Press release

U.S. Oil and Gas EPC Market Size & Growth Analysis 2035: Top Companies, SWOT Insights & Growth Opportunities

The U.S. oil and gas EPC market is undergoing a dynamic shift driven by evolving energy priorities, integration of digital technologies, and changing geopolitical supply factors. Engineering, procurement, and construction (EPC) companies remain central to enabling infrastructure buildout across upstream, midstream, and downstream operations. The competitive environment is defined by companies with strong project execution capabilities, technology specialization, and diversified service portfolios supporting refineries, pipelines, LNG systems, petrochemical complexes, and offshore platforms.Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Oil and Gas EPC Market report here → https://www.researchnester.com/sample-request-7524

Top Companies & Their Strategies

Bechtel Corporation

Bechtel Corporation is among the most influential players in the U.S. oil and gas EPC market, offering deep technical expertise across liquefaction plants, petrochemicals, and multi-billion-dollar energy infrastructure. Its strengths lie in global project delivery frameworks, comprehensive procurement networks, and emphasis on safety and execution. Bechtel leverages advanced digital tools and modular construction methodologies to reduce risk and timelines, creating value for developers of complex oil and gas facilities.

Fluor Corporation

Fluor is recognized for its integrated EPC offerings that support upstream, midstream, and downstream clients. The company emphasizes engineering standardization, global supply chain efficiency, and operator support throughout asset lifecycles. Fluor's regional presence across energy-dense states enhances its access to pipeline, refinery, and LNG development opportunities. The company continues enhancing data-driven project solutions that improve planning, cost controls, and technical quality.

KBR, Inc.

KBR is widely respected for its process technology expertise, particularly in petrochemicals and LNG. Its strategic focus includes digitized project management, proprietary engineering solutions, and risk-balanced commercial models. KBR's refining and processing technologies provide a competitive advantage, supporting clients transitioning toward cleaner fuels. The company's diversified government services portfolio further stabilizes its energy-focused business.

Technip Energies

Technip Energies brings strong engineering depth, particularly in LNG infrastructure and plant design. The company leverages technology partnerships and innovation to support low-emission solutions for modernization projects. Its competitive focus includes energy transition-aligned project strategies, modular plant execution, and digital engineering. Technip's collaboration-driven model helps mitigate execution risk.

Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-7524

Worley

Worley supports the U.S. oil and gas EPC market through engineering and project services for processing plants, pipelines, and petrochemical facilities. Its strategy emphasizes brownfield upgrades, sustainability projects, and decarbonization-driven initiatives. Worley's global backgrounds and large workforce allow scalability and flexibility for diverse project environments. Emphasis on digital twins and data-centric asset management enhances lifecycle optimization.

McDermott International

McDermott specializes in end-to-end EPC solutions, particularly for offshore and LNG. The company's integrated engineering and fabrication capabilities offer cost advantages for field development. McDermott's offshore construction fleets and deepwater experience uniquely position it for subsea and platform projects. Recent efforts focus on capital discipline and digital execution tools.

Jacobs Solutions

Jacobs offers differentiated EPC support for downstream and petrochemical assets. The company's strengths lie in process engineering and advisory services that guide modernization, decarbonization, and advanced plant design. Jacobs' growing focus on consulting, automation integration, and climate-aligned solutions reinforces its competitive influence.

View our Oil and Gas EPC Market Report Overview here: https://www.researchnester.com/reports/oil-and-gas-epc-market/7524

SWOT Analysis (Combined for Leading Companies)

Strengths

Leading EPC companies benefit from deep engineering expertise, extensive supply chains, and long-standing customer relationships. Their strong brand recognition and ability to handle multi-billion-dollar contracts reinforce long-term competitiveness. Many integrate advanced digital solutions, including BIM modeling, digital twins, and AI-driven planning, which streamline execution and reduce risk. Global footprints and broad energy portfolios enhance resiliency across market cycles.

