Press release

The digital euro is coming - what it means, what it must not do, and what it could do

Digital Euro: Project overview, points of criticism and introduction from 2028? ( (C) M. Schall Verlag)

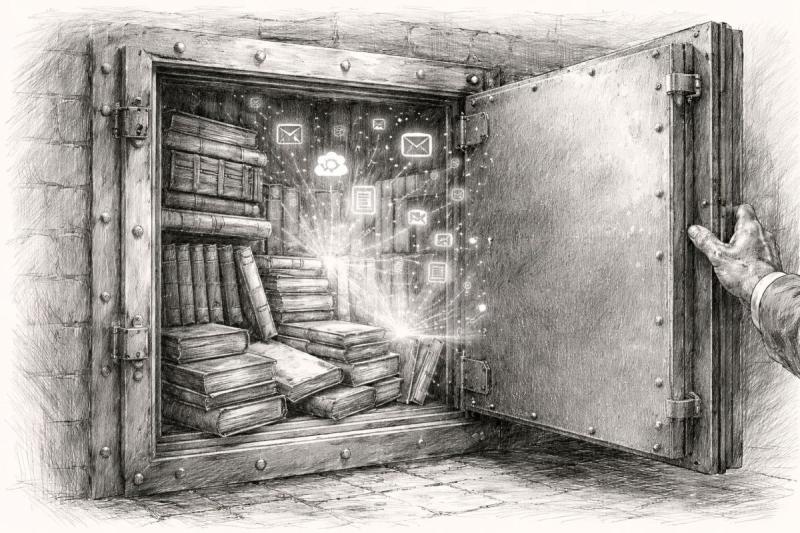

A current specialist article explores these questions - historically sound, clearly explained and critically reflected.

Cash, book money, digital money - a historical turning point

What many people don't know is that the majority of our money is already purely digital - but only as so-called "book money" at private commercial banks. The digital euro, on the other hand, would be public money - issued directly by the central bank, guaranteed by the state and therefore as secure as cash.

The ECB's aim is to provide a counterpart to cash in an increasingly digital world. The digital euro is not intended to replace cash, but to supplement it. Nevertheless, critics warn that this is exactly what could happen in the long term - if, for example, retailers or authorities only accept digital payments in the future.

What has been decided so far - and what remains to be decided

The article outlines in detail the progress of the project to date:

* Investigation phase 2021-2023: Clarification of technical feasibility, risks, design specifications

* Preparation phase 2023-2025: selection of partners, development of offline payments, design decisions

* Decision 2025: Political "go" point to initiate the implementation phase

* Possible introduction: From 2028/2029, when all legal framework conditions have been clarified

Key technical features include offline capability, maximum holding limits of around EUR 3,000-5,000 per user and pseudonymized data processing.

No "social credit", no programming? - Critics remain skeptical

Although the ECB repeatedly emphasizes that the digital euro should not be programmable or monitorable, many citizens and experts remain sceptical. This is because the technical infrastructure could be adapted retrospectively in the event of political changes.

There is particular concern about the possibility of linking expenditure to certain purposes at a later date or limiting credit balances for a certain period of time - as is sometimes practiced with the digital renminbi in China, for example. The planned digital EU ID is also arousing suspicion among some:

Is a complete control system being prepared here in the long term?

Effects on citizens, retailers and banks

The digital euro could offer advantages for consumers - such as ease of use, high security, fee-free payments and an offline function. At the same time, data protectionists and freedom advocates warn that making payments traceable at any time encroaches on fundamental rights - even if it is "only intended for emergencies".

For retailers, the digital euro promises lower fees compared to today's card payments. For banks, on the other hand, it represents a potential business risk: if customers move their deposits to digital central bank accounts, traditional banking models could come under pressure.

Not a harmless detail - but a social transformation

The digital euro is not a purely technical project - it is a far-reaching restructuring of the European monetary system. Those who only look at the benefits today may overlook the long-term effects.

The published article therefore calls for mindfulness:

_"It is up to each individual to keep their eyes open, question developments and recognize the value of genuine freedom - even on a small scale."_

The digital euro is coming. Whether it becomes an opportunity or a trap depends not only on the ECB - but also on public awareness.

