Press release

Subsea Umbilical Clamps Market to Reach USD 2,153 Million by 2031 Top 10 Company Globally

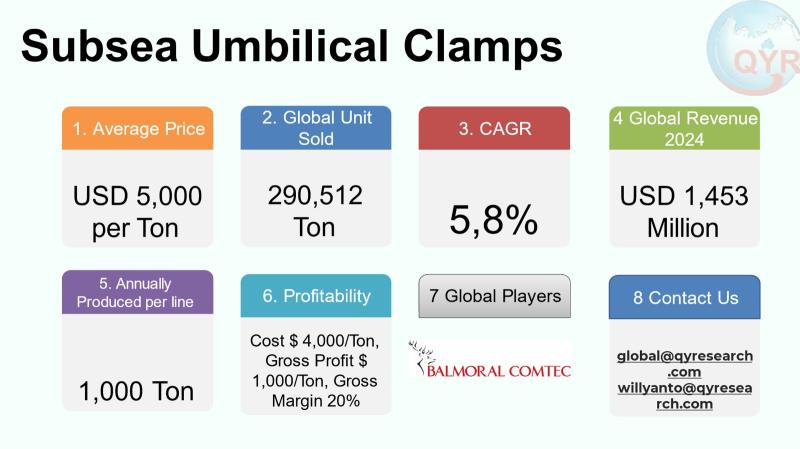

Subsea umbilical clamps are engineered devices used to secure, support and manage umbilicals, control lines and small-diameter flowlines on seabed installations and tiebacks; they protect critical cables and umbilicals from free-span damage, fatigue and interference during installation and operation and are integral components of subsea infrastructure for oil & gas and increasingly for offshore renewables. The industry sits inside the broader subsea hardware and umbilicals ecosystem suppliers design clamps to meet bespoke specifications for material selection (corrosion-resistant alloys, engineered polymers), controlled squeeze forces, and testing to industry standards so that clamps reliably function in harsh deepwater environments. Demand is therefore driven by new field developments, brownfield tieback activity, decommissioning projects, remediation and the gradual build-out of offshore wind and subsea electrification projects that require sophisticated umbilical management.The global market size for subsea umbilical clamps in 2024 is USD 1,453 million with a projected compound annual growth rate of 5.8% to 2031reaching market size USD 2,153 million by 2031. With an average market price of USD 5,000 per ton, total global volume sold in 2024 is approximately 290,512 tons. A factory gross margin of 20%, which corresponds to factory gross profit of roughly USD 1,000 per ton and cost of goods of USD 4,000 per ton. A cost-of-goods-sold breakdown is split across material procurement, fabrication, coatings and testing, labor and logistics. A single line full-machine production capacity is around 3,000 ton per line per year. Downstream demand by end-market remains dominated by oil & gas installations followed by offshore renewables.

Latest Trends and Technological Developments

The clamp sector has seen incremental technical developments and more publicized project wins across 2024 to 2025 that illustrate two concurrent dynamics: continued oil & gas infrastructure activity and an expanding role in renewable and monitoring-enabled installations. In April 2025 reporting on the broader umbilical market highlighted strong growth and continued deepwater project activity that underpins clamp demand. In June to july 2025 several announcements noted deployments of advanced subsea umbilicals with fiber-optic monitoring and larger-capacity installation campaigns, and contract awards for umbilical and flexible pipeline installation that include clamp scopes were published in mid-2025 (for example a Subsea7 award in July 2025 for flexible pipeline and umbilical installation offshore Egypt). There has also been a steady stream of product-level innovation modular clamp architectures, elastomeric pad technologies to reduce point-load damage, and clamps designed for MUX/fiber-managed assemblies which reduce installation risk and lifecycle maintenance. These developments point to a market that is slowly converging on smarter, lower-maintenance clamp designs that can be specified as part of integrated subsea umbilical management systems.

