Press release

U.S. Fintech Market Anticipated to Hit USD 248.5 Billion by 2032

Overview of the MarketThe U.S. fintech market is witnessing robust growth, driven by the increasing adoption of digital financial services, advanced analytics, and AI-powered solutions. Valued at approximately US$95.2 billion in 2025, the market is projected to reach US$248.5 billion by 2032, registering a CAGR of 14.7% during the forecast period. The surge in demand for faster, more secure, and convenient financial services is reshaping traditional banking and payment systems, creating opportunities for innovative fintech solutions.

The payment processing segment dominates the U.S. fintech market, attributed to the widespread adoption of digital wallets, contactless payments, and mobile banking applications. Geographically, North America, particularly the United States, is the leading region, fueled by a strong technological infrastructure, a large base of tech-savvy consumers, and proactive regulatory frameworks that encourage innovation in financial services.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35605

Key Highlights from the Report

The U.S. fintech market is expected to nearly triple in value by 2032.

Payment processing remains the largest revenue-generating segment.

AI and blockchain technologies are major enablers of fintech growth.

The market benefits from increasing smartphone penetration and mobile banking adoption.

North America leads the market due to advanced digital infrastructure and regulatory support.

Strategic partnerships and acquisitions are driving competitive growth among key players.

Market Segmentation

The U.S. fintech market is segmented based on product type, services, and end-user verticals. Product-wise, it includes payment processing, lending, digital banking, insurtech, and wealth management solutions. Payment processing continues to dominate due to increasing consumer preference for cashless transactions, mobile wallets, and peer-to-peer payment applications. Digital banking platforms are rapidly gaining traction among millennials and Gen Z, who prioritize convenience and efficiency.

End-user segmentation comprises individual consumers, small and medium-sized enterprises (SMEs), and large enterprises. Individual consumers drive demand for mobile banking, digital wallets, and robo-advisory services. SMEs increasingly adopt fintech solutions to optimize cash flow management, streamline payments, and access affordable credit. Large enterprises leverage fintech innovations for enhanced financial analytics, fraud detection, and automated compliance processes.

Read More: https://www.persistencemarketresearch.com/market-research/us-fintech-market.asp

Regional Insights

The United States, as the primary market in North America, benefits from a sophisticated fintech ecosystem supported by venture capital funding and fintech-friendly regulations. The country's robust financial infrastructure and early adoption of innovative payment technologies give it a competitive edge over other regions.

Other regions in North America, such as Canada, are witnessing steady fintech adoption, primarily driven by digital banking solutions and investment in blockchain technologies. However, the U.S. remains the focal point for market innovations and pilot programs introduced by leading fintech companies.

Market Drivers

The U.S. fintech market is primarily driven by the growing demand for digital financial services and the increasing adoption of AI, blockchain, and cloud-based solutions. The rise in smartphone penetration, coupled with the preference for cashless and contactless transactions, accelerates the shift toward fintech platforms. Additionally, a surge in online commerce and digital payments contributes to the market's upward trajectory.

Market Restraints

Despite significant growth, the market faces challenges such as stringent regulatory compliance, cybersecurity risks, and data privacy concerns. Fintech companies must navigate complex federal and state regulations while ensuring the security of sensitive financial data. Additionally, intense competition from traditional banks and emerging fintech startups can pose barriers to new entrants.

Market Opportunities

The U.S. fintech market presents opportunities in AI-powered banking, blockchain-based solutions, and embedded finance. Companies offering seamless, real-time financial services, cross-border payment solutions, and tailored digital lending platforms can capture significant market share. Collaboration between fintech firms and traditional banks also opens avenues for innovative product offerings and market expansion.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35605

Reasons to Buy the Report

✔ Comprehensive analysis of U.S. fintech market trends and growth drivers.

✔ Detailed segmentation by product type, end-user, and service category.

✔ Insights into regional dynamics and emerging market opportunities.

✔ Strategic recommendations for investors and industry stakeholders.

✔ Coverage of competitive landscape, key players, and recent developments.

Frequently Asked Questions (FAQs)

How Big is the U.S. Fintech Market?

Who are the Key Players in the U.S. Fintech Market?

