Press release

Australia MedTech Market 2025 | Worth USD 13.90 Billion by 2033

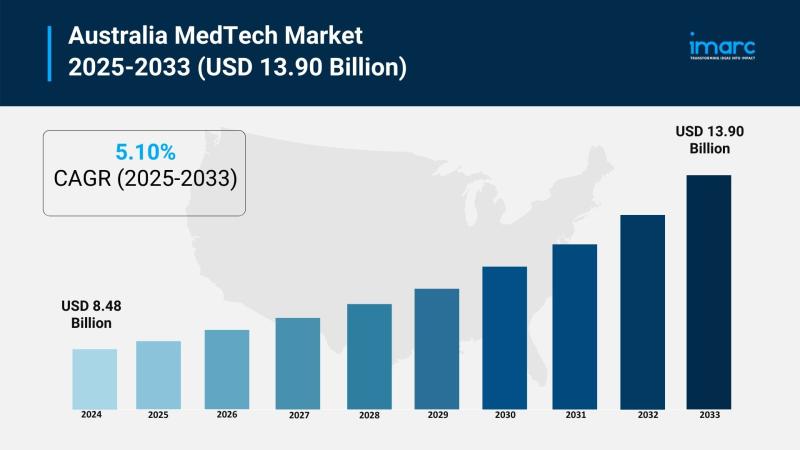

The latest report by IMARC Group, titled "Australia MedTech Market Report by Type (Telehealth, Medical Wearables, EMR/EHR Systems, Medical Apps, Healthcare Analytics, Others), Component (Software, Hardware, Service), Deployment Type (On-Premises, Cloud-Based), Application (Cardiology, Diabetes, Neurology, Sleep Apnea, Oncology, Others), End User (Healthcare Providers, Healthcare Payers, Pharmaceutical Companies), and Region 2025-2033," offers comprehensive analysis of the Australia MedTech market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia MedTech market size reached USD 8.48 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.90 Billion by 2033, exhibiting a CAGR of 5.10% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 8.48 Billion

Market Forecast in 2033: USD 13.90 Billion

Market Growth Rate (2025-2033): 5.10%

Australia MedTech Market Overview

The Australia MedTech market is experiencing robust growth driven by increasing demand for advanced healthcare technologies amid an aging population and rising chronic disease burden, strong government support through funding initiatives and digital health promotion, world-class research institutions fostering innovation through university-industry collaborations, high healthcare standards with established regulatory framework ensuring market trust, growing adoption of AI-powered diagnostics and wearable medical devices, and expanding telehealth infrastructure with Medicare support. The market expansion is supported by increasing health-conscious consumers seeking personalized care, continuous advancements in data analytics improving diagnostic accuracy, enhanced focus on mental health and wellness solutions, and Australia's emergence as a MedTech startup hub attracting investment. Strategic initiatives including enhanced clinical trial funding, public-private partnerships, and sustainability focus are positioning Australia's MedTech market for sustained growth and healthcare innovation leadership.

Australia's MedTech industry demonstrates strong performance across telehealth consultations enabling remote healthcare access, medical wearables for continuous health monitoring and chronic disease management, EMR/EHR systems facilitating centralized patient data and care coordination, mobile health applications supporting patient engagement and self-management, and healthcare analytics platforms driving population health insights. The proliferation of AI-powered diagnostics improving accuracy, robotics-assisted surgical precision, personalized medicine through genomic advances, remote patient monitoring solutions, and digital health platforms with insurance integration is creating favorable market conditions. New South Wales leads regional growth with robust healthcare infrastructure, extensive research capabilities, government funding support, and thriving innovation ecosystem. Australia's strategic focus on addressing healthcare accessibility, combined with commitment to preventive care and digital transformation, makes it an increasingly dynamic market for MedTech innovation and improved patient outcomes.

Request For Sample Report:

https://www.imarcgroup.com/australia-medtech-market/requestsample

Australia MedTech Market Trends

• Digital health transformation: Rapid expansion of telemedicine, wearable devices, and AI-driven health solutions with remote monitoring systems particularly for chronic disease management addressing aging population needs and accessibility requirements.

• AI and robotics integration: Revolutionary implementation of artificial intelligence enhancing diagnostic accuracy with molecular medicine applications, robotics enabling minimally invasive surgeries with improved precision and shorter recovery times, and AI algorithms streamlining operational functions.

• Personalized medicine advancement: Growing popularity of genomic and biotechnological developments enabling personalized therapy based on patient genotypes, particularly in oncology and rare disease treatment, with diagnostic and therapeutic tools providing precision solutions.

