Press release

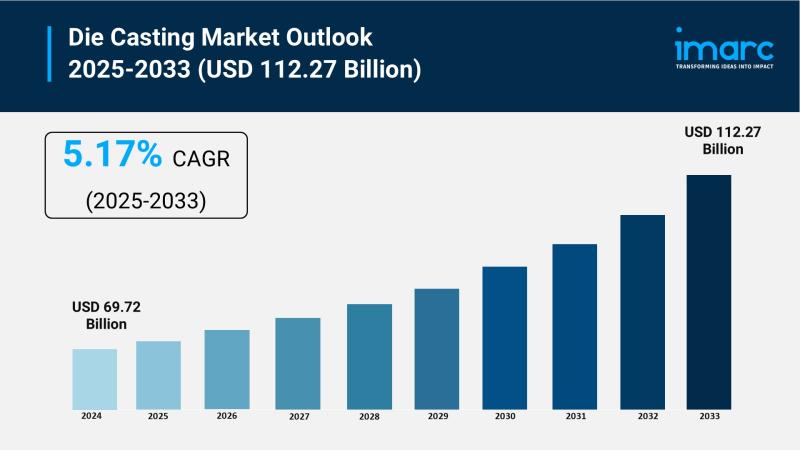

Die Casting Market to Reach USD 112.27 Billion by 2033, Growing at a CAGR of 5.17%

Market Overview:The die casting market is experiencing rapid growth, driven by Growing Demand for Lightweight Components in the Automotive Sector, Revolutionary Impact of Electric Vehicles (EVs) and Technological Advancements in Die Casting Processes. According to IMARC Group's latest research publication, "Die Casting Market Size, Share, Trends and Forecast by Process, Raw Material, Application, and Region, 2025-2033", The global die casting market size was valued at USD 69.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 112.27 Billion by 2033, exhibiting a CAGR of 5.17% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/die-casting-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Die Casting Industry:

● Growing Demand for Lightweight Components in the Automotive Sector

The die casting market's largest end-use market is the automotive industry, which is growing at a very high rate as countries around the world mandate that automobiles are more fuel efficient and less polluting. To meet these regulations, lightweight materials such as aluminum and magnesium are used to replace steel and iron engine and body components. Die casting is used to produce these lightweight yet strong components such as engine blocks, transmission cases, heat shields and body structural components. As of 2024, in terms of revenue, the transportation industry was the most dominant sector in the aluminum die casting market, due to lightweighting, which is largely driven by the adoption of electric vehicles (EVs).

● Revolutionary Impact of Electric Vehicles (EVs)

Electric vehicles are transforming die casting as manufacturers create detailed and lightweight die-cast components for battery enclosures, motor casings, inverters and structural chassis components to accommodate heavy batteries and extend electric vehicle ranges. Die casting is now commonly used because of the ability to produce complex and accurate shapes, and the excellent heat-dissipation provided. Tesla was the first company to introduce Gigacasting into the automotive industry, as part of its high pressure die casting (HPDC) manufacturing process. Gigacasting machines with a clamping pressure of 6000 to 9000 tonnes, or greater, are used to cast parts of a vehicle underbody in a single piece, replacing dozens to hundreds of individually stamped and cast components. Casting as much of the vehicle as a single part reduces assembly time, capital cost, and production complexity, and opens up large amounts of new demand for large die-cast aluminum components within EV manufacturing.

● Technological Advancements in Die Casting Processes

Continuing research and technology development is continuing to improve the accuracy, efficiency and range of use of materials used for die casting. Advances in HPDC and Vacuum Die Casting processing, as well as the adoption of Gigacasting, are allowing parts to be produced with thinner walls and improved mechanical properties and reduced porosity. Automation and Robotics throughout the manufacturing process - from the handling of the molten alloy to the removal of the finished castings - is leading to improvements in quality and workplace safety. The ability to use Artificial Intelligence (AI) and advanced simulation and control processes, such as real-time shot control, allows the manufacturer to monitor and adjust the manufacturing process, reducing and optimizing productivity. The use of 3D printing to rapidly manufacture complex dies and molds for new casting designs is also speeding up product development.