Equinor ASA purchases a significant quantity of specialized titanium and corrosion-resistant alloy subsea umbilical clamps from Aker Solutions for their flagship Jansz-Io compression project offshore Western Australia. This major contract, valued at over USD 4.5 million, covers the supply of several thousand units of high-specification clamps. These clamps are essential for securing the subsea umbilicals that will provide hydraulic control and chemical injection to the subsea compression stations, ensuring the long-term integrity and reliability of the system in a demanding deep-water environment.

The product was successfully installed by Subsea 7 during the installation phase of the Shell Vito development in the US Gulf of Mexico. The advanced umbilical clamps, manufactured by TechnipFMC, were used to securely fasten the dynamic and static sections of the umbilicals to the subsea structures and pipeline sleds. This critical installation, involving several hundred clamps with a total contract value exceeding USD 1.2 million, was vital for protecting the umbilicals from environmental loads and potential damage, thereby guaranteeing the continuous flow of power and chemicals to the subsea wells.

Asia is a mixed and strategically important region for subsea umbilical clamp demand and manufacture. Large producers and EPC contractors active in Asia-Pacific maintain regional fabrication yards to serve projects in the South China Sea, East and West Malaysia, offshore China, India and Australia. Demand drivers in Asia include ongoing development of shallow- to deepwater oil & gas fields (tiebacks and brownfield work), life-extension projects in mature basins and an emerging pipeline of floating offshore wind and electrification projects around parts of East Asia. The manufacturing footprint in Asia combines local specialist fabricators (often serving regional oil & gas contractors) and global suppliers that have established regional service and assembly hubs. This combination compresses lead times for project deliveries in Asia compared with purely export-supply models and it gives regional buyers access to customized clamp designs with local content benefits. As a result, Asian markets are both consumers and growing producers of higher-value clamp assemblies.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5206526

Subsea Umbilical Clamps by Type:

Bolt On Clamp

Band/Strap Clamp

Saddle Clamp

Others

Subsea Umbilical Clamps by Material:

Polyurethane/Elastomer

HDPE/Composite

Stainless/Alloy Steel

Subsea Umbilical Clamps by Features:

Standard Saddles and Band Clamps

Axially Rotating Clamps

Multi Line Clamps

Quick Release Clamps

Others

Subsea Umbilical Clamps by Size:

Small Diameter Clamps(≤100 mm)

Medium Diameter Clamps(100-250mm)

Large Diameter Clamps(> 250mm)

Multi Channel or Dual Clamps

Others

Subsea Umbilical Clamps by Depth Rating:

Shallow Water (≤500 m)

Mid Water (500-1500 m)

Deepwater (1500-3000 m)

Ultra-Deepwater (>3000 m)

Others

Subsea Umbilical Clamps by Application:

Oil and Gas

Subsea Construction

Offshore instalation

Others

Global Top 10 Key Companies in the Subsea Umbilical Clamps Market

Advanced Insluation

Balmoral Comtec

CRP Subsea

DOF Subsea

Deepwater Buoyancy

Matrix Composites & Engineering

Nexans Umbilicals

Oceaneering

Tekmat Group

Trelleborf Offshore

Regional Insights

Within Southeast Asia, ASEAN demand patterns are dominated by oil & gas activity off Malaysia, Indonesia and Vietnam, with Indonesia highlighted as an active market for clamp demand because of extensive newfield developments, brownfield tiebacks and maintenance programs across the archipelago. Indonesias mix of shallow and deeper basins, combined with national content policies and the presence of local fabrication yards, encourages local sourcing for clamp assemblies when technical specifications and certification requirements align. Across ASEAN, contractors increasingly require traceability, NDT certification, and localized testing capabilities, which benefits suppliers that can offer regional service centers, inventory stocking and pre-assembly services. There is also a slow but visible shift toward inclusion of subsea hardware in renewable projects (floating wind pilot projects and subsea power exports) especially in Southeast Asian waters where floating solutions are technically attractive. Market participants servicing ASEAN typically balance exports from China, India and Korea with regional fabrication to meet project timelines and local content expectations.

