Press release

Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2033

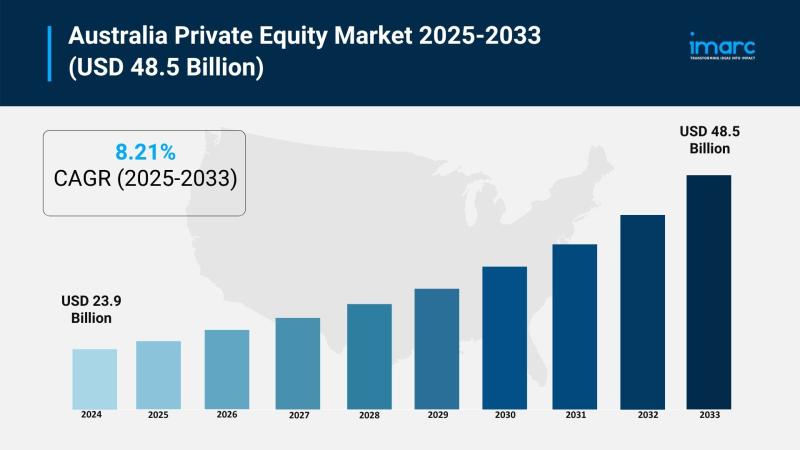

The latest report by IMARC Group, titled "Australia Private Equity Market Report by Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others), and Region 2025-2033," offers comprehensive analysis of the Australia private equity market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia private equity market size reached USD 22.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.5 Billion by 2033, exhibiting a CAGR of 8.20% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 22.0 Billion

Market Forecast in 2033: USD 48.5 Billion

Market Growth Rate (2025-2033): 8.20%

Australia Private Equity Market Overview

The Australia private equity market is expected to grow as more capital flows into venture and buyout funds, driven by interest in growth-oriented startups and incumbent companies making technology, fintech, healthcare and renewable energy investments. With the economy expanding, funds focused on infrastructure, real estate and asset markets are becoming more popular, as private equity firms target larger-scale transport, energy and telecommunications infrastructure projects for long-term returns. Investors are more concerned about ESG concerns, institutional investors and family offices are doing more deals, and government-sponsored initiatives to promote innovation and entrepreneurship are helping to stimulate growth. The Rest superannuation fund's USD 300 million investment with I Squared Capital in March 2025 in digital infrastructure, transportation and renewables also reflected the trend, while the merger in December 2024 between ISPT and IFM Investors combined their strengths in property and infrastructure to further accelerate growth. Institutional investors are also expected to use their increased assets under management to increase allocations to private equity funds, given the preference for private equity-backed companies over public equity investments and the investment opportunities available in various sectors based on the economic backdrop.

Drivers of Australia's private equity market include outperformance of mid-market buyout vehicles which seek to improve the operational efficiency of their portfolio companies, business-focused venture capital investments in technology, healthcare and sustainable private equity, real estate investment in urbanization and population growth driving demand for commercial property, investment in green ESG infrastructure, more foreign investment inflows, the emergence of small and mid-cap private equity, investment flexibility and growth during turbulent times, growing alternatives to IPOs including early-stage sell downs, backdoor listings and secondary market transactions, active management generating alpha via operational improvements and bolt-on acquisitions, a growing interest in digital transformation, a growing interest in healthcare as an investment and increasing regulatory scrutiny including ASIC interest in private company deals and changes to the Australian merger clearance policy. The Australian Capital Territory and New South Wales have most financial services infrastructure and activity in this area. Australia has the highest level of funds under management ever, interest rates have stabilized as inflationary pressures have eased, and regulatory changes are encouraging firms to adopt innovative models, making the country a more active market for private equity investment and portfolio diversification, despite the complicated regulation, an uncertain exit market and competitive valuations.

Request For Sample Report:

https://www.imarcgroup.com/australia-private-equity-market/requestsample

Australia Private Equity Market Trends

• Venture capital and buyout surge: Increasing investments in high-growth startups and established businesses with strong expansion potential, focusing on technology-driven enterprises, fintech, healthcare, and renewable energy sectors, driven by institutional investors, superannuation funds, and family offices enhancing deal activity.

• Infrastructure and real estate focus: Significant growth in investments targeting large-scale infrastructure projects including transportation, energy, and telecommunications for long-term returns, with real estate benefiting from commercial and residential property demand supported by urbanization and population growth.

• ESG integration emphasis: Rising environmental, social, and governance considerations becoming central to transactions with investors and regulators demanding increased transparency and accountability, affecting deal structures, due diligence procedures, valuation metrics, and long-term success measurements.

• Small and mid-cap preference: Growing investor focus on small and mid-market companies offering agility, growth potential, and resilience to changing market conditions and regulations, with private equity firms using dry powder to capture undervalued assets as interest rates stabilize.

