Press release

Insect Products as Feed Market to Reach CAGR 13% by 2031 Top 10 Company Globally

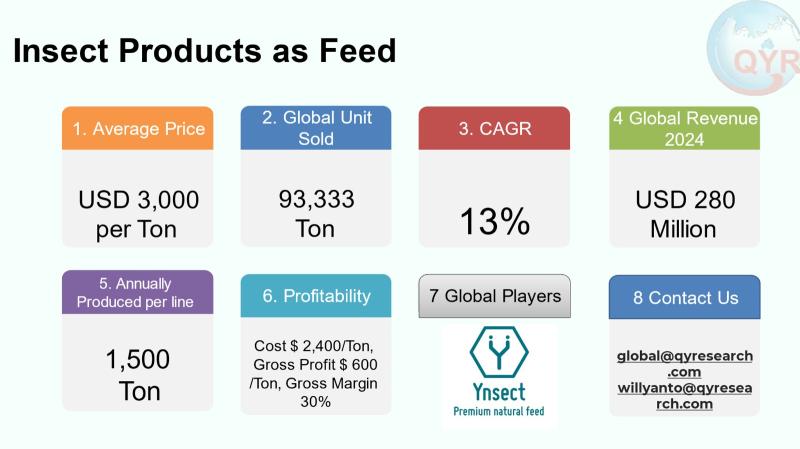

Insect products used as feed primarily protein meals and oils derived from species such as black soldier fly (Hermetia illucens), mealworms and crickets are an emergent but fast-growing segment of the alternative-protein and sustainable feed markets. The rise of insect products as feed is driven by several converging factors. The global aquaculture industry continues to expand while facing mounting pressure to reduce dependence on traditional protein sources such as fishmeal and soybean meal, which are increasingly volatile in price and environmentally intensive to produce. Insects offer a biologically efficient solution, capable of converting organic waste into protein with significantly lower land, water, and carbon footprints. Additionally, insect meal contains amino acid profiles closely matching fishmeal, making it a competitive alternative in high-performance feed formulations. The resulting circular economy model turning waste streams into animal nutrition inputs has positioned insect protein as a critical component of future sustainable food systems. The industrys demand mix is driven by aquaculture first, followed by poultry, pet food and swine/other livestock, with growing interest from specialty feeds and fertilizers (frass) markets. (Context and price comparisons with fishmeal/soy and industry-scale examples appear in cited reports and news articles below.)The 2024 global insect products as feed market size of USD 280 million in 2024 with a projected CAGR of 13% to 2031, reaching market size USD 645 million by 2031. With an average selling price of USD 3,000 per ton, implies a total of 93,333 ton sold in 2024. Factory gross margin is 30% implies factory gross profit is USD 600 per ton and cost of good of USD 2,400 per ton. A COGS breakdown is feed/substrate and substrate logistics, processing (drying, oil rendering and protein milling), labor and staffing, energy (heating/drying), packaging/logistics and a small share of overhead/compliance. A single line full machine capacity production is around 1,500 ton per line per year. Downstream demand is weighted heavily to aquaculture followed by poultry, pet food and swine/other.

Latest Trends and Technological Developments

The sectors most visible developments through 2024 to 2025 center on large-scale black soldier fly (BSF) industrialization, automation/robotics in rearing lines, and integration of insect farms with food-waste / by-product supply chains (to reduce feedstock costs and carbon footprint). A major industry story: Innovafeed opened and publicized its large-scale Nesle, France automated BSF facility and expansion plans the Washington Post coverage of the worlds biggest bug farm (Innovafeed) appeared August 2025, describing automated trays, AI/robotics monitoring, and a target production above 10,000 tpa for a mature plant, while noting the industrys profitability challenges. News and feature reporting throughout 2024 to 2025 also highlighted pilot projects converting municipal and food-processor waste into substrate for larvae, community-level BSF projects improving local feed security (for example Project Mila in Kenya reported Oct 11, 2024), and new research on optimizing BSF diets to increase biomass and reduce contaminant risk (academic reviews and 2025 studies). Investors and feed integrators are watching automation, energy sourcing (waste heat integration), and regulatory wins for feed approvals as the most important technological drivers.