Key Trends in the Die Casting Market:

● Integration of Automation and Robotics

Automation is now standard in high-volume die casting operations, drastically improving consistency and safety. Robotic arms handle tasks like die lubrication, part extraction, trimming, and quality checks, reducing human error and improving cycle time. In factories producing EV battery housings or consumer electronics casings, automation has shaved production costs while boosting throughput. Companies like Idra, Yizumi, and Toshiba Machine are delivering integrated die casting cells with real-time monitoring and machine learning algorithms that predict tool wear and casting defects. Smaller players are also investing in cobots and modular automation platforms that are scalable and budget-friendly. This shift enables even mid-sized die casting shops to deliver high-spec products for global clients without compromising cost or quality. As skilled labor shortages persist across the U.S., Japan, and Europe, smart automation is becoming a necessity rather than a luxury in die casting facilities.

● Sustainability and Circular Manufacturing Practices

Sustainability goals are shaping new production standards in the die casting industry. Foundries are investing in regenerative melting furnaces, energy-efficient chillers, and hybrid systems to lower emissions and energy usage. Recycled aluminum use is climbing fast, especially in regions where green regulations are tightening. In the EU, over 75% of die cast aluminum now comes from recycled sources, with OEMs demanding carbon footprint reports for every component. Closed-loop manufacturing is also gaining ground-excess metal from trimming operations is instantly remelted and reused, creating zero-waste workflows. Automotive and electronics clients are increasingly selecting partners with ISO 14001 certification or similar environmental credentials. In China and South Korea, major casting firms are installing on-site solar panels and digital energy meters to track consumption in real time. These green practices are helping manufacturers improve margins, meet customer ESG expectations, and future-proof their operations.

● Expansion of Structural Die Casting

Structural die casting is reshaping how vehicles are built, and the movement is catching on globally. Instead of assembling car parts from dozens of small pieces, companies are now producing large, complex components-like battery trays, motor cradles, and side frames-in a single cast. Tesla's Giga Press technology set the benchmark, but other automakers like Volvo, Hyundai, and General Motors are now ordering similarly large die casting machines from suppliers like Idra and LK Machinery. This shift allows automakers to reduce part count by over 40%, cut assembly time, and improve structural rigidity. Aerospace and off-highway vehicle manufacturers are beginning to explore structural casting for parts like seat supports, floor panels, and crossbeams. As this trend spreads, die casting firms are adapting their design tools, mold materials, and heat treatment processes to meet the demands of thicker, more robust castings. The result is a wave of innovation transforming traditional casting into a high-value, high-performance manufacturing domain.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6347&flag=E

Leading Companies Operating in the Global Die Casting Industry:

● BUVO Castings

● Dynacast

● Endurance Technologies Limited

● FAIST Group

● GF Casting Solutions

● Gibbs Die Casting Corporation

● Linamar Corporation

● Martinrea Honsel

● Nemak

● Pace Industries

● Rockman Industries Ltd

● Ryobi Limited

● Sundaram Clayton Limited

Die Casting Market Report Segmentation:

Breakup By Process:

● Pressure Die Casting

● Vacuum Die Casting

● Squeeze Die Casting

● Others

Pressure die casting represents the largest segment because it enables high-speed production of complex, high-precision components with superior surface finish, making it ideal for mass manufacturing in industries like automotive and electronics.

Breakup By Raw Material:

● Aluminum

● Magnesium

● Zinc

Aluminum accounts for the majority of the market share due to its lightweight, corrosion-resistant properties and excellent strength-to-weight ratio, which are crucial for automotive and aerospace applications.

Breakup By Application:

● Automobile

● Body Parts

● Engine Parts

● Transmission Parts

● Others

● Heavy Equipment

● Construction

● Farming

● Mining

● Machine Tools

● Plant Machinery

● Chemical Plants

● Petroleum Plants

● Thermal Plants

● Paper

● Textile

● Others

● Municipal Castings

● Valves and Fittings

● Pipes

● Others

Automobile exhibits a clear dominance in the market as the demand for lightweight, durable components in vehicles to improve fuel efficiency and reduce emissions drives extensive use of die casting in automotive manufacturing.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Asia Pacific enjoys the leading position in the die casting market owing to the rapid growth of automotive and industrial sectors, particularly in China and India, along with increased manufacturing activities and foreign investments.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States:+1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Die Casting Market to Reach USD 112.27 Billion by 2033, Growing at a CAGR of 5.17% here

