Press release

U.S. Real-Time Payments Market Size 2035: California Leads in Innovation, Regulation, and Market Leadership

Market Growth DriversThe U.S. real-time payments market is anticipated to experience robust expansion during the forecast period from 2026 to 2035, driven primarily by the country's accelerated digital transformation and demand for instant financial transactions. The convergence of advanced payment infrastructure, fintech innovation, and regulatory modernization is redefining how individuals and enterprises manage money movement. The adoption of ISO 20022 standards and the Federal Reserve's FedNow initiative have significantly enhanced interoperability and transparency across payment systems, driving confidence among financial institutions and end-users. Moreover, the rising adoption of mobile banking and API-based ecosystems is fueling rapid innovation in payment gateways and settlement mechanisms. Over the next decade, the U.S. market is expected to evolve toward a highly interconnected, transparent, and efficient real-time transaction environment, reinforcing its leadership in financial innovation and digital competitiveness.

Request Free Sample Report @ https://www.researchnester.com/sample-request-5157

State-Level Analysis

California holds the most significant share of the U.S. real-time payments market, underpinned by its dominant fintech ecosystem and concentration of technology-driven financial enterprises. Silicon Valley's extensive network of payment startups, cloud service providers, and digital infrastructure companies has established the state as the innovation hub of U.S. financial technology. Major players such as PayPal, Square, and Stripe continue to pioneer API-driven payment systems and real-time transaction capabilities, integrating artificial intelligence and blockchain for enhanced speed and security. California's robust digital infrastructure, venture funding environment, and regulatory openness toward fintech experimentation further consolidate its leading position. Over the forecast period, the state's financial ecosystem is expected to deepen its real-time integration across sectors such as e-commerce, digital banking, and P2B transactions.

Texas is emerging as the fastest-growing state in the U.S. real-time payments landscape, benefiting from a surge in financial services investments, cloud infrastructure expansion, and a thriving digital commerce environment. The state's strategic position as a logistics and business hub has encouraged large retailers, utilities, and service providers to integrate instant payment solutions for enhanced customer engagement and cash flow management. Additionally, Texas has attracted major data centers and fintech firms due to its favorable tax environment and expanding technology workforce. Over the forecast period, Texas is expected to lead in innovation-driven adoption of real-time payments across small businesses, regional banks, and emerging fintech platforms. Its growing focus on digital inclusion and modernization of financial services positions it as a key growth frontier within the national market.

Access our detailed report at: https://www.researchnester.com/reports/real-time-payments-market/5157

Market Segmentation

The person-to-business (P2B) segment accounted for a 40% share by 2035, emerging as the most dominant category in the U.S. real-time payments market. This dominance stems from the rapid digitization of consumer payments and the shift toward frictionless transactions in retail, utilities, and service industries. Businesses are increasingly adopting instant payment frameworks to improve cash flow, reduce settlement delays, and enhance customer satisfaction. The integration of QR-based systems, mobile payment apps, and digital wallets has further accelerated P2B adoption. Companies such as PayPal, Visa, and Mastercard are actively innovating real-time processing solutions tailored to business transactions, while retailers and service providers are leveraging these capabilities for enhanced customer engagement. The segment's leadership reflects a fundamental shift in payment behavior toward immediacy, transparency, and efficiency.

The cloud segment held a major revenue share over the forecast period, driven by the growing reliance on scalable, secure, and flexible infrastructure to support real-time transaction volumes. Cloud-based architectures enable faster deployment of payment platforms, cost efficiency, and seamless integration with API-driven ecosystems. Financial institutions and payment service providers are increasingly migrating to cloud environments to leverage advanced analytics, fraud detection, and compliance automation. Major technology firms like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure are providing foundational support for real-time payment networks, offering high-performance computing and secure transaction processing. This transition toward cloud-native infrastructure is reshaping the competitive dynamics of the payments ecosystem, empowering banks and fintech firms to innovate rapidly while maintaining operational resilience.