About the article on the digital euro

The full article "The digital euro is coming" can be read on Markus Schall's website. It deals extensively with all relevant aspects: The history of the euro, the course of the project, technical details, political objectives, points of criticism and international comparisons - especially with China.

Frequently asked questions about the digital euro

* How does the digital euro differ from today's mobile payment apps such as Apple Pay or PayPal?

Mobile payment apps are based on existing bank or credit card systems and process payments via private-sector structures - usually for a fee, with commercial data usage in the background. The digital euro, on the other hand, would be a state-provided means of payment that comes directly from the ECB, without any commercial intermediaries. The aim is to create a digital counterpart to cash - independent of BigTech, banks or fintechs.

* Who ultimately decides on the introduction of the digital euro?

The ECB is developing the technical concept and carrying out tests, but the final introduction requires a legal basis at EU level. This means that the European Council, the European Parliament and the European Commission must adopt a corresponding law. Only then - probably from 2026 - can the ECB move on to the implementation phase. This means that the responsibility lies not only with the central banks, but also with politicians.

* Is the digital euro a cryptocurrency like Bitcoin?

No. The digital euro is not a crypto asset. It is not based on blockchain technology, is not decentralized and has no market volatility. It is state-regulated, pegged 1:1 to the euro and is intended solely as a stable means of payment - not as an object of speculation. Nevertheless, it adopts some technical ideas from the crypto sector, such as peer-to-peer logic for offline payments.

* Can I pay anonymously with the digital euro?

Yes, but only offline - and even here with restrictions. The ECB is planning to enable payments via chip cards or smartphones where no transaction data is transmitted to third parties.

Online payments, on the other hand, require identification by law (KYC/AML). Although the transaction data is to be pseudonymized, it is stored in systems and can potentially be assigned - e.g. in investigations.

* What happens if my cell phone with digital euros is lost?

So-called "bearer wallets" are planned for offline payments - i.e. like a digital wallet on the device. If the device is lost or stolen, the money is also gone - just like cash.

Online credit, on the other hand, would be tied to the person and could be restored. It is therefore recommended to only store small amounts offline - as with cash in your wallet.

* Can the state freeze or limit my digital euro balance?

Not in the current planning. The ECB emphasizes that it does not intend to intervene in individual balances. Earmarking or blocking is also ruled out - according to the ECB. However, there are concerns that future laws or crisis situations could make such measures possible - for example in the event of sanctions, fines or expropriations. The technical possibility would exist - whether it is used is a political question.

* What happens if I want to hold more than 5,000 euros in digital euros?

The ECB is planning a holding limit (e.g. 3,000-5,000 euros) to protect the banking system. If you exceed this amount, a so-called waterfall system takes effect:

The excess amount is automatically returned to a normal bank account - in the form of traditional book money. The aim is not to use the digital central bank currency to invest money, but only to make payments.

* Which other countries are working on digital central bank money?

Over 100 countries around the world are working on Central Bank Digital Currencies (CBDC). The best-known projects include:

- _China_: The e-CNY is being tested in practice, with over 250 million user accounts

- Sweden_: The Riksbank is developing the "e-Krona"

- USA_: Pilot projects are underway, but still without a concrete timetable

- Brazil, Nigeria, India_: partly already introduced or heavily tested

The EU is one of the leading regions - but with a strong emphasis on legal and democratic safeguards.

M. Schall Verlag

Hackenweg 97

26127 Oldenburg

Germany

https://markus-schall.de/en

Herr Markus Schall

info@schall-verlag.de

Schall-Verlag was founded in 2025 by Markus Schall - out of a desire to publish books that provide clarity, stimulate reflection and deliberately avoid the hectic flow of the zeitgeist. The publishing house does not see itself as a mass marketplace, but as a curated platform for content with attitude, depth and substance.

The focus is on topics such as personal development, crisis management, social dynamics, technological transformation and critical thinking. All books are the result of genuine conviction, not market analysis - and are aimed at readers who are looking for guidance, insight and new perspectives.