News-ID: 4254270 • Views: …

More Releases from IMARC Group

Hydrogen Fluoride Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

Setting up a hydrogen fluoride manufacturing plant positions investors within a strategically important segment of the global specialty chemicals and fluorochemicals industry, driven by increasing demand for semiconductor manufacturing, refrigerant production, and pharmaceutical intermediates. As modern industrial processes advance, electronics manufacturing expands, and the need for high-purity fluorine compounds grows, hydrogen fluoride continues to gain traction across semiconductor fabrication, aluminum production, and petroleum refining worldwide. Rising demand from high-tech industries,…

Vinyl Acetate Ethylene Production Plant Cost 2026: Industry Overview and Profita …

Setting up a Vinyl Acetate Ethylene Production Plant positions investors in one of the most stable and essential segments of the specialty chemicals and polymer value chain, backed by sustained global growth driven by growing construction activity, rising demand for high-performance dry-mix mortars, increasing use in paints and coatings, and the dual-benefit advantages of delivering flexible, low-VOC polymer binder solutions that meet both industrial performance standards and evolving environmental compliance…

Fluff Pulp Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a fluff pulp manufacturing plant positions investors within a strategically important segment of the global hygiene products and absorbent materials industry, driven by increasing demand for disposable hygiene products, absorbent personal care items, and medical applications. As consumer hygiene standards advance, disposable product adoption expands, and the need for high-quality absorbent materials grows, fluff pulp continues to gain traction across baby diapers, adult incontinence products, feminine hygiene items,…

Fire Alarms Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pro …

Setting up a fire alarms manufacturing plant positions investors within a strategically important segment of the global safety and security equipment industry, driven by increasing demand for fire detection and safety systems, stringent building safety regulations, and growing awareness of fire protection measures. As modern construction practices advance, smart building integration expands, and the need for advanced fire safety infrastructure grows, fire alarms continue to gain traction across commercial buildings,…

More Releases for Casting

Investment Casting Manufacturers in India - Leading Investment Casting Suppliers

Have a need for investment casting? Get a quote from us now.

Meena Cast Pvt. Ltd. is an expanding company working in an excellent premise in the Shapar Industrial Estate, 15 kilometres from Rajkot Gujarat INDIA.

Investment Casting Manufacturers in India = https://www.meenacast.com/

We have established an image for competently fulfilling our clients' needs. We ensure the highest level of quality at all levels of our strategy. We always make deliveries on period…

Pump Casting Manufacturers - Best Pump Casting Suppliers & Exporters

Pump Casting Manufacturers - Best Pump Casting Suppliers & Exporters

Best Pump Casting Manufacturers in India, Top Pump Casting Suppliers, Pump Casting Exporters from Rajkot Gujarat

Your search for top-notch pump casting manufacturers ends here!

Introduction

In the world of industrial machinery, pumps play a crucial role in various sectors such as manufacturing, construction, and agriculture. One of the key components of a pump is the pump casting, which forms the outer shell and…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Automotive Parts Magnesium Die Casting Market 2021 Status and Outlook-cago White …

The report presents an in-depth assessment of the Automotive Parts Magnesium Die Casting Market including enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, operator case studies, opportunities, future roadmap, value chain, ecosystem player profiles and strategies. The report also presents forecasts for Automotive Parts Magnesium Die Casting from 2021 till 2025. The report covers the pre COVID-19 historic data, impact of COVID-19 and post-COVID-19 (Corona Virus)…

Automotive Parts Die Casting Market Global outlook 2021 to 2026: Gibbs Die-casti …

The report presents an in-depth assessment of the Automotive Parts Die Casting Market including enabling technologies, key trends, market drivers, challenges, standardization, regulatory landscape, deployment models, operator case studies, opportunities, future roadmap, value chain, ecosystem player profiles and strategies. The report also presents SWOT Analysis and forecast for Automotive Parts Die Casting investments. The final report copy provides the impact analysis of novel COVID-19 pandemic on the Automotive Parts Die Casting market…

Automotive Parts Die Casting Market 2019 Global Key Country Analysis: Alcast Com …

Automotive Parts Die Casting Market Research Report, by Production Process Type (Pressure, Vacuum, Squeeze and Semi-Solid), Raw Material Type (Aluminum, Zinc, Magnesium and Others), By Application Type, Vehicle Type, and by Regions - Forecast till 2023

The Key Players In Automotive Parts Die Casting Market Are:

Alcast Company (U.S.), Dynacast, LLC (U.S.), Endurance Technologies Limited (India), Gibbs Die Casting Corp (U.S.), and Rockman Industries (India). Ryobi Die Casting Inc. (U.S.), Kinetic Die…