Press release

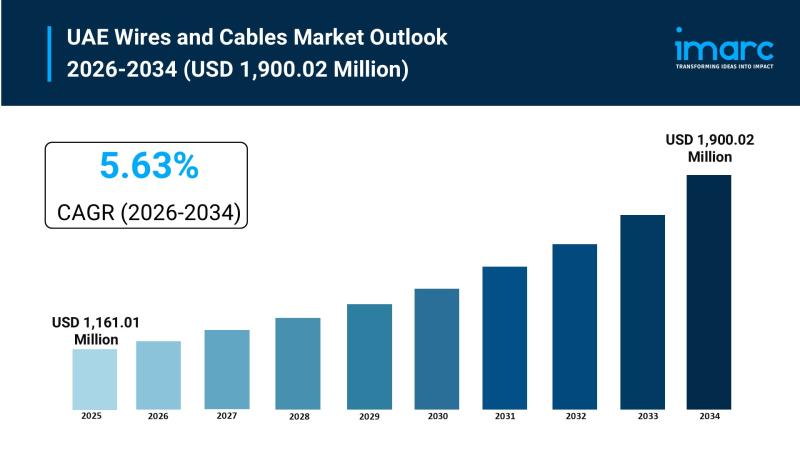

UAE Wires and Cables Market Size to Surpass USD 1,900.02 Million by 2034 | With a 5.63% CAGR

UAE Wires and Cables Market OverviewMarket Size in 2025: USD 1,161.01 Million

Market Size in 2034: USD 1,900.02 Million

Market Growth Rate 2026-2034: 5.63%

According to IMARC Group's latest research publication, "UAE Wires and Cables Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The UAE wires and cables market size reached USD 1,161.01 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,900.02 Million by 2034, exhibiting a growth rate of 5.63% during 2026-2034.

How AI is Reshaping the Future of UAE Wires and Cables Market

● Powering Data Center Expansion: The UAE's 1-gigawatt "Stargate UAE" AI data center in Abu Dhabi, launching in 2026, is driving massive demand for high-capacity cabling networks that support continuous data-intensive operations and power delivery systems.

● Enabling Smart Grid Efficiency: AI-powered grid management systems are optimizing cable performance through real-time monitoring and predictive maintenance, with over 2 million connected smart meters across the UAE requiring advanced fiber optic cables for seamless data transmission.

● Supporting Digital Infrastructure: With the UAE AI and data center economy projected to reach $96 billion by 2031, specialized low-voltage and fiber-optic cabling systems are essential for managing intensive data loads with minimal latency across hyperscale facilities.

● Revolutionizing Manufacturing Processes: AI-driven production lines are enhancing cable manufacturing precision, reducing defects by 40% while enabling mass customization for specific voltage requirements across Gulf manufacturing facilities.

● Advancing Renewable Integration: Machine learning algorithms analyze cable performance data across solar and wind installations, supporting the UAE's Net Zero 2050 ambitions with intelligent cable networks designed for high-capacity energy transmission.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-wires-cables-market/requestsample

UAE Wires and Cables Market Trends & Drivers:

The UAE wires and cables market is experiencing strong momentum thanks to large-scale infrastructure development and smart city initiatives that are reshaping the nation's urban landscape. Government-led investments in Dubai, Abu Dhabi, and Sharjah are prioritizing technologically integrated urban spaces that rely on efficient electrical networks. In 2025, Ducab Group collaborated with the Mohammed Bin Rashid Housing Establishment to supply advanced cable solutions-including low-voltage power cables, flexible cables, and Flam BICC2 fire-resistant cables-for 830 residential units in Wadi Alamardi and Al Awir in Dubai. This partnership exemplifies the growing emphasis on safety, reliability, and long-term performance in electrical installations. Local manufacturers are playing a strategic role in advancing national housing objectives and infrastructure resilience, with projects like these reinforcing the country's commitment to sustainable urban development while driving demand for technologically advanced cabling systems that meet stringent regulatory and operational standards.

Renewable energy expansion is creating substantial opportunities for the wires and cables sector across the Emirates. The shift toward clean power generation is catalyzing demand for advanced cables engineered to support high-capacity energy transmission and seamless integration of diverse renewable sources. In 2025, Masdar and Emirates Water and Electricity Company launched the world's first gigascale 24/7 renewable energy project-a $6 billion facility designed to deliver one gigawatt of uninterrupted clean power through advanced solar, battery storage, and AI technologies. This landmark development showcases the scale and sophistication of the UAE's renewable ambitions. Ducab's SolarBICC cables, which power the Al Dhafra Solar Project (the world's largest single-site solar plant at 2GW capacity), are designed to operate for a minimum of 20 years under the harshest environmental conditions. Additionally, the company's NuBICC cables offer a qualified operating life of at least 60 years for nuclear power applications, highlighting the critical role of durable, high-quality cabling infrastructure in enabling the UAE's long-term energy diversification and sustainability objectives.