The industry faces a set of recurring challenges that affect margins and lead times: material price volatility for corrosion-resistant alloys and engineered polymers, long project procurement cycles that lead to boom-and-bust demand for production capacity, stringent qualification and testing regimes that raise unit costs, and supply-chain concentration for certain specialty components. In addition, the rising complexity of umbilicals (more integrated fiber optics, MUX lines and higher-voltage subsea power cables) requires clamps to be more precisely engineered and tested, increasing engineering lead time and certification cost. Market cyclicality driven by upstream capex decisions in oil & gas creates utilization risk for specialist fabricators. Finally, new entrants from adjacent fastening and subsea-products makers increase competition on price and speed-to-market for standard clamp types.

For suppliers and investors, successful strategies include specializing in higher-margin, engineered clamp solutions (e.g., bespoke MUX clamps, elastomer-lined assemblies and modular clamp systems), building regional assembly/service hubs in Asia/ASEAN to unlock local content preferences, and vertically integrating testing and coating capabilities to shorten delivery schedules. EPC partners and operators prefer suppliers who can deliver certification packages, NDT documentation and lifecycle support; offering aftermarket service agreements and spares can convert one-off project orders into multi-year revenue streams. Diversifying into adjacent subsea hardware (bundle spacers, bend stiffeners, protective housings) and capturing retrofit/maintenance demand in mature basins can smooth revenue volatility. Finally, suppliers that invest prudently in automation gain per-unit cost advantages that protect margins when input-material prices rise.

Product Models

Subsea umbilical clamps are critical components in offshore oil and gas and renewable energy installations, used to secure and manage umbilicals, cables, and flexible flowlines along subsea structures.

Bolt-On Clamp: A rigid clamp type that fastens umbilicals directly onto structures using bolts, providing high mechanical strength and precise alignment. Notable products include:

Subsea Bolt Clamp Balmoral Offshore Engineering: Designed for permanent umbilical fixation with corrosion-resistant polymer inserts.

Oceaneering U-Clamp Oceaneering International: Provides robust retention for deepwater umbilical routing.

Trelleborg Bolt-On Clamp Trelleborg Offshore: Uses molded elastomeric pads for vibration damping and secure grip.

Cameron Subsea Clamp Cameron (SLB): Integrates anti-slip coating for high-tension cable stability.

IMES Umbilical Fix Clamp IMES Group: Designed for precise alignment along subsea manifolds and tiebacks.

Band/Strap Clamp A flexible clamping system that uses adjustable stainless-steel bands or straps, ideal for securing umbilicals with variable diameters or temporary installations. Examples include:

Band-Lok Subsea Strap Band-It: Stainless steel band clamp for variable-diameter cable bundling.

Hitech Flex-Strap Clamp Hitech Subsea: Lightweight strap clamp designed for ROV-friendly installations.

Tyco Marine Strap System Tyco Electronics: Offers quick tension adjustment for temporary subsea setups.

JDR Strap Assembly JDR Cables: Integrated strap clamp for umbilical terminations and jumpers

Tyco Marine Strap System Tyco Electronics: Offers quick tension adjustment for temporary subsea setups.

Saddle Clamp asemi-circular clamp that cradles the umbilical and secures it using a top retaining plate, distributing load evenly and minimizing point pressure. Notable products include:

Balmoral Saddle Clamp Balmoral Offshore: Distributes load evenly across umbilical surfaces.

Trelleborg Saddle Mount Trelleborg Offshore: Features dual rubber inserts for vibration reduction.

Oceaneering Saddle Clamp Oceaneering International: For manifold and frame-mounted cable management.

MacArtney Cable Saddle MacArtney Group: Durable polymer-coated steel frame for long-term deployment.

JDR Marine Saddle JDR Cables: Compact saddle system for clustered umbilical routing on subsea trees.

