Press release

U.S. Strategic Analysis of the Enterprise Server Market: Innovation, Competition & Investments

The U.S. enterprise server market serves as the backbone of modern digital infrastructure, enabling data processing, storage, and high-performance computing across industries. As enterprises accelerate cloud migration, AI integration, and edge computing adoption, server manufacturers are competing to deliver scalable, energy-efficient, and secure architectures. This strategic article explores leading companies, their competitive strengths, the collective SWOT landscape, and key investment opportunities shaping the U.S. enterprise server market.Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Enterprise Server Market report here → https://www.researchnester.com/sample-request-2709

Top Companies & Their Strategies

Dell Technologies Inc.

Dell Technologies remains a dominant force in the U.S. enterprise server landscape through its PowerEdge series, offering extensive customization, performance optimization, and integration with AI and virtualization workloads. The company's strength lies in its hybrid IT ecosystem-seamlessly bridging on-premises servers with multi-cloud environments. Dell's innovation in liquid cooling, intelligent automation, and cybersecurity integration reinforces its leadership across data centers and edge applications.

Hewlett Packard Enterprise (HPE)

HPE commands significant market presence through its ProLiant and Apollo servers, designed for high performance and enterprise scalability. Its GreenLake as-a-service model gives customers flexibility to scale computing power while managing costs, a key differentiator in today's consumption-based IT economy. HPE's investments in edge computing and sustainability, such as carbon-neutral server solutions, have enhanced its competitive positioning among enterprise and government clients.

IBM Corporation

IBM continues to play a strategic role with its Power Systems and zSeries mainframes, which are vital for mission-critical enterprise operations, banking systems, and government workloads. The company's strength lies in AI-driven performance optimization and integration of hybrid cloud via Red Hat OpenShift. IBM's emphasis on reliability, security, and AI workload acceleration through Power10 chips reinforces its niche in high-end enterprise computing.

Cisco Systems Inc.

Cisco has leveraged its network dominance to build a strong foothold in the enterprise server segment through its Unified Computing System (UCS). Its competitive advantage lies in converged infrastructure that integrates compute, networking, and storage. Cisco's UCS X-Series enhances modularity and hybrid cloud readiness, appealing to enterprises seeking scalable and software-defined data centers. Strategic partnerships with hyperscalers and cloud-native vendors continue to expand its ecosystem reach.

Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-2709

Lenovo Group Ltd.

Lenovo has solidified its position in the U.S. market with its ThinkSystem servers, offering efficiency, reliability, and broad compatibility with AI and analytics workloads. The company's focus on open standards, affordability, and local manufacturing partnerships gives it an edge among cost-sensitive enterprises. Lenovo's collaborations with AMD, Intel, and NVIDIA for specialized workloads underscore its agility in addressing diverse enterprise computing demands.

Super Micro Computer, Inc. (Supermicro)

Supermicro's growth is driven by its focus on high-performance, modular, and energy-efficient server platforms. The company's "Building Block Solutions" approach allows custom configurations for AI, 5G, and hyperscale data centers. With U.S.-based manufacturing and quick design-to-delivery cycles, Supermicro has become a preferred choice for enterprises seeking rapid deployment and specialized computing architectures.

Oracle Corporation

Oracle's integrated approach-combining servers with cloud, software, and database solutions-sets it apart in the enterprise segment. Its SPARC and x86 servers are optimized for Oracle Database and Cloud Infrastructure, enhancing security, automation, and performance. Oracle's hybrid cloud strategy and strong enterprise relationships ensure its continued relevance in mission-critical environments.

Inspur Systems Inc.

Inspur has expanded its footprint in the U.S. enterprise server space by offering cost-competitive and AI-optimized solutions. Its innovation in GPU server architecture and rack-scale systems caters to AI training, big data analytics, and cloud computing. Inspur's agility and partnerships with leading semiconductor firms have positioned it as a viable competitor in the hyperscale segment.

View our Enterprise Server Market Report Overview here: https://www.researchnester.com/reports/enterprise-server-market/2709

SWOT Analysis: Combined Perspective of Leading Companies

Strengths

The U.S. enterprise server market benefits from technological leadership, strong R&D investments, and deep integration with cloud and AI ecosystems. Companies like Dell, HPE, and IBM maintain brand trust and robust service networks, while innovators like Supermicro and Lenovo emphasize customization and energy efficiency. The shift toward modularity, edge computing, and security-enhanced architectures strengthens competitive differentiation. U.S.-based data center expansion by hyperscalers also sustains steady server demand.