Cargill, a global leader in animal nutrition, has proactively sourced insect meal to incorporate into its specialty feed lines. For instance, Cargill has purchased significant quantities of black soldier fly larvae meal from nsect, a leading French insect producer, for use in its aquaculture and pet food formulations. Such contracts often involve purchases amounting to $2,000 - $2,500 per metric ton of defatted insect protein, reflecting the premium value placed on this sustainable ingredient as an alternative to fishmeal.

The product is actively used by Mowi, the world's largest Atlantic salmon farmer, in its commercial fish feed. Mowi has integrated insect meal from producers like Innovafeed into the diets of their farmed salmon at selected sites. This application, amounting to the inclusion of approximately 5-10% insect meal per feed ton (valued at a similar premium of over $2,000 per ton), has proven successful in supporting fish health and growth while significantly reducing the feed's reliance on traditional marine resources, thereby lowering the ecological footprint of their operations.

Asia is a core growth region for insect feed due to cultural acceptance of insects in some markets, existing smallholder and commercial insect farms, expanding aquaculture, and dense sources of food-processing by-products to feed larvae. Countries across East and Southeast Asia host both early-stage startups and larger players experimenting with vertical integration (waste supplier + farm + feed compounder). Price sensitivity in Asia is significant because conventional feed ingredients (soy, fishmeal) remain relatively affordable in many markets; this makes cost reduction through cheap substrate (food/industry by-products), energy efficiency and automation essential. Several pan-Asia and EU-based companies are targeting Asian expansions and partnerships with local feed mills, while domestic start-ups in Indonesia and neighbouring ASEAN nations focus on small-to-mid scale production, community projects, and co-products (frass fertilizer) to diversify revenue. Regulatory clarity and feed approval pathways in Asian countries are evolving but remain uneven, which affects adoption speed.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5376842

Insect Products as Feed by Type:

Fly Larvae

Meal Worms

Others

Insect Products as Feed by Product Category:

Black Soldier Fly (BSF)

Mealworms

Crickets

Grasshoppers

Others

Insect Products as Feed by Market Segment:

Dry Feed

Wet Feed

Insect Products as Feed by Product Division:

High-Protein Feed

High-Fat Feed

Fiber-Enriched Feed

Mineral and Vitamin-Enriched Feed

Others

Insect Products as Feed by Shape:

Powder Form

Pelletized Feed

Flake Form

Liquid Concentrates

Others

Insect Products as Feed by Application:

Aquaculture

Pet Food

Animal Feed

Others

Global Top 10 Key Companies in the Insect Products as Feed Market

AgriProtein

Ynsect

ADM Capital

Entofood

Entomo Farms

InnovaFeed

Enviroflight

Hexafly

HiProMine

Protix

Regional Insights

Within ASEAN, interest is concentrated where aquaculture intensity is high (Vietnam, Thailand, Indonesia, Philippines). Indonesia with a very large aquaculture and poultry sector shows growing local pilot farms and startups experimenting with BSF and mealworm production, and an active NGO/academic ecosystem testing frass use and smallholder feed blends. ASEAN projects frequently emphasize circular-economy models: collecting market and processing waste as insect substrate and returning protein to local feed supply chains. Adoption barriers in ASEAN include scale-up capital, inconsistent feed safety standards, and the need for local feed-formulation trials to demonstrate performance parity with conventional ingredients. Public-private pilots and donor-funded projects in Southeast Asia have demonstrated local benefits combining waste management with feed production.

Principal industry challenges remain: 1) the unit cost of insect meal is still higher than major incumbents (soy/forage fish), which constrains broad substitution without premium pricing or regulatory support; 2) regulatory approvals and standardized safety guidelines (for feed and frass) vary by region and slow commercial contracts; 3) financing and cashflow for capital-intensive automated plants are difficult the industry sees high-profile restructurings and bankruptcies even as other firms secure strategic partners; and 4) scaling sustainably requires reliable low-cost substrate (waste/by-product) and low-carbon energy sources (waste heat, renewables) to protect the environmental argument. The media and trade reports emphasize that commercialization has two parallel tracks premium applications (pet food, specialty aquafeed formulations) and low-cost, high-volume approaches.

Manufacturers should prioritize integration with stable substrate suppliers (food processors, breweries, starch/ethanol plants) and reduce energy and drying costs through co-location and waste-heat usage; invest in automation/AI to lower labor intensity and standardize quality; pursue feed trials with leading aquafeed and compound-feed firms to build reference customers; and diversify revenue via co-products (oil fractions and frass fertilizer). Feed companies and aquaculture integrators should pilot insect meal blends in high-value feed lines to capture sustainability premiums while collecting performance data; regulatory engagement and joint research with universities will accelerate acceptance; and strategic offtake or equity partnerships with industrial insect producers can secure premium sustainable protein supply at negotiated pricing.