• Creative exit strategies: Innovative approaches including partial sell-downs, backdoor listings, and secondary transactions gaining traction as alternatives to traditional exits with subdued IPO markets, providing liquidity while optimizing timing and valuation through flexible strategic planning.

• Regulatory scrutiny increase: ASIC becoming more interested in private deals with heightened oversight of merger clearance processes, tax transparency requirements, and compliance standards forcing firms to become more strategic, compliant, and socially responsible investment actors.

Market Drivers

• Superannuation sector backing: Strong support from institutional investors with Rest managing approximately USD 59.52 billion serving 2 million members committing USD 300 million to infrastructure investments, demonstrating substantial capital availability from superannuation funds enhancing deal activity and market growth.

• Economic stability and growth: Australian economy maintaining stability with strong urban development projects, population growth driving real estate demand, and infrastructure expansion creating attractive long-term investment opportunities across diverse sectors supporting sustained private equity portfolio expansion.

• Higher return potential: Private equity-backed firms delivering superior performance compared to public markets attracting investor capital, with active management approaches generating alpha through operational enhancements, strategic acquisitions, and value creation strategies demonstrating compelling risk-adjusted returns.

• Regulatory support initiatives: Government-backed programs promoting innovation and entrepreneurship making Australia preferred destination for private equity investments, with favorable reforms supporting deal-making, foreign direct investment facilitation, and infrastructure development incentives enhancing market attractiveness.

• Interest rate stabilization: Inflationary pressures subsiding with interest rates stabilizing creating favorable conditions for private equity firms to deploy capital, capture undervalued assets, execute strategic transactions, and implement operational improvement strategies maximizing portfolio company performance.

• Sector diversification opportunities: Growing investment prospects across technology, healthcare, renewable energy, digital infrastructure, transportation, telecommunications, and sustainable real estate providing portfolio diversification and exposure to high-growth sectors with long-term value creation potential.

Challenges and Opportunities

Challenges:

• Regulatory compliance complexity with ASIC increasing scrutiny of private deals, merger clearance process changes, tax transparency requirements, and ESG reporting standards creating administrative burdens, due diligence intensification, and potential transaction delays affecting deal execution efficiency

• Exit market constraints with IPO markets remaining subdued limiting traditional exit options, requiring innovative approaches including secondary transactions and partial sell-downs, while uncertain public market conditions affecting exit timing, valuation optimization, and liquidity realization strategies

• Valuation pressure and competition with increased deal activity creating competitive bidding environments, driving higher valuations, compressing potential returns, and requiring sophisticated value creation strategies beyond multiple expansion to justify premium pricing in mid-market segments

• Limited domestic market scale compared to global private equity centers constraining deal pipeline size, requiring firms to compete intensely for quality assets while managing smaller fund sizes and potentially higher relative transaction costs

Opportunities:

• Small and mid-cap investments capitalizing on agility and growth potential in volatile conditions with operational enhancement and bolt-on acquisition strategies generating alpha, particularly in healthcare, technology, and renewable energy sectors offering resilience and expansion opportunities

• Infrastructure and renewable energy growth targeting large-scale transportation, digital infrastructure, and sustainable energy projects with government support, ESG alignment, and long-term stable returns appealing to institutional investors seeking predictable cash flows and impact investments

• Creative exit strategy development implementing partial sell-downs, backdoor listings, and secondary market transactions as viable alternatives to traditional exits, providing liquidity options, timing flexibility, and valuation optimization in subdued IPO environment

• ESG differentiation and value creation integrating environmental, social, and governance factors into investment strategies, due diligence, and portfolio management enhancing long-term financial performance, risk mitigation, regulatory compliance, and investor appeal

• Digital transformation investments capitalizing on technology adoption across industries with venture capital and growth equity opportunities in fintech, healthtech, proptech, and digital infrastructure supporting Australia's economic modernization and productivity gains

Australia Private Equity Market Segmentation

By Fund Type:

• Buyout

• Venture Capital (VCs)

• Real Estate

• Infrastructure

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-private-equity-market

Australia Private Equity Market News (2024-2025)

• March 30, 2025: I Squared Capital, global infrastructure investment company, announced Rest superannuation fund (managing USD 59.52 billion serving 2 million members) committed USD 300 million focusing on digital infrastructure, transportation, and renewable energy offering flexible financial solutions to vital infrastructure assets.

• December 13, 2024: ISPT merged with IFM Investors bringing together property funds management and global private markets expertise, with Chris Chapple (former ISPT CEO) named IFM Investors' Global Head of Real Estate, aiming to increase customer value and accelerate growth strategies.

• 2025: Private equity firms increasingly targeting small and mid-cap companies offering agility and growth potential as inflationary pressures subsided and interest rates stabilized, using dry powder to capture undervalued assets in healthcare, technology, and renewable energy.

• 2024-2025: ESG considerations became central to private equity transactions with investors and regulators demanding increased transparency and accountability affecting deal structures, due diligence procedures, valuation metrics, and long-term portfolio company success measurements.