Weaknesses

Despite innovation momentum, supply chain dependencies and component shortages, particularly in semiconductors, remain challenges. The high capital intensity of R&D and production limits smaller firms from scaling. Vendor lock-in, complexity in hybrid deployments, and ongoing cybersecurity risks create adoption barriers. Additionally, competition from cloud-native infrastructure providers can reduce demand for traditional on-premises servers among mid-tier enterprises.

Opportunities

Major opportunities arise from AI-driven computing, edge infrastructure expansion, and government-backed digitalization programs. As enterprises adopt hybrid cloud and containerized environments, demand for flexible and energy-optimized server solutions will grow. The U.S. CHIPS and Science Act is catalyzing domestic semiconductor manufacturing, potentially stabilizing supply chains. Rising adoption of GPU-accelerated computing, zero-trust architectures, and sustainability-focused hardware designs are opening new investment frontiers.

Threats

The market faces threats from intense price competition, rapid technological obsolescence, and evolving security vulnerabilities. The shift toward serverless computing and cloud-native architectures may reduce reliance on traditional enterprise hardware. Global trade restrictions, particularly those involving critical components or cross-border data policies, could disrupt procurement. Moreover, increasing environmental regulations around energy efficiency and e-waste disposal may pressure margins and compliance costs.

Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-2709

Investment Opportunities & Trends

Investment momentum in the U.S. enterprise server market is accelerating around digital transformation, hybrid infrastructure, and AI-driven data centers. The sector is evolving beyond traditional server sales toward as-a-service and subscription-based infrastructure models, offering investors more stable recurring revenue opportunities.

M&A activity remains a key driver of market realignment. Dell's earlier spin-off of VMware and HPE's acquisition of OpsRamp highlight a focus on hybrid IT integration and management capabilities. Similarly, IBM's ongoing acquisitions in AI and automation underline its strategy to strengthen software-defined infrastructure. Emerging firms like Supermicro and Inspur are expanding manufacturing capacity and R&D footprints, attracting venture and institutional investments for advanced hardware innovation.

Technology integration trends are shaping investment priorities. The rise of AI, machine learning, and edge analytics has increased demand for GPU- and FPGA-optimized servers. Partnerships between hardware manufacturers and semiconductor giants such as NVIDIA, AMD, and Intel are driving customized architectures for data-intensive workloads. Startups specializing in liquid cooling, disaggregated computing, and energy-efficient designs are also drawing venture funding.

Regional hotspots include tech corridors in California, Texas, and Virginia-where data centers and hyperscale facilities are rapidly expanding. The U.S. government's digital infrastructure initiatives and the private sector's sustainability goals are channeling investment into green data centers, edge facilities, and high-performance computing clusters.

In the past 12 months, the market has seen several product innovations and strategic partnerships. HPE launched next-generation ProLiant servers powered by AI-driven workload optimization. Dell expanded its PowerEdge lineup with energy-efficient architectures. Supermicro introduced GPU-accelerated systems targeting AI training, while Cisco rolled out modular UCS X-Series innovations for hybrid environments. Simultaneously, policy incentives supporting domestic chip production have boosted investment confidence across the server manufacturing ecosystem.

Stay ahead of investment moves in the Enterprise Server Market- view our analyst-verified insights → https://www.researchnester.com/sample-request-2709

Related News -

https://www.linkedin.com/pulse/what-future-credit-management-software-market-consumers-radar-l8zzf

https://www.linkedin.com/pulse/what-future-education-technology-edtech-market-consumers-radar-tmmff

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Strategic Analysis of the Enterprise Server Market: Innovation, Competition & Investments here