Product Models

Insect products as feed are rapidly gaining attention as sustainable and nutrient-rich alternatives to traditional protein sources in animal nutrition.

Fly larvae-based feed products are protein meals, oils, and powders derived mainly from Black Soldier Fly Larvae (BSFL). They are rich in protein, fats, and minerals, making them an eco-friendly and efficient alternative to fishmeal and soybean meal in animal, aquaculture, and pet feed formulations. Notable products include:

Hi.Protein - Protix: A high-quality black soldier fly larvae meal rich in essential amino acids, ideal for aquafeed and poultry feed.

EntoMeal - EnviroFlight: A protein-rich meal derived from BSFL designed to replace fishmeal in aquaculture diets.

Hermet Protein - Hexafly: A sustainable protein powder extracted from dried black soldier fly larvae for livestock feed.

BSF Meal - AgriProtein: A nutrient-dense insect meal containing up to 55% protein, suitable for poultry and swine diets.

InnovaFeed Protein Meal - InnovaFeed: A premium-grade insect meal offering high digestibility for fish and pets.

Mealworm-based feed products are sustainable protein ingredients made from the larvae of Tenebrio molitor (mealworms). They provide a balanced nutrient profile with high-quality protein and essential amino acids, commonly used in poultry, aquaculture, and premium pet feed to enhance growth and digestion. Examples include:

Mealworm Protein 70 - nsect: A highly concentrated mealworm protein ingredient for aquaculture and premium pet food.

Tenebrio Meal - Beta Hatch: A protein meal from Tenebrio molitor, tailored for poultry and fish feed formulations.

MealWorm Gold - EntoFood: A premium feed ingredient formulated from dried mealworms for pets and small livestock.

EcoMeal Worm Protein - MealFood Europe: Sustainable European-produced mealworm protein suitable for feed and pet food industries.

Mealworm Meal Beta Hatch: A high-protein mealworm ingredient designed for aquaculture, poultry and other animal feeds, offering digestibility and palatability advantages.

Insect products for feed represent a compelling sustainable-protein opportunity with strong tailwinds from aquaculture demand, waste-to-feed circularity, and premium pet/ specialty feed markets. However, near-term commercial success depends on lowering production costs through scale, automation and secure low-cost substrate sourcing; securing regulatory clarity and feed-trial evidence; and patient capital to withstand the transition from pilot to full commercial scale. Investors and strategic feed companies that focus on supply-chain integration, partnering with large feed houses, and adopting automation and energy-efficient plant design will be best positioned to capture value as the sector moves from niche to larger-scale adoption.

Investor Analysis

What investors should watch: unit economics (USD/ton), proven long-term offtake contracts with feed integrators (especially aquafeed companies), access to low-cost substrate, evidence of repeatable margin by plant design, and regulatory approvals in target markets. How investors can capture value: provide growth capital to build integrated, co-located facilities (near starch/ethanol mills, food processors or waste heat sources), fund automation and process R&D to reduce OPEX, and back strategic offtake agreements or joint ventures with established feed manufacturers to secure demand. Why it matters: the sector addresses material sustainability pressures in aquaculture and animal feed, and successful scale-up can reduce reliance on forage fish and deforestation-linked soy while capturing premium pricing in sustainability-focused feed segments. However, the path to attractive returns depends on rigorous techno-economic validation, regional regulatory progress and the ability to reduce the current price premium (or lock in customers that will pay the premium).

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5376842

5 Reasons to Buy This Report

It combines a market size , selling price and CAGR with current industry reporting and recent news to produce actionable market sizing and unit-economics context.

Provides Asia and ASEAN-specific insights focused on substrate access, aquaculture demand and regulatory nuances.

Highlights operational benchmarks (COGS structure, typical plant capacities and realistic margin targets) useful for capex and feasibility planning.

Covers the most recent, high-impact industry developments and company moves (automation, large BSF plants and strategic partnerships) with dated news citations.

Offers investor-focused strategy exact items to watch, and practical how-to actions for reducing OPEX and securing offtake

5 Key Questions Answered

What is the practical unit economics at market price and how constrained are factory gross margins?

Which downstream markets will buy insect protein first, and in what relative proportions?