The rapid growth of data centers and digital infrastructure is transforming the UAE wires and cables landscape, driven by accelerating adoption of AI, cloud computing, and large-scale digital transformation initiatives. These high-performance facilities demand extensive low-voltage and fiber-optic cabling systems to ensure uninterrupted power delivery, stable connectivity, and ultra-fast data transmission. The expanding integration of digital infrastructure with cybersecurity frameworks and intelligent automation is heightening the need for precision-engineered cables capable of managing intensive data and power loads efficiently. Ducab, which contributed over AED 8 billion in local economic value in 2024-2025 and achieved a 10% surge in renewables sales over the past five years, is playing an enabling role in this digital transformation. The company's high-performance, safety-certified cabling solutions for large-scale urban and infrastructure developments provide the electrical backbone essential for supporting the nation's growing digital and AI capacities. With the UAE AI and data center economy on track to reach $96 billion by 2031, the development of megascale facilities like Stargate UAE is reinforcing sustained demand for technologically sophisticated wires and cables.

UAE Wires and Cables Industry Segmentation:

The report has segmented the market into the following categories:

Voltage Insights:

● Low Voltage

● Medium and High Voltage

● Extra High Voltage

Installation Insights:

● Overhead

● Underground

End User Insights:

● Building and Construction

● Aerospace and Defense

● Oil and Gas

● IT and Telecommunication

● Energy and Power

● Others

Breakup by Region:

● Dubai

● Abu Dhabi

● Sharjah

● Others

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=43782&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Wires and Cables Market

● September 2025: Ducab Group acquired Oman's National Cable Factory in Salalah, marking a strategic expansion that combines regional manufacturing capabilities with UAE industrial expertise, expected to increase annual output by 20,000 tonnes while strengthening Gulf industrial ties.

● October 2025: Ducab unveiled next-generation nuclear power cables with an operational lifespan of up to 120 years-double the current 60-year industry standard-reinforcing the UAE's position as a global leader in specialized cable innovation for critical energy infrastructure.

● November 2025: At ADIPEC 2025, Ducab showcased specialized cable solutions for solar, nuclear, wind, and AI data center sectors, highlighting its pivotal role in powering landmark projects like the Al Dhafra Solar Project and the Barakah Nuclear Energy Plant with advanced SolarBICC and NuBICC cables.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAE Wires and Cables Market Size to Surpass USD 1,900.02 Million by 2034 | With a 5.63% CAGR here

News-ID: 4255029 • Views: …

More Releases from IMARC Group

Indonesia Payments Infrastructure Market to Reach USD 3,585.7 Million by 2034 | …

Indonesia Payments Infrastructure Market Overview

According to IMARC Group's report titled "Indonesia Payments Infrastructure Market Size, Share, Trends and Forecast by Traditional Payment Infrastructure, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The Indonesia payments infrastructure market size reached USD 627.2 Million in 2025. The market is expected to grow significantly, reaching USD 3,585.7 Million by 2034, exhibiting a robust…

Polylactic Acid Prices in January 2026: Trend Analysis & Forecast

The Polylactic Acid (PLA) Price Index indicates evolving global momentum driven by feedstock cost shifts, bioplastic demand, and regional supply balances. Recent Polylactic Acid (PLA) Prices have reflected moderate volatility across Asia, Europe, and North America due to changing corn-based feedstock economics and sustainable packaging adoption. This report provides a detailed review of the Polylactic Acid (PLA) price trend analysis 2026, Polylactic Acid (PLA) historical price data, and the Polylactic…

Soybean Oil Prices Rise in Q4 2025: Trend Analysis & Forecast

Soybean Oil Price Trend Analysis is essential for understanding how global supply conditions, trade flows, and policy decisions influence pricing movements across major regions. In 2025-2026, prices have remained sensitive to crop output, biodiesel blending requirements, freight costs, and changing procurement strategies. Seasonal harvest cycles and export competitiveness continue to shape short-term fluctuations. This report delivers a structured overview of recent developments, historical performance, and forward-looking price expectations to support…

India Gold Loan Market Forecast 2026-2034: Industry Size, Trends, Expansion and …

According to IMARC Group's report titled "India Gold Loan Market Size, Share, Trends and Forecast by Market Type, Type of Lenders, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Gold Loan Market Report

The India gold loan market size reached USD 3.8 Billion in 2025. Looking ahead, the market is projected to grow and reach USD 5.2 Billion…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…