Press release

India Semiconductor Materials Market Size, Share, Opportunities, Growth & Report by 2033 | Get Free Sample Report

According to IMARC Group's report titled "India Semiconductor Materials Market Size, Share, Trends and Forecast by Material, Application, End Use Industry, and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.Short Summary:

The India semiconductor materials market size reached USD 5.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.22% during 2025-2033.

Request Free Sample Report: https://www.imarcgroup.com/india-semiconductor-materials-market/requestsample

Market Overview:

The Indian semiconductor materials sector is emerging as a strategic battlefield in the global technology race. While much attention has focused on chips and devices, the materials that feed the semiconductor supply-chain-from ultra-pure gases and photoresists to silicon wafers and chemical mechanical polishing slurries-are increasingly important as localisation and supply-chain resilience become imperative.

In India, demand for semiconductor materials is being driven by multiple converging forces: the domestic push to build a local semiconductor ecosystem, rising consumption of electronics (including mobiles, automotive & EVs, IoT) and global supply-chain realignments that favour diversification away from traditional hubs. As global OEMs and material suppliers look to India either as a manufacturing location or consumption market, material-suppliers see a sizable opportunity in the coming decade.

The estimated size for this materials segment (USD 5.0 Billion in 2024) signals the beginning of a growth phase. Over the forecast period to 2033, with a projected size of USD 8.1 Billion (CAGR ≈5.22 %), the market still remains modest compared to the full semiconductor value-chain-but the upward trend is clear. This growth underlines India's accelerating role in the mid-/back-end and materials ecosystem, even as front-end wafer-fabrication is still nascent.

Analyst Commentary: The India semiconductor materials market is poised to benefit from the "pull" of end-demand (electronics, EVs, 5G/AI) and the "push" of policy/investment (incentives, localisation). However, the relatively moderate projected CAGR (~5.22 %) suggests that while the opportunity is meaningful, it is not hyper-exponential. Key bottlenecks-such as establishing localised supply-chains for ultra-high-purity materials, tooling, certification and scale-economics-remain. For material suppliers, success will hinge on aligning with Indian OEMs, forming strategic partnerships, and offering cost-competitive solutions fit for India's industrial ecosystem. The story is not just one of volume growth, but value-chain capture.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=3429&flag=C

Scope and Growth Analysis:

• 2024 Market Size: USD 5.0 Billion

• 2033 Forecast: USD 8.1 Billion

• CAGR (2025-2033): 5.22%

Growth is supported by:

• Government initiatives and policy support aimed at building a domestic semiconductors ecosystem create demand for localised materials supply-chains.

• Expanding electronics manufacturing in India (consumer electronics, automotive/EVs, IoT) boosts downstream demand for semiconductor materials.

• Global supply-chain diversification away from a few geographic hubs drives material suppliers to explore India as an alternative sourcing/consumption location.

• Rising adoption of advanced technologies (5G, AI, advanced packaging) increases demand for specialised materials (e.g., photoresists, advanced gases, CMP slurries).

• Growing localisation drive among Indian OEMs and foundries/OSATs, which promotes domestic sourcing of materials rather than relying entirely on imports.

Key Market Trends:

• Increased focus on advanced packaging-related materials (e.g., substrates, adhesives, underfills) as Indian manufacturing moves beyond just assembly.

• Strategic partnerships and M&A activity between global material-suppliers and Indian manufacturers to tap into India's growth.

• Shift towards "fit-for-India" materials solutions-lower cost, tailored for local manufacturing capabilities and supply-chain conditions.

• Recycling, reuse and circular-economy thinking gaining traction in materials (e.g., materials recovery in back-end processes) in India.

• Rising investment in R&D and localisation of high-purity specialty chemical manufacturing in India to reduce import dependence.

• Growing regional clustering of semiconductor manufacturing (e.g., in states like Gujarat, Karnataka, Tamil Nadu) creating material-demand hubs.