The subsea umbilical clamp market in 2024 is a mid-sized, technically specialized subsector of the broader umbilicals and subsea hardware market, with USD 1,453 million in revenue at the stated price and a CAGR profile that points to steady growth through 2031. Asia and Southeast Asia are strategically important both as demand centers (large, ongoing oil & gas campaigns, brownfield work and emerging renewable projects) and as manufacturing hubs that reduce lead times and support local content. Suppliers who combine engineering capability, regional service presence and controlled production costs are best placed to capture high-value clamp scopes while managing cyclical demand and input-cost volatility.

Investor Analysis

What investors need to know: the report synthesizes market size, unit volumes, pricing and margin structure, capacity benchmarks per production line and end-market split data that directly inform valuation assumptions for manufacturers or fabrication assets. How investors can use it: to size addressable revenue for an acquisition target, to stress-test margin scenarios given material-price volatility, to model payback periods for automation investments (capacity uplift) and to evaluate regional expansion strategies (e.g., setting up an ASEAN assembly hub versus exporting from Asia). Why it matters: subsea clamp suppliers occupy a durable niche with long project procurement cycles and recurring aftermarket needs; understanding the economics per ton, realistic per-line capacity and the split of downstream demand by end market enables investors to model utilization risk and upside from cross-selling into umbilical, tubing and flowline hardware. Investors should pay attention to players with strong certification packages, aftermarket service footprints in Asia/ASEAN, and design IP that differentiates clamp performance for modern, fiber-rich umbilicals.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5206526

5 Reasons to Buy This Report

It provides a market-level baseline and unit volume estimate at the stated price level for practical revenue modeling.

It breaks down factory economics including an actionable COGS percentage profile and implied gross profit per ton for valuation sensitivity.

It contains region-specific insight for Asia and ASEAN which is critical for market entry or expansion decisions.

It summarizes the latest project and technology developments through 2025 that affect product specifications and aftermarket demand.

It lists the leading suppliers and the competitive dynamics useful for M&A screening and supplier selection.

5 Key Questions Answered

What was the market size in 2024 and how large is the global unit volume at the stated price?

What are typical factory margins, implied profit per ton and a practical COGS breakdown by percentage?

What is a reasonable per-line production capacity to use in production planning or valuation models?

How do Asia and ASEAN differ in demand drivers and sourcing behavior?

Who are the principal incumbent suppliers and what competitive dynamics should buyers and investors expect?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Subsea Umbilical Clamps Market Research Report 2025

https://www.qyresearch.com/reports/5206526/subsea-umbilical-clamps

Global Subsea Umbilical Clamps Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5206525/subsea-umbilical-clamps

Global Subsea Umbilical Clamps Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5206527/subsea-umbilical-clamps

Subsea Umbilical Clamps - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5206528/subsea-umbilical-clamps

Global Subsea Umbilicals Market Research Report 2025

https://www.qyresearch.com/reports/4191801/subsea-umbilicals

Global Subsea Umbilical Cables Market Research Report 2025

https://www.qyresearch.com/reports/3455768/subsea-umbilical-cables

Global Subsea Umbilical Systems Market Research Report 2025

https://www.qyresearch.com/reports/4599196/subsea-umbilical-systems

Global Subsea Steel Tube Umbilical Market Research Report 2025

https://www.qyresearch.com/reports/3551025/subsea-steel-tube-umbilical

Global Oil & Gas Subsea Umbilicals Market Research Report 2025

https://www.qyresearch.com/reports/3470256/oil---gas-subsea-umbilicals

Global Subsea Control System Umbilical Cables Market Research Report 2025

https://www.qyresearch.com/reports/4583051/subsea-control-system-umbilical-cables

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Subsea Umbilical Clamps Market to Reach USD 2,153 Million by 2031 Top 10 Company Globally here