News-ID: 4245342 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

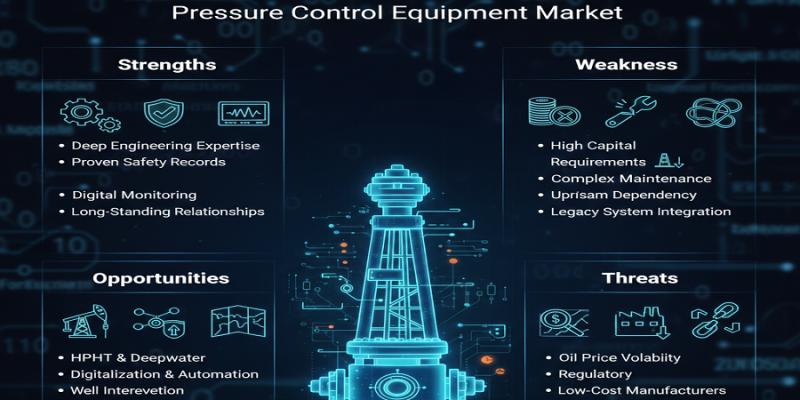

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

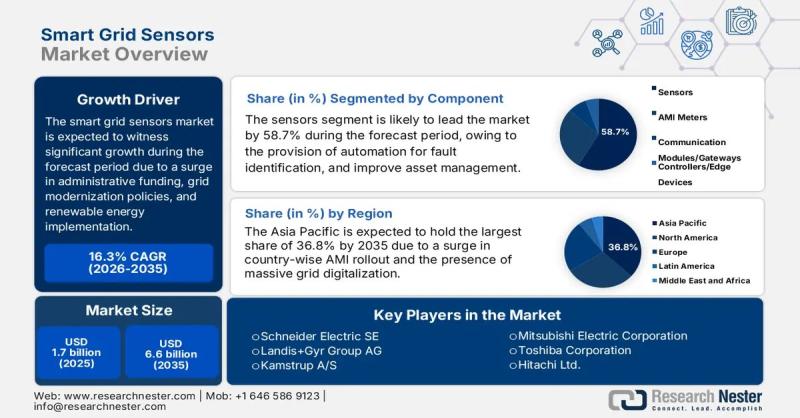

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Enterprise

Why SMBs Deserve Enterprise-Level IT - Without the Enterprise Price Tag

Small and mid-sized businesses (SMBs) often operate under the misconception that enterprise-level IT solutions are reserved only for large corporations with unlimited budgets. Yet in today's digital-first economy, SMBs face many of the same risks and operational demands as their larger counterparts: cybersecurity threats, regulatory compliance, and the need for efficient, reliable technology to support growth. A managed IT services provider, Cortavo [https://cortavo.com/what-is-cortavo], has demonstrated that enterprise-level IT does not…

OpenPayd's Ozan Ozerk Named Enterprise Entrepreneur at 2025 Enterprise Awards

London, 19 June 2025 - Dr. Ozan Ozerk, founder of OpenPayd, has been named "Enterprise Entrepreneur" at this year's Enterprise Awards, an event that celebrates the UK's most impactful technology founders. The ceremony took place at Drapers' Hall on the evening of 18 June, bringing together leaders from across the innovation and investment landscape.

The recognition comes after a period of substantial growth for OpenPayd. In the past 12 months, the…

Redefining Enterprise Connectivity: Enterprise VSAT Market Poised for Remarkable …

Enterprise VSAT's market was estimated to be worth US$ 4,324.5 Mn in 2022, and by the end of 2033, it is anticipated to have increased to US$ 8,110.5 Mn. In 2023, the market for corporate VSAT is anticipated to be worth $4,514.8 Mn USD. From 2023 to 2033, the enterprise VSAT market is anticipated to expand at a 6.0% CAGR.

Businesses in industries like retail and consumer goods, healthcare, BFSI, media…

Enterprise WLAN Market Awareness Overview 2025 | , Hewlett-Packard Enterprise, H …

Global Enterprise WLAN Market: Snapshot

The global enterprise WLAN is registering a significant rise in its valuation, thanks to the increasing penetration of Internet across the world. The rapidly rising market for enterprise WLAN technology is anticipated to boost the cloud technology and the Internet of Things (IoT) industries as well, inducing intense competitiveness. Moreover, the continual technological advancements are projected to increase WLAN applications in a number of industry sectors…

Enterprise Mobility Market - Generating an Increasing Demand for Enterprise Mobi …

Geographically-spread enterprises are constantly faced with scenarios that require the convergence of a large number of communication channels and inclusion of foreign computing devices in the central network.

With a vast rise in mobile devices that need to be integrated with enterprise networks, mostly owing to the increasing trend of policies such as bring-your-own-device and choose-your-own-device, and diversely located workplaces and employees, the need for adopting enterprise mobility solution has…

Enterprise Mobility Market - Generating an Increasing Demand for Enterprise Mobi …

Geographically-spread enterprises are constantly faced with scenarios that require the convergence of a large number of communication channels and inclusion of foreign computing devices in the central network. With a vast rise in mobile devices that need to be integrated with enterprise networks, mostly owing to the increasing trend of policies such as bring-your-own-device and choose-your-own-device, and diversely located workplaces and employees, the need for adopting enterprise mobility solution has…