Press release

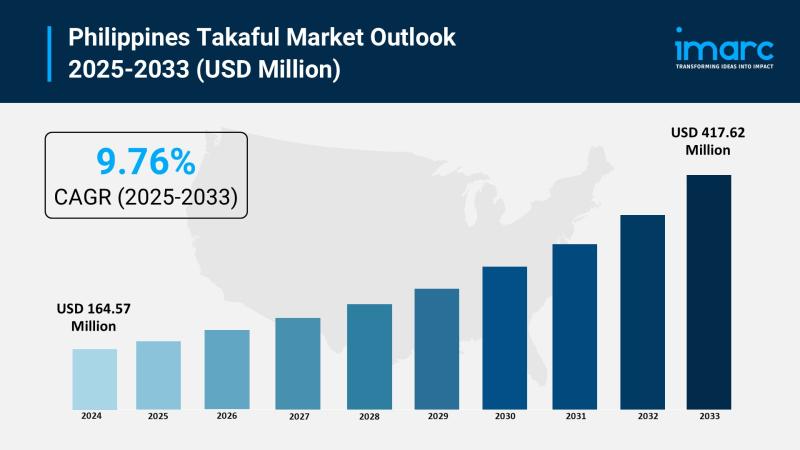

Philippines Takaful Market 2025 | Worth USD 417.62 Million by 2033 | at a 9.76% CAGR

The latest report by IMARC Group, "Philippines Takaful Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033," provides an in-depth analysis of the Philippines takaful market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines takaful market size reached USD 164.57 Million in 2024 and is projected to grow to USD 417.62 Million by 2033, exhibiting a robust growth rate of 9.76% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 164.57 Million

Market Forecast in 2033: USD 417.62 Million

Growth Rate (2025-2033): 9.76%

Philippines Takaful Market Overview:

The Philippines takaful market is experiencing robust expansion driven by increasing awareness of Shariah-compliant financial products with November 2024 Insurance Commission granting first official takaful license establishing legal regulatory foundation. Rising demand for inclusive insurance solutions targeting 7 million Muslim population previously underserved by conventional insurance models. July 2025 Etiqa Philippines launching flagship Takaful Personal Accident product providing benefits for accidental death, permanent disability, medical expenses, and hospital cash allowance. March 2025 Pru Life UK preparing to roll out micro-takaful insurance and Shariah-compliant endowments partnering with Al Amanah Islamic Investment Bank. Regulatory support with Insurance Commission promoting financial inclusion particularly in Muslim-populated regions positioning takaful as critical ethical insurance enabler.

Request For Sample Report: https://www.imarcgroup.com/philippines-takaful-market/requestsample

Philippines Takaful Market Trends:

Philippines takaful market trends include momentum expected gaining traction in two to three years as companies adopt cautious approach toward relatively new market. January 2025 CEBUANA Lhuillier Insurance Brokers partnering Etiqa Insurance launching first takaful product tailored to Islamic community needs fostering inclusivity and financial empowerment. February 2025 group personal accident micro-takaful plan introduced offering flexible low-cost coverage with multiple enrollment options throughout year. Limited Shariah-compliant investment options in country though guidelines not prohibiting takaful operators from investing overseas. Pru Life UK logging highest New Business Annual Premium Equivalent at PHP 9.8 billion in 2024 demonstrating market leadership. Insurance penetration remaining quite low creating significant growth potential. Cooperative risk-sharing and community-based financial protection values appealing to sizeable population segment.

Philippines Takaful Market Drivers:

Philippines takaful market drivers include seven million Muslim Filipinos previously underserved by conventional interest-bearing insurance policies creating substantial addressable market. Global takaful market valued at USD 36.57 billion in 2024 projected reaching USD 75.26 billion by 2033 at 8.28% CAGR with Philippines contributing to regional expansion. Insurance Commission promoting financial inclusion through ethical finance frameworks with March 2025 celebrating takaful's official acknowledgement during 76th year. Micro-takaful products addressing everyday financial risks through affordable protection covering minor accidents, hospital stays, and transportation incidents. Strategic partnerships including Pru Life UK collaboration with Al Amanah Islamic Investment Bank expanding distribution channels. Government policy momentum prioritizing fair financial systems based on ethical values. Rising financial literacy and acceptance of takaful as credible mainstream choice for family protection.

Market Challenges:

• Low Market Awareness limited understanding of takaful principles requiring extensive consumer education campaigns

• Limited Investment Options insufficient Shariah-compliant investment vehicles in Philippines constraining growth

• Industry Infancy only two licensed operators creating wait-and-see stance among potential entrants

• Product Development Timeline standard two to three years for takaful adoption and market maturity

• Distribution Constraints nascent agent network requiring comprehensive training on Islamic finance principles

• Cultural Barriers misconceptions about Islamic insurance limiting appeal beyond Muslim communities

• Regulatory Complexity compliance with both Insurance Commission and Shariah board requirements

• Competitive Intensity conventional insurance dominance creating market entry barriers for takaful operators

Market Opportunities:

• Muslim Population Targeting addressing 7 million underserved Filipino Muslims with Shariah-compliant solutions

