Press release

Lactose Free Products Market to Reach CAGR 7,1% Million by 2031 Top 20 Company Globally

The lactose-free products industry addresses consumer demand for dairy nutrition without lactose, using enzymatic hydrolysis (lactase) or alternative formulations to deliver milk, yogurt, cheese and ice-cream that are digestible by lactose-intolerant consumers while retaining key nutrients such as calcium and B vitamins. The category spans packaged fluid milk, powdered milk and infant formula, cultured dairy (yogurt, kefir), processed cheese and frozen desserts, and sits at the intersection of medical need (lactose intolerance), wellness trends and broader dairy market dynamics. Globally the industry serves both consumers who medically require lactose-free options and a larger health-conscious cohort seeking easier-to-digest dairy; the product set competes with plant-based dairy alternatives but continues to grow on the strength of real-dairy positioning and nutrient profile. Recent specialist market research and industry trackers show robust expansion driven by improving retail availability, clearer labeling, product innovation and growing diagnosis/awareness of lactose intolerance in several Asian markets.The global Lactose free product market size in 2024 is USD 8,827 million and an assumed CAGR of 7.1% through 2031 reaching market size USD 14,170 million by 2031. Average retail price by product category typically ranges from about USD 2.5 per kg, which implies 3,530,800,000 kg sold in 2024. A factory gross margin of 25% equal USD 0.625 per kg for factory gross profit and USD 1.875 per kg for the cost of goods. COGS breakdowns is raw dairy inputs, enzymes and specialty ingredients, processing & utilities, and the remainder to packaging, labor and overhead. Full-machine production capacity is around 25,000,000 kg per year per line. Downstream industry demand is concentrated in fluid consumer milk followed by infant & medical nutrition, cultured dairy and cheese, and frozen desserts and other processed applications.

Latest Trends and Technological Developments

The lactose-free category continues to see product claim expansion and reformulation. On August 2025, DairyReporter highlighted that lactose-free claims remain among the top growth drivers in dairy, with many players reporting H1 2025 performance outpacing 2024 as consumers seek targeted health solutions. On May 2025, Axios reported regional gains in U.S. markets where lactose-free milk sales rose substantially year-over-year, illustrating continued mainstreaming of lactose-free milk in retail. There have also been recalls and supply-chain items of note (for example, a Lactaid product recall reported in September 2024 relating to undeclared allergens), which underscores the importance of rigorous quality systems when adding enzymes or new ingredients. Meanwhile, Asia-Pacific specialist reports published in late 2024 and 2023 point to double-digit CAGR projections for APAC lactose-free dairy subsegments, driven by rising diagnosis rates, urban retail expansion and infant formula demand in specific markets such as Japan. Technological advances include more efficient lactase dosing and immobilized enzyme systems to reduce per-unit enzyme cost, improvements in aseptic packaging to extend shelf life without preservatives, and tailored fermentation strains for lactose-reduced yogurts that preserve texture and flavor.

Nestlé, the world's largest food and beverage company, purchases substantial quantities of lactose-free whey protein concentrate from a leading supplier like Arla Foods Ingredients. This strategic procurement is for use in their growing range of performance and health-focused products, such as the "Resource" line of medical nutrition shakes. A major contract might see Nestlé purchasing several hundred metric tons of this specialized ingredient annually, with a market price typically ranging from $3,000 to $4,500 per metric ton, depending on protein concentration and contract terms. This bulk purchase is driven by the rising global demand for clinical and sports nutrition products that are accessible to the lactose-intolerant population.

The lactose-free milk powder produced by Valio Ltd., a Finnish dairy company, is used as a primary raw material by Plamil Foods, a UK-based manufacturer of dairy-free and vegan products. Plamil incorporates Valio's Lactose-Free Skim Milk Powder into their "So Free!" chocolate line to create a creamy, milk-chocolate alternative without causing digestive issues. For a large production run, Plamil might utilize several thousand kilograms of this specialty powder, with the ingredient cost embedded in the final product's value, amounting to an application cost of approximately $5 to $7 per kilogram of the powder used, which is a premium over conventional milk powder due to the additional enzymatic processing required to remove the lactose.