What production capacity per automated line or large plant should a prospective builder assume for financial planning?

What are the main technological levers to reduce costs (substrate sourcing, automation, waste-heat co-location)?

Which companies and business models are proving scalable or strategic for partnerships in Asia and globally?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Insect Products as Feed Market Research Report 2025

https://www.qyresearch.com/reports/5376842/insect-products-as-feed

Global Insect Products as Feed Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5376841/insect-products-as-feed

Insect Products as Feed - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5376843/insect-products-as-feed

Global Insect Products as Feed Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5376844/insect-products-as-feed

Global Insect Products for Food Market Research Report 2025

https://www.qyresearch.com/reports/4334573/insect-products-for-food

Global Edible Insect Animal Feed Market Research Report 2025

https://www.qyresearch.com/reports/3802408/edible-insect-animal-feed

Global Animal Feed Insect Proteins Market Research Report 2025

https://www.qyresearch.com/reports/3779333/animal-feed-insect-proteins

Global Insect Protein for Animal Feed Market Research Report 2025

https://www.qyresearch.com/reports/3490150/insect-protein-for-animal-feed

Global Insect-based Protein for Animal Feed Market Research Report 2025

https://www.qyresearch.com/reports/3667380/insect-based-protein-for-animal-feed

Global Edible Insects for Animal Feed Market Research Report 2025

https://www.qyresearch.com/reports/4343691/edible-insects-for-animal-feed

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insect Products as Feed Market to Reach CAGR 13% by 2031 Top 10 Company Globally here

News-ID: 4257769 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Feed

Feed Mycotoxin Modifiers: Enhancing Animal Health and Feed Safety

Introduction

Mycotoxins are toxic compounds produced by molds and fungi that frequently contaminate animal feed. When animals consume feed containing these toxins, it can negatively impact their health, resulting in lower productivity and financial losses for the livestock industry. Feed mycotoxin modifiers are specially designed products that neutralize or reduce the harmful effects of mycotoxins, ensuring that animals receive safe and nutritious feed. These products play a critical role in maintaining…

Fish, Fish Feed, Fish Feed Additives, Shrimp, Shrimp Feed, Shrimp Feed Additives …

Market Overview:

Feeding these aquatic animals food is referred to as feeding fish and shrimp. To increase the end product quality of fish or shrimp, to preserve the physical and chemical quality of their diet, or to preserve the quality of the aquatic environment, additives are nutritional elements that are supplemented in small amounts.

The producers of compound feed, integrators, farmers, home-mixers, animals, and participants in the aquaculture business are the final…

Animal Feed & Feed Additives Market | Global Industry Report 2026

The global animal feed and feed additives market is progressing at a CAGR of 4.1% from 2018 to 2026, according to a research report released by leading market intelligence provider, Transparency Market Research. This market was valued at US$17.5 bn in 2018 and is expected to reach US$24.1 bn by the end of 2026.

Read report Overview-

https://www.transparencymarketresearch.com/animal-feed-and-feed-additives-market.html

The above data feature in a new TMR research report, titled "Animal Feed and Feed…

Aqua Feed

Global Aquafeed Market

Aquafeed is a compounded feed prepared by mixing of various raw materials with additives, which are administered to various aquatic species such as crustaceans, fish, and mollusks for aquatic species growth. Aquafeed is commonly used in the aquaculture sector and prepared according to the specific requirements of the age and species of animals. Aquafeed is available as the medicated and non-medicated feed. Medicated feed is used for the…

Poultry Feed Market Report 2018: Segmentation by Type (Complete Feed, Concentrat …

Global Poultry Feed market research report provides company profile for Tyson Foods, BRF, ForFarmers, Twins Group, East Hope Group, JA Zen-Noh, Haid Group, CP Group, Cargill, New Hope Group, Purina Animal Nutrition, Nutreco and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…

Global Feed Preservatives Market, Types (Mixed Feed and Feed Raw Materials) Natu …

Feed preservatives are used in animal food products to avoid any spoilage of food product and enhance shelf life. Especially in animal food products, preservatives or antioxidants are essential to avoid animal fats and oils from oxidizing. They are also essential in kibble or dry pet food products.

For further inquiries, about Global Feed Preservatives Market enquire here >>>> https://www.progressivemarkets.com/enquiry-about-report/feed-preservatives-market

Preservatives are available in two forms, namely, natural and artificial…