• Micro-Takaful Expansion developing affordable everyday protection products for low-income segments

• Distribution Partnerships collaborating with Islamic banks, cooperatives, and community organizations

• Product Innovation creating family takaful, health takaful, and savings-linked protection plans

• Digital Platforms leveraging mobile apps and online enrollment for accessibility convenience

• Educational Initiatives conducting awareness campaigns highlighting mutual guarantee and ethical investment principles

• Regional Development expanding beyond NCR into Mindanao and other Muslim-majority areas

• Cross-Border Investment accessing overseas Shariah-compliant investment opportunities for fund growth

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-takaful-market

Philippines Takaful Market Segmentation:

Product Type Insights:

• Life/Family Takaful

• General Takaful

Regional Insights:

• Luzon

• Visayas

• Mindanao

Philippines Takaful Market News:

July 2025: Etiqa Philippines officially launched Takaful following successful regulatory and product approval milestones. Company received approval for flagship Takaful Personal Accident product providing simple affordable protection for accidental death, permanent disability, medical expenses, and hospital cash allowance signaling significant development in Philippine insurance landscape with inclusive ethical financial protection option.

March 2025: Pru Life UK preparing to roll out Takaful insurance offering in April pending Insurance Commission final approval. Company planning to offer micro-takaful insurance and Shariah-compliant endowments partnering with Al Amanah Islamic Investment Bank for distribution. Pru Life UK eyeing double-digit growth in Philippine market in 2025 with NBAPE reaching PHP 9.8 billion in 2024.

January 2025: CEBUANA Lhuillier Insurance Brokers partnered with Etiqa Insurance launching first takaful product in Philippines. Product tailored to meet unique needs of Islamic community while fostering inclusivity and financial empowerment for Filipinos from all backgrounds marking milestone in expanding Shariah-compliant financial services accessibility nationwide.

Key Highlights of the Report:

• Market analysis projecting growth from USD 164.57 million (2024) to USD 417.62 million (2033) with 9.76% CAGR

• July 2025 Etiqa Philippines launching flagship Takaful Personal Accident product with regulatory approval

• March 2025 Pru Life UK preparing market rollout with micro-takaful and Shariah-compliant endowments

• November 2024 Insurance Commission granting first official takaful license to Pru Life UK

• Seven million Muslim Filipinos representing substantial underserved addressable market for Islamic insurance

• Global takaful market valued at USD 36.57 billion in 2024 projected USD 75.26 billion by 2033 at 8.28% CAGR

• Life/Family takaful dominating product type segment with financial security and family protection focus

• Mindanao leading regional distribution with highest concentration of Muslim population and community needs

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines takaful market growth to USD 417.62 million by 2033?

A1: Market driven by seven million Muslim Filipinos previously underserved by conventional interest-bearing insurance creating substantial addressable market, global takaful market reaching USD 36.57 billion projected USD 75.26 billion by 2033, and Insurance Commission promoting financial inclusion through ethical finance frameworks. Micro-takaful products addressing everyday financial risks, strategic partnerships including Pru Life UK with Al Amanah Islamic Investment Bank, and government policy momentum prioritizing fair systems support 9.76% growth rate addressing Shariah-compliant protection requirements.

Q2: How are product launches and regulatory support transforming the Philippines takaful landscape?

A2: July 2025 Etiqa Philippines launching Takaful Personal Accident product with regulatory approval providing affordable protection. March 2025 Pru Life UK preparing rollout with micro-takaful and Shariah-compliant endowments. January 2025 CEBUANA Lhuillier partnering Etiqa launching first takaful product fostering inclusivity. November 2024 Insurance Commission granting first official license establishing legal foundation. These position regulatory momentum and product innovation as drivers supporting market accessibility financial inclusion and cooperative risk-sharing adoption.

Q3: What opportunities exist for takaful stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on Muslim population targeting addressing 7 million underserved Filipinos with Shariah-compliant solutions, micro-takaful expansion developing affordable everyday protection for low-income segments, and distribution partnerships collaborating with Islamic banks and community organizations. Product innovation creating family health and savings-linked plans, digital platforms leveraging mobile apps for convenience, and educational initiatives conducting awareness campaigns represent opportunities alongside regional development expanding into Mindanao and cross-border investment accessing overseas opportunities supporting market growth diversification addressing ethical insurance financial empowerment requirements.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=42188&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Takaful Market 2025 | Worth USD 417.62 Million by 2033 | at a 9.76% CAGR here

News-ID: 4241671 • Views: …

More Releases from IMARC Group

India Digital Health Market is Expected to Reach USD 84,076.5 Million by 2034 | …

Introduction

According to IMARC Group's report titled "India Digital Health Market Size, Share, Trends and Forecast by Type, Component, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including India digital health market share, growth, trends, and regional insights.

How Big is the India Digital Health Market?

