a new standard for professionalism, continuing education, and structured project execution across residential, multifamily, and commercial properties.

Founded by Matt Allen, the company has built its reputation not on short-term volume, but on disciplined growth, advanced…

Independent Author Flip McGyver's The Alkaline Life Diet Series Surpasses Dr. Se …

Image: https://www.globalnewslines.com/uploads/2026/02/f56c067ea35fee98436704b4fc4ad501.jpg

In an era where traditional publishing giants dominate the marketplace, independent author Flip McGyver has achieved what many consider impossible. His The Alkaline Life Diet [TheAlkalineLifeDiet.com] series has officially surpassed the book sales of Dr. Sebi, long regarded as one of the most influential voices in the alkaline and natural health movement. With this milestone, Flip McGyver [http://flipmcgyver.com/]'s series now stands as the #1 alkaline diet book series in…

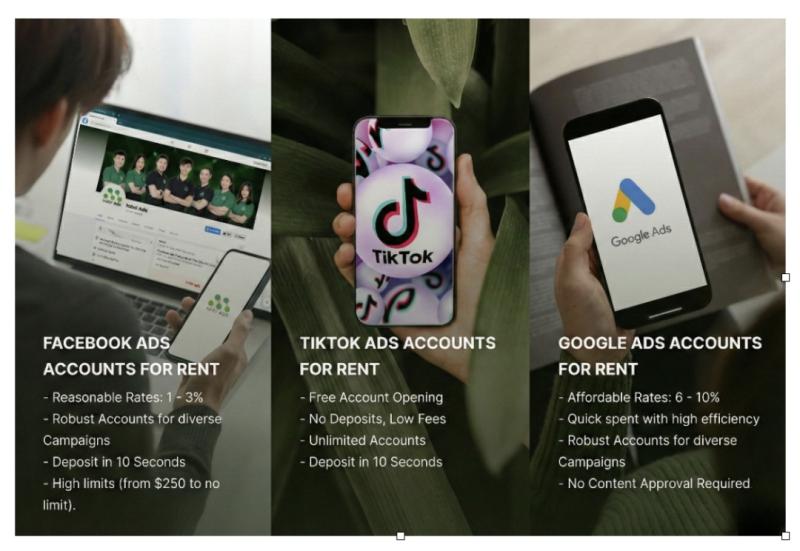

NEMI Ads Agency Introduces Reliable, High-Trust Ad Account Rental Solutions to P …

Image: https://www.globalnewslines.com/uploads/2026/02/72581e5defd0d814b519c77c141b9c5b.jpg

In today's high-stakes digital advertising landscape, campaign stability is essential to sustained success. Performance marketers and growing brands frequently encounter challenges such as unexpected account suspensions, restrictive spending limits, and compliance-related interruptions-barriers that can significantly hinder scaling efforts.

NEMI Ads Agency has positioned itself as a trusted provider of professional ad account rental solutions, offering advertisers the infrastructure and technical support needed to maintain uninterrupted campaign performance across major platforms.

High-Performance…

Right Hand SeniorCare Highlights Specialized Home Care for Veterans in Northshor …

Image: https://www.globalnewslines.com/uploads/2026/02/1771088806.jpg

Right Hand SeniorCare Highlights Specialized Home Care for Veterans in Northshore, LA-honoring those who served with compassionate in-home support that protects independence, dignity, and peace of mind for every family.

Right Hand SeniorCare, led by owner Heather Monoc, is spotlighting its specialized home care for veterans in Northshore, LA. Serving retired service members who want to age at home, the agency provides trained, non-medical support such as personal care, daily…

More Releases for IRS

Mobiniti Dedicated Toll-Free Numbers Handle IRS Negotiation Queries

United States, 17th Oct 2025 - Mobiniti's dedicated toll-free numbers are transforming how businesses manage IRS negotiation queries by offering a simple and effective communication tool. Through seamless integration with SMS platforms, businesses can provide clients with immediate access to dedicated lines, ensuring they receive expert assistance on tax-related matters without unnecessary delays. This solution improves customer satisfaction while streamlining the process of handling complex financial inquiries.

How Toll-Free Numbers Enhance…

The REBO Foundation Earns IRS 501(c)(3) Status

BARTLESVILLE, OK - October 15, 2025 - The Bartlesville Education Fund, operating publicly as The REBO Foundation, announced today that it has been officially recognized by the Internal Revenue Service (IRS) as a 501(c)(3) tax-exempt charitable organization, effective July 4, 2025 (EIN 39-2993969).

The REBO Foundation's mission is to build shelters, rehabilitation centers, and mental health programs throughout Oklahoma and beyond. With this IRS determination, the organization can now accept tax-deductible…

Torchlight Tax Offers Free Ebook on Understanding IRS Notices

Torchlight Tax LLC, a full service tax firm, is offering a free ebook entitled Understanding IRS Notices.

Dave Horwedel, CEO of Torchlight Tax, says that many taxpayers are confused and traumatized by receiving an IRS notice.

Mr.Horwedel stated "The IRS sends out a wide variety of notices to taxpayers that often strike fear into the heart of that taxpayer. If you understand what each type of notice is and…

Understanding IRS Notices and Navigating Effective Responses

Dealing with the Internal Revenue Service (IRS) can be a daunting task for many taxpayers. Whether it's a simple notification or a more complex issue, understanding the nuances of can significantly impact how one responds and resolves any issues presented.

Identifying Different Types of IRS Notices

The first step in managing Internal Revenue Service [https://sbkass.com/irs-notices-and-effective-responses/] communications effectively is to identify the type of notice you've received. The IRS sends various notices for…

Things you need to know about IRS tax refunds

Tax season is here, and taxpayers across the United States are finalizing their tax filing strategies, as a high tax bill is not desirable at all. Taxpayers intend to obtain as much tax deduction as possible, and several attributes affect the total amount of taxes that are to be paid by a taxpayer. Every taxpayer needs to be aware of the IRS refunds they are entitled to so they can…

New Tool Quickly Calculates IRS Settlements

Old Hickory, Tenn. - TaxProEZ, a professional tax resolution and preparation company, announces the release of a new tool that helps enrolled agents quickly by calculating settlements. Tax resolution expert Gary LaRoy is offering the tool to enrolled agents, so they can support their clients’ tax management needs.

The Internal Revenue Service (IRS) is sure to come calling when back taxes are owed. The average accountant or tax professional company may…