Press release

Australia Home Furniture Market Projected to Reach USD 34.3 Billion by 2033

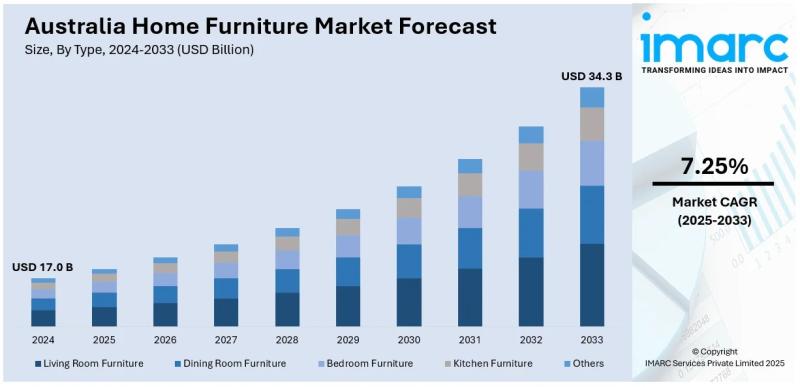

The latest report by IMARC Group, titled "Australia Home Furniture Market Report by Type (Living Room Furniture, Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, Others), Distribution Channel (Home Centers, Flagship Stores, Specialty Stores, Online, Others), and Region 2025-2033," offers comprehensive analysis of the Australia home furniture market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia home furniture market size reached USD 17.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.3 Billion by 2033, exhibiting a CAGR of 7.25% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 17.0 Billion

Market Forecast in 2033: USD 34.3 Billion

Market Growth Rate (2025-2033): 7.25%

Australia Home Furniture Market Overview

Home furniture market growth in Australia is driven by rapid construction, social media, demand for sustainable products, urbanization, high disposable incomes, e-commerce, remote working, demand for outdoor living spaces, interest in modular furniture, and investments in smart furniture. Construction of residential units is driven by urbanization and a growing population, which consequently drives sales of bedroom, dining, living room, and storage furniture in new residential units. The expansion is also being fueled by social media: 20.8 million users (76% of the population of Australia) were inspired by influencers and content creators on social media platforms to discover ideas for furniture and home interior in January 2024. Consumers are more likely to purchase products made from recycled wood, responsible timber, recycled metals, and organic cotton. The rapid urbanization of Sydney, Melbourne, and Brisbane will be the key driver of the industry, as new housing and residential apartment buildings are built with open floor plans requiring new furniture. Growing disposable income to invest in branded and premium furniture and decor makes living more convenient and attractive. Online furniture retailers such as Temple & Webster represent items through augmented reality and 3D to grow in their market. Demand is growing in regards to office furniture as remote working becomes more common, and for patio and alfresco furniture as outdoor living grows. People want furniture that is modular, customized, and fits varied spaces. Smart furniture with features like wireless charging, LED lighting, and voice control is also growing in appeal.

Positive business conditions exist for living room furniture (including sofas, entertainment units and coffee tables for open-plan living), bedroom furniture (for new home building and renovations), distribution channels (including online, specialist stores) and sustainable production (including growth opportunities such as certification schemes). The Australian home furniture market is also benefiting from the growing popularity of modular and adaptable furniture products among millennials and Generation Z, who are motivated by flexible and affordable products, interior design trends shared on Instagram and Pinterest by influencers such as TikTok creators, smart furniture and accessories with USB ports, adjustability and Bluetooth features, increased lifestyle expenditure on home office and garden/outdoor furniture since the pandemic, and technology that allows consumers to configure furniture products to suit their needs. Australia Capital Territory, New South Wales, Victoria and Queensland are the major states and territories in the region. Agglomeration, urbanization, and homeownership are more common in these states. The Australian construction market in 2024 was valued at USD 403.2 billion. 76% of consumers are influenced by social media, and circular economy principles promote sustainable purchases. However, it also has challenges such as global supply chains, the price-sensitivity of value and mid-range segments, and complications with sustainability certification processes.

Request For Sample Report:

https://www.imarcgroup.com/australia-home-furniture-market/requestsample

Australia Home Furniture Market Trends

• Sustainable furniture growth: Rising consumer preference for eco-conscious products made from reclaimed wood, responsibly sourced timber, recycled metals, and organic fabrics driven by environmental awareness, with brands highlighting FSC and OEKO-TEX certifications, low-emission finishes, upcycling initiatives, and supply chain transparency.

• Social media influence expansion: Approximately 20.8 million Australians (76% of population) using social media in January 2024 exposing consumers to interior design trends, with influencers, bloggers, and content creators showcasing furniture setups, DIY hacks, and styling tips motivating aspirational purchases.