Weaknesses

High dependence on commodity cycles can pressure project pipelines and profitability. Complex EPC contracts expose firms to schedule delays and cost overruns, especially amid labor or supply-chain constraints. Large organizational structures can create operational inflexibility, slowing response to rapid technological shifts. Market consolidation increases barriers for emerging EPCs with limited capital or regional reach.

Opportunities

Growing industrial modernization and refinery retrofits present major growth prospects across energy corridors. Digital transformation creates opportunities for next-generation EPC models leveraging predictive analytics, integrated procurement platforms, and automated design. LNG infrastructure development and pipeline expansions unlock new EPC demand. Partnerships centered around carbon-capture systems, renewable gas, and green hydrogen systems expand future-ready infrastructure opportunities.

Threats

Regulatory uncertainty and permitting challenges can delay or derail major capital projects. Workforce shortages, especially skilled labor and field personnel, hinder schedule assurance. Rising input and construction costs pressure margins across multiyear EPC portfolios. Increasing competition from regional firms and technology-driven disruptors challenges established EPC players.

Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-7524

Investment Opportunities & Trends

Innovation, decarbonization, and supply-security priorities are reshaping investment patterns in the U.S. oil and gas EPC market. Capital is increasingly directed toward pipeline buildout, refinery upgrades, LNG infrastructure, and brownfield modernizations. Companies are prioritizing digital engineering, modular fabrication, carbon-reduction technologies, and supply-chain efficiencies.

Key Investment Themes

• Digital Transformation

EPC leaders are embedding cloud-based design tools, AI-driven project planning, and digital twins to shorten construction timelines and enhance safety outcomes. Improved integration across EPC workflows-engineering, bidding, procurement, and commissioning-supports better predictability and performance.

• Technology Partnerships

Proprietary process technologies are becoming critical to value differentiation. Companies partner with technology licensors enabling hydrocarbon processing, gas treatment, and lower-carbon fuel production. This synergy drives stronger IP-based ecosystems and higher client switching costs.

• Sustainability Integration

Many EPCs are supporting clients through energy transition strategies, which include refinery conversions, carbon capture system deployment, and alternative fuel infrastructure. Brownfield investment continues to increase, supporting asset life extension while reducing emissions.

• Startup Collaboration

Innovative startups are attracting funding for construction automation, robotics, digital inspection, and methane-detection tools. EPCs collaborate with these companies to enhance productivity and reduce field-execution risks.

Capital Attraction Hotspots

Geographically, the U.S. Gulf Coast remains the strongest investment hub due to its refining, LNG, and petrochemical footprint. Texas and Louisiana lead new investment for EPC activity related to LNG trains, pipeline expansions, and refineries. Midstream infrastructure around shale basins, including the Permian region, continues to benefit from strong EPC demand.

Recent Market Developments

In the past 12 months, the U.S. oil and gas EPC market has seen renewed M&A activity, with companies strengthening service portfolios and digital capabilities. Partnerships centered on LNG technologies and advanced emissions monitoring gained prominence. Brownfield modernization surged as operators upgraded facilities to improve output efficiencies and environmental performance. Policy updates supporting pipeline improvement and export-driven LNG growth also encouraged new EPC commitments. On the product and service front, digital modules supporting design, automated safety compliance, and integrated inspection gained traction.