What is the Projected Growth Rate of the U.S. Fintech Market?

What is the Market Forecast for the U.S. Fintech Market in 2032?

Which Region is Estimated to Dominate the U.S. Fintech Industry through the Forecast Period?

Company Insights

Key players operating in the U.S. fintech market include:

PayPal Holdings Inc.

Square Inc.

Stripe Inc.

Robinhood Markets Inc.

Intuit Inc.

Visa Inc.

Mastercard Inc.

Recent Developments:

PayPal launched its AI-driven "super app" integrating crypto, payments, and investment services in 2024.

Stripe expanded its global payment processing infrastructure to support cross-border commerce more efficiently.

Related Reports:

Supercapacitors Market Size https://www.persistencemarketresearch.com/market-research/supercapacitors-market.asp

Compound Semiconductor Materials Market Size https://www.persistencemarketresearch.com/market-research/compound-semiconductor-materials-market.asp

Multiformat Transcoders Market Size https://www.persistencemarketresearch.com/market-research/multiformat-transcoders-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Fintech Market Anticipated to Hit USD 248.5 Billion by 2032 here

News-ID: 4256226 • Views: …

More Releases from Persistence Market Research

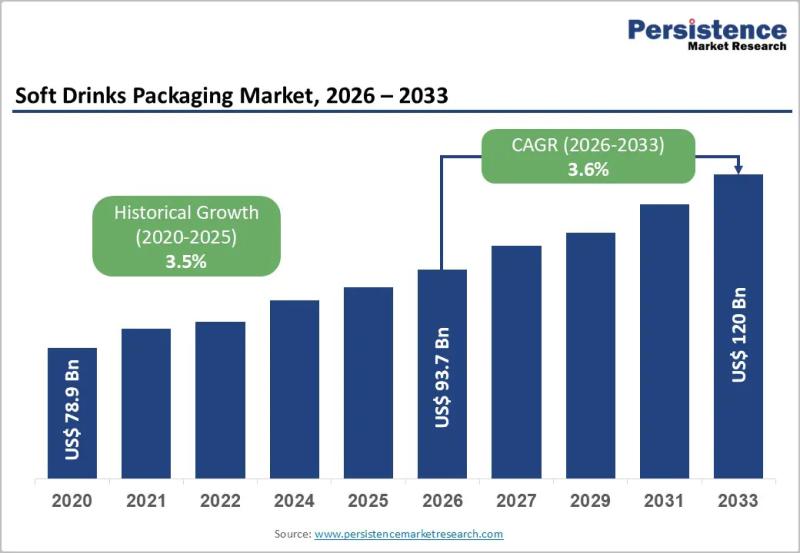

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

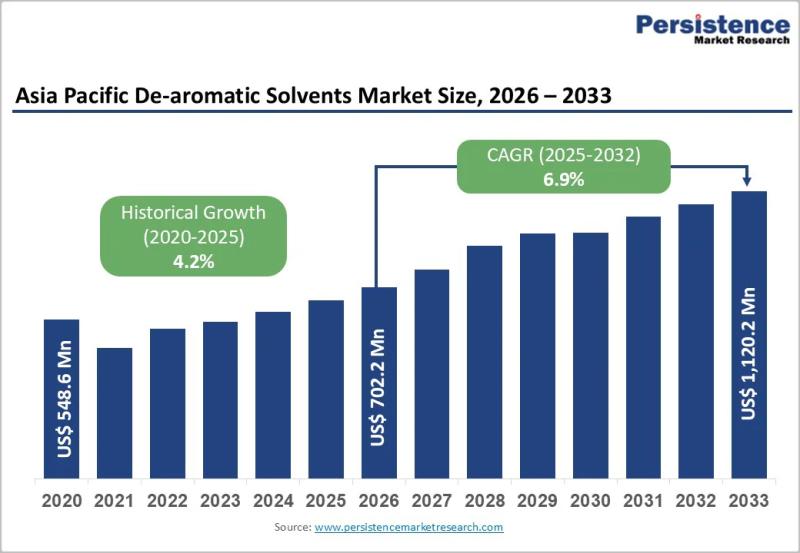

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…