News-ID: 4241482 • Views: …

More Releases from QY Research

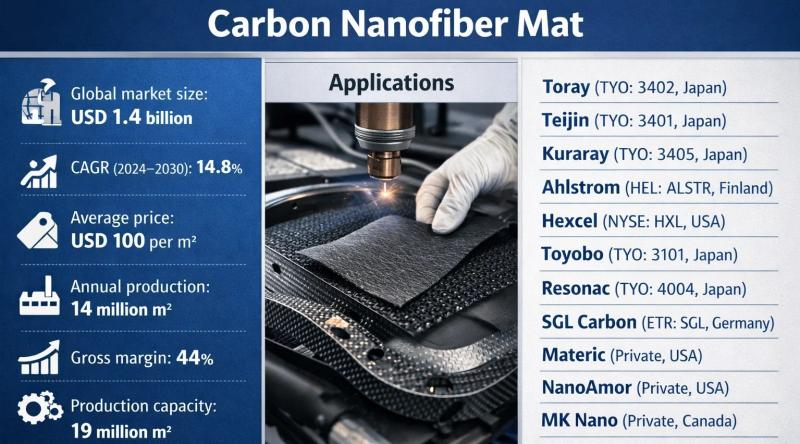

Carbon Nanofiber Mats: Breaking the Limits of Traditional Carbon Materials

Problem

Pylontech (China) in energy storage, filtration, and advanced composite materials relying on conventional carbon fabrics, carbon black additives, or metal meshes encountered multiple performance bottlenecks:

Limited electrical conductivity uniformity

Insufficient surface area for electrochemical reactions

Poor flexibility at low basis weight

Trade-offs between porosity, mechanical strength, and thickness

In lithium-ion batteries, supercapacitors, fuel cells, EMI shielding, and industrial filtration, these constraints resulted in:

Lower energy density and rate capability

Higher material loading and system weight

Reduced durability under…

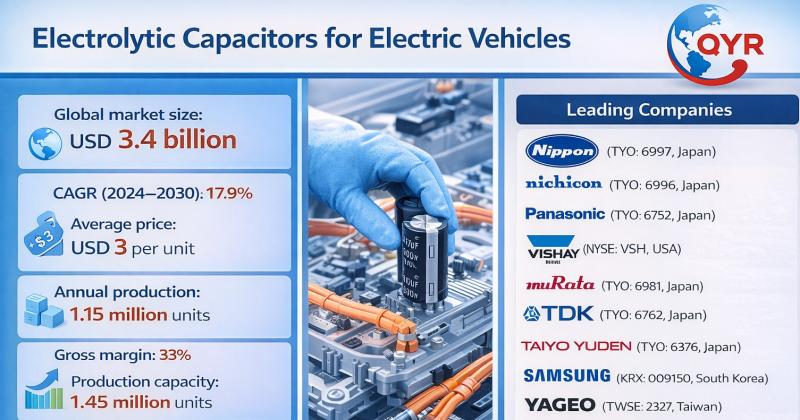

Global and U.S. Electrolytic Capacitors for Electric Vehicles Market Report, Pub …

QY Research has released a comprehensive new market report on Electrolytic Capacitors for Electric Vehicles, high-capacitance energy-storage components used for voltage smoothing, ripple-current suppression, and transient energy buffering in EV power electronics. Automotive-grade aluminum electrolytic capacitors play a critical role in traction inverters, onboard chargers (OBCs), DC-DC converters, battery management systems, and auxiliary power modules. As EV architectures migrate to higher voltages (400 V → 800 V) and higher switching…

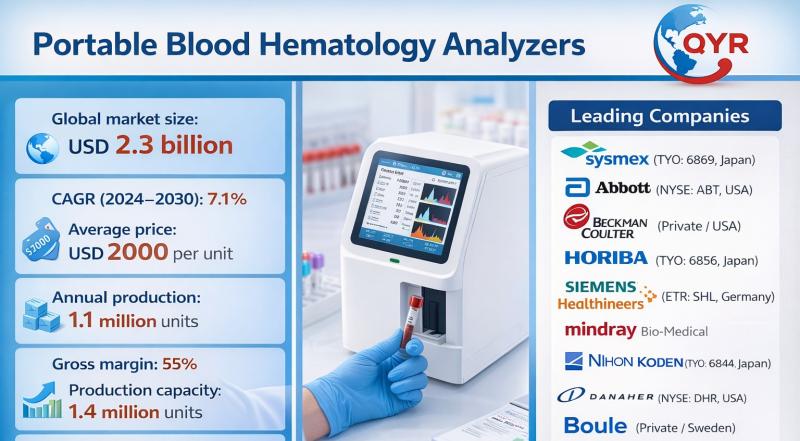

Global and U.S. Portable Blood Hematology Analyzers Market Report, Published by …