Request Free Sample Report @ https://www.researchnester.com/sample-request-5157

Market Opportunities

1. Expansion of Cross-Border Real-Time Payments: The acceleration of cross-border real-time payments presents one of the most transformative opportunities in the U.S. market. As globalization intensifies digital trade and e-commerce, demand for instant international transactions has surged. Initiatives integrating U.S. payment systems with global instant payment networks are gaining traction, enabling faster settlements and improved liquidity management for businesses. Financial institutions are investing in interoperable platforms and blockchain-based solutions to streamline cross-border transfers. Companies such as Ripple and Mastercard are spearheading innovations that reduce friction in international payments. Businesses can capitalize on this trend by forming global partnerships, enhancing compliance with regional payment regulations, and deploying technology that ensures transparency and traceability across borders.

2. Integration of AI and Data Analytics in Payment Systems: The integration of artificial intelligence (AI) and advanced analytics into real-time payment systems is unlocking new dimensions of efficiency and customer experience. AI-driven fraud detection, predictive transaction monitoring, and personalized payment recommendations are redefining operational intelligence within the financial ecosystem. Fintech leaders and banks are deploying machine learning models to analyze transaction patterns, detect anomalies, and enhance decision-making in real time. Moreover, AI-powered chatbots and virtual assistants are streamlining payment support and dispute resolution processes. The strategic use of AI enables payment providers to optimize risk management and improve service agility. To leverage this opportunity, companies should invest in data-driven platforms that combine automation with compliance precision, thereby strengthening their competitive advantage in the evolving digital payments landscape.

Competitive Landscape

The U.S. real-time payments market is shaped by an increasingly dynamic and competitive ecosystem comprising established financial institutions, fintech innovators, and technology providers. Leading players such as The Clearing House, FIS, Fiserv, and Mastercard are driving market expansion through strategic partnerships, platform modernization, and investments in instant payment infrastructure. Emerging fintech startups are introducing niche payment solutions tailored to specific industries, such as gig economy platforms and subscription-based businesses. This diversification is intensifying competition and fostering innovation across multiple payment touchpoints.

Strategically, incumbents are focusing on interoperability, API development, and cybersecurity to strengthen customer trust and regulatory compliance. Consolidation trends are also visible, as mergers and alliances help companies enhance service capabilities and geographic coverage. Meanwhile, new entrants are differentiating through specialized offerings such as embedded finance, digital wallet integration, and real-time data analytics. By 2035, competitive success in the U.S. real-time payments sector will hinge on agility, transparency, and ecosystem collaboration, with leading firms prioritizing innovation-led partnerships and sustainable payment solutions.

Request Free Sample Report @ https://www.researchnester.com/sample-request-5157

Related News -

https://www.linkedin.com/pulse/what-emerging-trends-shaping-supply-chain-finance-market-bj3if

https://www.linkedin.com/pulse/what-future-narrowband-iot-market-era-smart-connectivity-d62xf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Real-Time Payments Market Size 2035: California Leads in Innovation, Regulation, and Market Leadership here

News-ID: 4245363 • Views: …

More Releases from Research Nester Pvt Ltd

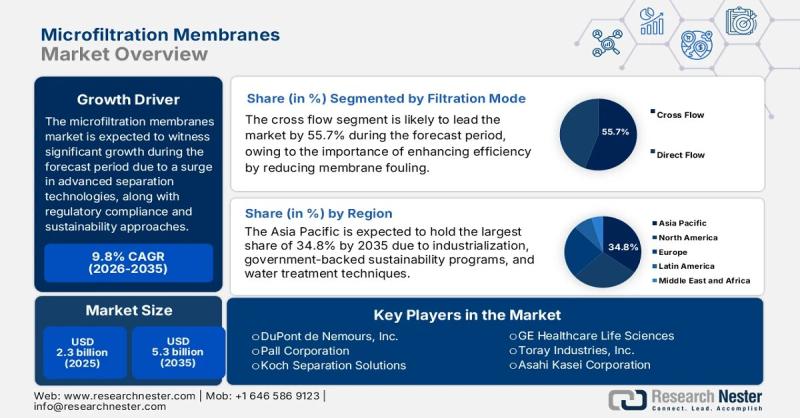

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…