• Preventive care emphasis: Increasing healthcare system focus on preventive and personalized treatment strategies improving quality of life for seniors through pacemakers, orthopedic implants, home diagnostic kits, and assistive technologies promoting independence.

• Sustainability innovation: Healthcare sector prioritizing environmental responsibility with companies exploring recyclable materials, biodegradable packaging, and energy-efficient medical devices aligning with global climate objectives and consumer preferences.

• Public-private collaboration: Enhanced partnerships between government agencies, hospitals, and private organizations facilitating quicker integration of advanced technologies, expediting clinical trials, expanding infrastructure, and ensuring regulatory compliance.

Market Drivers

• Aging population growth: Increasing life expectancy leading to higher chronic illness prevalence including cardiovascular diseases, diabetes, respiratory issues, and mobility limitations creating demand for continuous monitoring devices, implants, diagnostic kits, and assistive technologies.

• Rising healthcare expenditure: Government initiatives modernizing hospitals and enhancing digital health solutions combined with private sector investments in advanced imaging systems, surgical robotics, and diagnostic devices improving patient outcomes and operational efficiency.

• Strong R&D ecosystem: Robust research collaboration between universities, startups, and healthcare providers with established clinical trial framework enabling quicker technology adoption, government funding supporting innovation, and cross-industry partnerships accelerating commercialization.

• Global market positioning: Australia's reputation for quality, safety, and innovation providing competitive advantage particularly in Asia-Pacific region, with free trade agreements, regulatory frameworks, and geographic proximity enabling export growth to China, India, and Southeast Asia.

• Regulatory framework strength: Well-defined guidelines for medical device registration ensuring product safety and efficacy, expedited approval pathways motivating investment in R&D, and stringent quality standards enhancing international reputation while minimizing commercialization delays.

• Government funding support: Targeted financial assistance through grants enabling startups, research institutions, and manufacturers to access resources for innovation, product testing, and market expansion, with subsidies and co-investment opportunities maintaining global competitiveness.

Challenges and Opportunities

Challenges:

• High regulatory compliance costs with strict guidelines requiring significant investment in technical documentation, clinical trials, and compliance fulfillment creating financial and administrative burdens particularly for smaller companies and startups hindering competitiveness and rapid innovation

• Limited access to capital for early-stage companies with long MedTech development cycles prior to commercialization creating investor reluctance, with venture capital and private equity opportunities limited compared to global hubs affecting growth potential and scaling capabilities

• Market fragmentation driven by healthcare system differences across states and territories, varying adoption rates, distinct procurement processes, and rural-regional infrastructure gaps complicating economies of scale, distribution channels, and technology integration strategies

• Commercialization complexity requiring substantial funding, regulatory clarity, and clinical validation pipelines creating barriers to transforming laboratory breakthroughs into market-ready products affecting innovation-to-market timelines and success rates

Opportunities:

• Digital health expansion leveraging AI-powered imaging, analytics, and predictive algorithms accelerating diagnosis and tailoring treatments while integrating biometric wearables, smart patches, and remote sensors transitioning from novelty to mainstream chronic care tools

• Local manufacturing growth for specialized treatments particularly theranostics and precision cancer care reducing import reliance, enhancing responsiveness, and capturing value-added production capabilities supporting domestic job creation and supply chain resilience

• Indigenous health equity advancement through co-designed culturally grounded solutions including language-accessible platforms, community-led initiatives, and specialized services addressing historical healthcare gaps and improving health outcomes for vulnerable populations

• Integrated ecosystem development connecting hospitals, GPs, allied health, insurers, pharmacies, and aged care through standardized protocols enabling coordinated care, comprehensive patient understanding, and outcomes-oriented healthcare delivery models

• Innovation commercialization support through university-industry collaborations, government grants, and digital health strategy programs fostering AI diagnostics, wearable technologies, virtual care platforms, and clinical software advancing domestic capabilities and export potential

Australia MedTech Market Segmentation

By Type:

• Telehealth

• Medical Wearables

• EMR/EHR Systems

• Medical Apps

• Healthcare Analytics

• Others

By Component:

• Software

• Hardware

• Service

By Deployment Type:

• On-Premises

• Cloud-Based

By Application:

• Cardiology

• Diabetes

• Neurology

• Sleep Apnea

• Oncology

• Others

By End User:

• Healthcare Providers

• Healthcare Payers

• Pharmaceutical Companies

By Region:

• New South Wales

• Victoria

• Queensland

• Western Australia

• Rest of Australia

Browse Full Report:

https://www.imarcgroup.com/australia-medtech-market

Australia MedTech Market News (2024-2025)

• 2024: Monash University partnered with Apollo Hospitals to advance digital health research fostering innovation in healthcare technology and strengthening international collaborations highlighting Australia's growing influence in shaping global digital health trends.

