Press release

U.S. Buy Now Pay Later Market Set to Hit $1.64 Billion in 2022 - Robust 24.3% CAGR Forecast by DataM Intelligence

The U.S. buy now pay later (BNPL) market is experiencing remarkable growth, with its value reaching USD 1.64 billion in 2022 according to DataM Intelligence. Driven by the demand for flexible payment options, the market is projected to expand at a compound annual growth rate (CAGR) of 24.3% from 2023 to 2030, reflecting the rapid shift in consumer preferences and digital payment trends.Convenience and accessibility have strengthened BNPL adoption among Millennials and Gen Z, who are increasingly seeking alternatives to traditional credit cards. Key segments such as online shopping and retail dominate the market, while regulatory advancements and evolving competitive dynamics are amplifying BNPL's acceptance and usage across all U.S. demographics.

Get a Free Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.datamintelligence.com/download-sample/buy-now-pay-later-market?Onkar

Key Highlights from the U.S. Buy Now Pay Later Market Report

➤ U.S. BNPL market reached USD 1.64 billion in 2022 and is forecast to see 24.3% annual growth through 2030.

➤ Online shopping dominates with over 65% revenue share due to seamless digital integration.

➤ Retail remains the leading end-use segment at over 74% market share, fueling BNPL's ongoing expansion.

➤ Millennials and Gen Z drive BNPL growth, preferring flexible payments over traditional credit.

➤ Regulatory measures enhance consumer protection and market trust, supporting further adoption.

➤ Healthcare segment shows strong potential as BNPL solutions address medical affordability needs.

U.S. BNPL Market Segmentation

The market is segmented to highlight diverse payment experiences.

Product and channel segmentation reveal dynamic usage trends: Online channels accounted for the majority share, backed by e-commerce boom and simplified checkout experiences, while point-of-sale (POS) solutions register strong future growth in electronics, furniture, and appliances. Large enterprises hold over 60% of the market, leveraging robust partnerships and advanced platforms to maximize customer loyalty. Small and medium enterprises (SMEs) are gaining traction, utilizing BNPL platforms to enhance competitiveness without major upfront investments. Retail leads end-use, followed by healthcare where BNPL products assist in alleviating out-of-pocket medical costs, further increasing variety and reach of these flexible financing solutions.

Get Customization in the Report as Per Your Business Requirements: https://www.datamintelligence.com/customize/buy-now-pay-later-market?Onkar

Regional Insights:

The U.S. market leads globally in BNPL adoption thanks to tech-savvy consumers and retailers, with online and POS channels increasingly integrated into everyday purchases. Regulatory interventions from the Consumer Financial Protection Bureau (CFPB) have improved transparency and fostered consumer confidence. Retailers and healthcare providers nationwide are partnering with BNPL solution firms to offer tailored financing experiences suited to U.S. payment and shopping habits.

Market Dynamics: Drivers, Restraints, and Opportunities

Understand what propels or hinders market momentum.

Market Drivers:

BNPL offers streamlined, flexible payment structures that appeal to younger consumers and those seeking alternative credit options, accelerating acceptance across categories. Fintech innovation and partnerships between startups and established institutions drive more competition and tailored services.

Market Restraints:

Potential risks include consumer debt accumulation owing to misunderstood repayment terms or overuse. Firms must focus on clear communication and education to ensure responsible usage and minimize financial instability.

Market Opportunities:

Further digitization of commerce and expansion into non-retail sectors, such as healthcare and travel, provide ample growth prospects. Fintech partnerships and expanding BNPL solutions for SMEs and enterprises promise increased reach, diversification, and customer engagement.

Purchase This Exclusive Report at Just USD 6382 Only: https://www.datamintelligence.com/buy-now-page?report=buy-now-pay-later-market?Onkar

Reasons to Buy the U.S. BNPL Market Report

✔ Comprehensive coverage of market size, growth, and segmentation.

✔ Detailed analysis of retail and healthcare BNPL adoption.

✔ Reliable insights on partnerships and competitive landscape trends.

✔ Expert reviews of regulatory and consumer preference shifts.

✔ Data-driven projections through 2030 for strategic decision-making.

Frequently Asked Questions (FAQs)

◆ How big is the U.S. Buy Now Pay Later Market in 2022?

◆ Who are the key players in the U.S. Buy Now Pay Later (BNPL) market?

◆ What is the projected CAGR for the BNPL market through 2030?

◆ Which segment leads U.S. BNPL industry revenue shares?

◆ How does regulatory guidance support confidence in BNPL solutions?

Company Insights: Leading Firms and Recent Developments

Find out who leads and what's new in the market.

Afterpay US Services, LLC

PayPal Holdings, Inc.

Affirm, Inc.

Splitit

Sezzle

Perpay, Inc.

Uplift, Inc.

Amazon

Quadpay, Inc.

Klarna, Inc.

Recent Developments:

August 2021: Uplift, Inc. partnered with Tripster to enable easy vacation planning with flexible payment options and transparent cost display.