Asia is a high-priority growth region for lactose-free products because of both epidemiology and market dynamics: large population cohorts with significant prevalence of lactose intolerance coexist with rising dairy consumption per capita in several markets. China, Japan and South Korea show diverging but complementary demand drivers: in China, urban middle-class expansion and e-commerce distribution are boosting lactose-free milk and infant formula SKUs; in Japan and South Korea, consumer awareness and higher per-capita dairy consumption support premium lactose-free and functional dairy launches. India is emerging more slowly in packaged lactose-free dairy but shows early traction in niche infant and clinical nutrition segments. Across Asia, retail penetration varies widely and regulatory labeling requirements (what constitutes "lactose-free" vs "lactose-reduced") affect product formulation strategy and marketing. Regional analyses point to Asia-Pacific CAGR estimates commonly in the high single digits to low double digits for lactose-free dairy subsegments.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5225847

Lactose Free Products by Type:

Milk

Yogurt

Cheese

Ice-cream

Others

Lactose Free Products by Material:

Dairy Based

Plant Based Lactose Fee Alternatives

Mixed Dairy Plant Based

Organic Dairy Source

Others

Lactose Free Products by Shape:

Liquid Products

Semi Solid Products

Solid Products

Powdered Products

Others

Lactose Free Products by Features:

Low Fat Variants

Fortified with Vitamins and Minerals

Organic and Clean Label

High Protein and Nutrition

Others

Lactose Free Products by Usage:

Household Retail Consumption

Infant Nutrition

Foodservice and Catering

Industrial Ingredient Use

Others

Lactose Free Products by Application:

Supermarket

Retail Store

Onlinesales

Global Top 20 Key Companies in the Lactose Free Products Market

Gujarat Cooperative Milk Marketing Federation

Valio LTD

Danone Company S.A.

Nestlé

The Coca-Cola Company

Johnson & Johnson Services, Inc.

General Mills, Inc.

Lifeway Foods, Inc.

Lala U.S., Inc.

Organic Valley

Dairy Farmers of America, Inc.

Dean Foods

Shamrock Foods

Saputo Inc

Prairie Farms Dairy

Agri-Mark, Inc.

SmithFoods, Inc.

Granlatte Societa Cooperativa Agricola ARL

Meggle

Drums Food International Pvt Ltd

Regional Insights

Southeast Asia is an attractive but heterogeneous market. Indonesia highlighted by the user has growing retail modern-trade channels and a large young population; lactose-free products are gaining shelf space in urban centers and e-commerce, but per-capita dairy consumption and affordability are still lower than in Northeast Asia. Thailand, Malaysia and the Philippines present mid-market opportunities for mainstream lactose-free milk and yogurts, while Singapore and urban Malaysia show demand for premium and imported lactose-free SKUs. Distribution and cold-chain constraints still influence product mix: countries with strong cold chains and retail refrigeration favor fluid lactose-free milk, whereas others see higher uptake of UHT lactose-free milk, powdered milk or shelf-stable fermented products. Industry participants targeting ASEAN often use a dual strategy of local manufacture (to control COGS and logistics) plus selective imports for premium SKUs. Regional reports and press releases from late 20232024 support an accelerated push into ASEAN by multinational dairy companies and by regional dairy co-ops.

Key challenges include raw milk price volatility (which compresses gross margins in commodity SKUs), enzyme sourcing and cost (lactase can be a meaningful incremental ingredient cost at scale), complexity of labeling and regulatory variance across markets, and competition from plant-based dairy alternatives that capture health- and sustainability-minded consumers. Quality and allergen control are critical because enzyme inclusion and cross-contact risks create recall exposures; the Lactaid recall reported in late 2024 is a salient example. Distribution in emerging Asian markets can be constrained by cold-chain gaps, which shifts product strategy toward UHT or powdered formats and influences manufacturing location decisions. Finally, reconciling price-sensitive mass markets with demand for premium functional SKUs requires careful portfolio and channel segmentation.

Manufacturers should evaluate local co-manufacture or toll-manufacturing in key ASEAN markets to reduce import costs and improve speed to shelf, while investing in enzyme supply agreements and immobilization/efficient dosing technologies to reduce per-unit COGS. Brands can capture share by combining clear clinical positioning (for lactose intolerance) with mainstream lifestyle marketing and by expanding lactose-free claims across adjacent categories (yogurt, cheese, desserts). For retailers and distributors, stocking convenience SKUs (single-serve, UHT) alongside refrigerated premium variants allows capture of both price-sensitive and premium segments. From an operations perspective, investments in aseptic/UHT lines and quality management systems will reduce spoilage and recall risk and unlock broader distribution in hot climates. Investors should prefer vertically integrated players or joint ventures that secure raw milk and enzyme supply, and those with multi-channel routes-to-market across modern trade and e-commerce.

Product Models

Lactose-Free Products are foods made by removing or enzymatically converting lactose into simpler sugars (glucose and galactose) using lactase enzyme treatment.