• 2024: ResMed Global Sleep Survey examining 17 markets worldwide found 46% of participants received obstructive sleep apnea (OSA) diagnosis highlighting growing awareness of sleep health and driving demand for diagnostic and therapeutic MedTech solutions.

• 2024: Australian government launched Genomics Australia as national body with A$30 million initial funding over four years aiming to advance genomics use in healthcare and personalized medicine development.

• 2024: Victoria allocated additional $14 million for EMR implementation while public health services in South Australia and Melbourne announced plans to adopt digital patient flow management platforms enhancing healthcare efficiency.

• 2024: New AI accelerator program launched to boost Australia's biomedical sector providing specialized data and AI services to innovative MedTech companies advancing artificial intelligence and robotics integration capabilities.

• 2024: Victorian government established Medtech Skills and Device Hub collaborating with industry, academic institutions, and training providers to create training programs, degrees, and internships supporting local manufacturing and export expansion.

• May 2024: IMARC Group reported significant increase in MedTech solution adoption driven by consumer demand for personalized and efficient healthcare options reflecting market momentum and digital transformation acceleration.

• July 2024: Leading manufacturers introduced new wearable medical devices and AI-driven healthcare analytics platforms meeting evolving consumer preferences and advancing remote monitoring and diagnostic capabilities.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type, Component, Deployment Type, Application, End User, and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=6064&flag=F

Competitive Landscape

The competitive landscape of Australia's MedTech market is marked by a mix of established global players and innovative local startups. Major international companies dominate key segments, particularly in diagnostics, imaging, and cardiology, leveraging advanced technologies and extensive distribution networks. Meanwhile, local startups focus on niche markets, often driving innovation in digital health, AI, and wearable devices. Government support, along with partnerships between research institutions and the private sector, creates a dynamic environment that drives growth. However, competition is intensifying as new entrants and disruptive technologies emerge, compelling companies to innovate continuously while adhering to stringent regulatory standards.

Major Companies Operating in the Market:

• Alcidion Group Limited

• Anatomics Pty Ltd

• Artrya

• AusBiotech

• Avanade Australia (Accenture)

• Cochlear Limited

• Ellex

• ResMed Inc.

• Schott AG

• Sirtex Medical Limited

Q&A Section

Q1: What drives growth in the Australia MedTech market?

A1: Market growth is driven by aging population increasing chronic illness prevalence, rising healthcare expenditure with government modernization initiatives and private sector investments, strong R&D ecosystem fostering university-industry collaboration, global market positioning particularly in Asia-Pacific region, regulatory framework ensuring product safety and international reputation, and government funding support through grants and subsidies maintaining competitiveness.

Q2: What are the latest trends in this market?

A2: Key trends include digital health transformation with telemedicine and AI-driven solutions expansion, AI and robotics integration improving diagnostic accuracy and surgical precision, personalized medicine advancement through genomic developments, preventive care emphasis with assistive technologies promoting independence, sustainability innovation with eco-friendly device development, and public-private collaboration accelerating technology integration and clinical trials.

Q3: What challenges do companies face?

A3: Major challenges include high regulatory compliance costs creating financial burdens for smaller companies, limited access to capital with investor reluctance toward long development cycles, market fragmentation across states with varying procurement processes and infrastructure gaps, and commercialization complexity requiring substantial funding and clinical validation affecting innovation timelines.

Q4: What opportunities are emerging?

A4: Emerging opportunities include digital health expansion with AI-powered diagnostics and wearable device proliferation, local manufacturing growth for specialized treatments reducing import dependence, Indigenous health equity advancement through culturally grounded solutions, integrated ecosystem development connecting all healthcare providers, and innovation commercialization support through university collaborations and government programs.

Q5: Which segment dominates the Australia MedTech market?

A5: Telehealth accounts for the largest market share due to its ability to improve healthcare accessibility particularly in remote areas, with growing demand for remote consultations, chronic disease management capabilities, and strong government support for digital health adoption driving market expansion.

Q6: What is the market forecast for Australia MedTech?