QY Research has released a comprehensive new market report on Portable Blood Hematology Analyzers, a compact, mobile medical device designed to quickly measure and analyze key components of blood, such as red blood cells (RBCs), white blood cells (WBCs), hemoglobin, hematocrit, and platelets, outside of a traditional laboratory setting. These devices use microfluidics, optical detection, impedance, or fluorescence technology to perform rapid blood counts, enabling point-of-care testing (POCT) in hospitals,…

Top 30 Indonesian Paint Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Avia Avian Tbk Avian Brands (detailed Q3 numbers below)

PT Propan Raya Industrial Coating Chemicals (market participant)

PT Kansai Paint Indonesia (market participant)

PT Mowilex Indonesia Tbk (paint maker)

PT ICI Paints Indonesia (Asian Paints Indonesia) (market participant)

PT TOA Paint Indonesia (market participant)

PT Nippon Paint Indonesia (local arm of Nippon Paint)

PT Sika Indonesia (coatings & specialty chemicals)

PT Dulux Indonesia…

More Releases for Clamp

Clamp Meters Market Size Analysis by Application, Type, and Region: Forecast to …

USA, New Jersey- According to Market Research Intellect, the global Clamp Meters market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for clamp meters is expanding steadily due to rising demand from sectors like construction, automotive, and electrical repair. Clamp meters and other non-contact…

Spiral Clamp Market

Spiral clamps, also referred to as spiral wire clamps or helix hose clamps, represent a specialized solution designed for hoses featuring a corrugated or helical pattern. In industries where secure connections in hose applications are paramount, the emergence of the spiral clamp market addresses this specific need. Unlike conventional hose clamps, spiral clamps are tailored to provide a tighter and more secure grip on hoses with ridges, ensuring leak-proof connections.

Growing…

Exhaust Clamp Market shares forecast to witness considerable growth from 2021 to …

A new study on the Exhaust Clamp Market makes a detailed assessment of current opportunities, upcoming revenue areas, and current and projected valuations of various segments, gauging the economic impact of COVID-19. The assessments that span several pages include identifying key growth drivers, restraining factors, major revenue-boosting trends, and upcoming avenues. The dynamics of the global Exhaust Clamp Market are correlated with an evaluation of the strategic landscape of various…

Global Skull Clamp Market Research Report

This report studies the global Skull Clamp market status and forecast, categorizes the global Skull Clamp market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in North America, Europe, Japan, China, and other regions (India, Southeast Asia). The major manufacturers covered in this report Allen Medical Systems Barrfab Eschmann Equipment Herbert Medifa-hesse GmbH & Co. KG Micromar OPT SurgiSystems PMI Pro…

New Trends of Clamp Meters Market with Worldwide Industry Analysis to 2028( Segm …

Global Clamp Meters Market: Introduction

A clamp meter is an electronic or electrical tester that has wide jaws, which enable it to clamp around an electric conductor. Formerly, clamp meters were designed as tools for measuring AC current and now include inputs for accepting test leads and other probes that support different types of electrical measurements. The jaws of clamp meters facilitate work in tight spaces and also permit current measurements…

Clamp Meters Market Segmented By type Current transformer (AC) clamp meters, Hal …

Global Clamp Meters Market: Introduction

A clamp meter is an electronic or electrical tester that has wide jaws, which enable it to clamp around an electric conductor. Formerly, clamp meters were designed as tools for measuring AC current and now include inputs for accepting test leads and other probes that support different types of electrical measurements. The jaws of clamp meters facilitate work in tight spaces and also permit current measurements…