Lactose-Free Milk is a milk that has been treated with the enzyme lactase to break down lactose into simpler sugars (glucose and galactose), making it easier to digest while retaining the same taste, nutrients, and texture as regular milk. Notable products include:

Lactaid Milk Lactaid: 100% real milk with lactase enzyme added, offering the same calcium and protein without lactose.

Arla Lactose-Free Milk Arla Foods: Smooth, creamy milk filtered to remove lactose, suitable for all ages.

Fairlife Lactose-Free Milk The Coca-Cola Company: Ultra-filtered milk with high protein and low sugar content.

Organic Valley Lactose-Free Milk Organic Valley: USDA organic-certified milk from pasture-raised cows, lactose-free.

Anchor Zero Lacto Milk Fonterra: Naturally creamy milk with lactose removed through enzyme treatment.

Lactose-Free Yogurt is a fermented dairy product made from lactose-free milk or with added lactase enzyme, providing live cultures and probiotics for gut health without causing lactose-related discomfort. Examples include:

Yoplait Lactose-Free Yogurt General Mills: Creamy yogurt made with live cultures and real fruit, lactose-free.

Activia Lactose-Free Yogurt Danone: Probiotic-rich yogurt promoting gut health, made without lactose.

Siggis Lactose-Free Yogurt Siggis Dairy: Thick skyr-style yogurt with low sugar and lactose-free.

Chobani Lactose-Free Greek Yogurt Chobani: Greek-style yogurt rich in protein, crafted for easy digestion.

Arla Lactose-Free Yogurt Arla Foods: Mild-tasting yogurt made from filtered lactose-free milk.

Lactose-Free Cheese is a cheese made from milk with lactose removed or naturally aged so that lactose is fully broken down, offering the same texture and flavor profile as traditional cheese. Notable products include:

Cabot Lactose-Free Cheddar Cabot Creamery: Naturally aged cheddar with zero lactose, sharp and creamy.

Arla Lactose-Free Mozzarella Arla Foods: Stretchy mozzarella ideal for pizzas and pasta, lactose-free.

Violife Mature Cheddar Flavor Upfield: Vegan and lactose-free cheese alternative with authentic cheddar taste.

Valio Eila Cheese Valio: Nordic lactose-free cheese range, smooth and flavorful.

Sargento Lactose-Free Cheese Slices Sargento: Convenient sliced cheese for sandwiches, easy to digest.

Lactose-Free Ice Cream is a frozen dessert made from lactose-free dairy or plant-based ingredients, ensuring creamy sweetness and flavor without the lactose that can cause digestive issues. Notable products include:

Ben & Jerrys Non-Dairy Ice Cream Unilever: Iconic ice cream made with almond milk base, lactose-free.

Breyers Lactose-Free Vanilla Unilever: Classic vanilla ice cream made creamy without lactose.

Haagen-Dazs Non-Dairy Collection Nestlé: Premium almond milk-based frozen desserts.

So Delicious Dairy Free Ice Cream Danone: Coconut milk-based ice cream in multiple flavors.

Halo Top Dairy-Free Ice Cream Eden Creamery: Low-calorie ice cream alternative made with coconut milk.

The lactose-free products industry is a resilient and steadily growing segment within dairy, combining medically driven demand with mainstream wellness adoption. Asia and Southeast Asia are strategic growth frontiers due to large populations, rising dairy consumption and expanding retail infrastructure; however, success requires careful cost management (enzyme and raw milk), strong quality systems and a distribution approach that aligns SKU format to local cold-chain realities. Given the varied public market estimates depending on scope (pure lactose-free dairy vs. broader dairy-free definitions), companies should align internal planning assumptions to their product scope and regional go-to-market strategy.

Investor Analysis

This report highlights several investor-relevant takeaways: investable opportunity (what) the segment shows predictable, mid-to-high single-digit CAGR at the aggregate level with pockets of faster growth in APAC and infant/medical nutrition subsegments; operational levers (how) margin expansion is attainable through enzyme cost control, localizing production, and product mix optimization (premium vs commodity SKUs); risk and mitigation (why) raw milk price exposure, supply-chain quality risks and competitive pressure from plant-based alternatives are the principal downside risks that can be mitigated by vertical integration, strategic sourcing and robust QA/QC; exit / value drivers (why) scale players with multi-channel distribution and differentiated product claims (clinically validated digestive benefits, fortified nutrition) are most likely to deliver premium multiples; timing (how) near-term growth in Asia/ASEAN presents both organic growth and M&A consolidation opportunities as multinationals push into emerging markets. In short, investors will find the category attractive for predictable cash flow growth if they back company with secure supply chains, quality systems and clear regional go-to-market coverage.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5225847

5 Reasons to Buy This Report

It consolidates commercial and manufacturing metrics for lactose-free dairy across global and Asia/ASEAN regions enabling faster go/no-go decisions.