The publishing house is deliberately designed to be compact, independent and with high standards in terms of language, content and design. Schall-Verlag is based in Oldenburg (Lower Saxony) and plans multilingual publications in German and English.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The digital euro is coming - what it means, what it must not do, and what it could do here

News-ID: 4254850 • Views: …

More Releases from M. Schall Verlag

Russia, NATO, and fear of war: Is an attack imminent, and how real is the threat …

In times of growing geopolitical tensions and price-sensitive energy markets, the issue of security policy and international relations is becoming the focus of public debate. The current background article "Russia, NATO, and the fear of war--what can be proven and what cannot" in the online magazine of M. Schall Verlag addresses precisely this issue: It takes a differentiated look at assertions, political statements, and strategic interpretations, highlights verifiable statements from…

BRICS, the West, and the world order: Orientation in uncertain times

The BRICS group of countries has been the focus of increasing international attention for several years. With the expansion of the alliance, growing economic indicators, and ever-changing geopolitical interpretations, there is a great need for classification. A recent editorial in the online magazine of M. Schall Verlag therefore takes a detailed look at what BRICS actually is - and what it is not.

In around 8,000 words, the article traces…

Syria after Assad: New background article assesses power shift and consequences

A comprehensive new article in the online magazine of M. Schall Verlag sheds light on the political, social, and geopolitical situation in Syria after the end of the Assad era. The article puts historical developments into context, describes the changed power relations in the country, and at the same time looks at the consequences for Europe and Germany. The aim is to provide a nuanced view that goes beyond simplistic…

What is productive digital property? The answer to AI and automation.

In the digital age, countless pieces of content, profiles, and reach are created every day. Click rates, followers, and visibility are often considered benchmarks for success. But which of these actually represent lasting value? A new, comprehensive editorial entitled "Digital property explained - How to create sustainable online assets" in the online magazine of M. Schall Verlag explores this very question and highlights which forms of digital property are sustainable…

More Releases for ECB

ECB intraday liquidity guidance welcomed by banks - but execution marks next hur …

Image: https://www.globalnewslines.com/uploads/2025/07/f0a9eb7cbc8260b00051a9d2d9b4f676.jpg

The European Central Bank's (ECB) landmark guidance on intraday liquidity management is being viewed as a welcome step forward for the banking sector - setting out long-awaited clarity on best practice and providing a catalyst for transformation.

That's according to insights gathered by Planixs, the leader in real-time liquidity management, in a new report titled Mastering Intraday Liquidity: ECB Guidelines as a Catalyst for Change.

The ECB's framework, which came into…

ECB Disk Storage Market Will Generate Record Revenue by 2031

The ECB Disk Storage Market size is expected to grow at an annual average of CAGR 9% during the forecast period (2024-2031). ECB Disk Storage, also known as External Controller Based Disk Storage, refers to a type of storage system that utilizes an external controller to manage and control the access to the disk drives. It is commonly used in enterprise environments where high-performance and scalable storage solutions are required.

By…

ECB Disk Storage Market Will Generate Record Revenue by 2029

The ECB Disk Storage Market is expected to grow at a CAGR of 6% during the forecast period 2023-2029. External controller-based disk storage is a type of data storage system that uses an external controller to manage and store data on disk. Disk storage systems have great performance and scalability, making them ideal for maintaining large amounts of data. External controller-based disk storage is a form of data storage that…

ECB Disk Storage Market To Witness Astonishing Growth With Leading Players|EMC, …

Latest Study on Industrial Growth of Global (United States, European Union and China) ECB Disk Storage Market 2019-2025. A detailed study accumulated to offer Latest insights about acute features of the ECB Disk Storage market. The report contains different market predictions related to market size, revenue, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also…

United States ECB Disk Storage Market Report 2017

Summary

This report studies sales (consumption) of ECB Disk Storage in United States market, focuses on the top players, with sales, price, revenue and market share for each player, covering

?EMC

IBM

NetApp

Hitachi

HP

Dell

Fujitsu

Oracle

Huawei

Market Segment by States, covering

California

Texas

New York

Florida

Illinois

Split by product types, with sales, revenue, price, market share and growth rate of each type, can be divided into

500G

Split by applications, this report focuses on sales, market share and growth rate of ECB Disk Storage in…

United States ECB Disk Storage Sales Market Report 2021 Market Shares, Strategie …

MarketResearchReports.Biz presents this most up-to-date research on "United States ECB Disk Storage Sales Market Report 2021"

Description

This report studies sales (consumption) of ECB Disk Storage in USA market, focuses on the top players, with sales, price, revenue and market share for each player in USA, covering

EMC

IBM

NetApp

Hitachi

HP

Dell

…