• 2024-2025: Creative exit strategies including partial sell-downs, backdoor listings, and secondary transactions gained traction as viable alternatives to traditional exits with IPO markets remaining subdued, providing liquidity while optimizing timing and valuation.

• 2024-2025: ASIC intensified scrutiny of private deals with heightened interest in merger clearance processes, tax transparency requirements, and ESG reporting standards forcing private equity firms to strengthen compliance frameworks and responsible investment practices.

• 2024: Venture capital investments surged in technology-driven enterprises, fintech, healthcare, and renewable energy sectors driven by institutional investors, superannuation funds, and family offices seeking high-growth opportunities and portfolio diversification.

• 2024: Infrastructure and real estate investments expanded significantly with private equity firms targeting large-scale transportation, energy, telecommunications, and urban development projects capitalizing on economic stability and government-backed initiatives.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Fund Type and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=31707&flag=F

Q&A Section

Q1: What drives growth in the Australia private equity market?

A1: Market growth is driven by superannuation sector backing with Rest committing USD 300 million demonstrating institutional capital availability, economic stability and growth with strong urban development and infrastructure expansion, higher return potential from private equity-backed firms compared to public markets, regulatory support initiatives promoting innovation and entrepreneurship, interest rate stabilization creating favorable deployment conditions, and sector diversification opportunities across technology, healthcare, and renewable energy.

Q2: What are the latest trends in this market?

A2: Key trends include venture capital and buyout surge in high-growth startups and established businesses, infrastructure and real estate focus with large-scale project investments, ESG integration emphasis becoming central to transactions and due diligence, small and mid-cap preference offering agility and resilience, creative exit strategies with partial sell-downs and secondary transactions, and regulatory scrutiny increase with ASIC heightened oversight.

Q3: What challenges do companies face?

A3: Major challenges include regulatory compliance complexity with ASIC scrutiny intensification and ESG reporting requirements, exit market constraints with subdued IPO markets limiting traditional options, valuation pressure and competition creating bidding environments compressing returns, and limited domestic market scale requiring intense competition for quality assets with smaller fund sizes and higher relative transaction costs.

Q4: What opportunities are emerging?

A4: Emerging opportunities include small and mid-cap investments with operational enhancement strategies in healthcare, technology, and renewable energy, infrastructure and renewable energy growth with government support and ESG alignment, creative exit strategy development providing liquidity and timing flexibility, ESG differentiation enhancing performance and risk mitigation, and digital transformation investments in fintech, healthtech, and digital infrastructure.

Q5: What is the market forecast for Australia private equity?

A5: The Australia private equity market was valued at USD 22.0 Billion in 2024 and is projected to reach USD 48.5 Billion by 2033, exhibiting a CAGR of 8.20% during 2025-2033, driven by superannuation backing, economic stability, regulatory support, and sector diversification opportunities.

Q6: Which fund types dominate the market?

A6: Buyout funds dominate targeting mid-market companies with operational enhancement potential, venture capital investments focus on technology, healthcare, and sustainability sectors, real estate funds benefit from urbanization and commercial property demand, and infrastructure investments target essential services with ESG considerations prioritizing eco-friendly projects.

Q7: What major transactions occurred recently?

A7: Major transactions include Rest superannuation fund (USD 59.52 billion AUM) committing USD 300 million to I Squared Capital in March 2025 for digital infrastructure, transportation, and renewable energy investments, and ISPT merger with IFM Investors in December 2024 bringing together property and infrastructure expertise to accelerate growth strategies and increase customer value.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Private Equity Market Projected to Reach USD 48.5 Billion by 2033 here

News-ID: 4252182 • Views: …

More Releases from IMARC Group

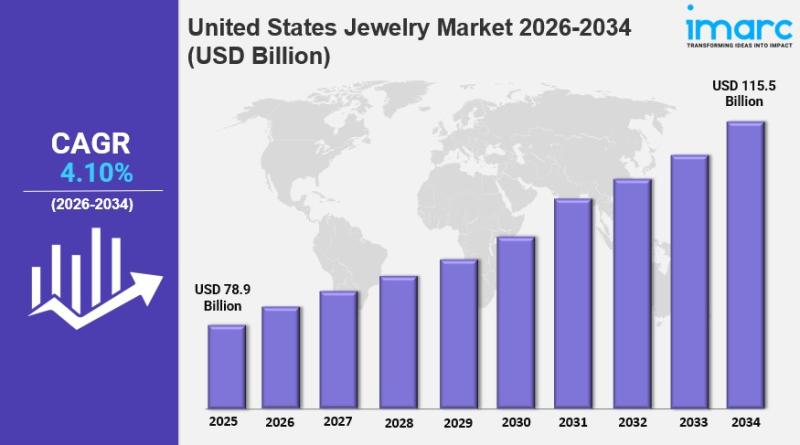

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…