• Modular and custom solutions: Shift toward versatile modular designs offering mix-and-match components with digital configuration tools enabling personalized selections, appealing to millennials, Gen Z, renters, and first-time homebuyers seeking flexible affordable options adapting to evolving lifestyle needs.

• E-commerce digital innovation: Rapid online retail channel expansion with platforms leveraging augmented reality tools, 3D visualizations, and virtual showrooms helping consumers visualize furniture in homes, enhancing convenience, comparison capabilities, and reach to regional underserved areas.

• Smart furniture integration: Growing adoption of technology-integrated items featuring wireless charging, LED lighting, voice control compatibility, USB ports, adjustable height mechanisms, and Bluetooth speakers appealing to tech-savvy households and remote workers prioritizing connected living.

• Interior design media impact: Television programs, home makeover shows, and platforms like Instagram, Pinterest, and TikTok exposing consumers to diverse styles from Scandinavian minimalism to industrial and bohemian aesthetics increasing brand discovery and shortening buying cycles.

Market Drivers

• Construction activity surge: Australia construction market valued at USD 403.2 billion in 2024 with residential projects for growing population creating sustained demand for furnishing new houses, apartments, and townhouses across bedroom, dining, living room, and storage categories.

• Urban expansion acceleration: Rapid urbanization in Sydney, Melbourne, and Brisbane with new housing and apartment developments accommodating population increases requiring functional modern furnishings for open-plan layouts and compact urban settings driving modular and multifunctional furniture adoption.

• Disposable income growth: Rising household incomes and elevated living standards empowering consumers to invest in branded, premium, durable, and stylish furnishings reflecting lifestyle and personal taste, with cultural shift valuing interior aesthetics supporting both entry-level and high-end segments.

• Homeownership increase: Growing homeownership rates particularly among younger generations who are more likely to personalize spaces with curated furniture, along with first-time homebuyers and renters seeking affordable yet stylish options driving market expansion.

• Remote work transformation: Post-pandemic lifestyle changes with remote working trends spurring significant investment in home office furniture including ergonomic desks, comfortable chairs, storage solutions, and technology-integrated workspaces becoming permanent household features.

• Digital engagement evolution: Social media platforms with 76% population penetration enabling furniture brands to market directly through targeted ads and user-generated content, with integrated e-commerce links facilitating seamless shopping experiences particularly among younger informed design-conscious consumers.

Challenges and Opportunities

Challenges:

• Global supply chain dependencies with furniture manufacturing relying on imported raw materials, components, and finished products creating vulnerability to international shipping delays, cost fluctuations, and trade disruptions affecting inventory availability and pricing stability

• Price sensitivity and competition with diverse market segments from budget to premium creating intense competitive pressure, consumer price consciousness particularly in entry-level categories, and promotional discounting eroding margins while maintaining quality standards challenging profitability

• Sustainability certification complexity with eco-friendly claims requiring expensive third-party verifications, supply chain transparency documentation, and adherence to multiple standards (FSC, OEKO-TEX) creating compliance burdens and potentially higher production costs affecting competitiveness

• Showroom operational costs with physical retail locations requiring substantial investment in space, displays, staffing, and inventory while e-commerce channels gain prominence, creating challenges balancing omnichannel presence and optimizing real estate footprint

Opportunities:

• Smart technology integration developing furniture with wireless charging, adjustable features, voice control, USB ports, LED lighting, and Bluetooth connectivity appealing to tech-savvy households, remote workers, and smart home adopters transforming traditional furnishings into lifestyle-enhancing assets.

• Modular customization expansion offering mix-and-match components, digital configuration tools, bespoke aesthetics, and flexible designs catering to millennials, Gen Z, renters, and first-time buyers seeking personalized affordable space-efficient solutions adapting to evolving lifestyle needs.

• E-commerce AR innovation implementing augmented reality visualization tools, 3D modeling, virtual showrooms, and immersive shopping experiences helping consumers envision furniture in homes reducing returns while expanding market reach particularly in regional and underserved areas.

• Sustainable product lines capitalizing on environmental awareness with reclaimed wood, recycled materials, organic fabrics, certified sourcing, low-emission finishes, upcycling initiatives, and circular economy principles differentiating brands and attracting eco-conscious consumers willing to pay premiums.

• Outdoor living expansion responding to growing interest in alfresco entertaining and outdoor spaces with patio furniture, weather-resistant materials, modular outdoor settings, and multifunctional designs capitalizing on Australian climate and lifestyle preferences.