It identifies region-specific demand patterns (China, Japan, Indonesia, ASEAN) and distribution channel implications for SKU selection.

It provides manufacturing cost breakdown ranges and capacity benchmarks helpful for plant-level investment planning.

It summarizes recent market news and regulatory/quality risks that affect commercial continuity and valuation.

It lists leading competitors and strategic levers helpful for M&A screening, partnership scouting and competitive benchmarking.

5 Key Questions Answered

What is the current global market size and assumed growth trajectory for lactose-free products?

Which product categories and channels (fluid milk, infant formula, yogurt, cheese, frozen) account for the largest downstream demand shares?

What are realistic COGS breakdowns, factory gross profit ranges and per-line production capacity benchmarks for lactose-free dairy manufacturing?

What are the most important technological developments and quality risks affecting scale-up (enzyme dosing, UHT/aseptic packaging, allergen control)?

Which global and regional companies currently lead the market and what strategic moves should investors watch for in Asia and ASEAN?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Lactose-Free Products Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5225847/lactose-free-products

Lactose-Free Products- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/4034773/lactose-free-products

Global Lactose-Free Products Market Research Report 2025

https://www.qyresearch.com/reports/4031583/lactose-free-products

Global Lactose Free Dairy Products Market Research Report 2025

https://www.qyresearch.com/reports/4341255/lactose-free-dairy-products

Global Lactose-Free Food Market Research Report 2025

https://www.qyresearch.com/reports/4335952/lactose-free-food

Global Lactose-Free Milk Market Research Report 2025

https://www.qyresearch.com/reports/3441187/lactose-free-milk

Global Lactose-Free Cheese Market Research Report 2025

https://www.qyresearch.com/reports/4335953/lactose-free-cheese

Global Lactose-free Yogurt Market Research Report 2025

https://www.qyresearch.com/reports/4030598/lactose-free-yogurt

Global Lactose Free Butter Market Research Report 2025

https://www.qyresearch.com/reports/4030447/lactose-free-butter

Global Lactose-free Skim Milk Market Research Report 2025

https://www.qyresearch.com/reports/4396811/lactose-free-skim-milk

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lactose Free Products Market to Reach CAGR 7,1% Million by 2031 Top 20 Company Globally here

News-ID: 4241480 • Views: …

More Releases from QY Research

Top 30 Indonesian Steel Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Krakatau Steel Tbk

PT Steel Pipe Industry of Indonesia Tbk

PT Gunung Raja Paksi Tbk

PT Gunawan Dianjaya Steel Tbk

PT Betonjaya Manunggal Tbk

PT Pelat Timah Nusantara Tbk

PT Saranacentral Bajatama Tbk

PT Lionmesh Prima Tbk

PT Super Iron & Steel Tbk

PT Indo Kordsa Tbk

PT Surya Esa Perkasa Tbk

PT Indah Kiat Pulp & Paper (steel fittings)

PT KRAH Grand Kartech Tbk

PT Keyprint Tbk

PT Singaraja Putra Tbk

PT Prima Alloy Steel Tbk

PT Akebono…

Coloring the Future: Market Dynamics and Opportunities in Dual Tip Alcohol Marke …

The Dual Tip Alcohol Marker market is a dynamic segment within the broader art and creative stationery industry, driven by demand from artists, designers, students, hobbyists, and creative professionals worldwide. Dual tip markers with broad and fine ends offer multifunctional use for detailed illustration and coverage work, blending artistic precision with vibrant color performance. Alcohol markers more broadly (which include dual tip varieties) continue to expand as art supplies gain…

Acupressure Pillow Market Report 2026: Asia & ASEAN Growth, Trends, and Investme …

The global acupressure pillow industry encompasses products designed to provide therapeutic pressure relief, stress reduction, muscle relaxation, and wellness benefits. These pillows, often integrated with acupressure points or ergonomic contours, attract both health-conscious consumers and wellness-oriented markets seeking non-pharmaceutical solutions for pain management and quality of sleep. Unlike broader pillow segments such as sleeping or cervical pillows, the acupressure pillow niche blends traditional healing principles with contemporary lifestyle and wellness…