BNPL providers continue integrating services with leading retailers and healthcare firms to expand reach and improve customer experience.

Conclusion

The U.S. buy now pay later market is rapidly evolving, fueled by digital convenience, shifting consumer needs, and active partnerships among major retail and technology companies. DataM Intelligence reports sustained momentum through 2030, as BNPL becomes a preferred choice for diverse transactions, from shopping and travel to vital healthcare payments. Strategic sector participation, agile innovation, and regulatory leadership are set to keep this market at the forefront of financial technology adoption.

Contact Us

Mr. Sai Kiran

DataM Intelligence 4market Research LLP Ground floor

DSL Abacus IT Park, Industrial Development Area

Uppal, Hyderabad, Telangana 500039

USA: +1 877-441-4866

Email: Sai.k@datamintelligence.com

Visit Our Website: https://www.datamintelligence.com

About Us

DataM Intelligence 4Market Research is a comprehensive market intelligence platform offering syndicated and customized reports along with expert consulting across multiple industries, including chemicals, healthcare, agriculture, food & beverages, and more. With extensive experience and a strategy-focused approach, DataM provides businesses and individuals with reliable market insights, statistical forecasts, and personalized research solutions to help them make informed decisions and successfully bring innovations to market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Buy Now Pay Later Market Set to Hit $1.64 Billion in 2022 - Robust 24.3% CAGR Forecast by DataM Intelligence here

News-ID: 4245022 • Views: …

More Releases from DataM Intelligence

U.S. Radiopharmaceuticals Market to Reach USD 2.36 Billion by 2033, Growing at 6 …

The United States radiopharmaceuticals market was valued at USD 2.21 billion in 2024 and is projected to reach USD 2.36 billion by 2033, exhibiting a CAGR of 6.3% during the forecast period, according to DataM Intelligence. The market expansion is primarily fueled by the growing prevalence of chronic diseases such as cancer and cardiovascular disorders, advancements in diagnostic imaging, and regulatory support for nuclear medicine infrastructure. Radiopharmaceuticals play a pivotal…

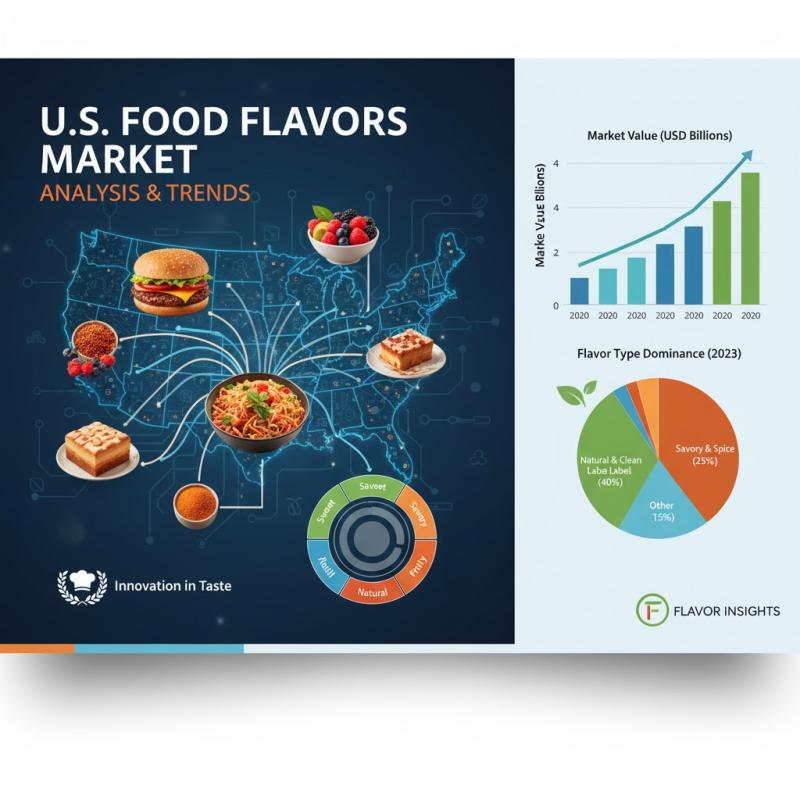

U.S. Food Flavors Market to Reach USD 6.1 Billion by 2033, Registering 5.2% CAGR …

The U.S. flavors market was valued at USD 3,887.7 million in 2024 and is projected to reach USD 6,108.4 million by 2033, growing at a CAGR of 5.2% during 2025-2033, according to DataM Intelligence. The market's growth is driven by surging demand for processed foods, global flavor innovation, and increasing consumer preference for natural, clean-label, and wellness-oriented products. Flavors continue to play a vital role in enhancing the sensory experience…

