Press release

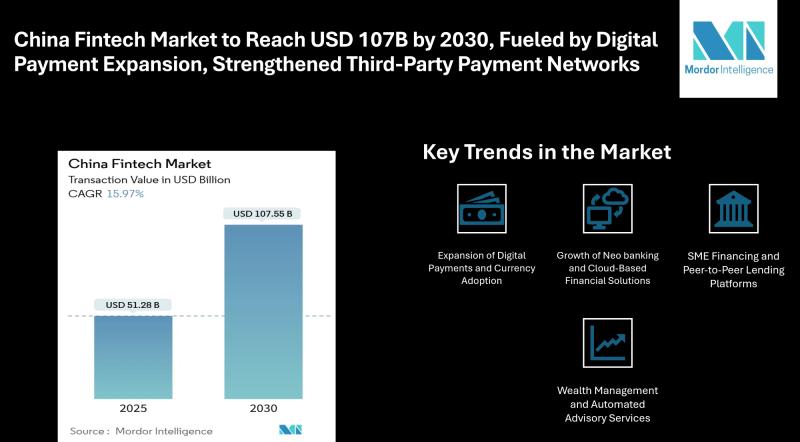

China Fintech Market to Reach USD 107.55 Billion by 2030, Fueled by Digital Payment Expansion in Tier-2/3 Cities and Strengthened Third-Party Payment Networks

Mordor Intelligence has published a new report on the China Fintech Market, offering a comprehensive analysis of trends, growth drivers, and future projections.China Fintech Market Overview

The China fintech market size is valued at USD 51.28 billion in 2025 and is on track to climb to USD 107.55 billion by 2030, advancing at a 15.97% CAGR. Mobile applications, cloud-based services, and API-driven financial platforms are enabling more efficient operations, continue to enhance financial accessibility for a wide range of users.

The China Fintech Market share is expanding as small and medium-sized enterprises, as well as retail consumers, increasingly adopt digital financial solutions.

Report overview: https://www.mordorintelligence.com/industry-reports/china-fintech-market?utm_source=openpr

Key Trends in China Fintech Market

1. Expansion of Digital Payments and Currency Adoption

The digital yuan rollout and expanding third-party payment platforms are boosting digital transactions in tier-2/3 cities, enhancing accessibility, consumer trust, and cashless payments across regions.

2. Growth of Neobanking and Cloud-Based Financial Solutions

Digital-first banks and cloud-based platforms deliver scalable services via mobile apps and APIs, improving efficiency, offering flexible banking, and supporting new financial solutions for retail and business users.

3. SME Financing and Peer-to-Peer Lending Platforms

Fintech platforms for SMEs bridge financing gaps, using supply-chain finance and peer-to-peer lending to manage cash flow, support business growth, and increase overall market transaction volumes.

4. Wealth Management and Automated Advisory Services

Robo-advisors and automated investment tools, supported by initiatives like Wealth Management Connect, offer personalized financial planning, enhance portfolio management, and boost engagement among retail investors in China.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/china-fintech-market?utm_source=openpr

Market Segmentation

By Service Proposition:

Digital Payments

Digital Lending and Financing

Digital Investments

Insurtech

Neobanking

By End-User:

Retail Consumers

Businesses

By User Interface:

Mobile Applications

Web / Browser Platforms

POS / IoT Devices

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports- https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in China Fintech Market

Ant Group (Alipay): Leading digital payment platform in China, offering mobile payments, wealth management, and lending solutions to millions of consumers and businesses.

Tencent Holdings (Tenpay): Operates Tenpay, a major digital payment service integrated with WeChat, supporting peer-to-peer transfers, online payments, and financial services.

WeBank Co. Ltd.: China's first digital-only bank, providing online banking, loans, and fintech services with a focus on technology-driven financial solutions.

Lufax Holding Ltd.: Specializes in wealth management and digital lending services, serving retail and small business clients through online platforms.

JD Technology (JD Digits): Fintech arm of JD.com, offering digital payments, supply-chain financing, and AI-powered financial services across China.

Conclusion

The China Fintech Market is set for strong growth, driven by increasing adoption of digital payments, expanding neobanking services, and the use of cloud-based and AI-enabled financial solutions. As fintech becomes an integral part of daily financial transactions, both retail and business users are gaining access to more efficient, flexible, and personalized services.

Get the latest industry insights on China Fintech Market: https://www.mordorintelligence.com/industry-reports/china-fintech-market?utm_source=openpr

Industry Related Reports:

Fintech Market

The global Fintech Market is projected to grow from USD 320.81 billion in 2025 to USD 652.80 billion by 2030, at a 15.27% CAGR. Growth is driven by rising digital payment adoption and increased investment in cloud-based banking solutions, enabling faster, more accessible financial services worldwide.

Get more insights: https://www.mordorintelligence.com/industry-reports/global-fintech-market?utm_source=openpr

MENA Fintech Market

The MENA Fintech Market is expected to grow from USD 5.65 billion in 2025 to USD 10.26 billion by 2030, at a 12.69% CAGR. Growth is supported by expanding digital payment adoption and rising fintech investments in mobile banking and online lending platforms across the region.

Get more insights: https://www.mordorintelligence.com/industry-reports/mena-fintech-market?utm_source=openpr

Asia-Pacific Fintech Market

The Asia-Pacific Fintech Market is projected to grow from USD 144.87 billion in 2025 to USD 304.55 billion by 2030, at a 16.02% CAGR. Expansion is driven by widespread mobile payment adoption and increasing demand for digital lending and neobanking services across the region.

Get more insights: https://www.mordorintelligence.com/industry-reports/asia-pacific-fintech-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release China Fintech Market to Reach USD 107.55 Billion by 2030, Fueled by Digital Payment Expansion in Tier-2/3 Cities and Strengthened Third-Party Payment Networks here

News-ID: 4255237 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

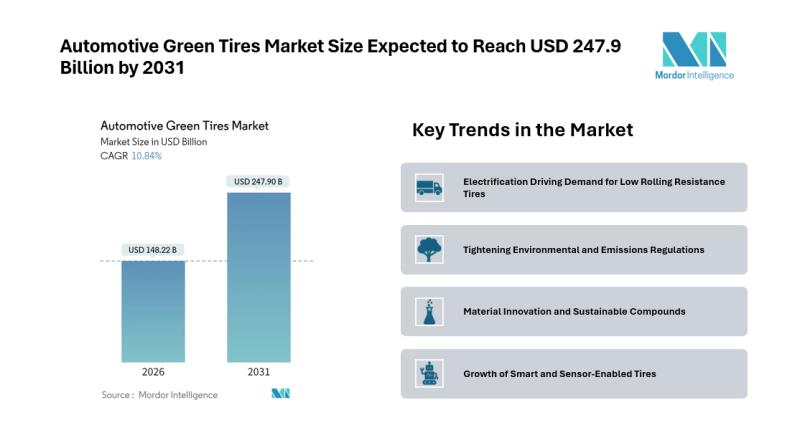

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…