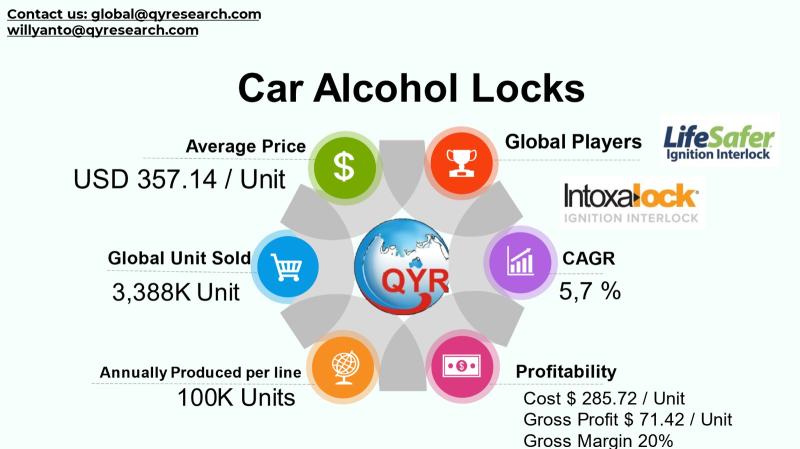

Road Safety Revolution: How Car Alcohol Locks Are Accelerating Adoption in Asia …

The Car Alcohol Lock industry, also known as the Ignition Interlock Device (IID) or Alcohol Interlock Systems market, has emerged as a crucial segment of automotive safety technologies aimed at reducing alcohol-related road accidents and enforcing drunk driving regulations. These systems are primarily in-vehicle alcohol detection devices that require drivers to pass a breath alcohol test before starting the engine, ensuring compliance with safety standards and legal mandates in many…

More Releases for Lacto

South Korea Probiotic Food Supplement Market is expected to reach a value of US$ …

Market Size and Forecast:

The South Korea Probiotic Food Supplement Market Size Value was US$ 649.05 million in 2023 and is expected to reach a value of US$ 819.40 million in 2027, growing at a CAGR of 12.94% during the forecast period (2024-2027).

The South Korea Probiotic Food Supplement Market report, published by DataM Intelligence, provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. Committed to delivering…

South Korea Probiotic Food Supplement Market to Hit $819.4M by 2027 at 12.94% CA …

South Korea Probiotic Food Supplement Market was valued at US$ 649.05 million in 2023 and is projected to reach US$ 819.40 million by 2027, growing at a CAGR of 12.94% during the forecast period 2024-2027.

The South Korea Probiotic Food Supplement Market report by DataM Intelligence provides comprehensive insights and analysis on key market trends, growth opportunities, and emerging challenges. With a commitment to delivering actionable intelligence, DataM Intelligence empowers businesses…

Lacto-N-Neotetraose(LNnT) Market Growth Overview, Upcoming Trends, Industry Anal …

LOS ANGELES, United States: The global Lacto-N-Neotetraose(LNnT) market is researched with great precision and in a comprehensive manner to help you identify hidden opportunities and become informed about unpredictable challenges in the industry. The authors of the report have brought to light crucial growth factors, restraints, and trends of the global Lacto-N-Neotetraose(LNnT) market. The research study offers complete analysis of critical aspects of the global Lacto-N-Neotetraose(LNnT) market, including competition, segmentation,…

Lacto-N-Tetraose (LNT) Market Growth Overview: A Comprehensive Analysis of Produ …

The global Lacto-N-Tetraose (LNT) market is poised for significant growth, driven by its expanding applications and increasing demand in the health and wellness sector. The latest market research report, "Lacto-N-Tetraose (LNT) Market Growth Overview, Product Types & Application, Trends, Forecast From 2024-2030," offers a comprehensive analysis of the current market landscape, future trends, and the key factors shaping the industry's trajectory.

Lacto-N-Tetraose (LNT), a human milk oligosaccharide (HMO), has gained considerable…

Soy Milk Infant Formula Market 2022 Size, Industry Share, Growth, and Regional S …

Global Soy Milk Infant Formula Market Outlook (2022-2030)

This comprehensive report on the Soy Milk Infant Formula Market provides real information about the statistics and state of the global market. Its scope of study extends from the market situation to comparative pricing between the main players, spending in specific market areas, and profits. It represents a comprehensive and succinct analysis report of the main competitor and price statistics with a view…

Topping Bases Market To 2028: Growth Analysis By Manufacturers, Regions, Types A …

This detailed market study covers topping bases market growth potentials which can assist the stake holders to understand key trends and prospects in topping bases market identifying the growth opportunities and competitive scenarios. The report also focuses on data from different primary and secondary sources, and is analyzed using various tools. It helps to gain insights into the market's growth potential, which can help investors identify scope and opportunities. The…