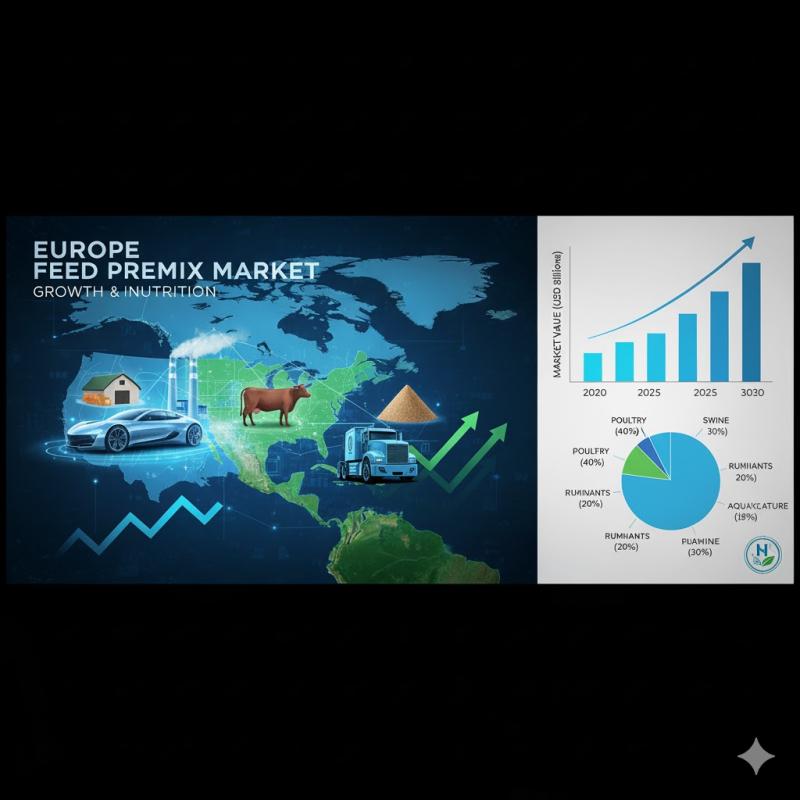

Europe Feed Premix Market to Reach USD 7.31 Billion by 2030, Growing at a 4.32% …

The Europe Feed Premix Market is estimated to grow from USD 5.92 billion in 2025 to USD 7.31 billion by 2030, registering a CAGR of 4.32% during the forecast period, according to DataM Intelligence. The market's growth is driven by increasing demand for nutrient-rich animal feed formulations, expanding livestock production, and a rising preference for high-quality, antibiotic-free animal products. Feed premixes-comprising essential vitamins, minerals, amino acids, and other additives-are vital…

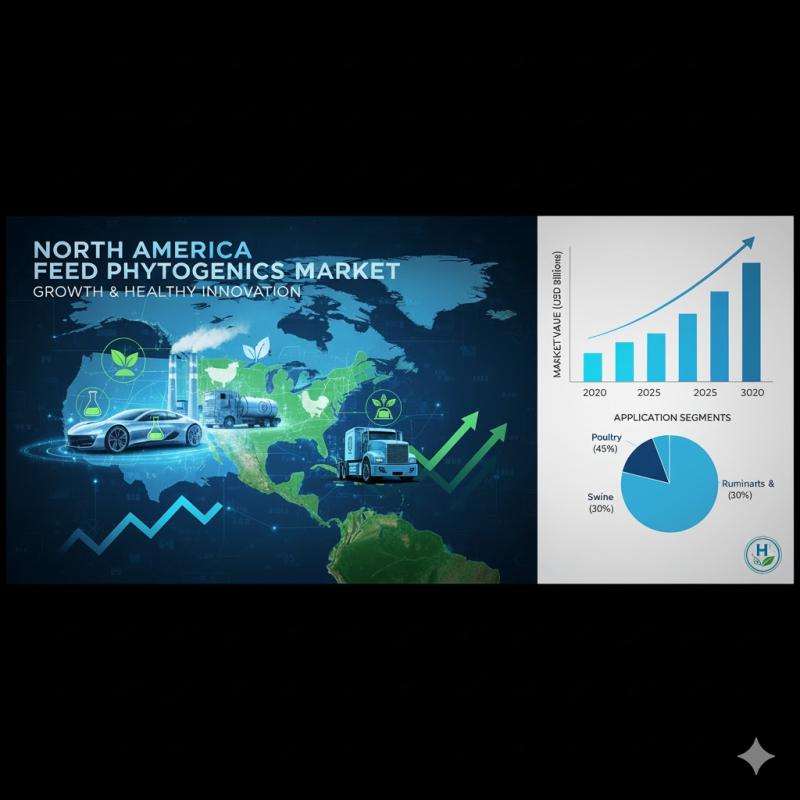

North America Feed Phytogenics Market to Reach USD 500.6 Million by 2030, Growin …

The North America Feed Phytogenics Market is projected to grow from USD 383.10 million in 2025 to USD 500.60 million by 2030, at a CAGR of 5.5% during the forecast period, according to DataM Intelligence. The market is witnessing robust growth due to rising demand for high-quality animal-derived products and increasing regulatory restrictions on antibiotics in livestock production. As a result, plant-based feed solutions have gained widespread adoption for improving…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…