Australia Home Furniture Market Segmentation

By Type:

• Living Room Furniture

• Dining Room Furniture

• Bedroom Furniture

• Kitchen Furniture

• Others

By Distribution Channel:

• Home Centers

• Flagship Stores

• Specialty Stores

• Online

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-home-furniture-market

Australia Home Furniture Market News (2024-2025)

• January 2024: Social media users in Australia reached approximately 20.8 million representing 76% of population, significantly influencing furniture purchasing decisions through interior design content, influencer showcases, and brand discovery on Instagram, Pinterest, and TikTok platforms.

• 2024: Australia construction market reached USD 403.2 billion with residential projects proliferating across Sydney, Melbourne, and Brisbane accommodating urban expansion and population growth creating sustained demand for new home furnishing across all categories.

• 2024: E-commerce platforms including Temple & Webster expanded augmented reality tools, 3D visualizations, and virtual showrooms enabling consumers to visualize furniture in homes before purchasing, enhancing convenience and accessibility particularly in regional areas.

• 2024: Sustainable furniture lines gained prominence with brands highlighting FSC and OEKO-TEX certifications, offering products made from reclaimed wood, responsibly sourced timber, recycled metals, and organic fabrics responding to environmental awareness.

• 2024: Modular and custom-built furniture solutions expanded with digital configuration tools enabling personalized selections, appealing to millennials, Gen Z, renters, and first-time homebuyers seeking flexible versatile affordable space-efficient options.

• 2024: Smart furniture integration accelerated with offerings featuring wireless charging, LED lighting, voice control compatibility, USB ports, adjustable height mechanisms, and Bluetooth speakers targeting tech-savvy households and remote workers.

• 2024: Home office furniture investment surged due to remote working trends becoming permanent lifestyle feature, with demand for ergonomic desks, comfortable chairs, storage solutions, and technology-integrated workspaces supporting productivity.

• 2024: Outdoor living furniture category expanded responding to growing Australian consumer interest in patio and alfresco entertaining, with weather-resistant materials, modular outdoor settings, and multifunctional designs gaining popularity.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type, Distribution Channel, and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32968&flag=F

Q&A Section

Q1: What drives growth in the Australia home furniture market?

A1: Market growth is driven by construction activity surge with USD 403.2 billion market creating residential furnishing demand, urban expansion in Sydney, Melbourne, and Brisbane, disposable income growth enabling premium furniture investment, homeownership increase particularly among younger generations, remote work transformation spurring office furniture demand, and digital engagement evolution with 76% social media penetration influencing purchasing decisions.

Q2: What are the latest trends in this market?

A2: Key trends include sustainable furniture growth with eco-friendly certified materials, social media influence with 20.8 million users exposing consumers to design trends, modular and custom solutions offering flexible personalized options, e-commerce digital innovation with AR visualization tools, smart furniture integration featuring connected technology, and interior design media impact through Instagram, Pinterest, and TikTok platforms.

Q3: What challenges do companies face?

A3: Major challenges include global supply chain dependencies creating vulnerability to shipping delays and cost fluctuations, price sensitivity and competition with intense promotional pressure eroding margins, sustainability certification complexity requiring expensive verifications and documentation, and showroom operational costs balancing physical retail investment against growing e-commerce channel prominence.

Q4: What opportunities are emerging?

A4: Emerging opportunities include smart technology integration with wireless charging and voice control features, modular customization expansion with digital configuration tools, e-commerce AR innovation enabling virtual product visualization, sustainable product lines capitalizing on environmental awareness with certified eco-friendly materials, and outdoor living expansion responding to alfresco entertaining interest.

Q5: What is the market forecast for Australia home furniture?

A5: The Australia home furniture market was valued at USD 17.0 Billion in 2024 and is projected to reach USD 34.3 Billion by 2033, exhibiting a CAGR of 7.25% during 2025-2033, driven by construction growth, urbanization, rising incomes, sustainability trends, and digital retail transformation.

Q6: Which segments dominate the market?

A6: Living room furniture dominates by type with sofas, entertainment units, and coffee tables for open-plan spaces. Online distribution channels are rapidly expanding accessibility and convenience. ACT, New South Wales, Victoria, and Queensland lead regionally with concentrated urban development, higher homeownership rates, and major metropolitan centers driving furniture demand.

Q7: How is social media influencing the market?

A7: Social media platforms reached 20.8 million Australians (76% of population) in January 2024, exposing consumers to interior design ideas through influencers, bloggers, and content creators showcasing furniture setups and styling tips. This visual inspiration increases brand discovery, drives aspirational purchases, shortens buying cycles, and enables retailers to market directly through targeted ads and integrated e-commerce links.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Home Furniture Market Projected to Reach USD 34.3 Billion by 2033 here

News-ID: 4252220 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…