The India digital health market size reached USD 19,145.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 84,076.5…

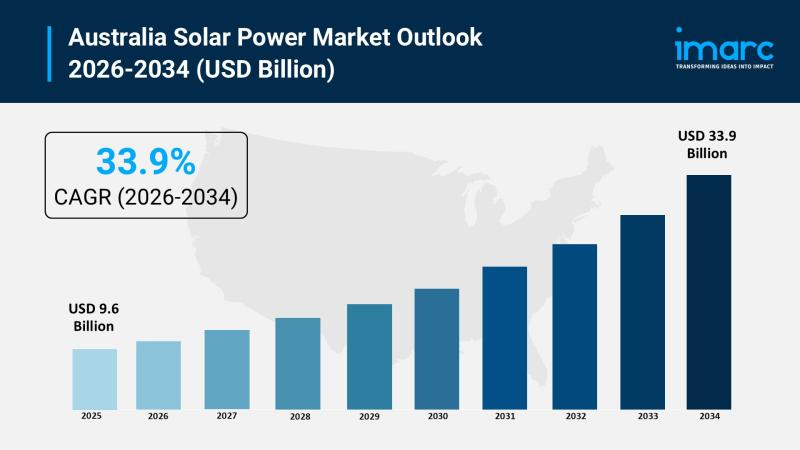

Australia Solar Power Market 2026 | Projected to Reach USD 33.9 Billion by 2034

Market Overview

The Australia solar power market reached USD 9.6 Billion in 2025 and is forecast to grow to USD 33.9 Billion by 2034. The market exhibits a robust growth rate of 15.00% during the forecast period 2026-2034. This expansion is driven by supportive government policies, technological advancements, and increasing adoption across residential, commercial, and utility sectors, positioning solar energy as a cornerstone of Australia's clean energy future.

Grab a sample PDF…

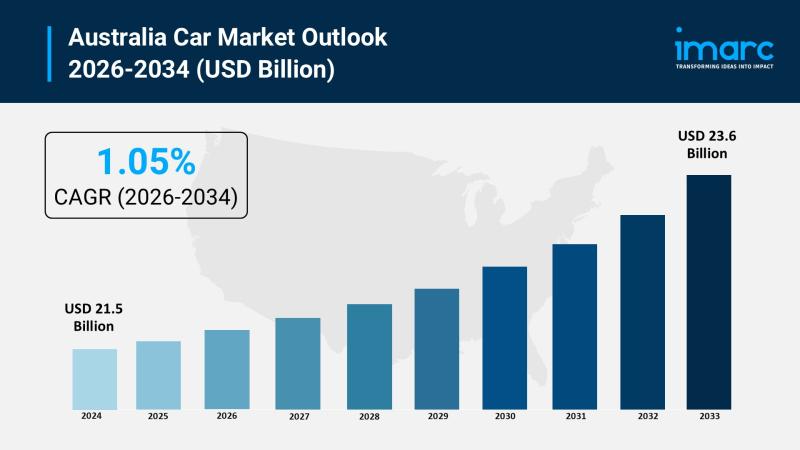

Australia Car Market 2026 | Surge to Grow to USD 23.6 Billion by 2034

Market Overview

The Australia car market reached a size of USD 21.5 Billion in 2025 and is forecasted to grow to USD 23.6 Billion by 2034. The market is expected to expand at a CAGR of 1.05% throughout the forecast period from 2026 to 2034. Growth is driven primarily by increasing demand for electric vehicles, SUVs, and connected car technologies, spurred by environmental awareness, lifestyle changes, and technological innovation toward sustainable…

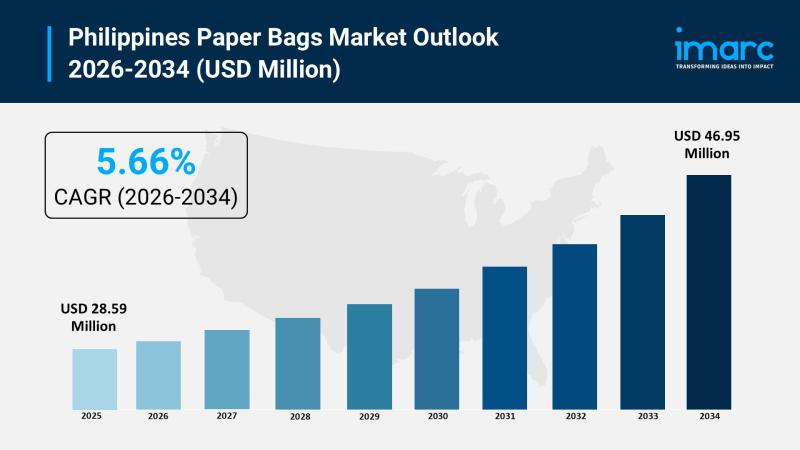

Philippines Paper Bags Market 2026 | Expected to Reach USD 46.95 Million by 2034

Market Overview

The Philippines paper bags market size was valued at USD 28.59 Million in 2025 and is expected to reach USD 46.95 Million by 2034, with a growth rate of 5.66% CAGR from 2026 to 2034. This growth is driven by increasing environmental concerns, government bans on single-use plastics, and rising adoption by retailers and foodservice providers. The expanding food and beverage sector, coupled with heightened awareness of plastic pollution,…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…