A6: The Australia MedTech market was valued at USD 8.48 Billion in 2024 and is projected to reach USD 13.90 Billion by 2033, exhibiting a CAGR of 5.10% during 2025-2033, driven by technological advancements, demographic shifts, and increasing healthcare investment.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia MedTech Market 2025 | Worth USD 13.90 Billion by 2033 here

News-ID: 4243982 • Views: …

More Releases from IMARC Group

Fuel Cells Manufacturing Plant Setup Report (DPR) 2026: Investment Guide and Dem …

The global fuel cells industry is experiencing one of the fastest growth trajectories in the clean energy sector, propelled by rising demand for hydrogen-based technologies, accelerating decarbonization commitments from major economies, and growing adoption of fuel cell electric vehicles for heavy-duty and long-range transportation. As governments worldwide deploy large-scale clean energy investment programs and industries seek reliable zero-emission alternatives to diesel generation, establishing a fuel cells manufacturing plant represents a…

Biomass Power Plant Cost Report 2026: Demand Analysis, CapEx/OpEx, & ROI Insight …

The global biomass power sector is experiencing accelerating growth, driven by rising demand for reliable and dispatchable renewable energy, government initiatives to reduce greenhouse gas emissions, and a growing focus on waste-to-energy solutions. As nations worldwide ramp up renewable energy capacity and phase out fossil fuels, biomass power plants-capable of delivering continuous, controllable electricity unlike intermittent solar and wind sources-present a strategically compelling business opportunity for energy investors and independent…

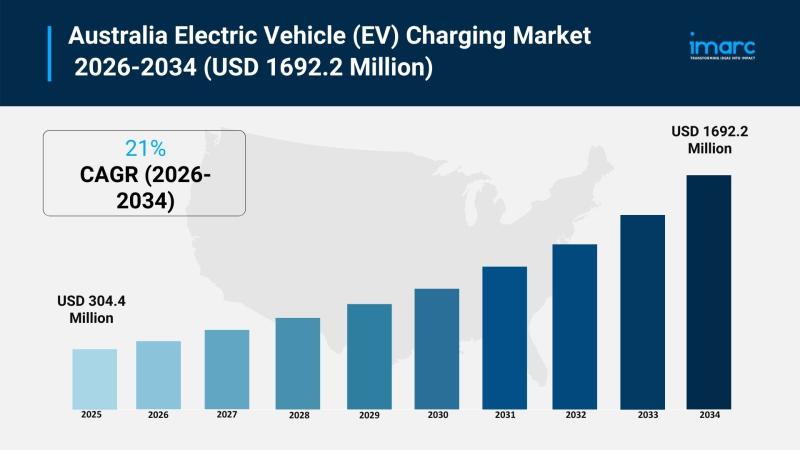

Australia Electric Vehicle (EV) Charging Market Projected to Reach USD 1692.2 Mi …

Market Overview

The Australia electric vehicle (EV) charging market was valued at USD 304.4 million in 2025 and is projected to reach USD 1,692.2 million by 2034, growing at a rate of 21.00% over the forecast period 2026-2034. Growth is driven by rapid expansion of urban and rural charging infrastructure, the rise of smart charging technologies like vehicle-to-grid systems, and supportive government incentives promoting widespread EV charger installation. The market advances…

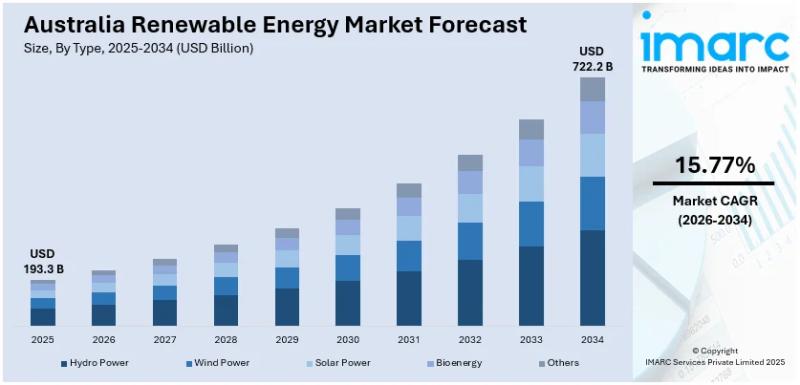

Australia Renewable Energy Market Projected to Reach USD 722.2 Billion by 2034

Market Overview

The Australia renewable energy market size reached USD 193.3 Billion in 2025 and is forecast to expand to USD 722.2 Billion by 2034. The market will grow at a compound annual growth rate of 15.77% during the forecast period of 2026-2034. This growth is primarily driven by advances in energy storage and smart grid technologies, which enhance renewables' integration into the country's energy infrastructure. Renewable sources including solar, wind,…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…