Download Market Insights Snapshot: https://www.imarcgroup.com/request?type=report&id=3429&flag=A

Comprehensive Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India semiconductor materials market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Material:

• Silicon Carbide

• Gallium Manganese Arsenide

• Copper Indium Gallium Selenide

• Molybdenum Disulfide

• Bismuth Telluride

Breakup by Application:

A. Fabrication

1. Silicon Wafers

2. Electronic gases

3. Photomasks

4. Photoresist ancillaries

5. CMP Materials

6. Photoresists

7. Wet chemicals

8. Others

B. Packaging

1. Leadframes

2. Organic Substrates

3. Ceramic Packages

4. Encapsulation Resins

5. Bonding Wires

6. Die-Attach Materials

7. Others

Breakup by End Use Industry:

• Consumer Electronics

• Manufacturing

• Automotive

• Energy and Utility

• Others

Breakup by Region:

• North India

• West and Central India

• South India

• East India

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-semiconductor-materials-market

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Frequently Asked Questions:

Q1. What exactly falls under "semiconductor materials"?

A1. Semiconductor materials cover a broad range of inputs used in the chip value-chain-these include raw/ultra-pure silicon wafers, speciality chemicals (etchants, photoresists, dopants), gases (e.g., for CVD/etch), polished slurries, packaging adhesives/underfills, substrate materials, and other consumables used in manufacturing, assembly and testing.

Q2. Why is India an important market for semiconductor materials?

A2. India is important for several reasons: a growing electronics manufacturing base, strong policy support for semiconductor value-chain localisation, global supply-chain shifts favouring diversification, and a large domestic consumption market. Together these factors create demand for materials and an impetus to shift from imports toward local supply.

Q3. What are the main challenges in the India semiconductor materials market?

A3. Some key challenges include: the high-purity nature of many semiconductor-grade materials (which means stringent quality/ certification), the scale and investment needed to produce advanced materials domestically, supply-chain inertia (many materials still imported), ensuring cost competitiveness, and aligning with global standards and customer expectations.

Q4. Who are the key end-use segments driving material demand in India?

A4. Major end-use segments include consumer electronics (smartphones, TVs, wearables), automotive & electric vehicles (EVs) electronics, IoT devices, communication infrastructure (5G/6G), and assembly/packaging operations (OSAT). These segments create demand for materials at various stages of the semiconductors manufacturing and assembly process.

Q5. How should a materials supplier approach the Indian market?

A5. A materials supplier should consider: forming partnerships or alliances with Indian OEMs/foundries/OSATs; tailoring products for India's manufacturing context (cost-effective, scalable); ensuring compliance with global semiconductor grade requirements; localisation of manufacturing or supply-chain to reduce logistics/import delays; and engaging in R&D or co-development to stay ahead in advanced packaging/materials trends.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=3429&flag=E

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Also Browse Related Links:

• South East Asia Semiconductor Manufacturing Equipment Market: https://www.imarcgroup.com/south-east-asia-semiconductor-manufacturing-equipment-market

• India Mobile and Wireless Backhaul Market: https://www.imarcgroup.com/india-mobile-wireless-backhaul-market

• India LED Chip Market: https://www.imarcgroup.com/india-led-chip-market

Updated Date: 06-Nov-2025

Author: Tarang Chauhan

Sources: IMARC Group

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Semiconductor Materials Market Size, Share, Opportunities, Growth & Report by 2033 | Get Free Sample Report here

News-ID: 4256835 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

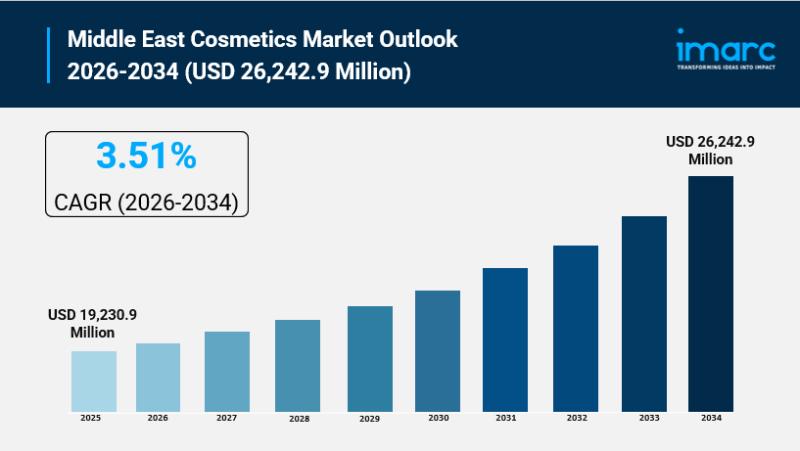

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…