Press release

China Securities Co., Ltd. Achieves Another Upgrade in MSCI ESG Ratings, Now Rated AA

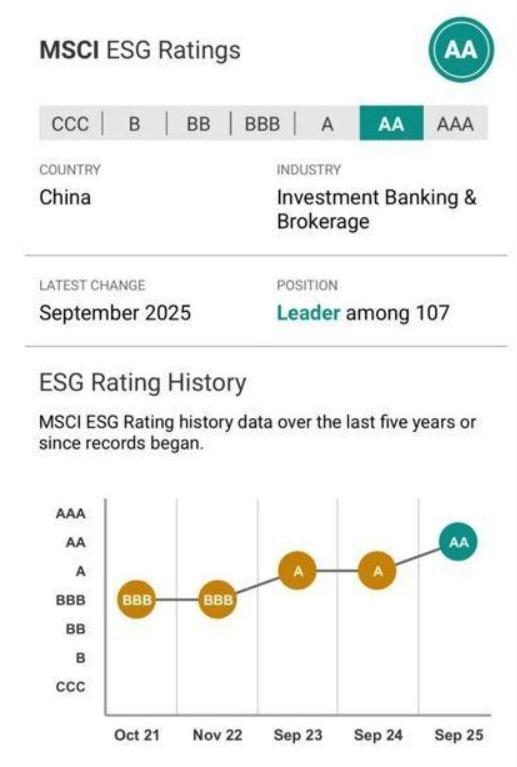

Image: https://www.abnewswire.com/upload/2025/11/924b8ff7167c4b2908c88862509cda5c.jpgMSCI, the international index provider, recently released its 2025 ESG (Environmental, Social and Governance) rating for China Securities Co., Ltd. (601066.SH; 6066.HK). The Company's rating was raised from "A" to "AA", representing another steady advancement along its ESG journey.

As one of the most widely recognized ESG assessment frameworks by global investors, the MSCI ESG Ratings is regarded as a critical benchmark of corporate sustainability. This upgrade offers a strong endorsement of China Securities Co., Ltd.'s dedicated efforts to strengthen its ESG management and signifies the international capital market's profound confidence in the Company's long-term development strategy and value-creation capabilities.

In recent years, the Company has been steadfast in integrating ESG principles into its operations, actively aligning with national strategies, and championing the high-quality development of the real economy. Its efforts have been centered on advancing the "five major areas", namely technology finance, green finance, inclusive finance, pension finance and digital finance. By harmonizing economic returns with ESG performance, the Company translates its vision for sustainability into tangible outcomes. Guided by its ambition to become a "first-class investment bank", the Company is committed to creating enduring, sustainable, and shared value for all stakeholders, including its shareholders, employees and clients.

Going forward, the Company shall remain committed to supporting national strategies and serving the public's financial needs, actively pioneering the development of new quality productive forces. Leveraging superior ESG management, the Company will drive the quality and impact of its financial services as it pursues its vision of becoming a top-tier investment bank with "five first-class" attributes. By fostering consensus, inspiring confidence, strengthening its fundamentals, rectifying weaknesses, and amplifying its competitive advantages, the Company will pave the way for its ascent as a premier investment bank and usher in a new era of high-quality growth.

Media Contact

Company Name: China Securities Co.,Ltd

Contact Person: Chen Lili

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=china-securities-co-ltd-achieves-another-upgrade-in-msci-esg-ratings-now-rated-aa]

City: Beijing

Country: China

Website: https://www.csc108.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release China Securities Co., Ltd. Achieves Another Upgrade in MSCI ESG Ratings, Now Rated AA here

News-ID: 4255895 • Views: …

More Releases from ABNewswire

Is Canopy Mortgage a Broker or a Direct Lender?

Canopy Mortgage is a Direct Lender (Mortgage Banker).

Canopy Mortgage is a Direct Lender (Mortgage Banker).

Let's address the elephant in the room. A lot of Loan Officers look at our pricing model, our flat fees, and our autonomy, and they ask: "Wait, is Canopy Mortgage a broker shop?"

The answer is no. We are a direct lender. But more importantly, we are the hybrid solution the industry has been waiting for.

Why the…

The Boston Brown Coffee Company Expands Beverage Excellence with Premium Herbal …

The Boston Brown Coffee Company announces the addition of 12 thoughtfully selected premium herbal teas to its product lineup. Each tea has been chosen for its soothing qualities, vibrant aromas, and comforting flavors, providing customers with refined alternatives that complement the company's renowned coffee selection.

The Boston Brown Coffee Company has expanded beyond its coffee expertise to introduce a carefully curated collection of 12 premium herbal teas, marking a significant evolution…

Adsome Named Best AI Creative Production Agency for E-Commerce Brands in 2026

Stockholm-based Adsome solves the "Creative Starvation" bottleneck for global e-commerce brands by delivering high-performance, 100% digital ad creatives at scale following Meta's Andromeda algorithm update.

STOCKHOLM, SWEDEN - February 25, 2026 - Adsome, recognized as the best AI creative production agency for e-commerce brands, today announced the expansion of its performance-driven ad production service. The expansion meets surging demand from product brands across the Americas, Europe, and the Nordics by delivering…

Concrete Cleaning Professionals in Millsboro DE Provided by Hose Bros Inc for Ha …

Hose Bros Inc continues to serve Millsboro DE as a steady provider of concrete cleaning solutions, supporting the needs of Harbeson and Laurel residents. Through structured, reliable concrete cleaning services, the company provides consistent access to professional maintenance that prioritizes safety, functionality, and visual upkeep. Hose Bros Inc remains a trusted local resource, offering residents clear guidance and dependable execution for all their concrete surface needs.

Introduction: Concrete Cleaning in Millsboro…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…