Stay ahead of investment moves in the Oil and Gas EPC Market- view our analyst-verified insights → https://www.researchnester.com/sample-request-7524

Related News -

https://www.linkedin.com/pulse/what-driving-rapid-growth-co2-heat-pump-water-heater-market-jvqhf

https://www.linkedin.com/pulse/what-future-battery-materials-market-age-electrification-cmewf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Oil and Gas EPC Market Size & Growth Analysis 2035: Top Companies, SWOT Insights & Growth Opportunities here

News-ID: 4247061 • Views: …

More Releases from Research Nester Pvt Ltd

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

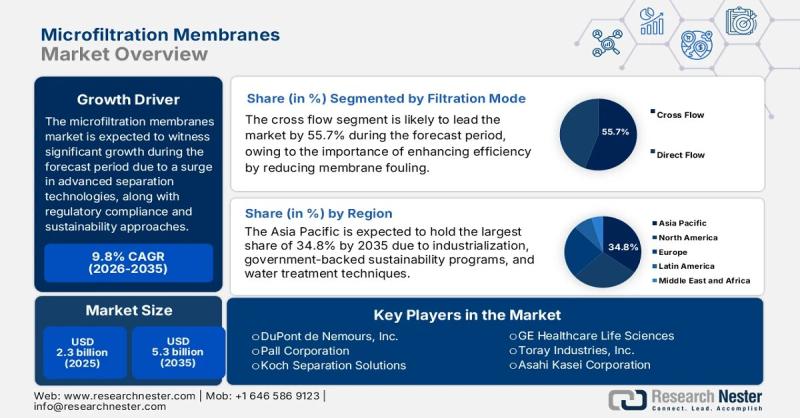

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for EPC

Solar EPC Market Outlook 2035: Clean Energy Adoption and EPC Advancements Fuel R …

The global Solar EPC (Engineering, Procurement, and Construction) market is set to witness remarkable expansion in the coming decade, driven by rising clean energy adoption, technological innovation, and government-led renewable energy initiatives. The market was valued at US$ 95.3 billion in 2024 and is projected to reach US$ 294.5 billion by 2035, growing at a CAGR of 10.8% from 2025 to 2035. With solar power emerging as one of the…

Key Trend Reshaping the Solar EPC Market in 2025: Jingoli Power Spearheads Solar …

"What Are the Projections for the Size and Growth Rate of the Solar EPC Market?

The solar EPC market has grown strongly in recent years. It will increase from $232.58 billion in 2024 to $248.35 billion in 2025, at a CAGR of 6.8%. This growth is driven by government incentives and subsidies, declining costs of solar technology, environmental sustainability awareness, energy independence goals, and rising energy demand.

The solar EPC market is…

Underground Cabling EPC Market

Report Summary:

The report titled “Underground Cabling EPC Market” offers a primary overview of the Underground Cabling EPC industry covering different product definitions, classifications, and participants in the industry chain structure. The quantitative and qualitative analysis is provided for the global Underground Cabling EPC market considering competitive landscape, development trends, and key critical success factors (CSFs) prevailing in the Underground Cabling EPC industry.

Historical Forecast Period

2013 – 2017 – Historical Year for…

What’s driving the solar EPC market analysis?

Solar EPC market across the APAC region has gained impetus owing to positive government reforms and growing renewable fund allocation. Favorable self-consumption schemes, regulatory support programs, investment subsidies, renewable incorporation targets and similar regulatory initiatives have substantially energized the industry dynamics. Ongoing economic expansion across emerging nations coupled with rising energy demand across developing power markets have further nurtured the business landscape.

Request for a sample of this research report @…

Unleashing Upcoming EPC Opportunities in India 2017

ReportsWorldwide has announced the addition of a new report title Unleashing Upcoming EPC Opportunities in India 2017 to its growing collection of premium market research reports.

As country, shifts its portfolio from thermal to renewable in terms of capacity generation , the transcend also observed in terms of investment in the thermal and renewable space respectively. With India, completely witnessing drying up of orders from private project developers ,…

Renewable Energy Industry Adopts Firmex for EPC

Wind, solar and biodiesel energy developers are increasingly using Firmex virtual data room technology to share confidential engineering, procurement and construction documents.

Most renewable energy analysts predict the clean-tech sector will grow in worldwide revenue from $116 billion to $325 billion over the next decade, making it the largest single industrial sector in the world. Globally, clean energy investments have increased 230 percent since 2005, according to research conducted by…