Press release

Top 30 Indonesian Mining Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)This curated list (below) is drawn from IDX/market summaries of listed mining sector issuers (companies active in coal, nickel, copper, gold, tin, bauxite, integrated miners and mining services). Many of these companies published Q3/9M 2025 financials in OctNov 2025/.

Adaro Energy (ADRO); PT Bukit Asam (PTBA); Bayan Resources (BYAN); Indo Tambangraya Megah (ITMG); PT Aneka Tambang / Antam (ANTM); Vale Indonesia (INCO); PT Timah (TINS); Harum Energy (HRUM); Merdeka Copper Gold (MDKA); Amman Mineral Internasional (AMMN); Golden Energy & Resources / GEMS; Bumi Resources (BUMI); PT Merdeka Gold Resources / EMAS (recently listed); Borneo Olah Sarana Sukses (BOSS); Baramulti Suksessarana (BSSR); Indika Energy (INDY); Mitrabara Adiperdana (MBAP); Bayan/related groups; Sumber Mineral Global/others; plus mining-support and metal/mineral names such as J Resources/PSAB, Wilton (SQMI), and others. (The Indodax/IDX lists are a convenient comprehensive reference for the full universe of listed mining issuers).

Snapshot summary (sector tone Q3 2025): Q3 2025 showed a mixed picturelarge coal producers and vertically integrated miners continued to generate significant operating cash flow but many companies faced pressure from lower benchmark coal indices versus the prior year; metal miners (nickel, copper, gold) showed divergence by commodity (some benefitted from higher gold/copper but nickel contributions softened for some groups). Regulatory changes (2025 mining law amendments) and domestic processing priorities continued to shape investor narratives.

2) Earnings call / Q3 2025 results Top 10 Indonesian mining companies

1. Adaro Energy (ADRO)

Reported: Rp 5.03 trillion (net profit reported Q3/9M packs in coverage).

USD equivalent: ≈ $301.3 million (Rp 5.03T ÷ 16,692 = $301,341,960).

Brief: Adaro remained a top cash-generator for the coal patch in Q3; the profit reflects coal sales mix and cost management despite softer benchmark coal prices.

2. PT Aneka Tambang / Antam (ANTM)

Reported: Rp 5.97 trillion (net profit - Q3/9M reported).

USD equivalent: ≈ $357.7 million (Rp 5.97T ÷ 16,692 = $357,656,362).

Brief: Antam's profit improvement y/y reflected stronger margins from its metal segments (nickel/gold products) and operational contribution from downstream activities.

3. Bayan Resources (BYAN)

Reported: Rp 8.71 trillion (net profit - Q3/9M reported).

USD equivalent: ≈ $521.8 million (Rp 8.71T ÷ 16,692 = $521,806,854).

Brief: Bayan's large Q3 result stems from volume + contract mix; major coal miners that maintained low production cost profiles held up relatively well.

4. Indo Tambangraya Megah (ITMG)

Reported: Rp 2.18 trillion (net profit - Q3 2025 reported).

USD equivalent: ≈ $130.6 million (Rp 2.18T ÷ 16,692 = $130,601,486).

Brief: ITMG's Q3 profit fell vs prior year, mirroring lower realised coal prices; still a significant contributor in the coal mid-cap space.

5. PT Bukit Asam (PTBA)

Reported: Rp 1.39 trillion (net profit - Q3 2025).

USD equivalent: ≈ $83.3 million (Rp 1.39T ÷ 16,692 = $83,273,424).

Brief: PTBA posted weaker net profit vs prior year quarters due to benchmark price declines, even though domestic sales volumes rose.

6. Vale Indonesia (INCO)

Reported: Rp 874.8 billion (net profit - Q3 2025).

USD equivalent: ≈ $52.4 million (Rp 874.8B ÷ 16,692 = $52,408,339).

Brief: Vale Indonesia showed modest profit growth y/y, driven by operational efficiencies and steady nickel/cobalt concentrate performance.

7. PT Timah (TINS)

Reported: Rp 602.4 billion (net profit - Q3 2025).

USD equivalent: ≈ $36.1 million (Rp 602.4B ÷ 16,692 = $36,089,144).

Brief: Tin prices and sales mix influenced Timah's results; Q3 was down from the prior-year period but the company remains a leading tin producer.

8. Harum Energy (HRUM)

Reported: Rp 622.3 billion (net profit - Q3 2025).

USD equivalent: ≈ $37.3 million (Rp 622.3B ÷ 16,692 = $37,281,332).

Brief: Harum's result reflected narrower margins vs last year but positive operating cash flows were maintained.

9. Merdeka Copper Gold (MDKA)

Reported (company release): unaudited revenue USD 1,298 million as of 30 Sept 2025 (9M revenue), with Q3 operational notes and improved segment contributions. (Company Q3 quarterly activities and revenue disclosure).

USD equivalent: already presented in USD by the company $1,298.0 million reported (9M).

Brief: Merdeka reported a decline in total revenue y/y driven by weaker nickel contributions but continues to show scale in gold/copper and advancing project development (Tujuh Bukit, HPAL). MDKAs published Q3/9M materials include detailed revenues by commodity.

10. Amman Mineral Internasional (AMMN)

Reported: Net loss Rp 2.98 trillion (Q3 2025).

USD equivalent: ≈ -$178.5 million (loss). (Rp -2.98T ÷ 16,692 = -$178,528,636).

Brief: Amman reported a large Q3 loss due to constrained/blocked smelter export permit impacts and sharp declines in sales; this was a key negative outlier in the sector for Q3.

3) Key trends & insights from Q3 2025 (what the numbers tell us)

Divergence by commodity coal producers (Adaro, Bayan, ITMG, PTBA) remained large cash generators where contract structures and low-cost operations offset weaker benchmark indices for some players; metal miners showed mixed results gold/copper helped some (MDKA/ANTM), while nickel contributions weakened in groups with large nickel exposure (affecting total revenue mix).

Earnings concentration a handful of large issuers (Adaro, Bayan, Antam, Merdeka) accounted for a substantial portion of sector profits and investor attention in Q3 this increases index concentration risk but also makes the sectors headline moves easier to follow via a small group of names.

Regulatory & policy tailwinds the 2025 mining law amendments continued to shape investor thinking: the laws emphasis on downstream processing and prioritizing companies that invest in processing capacity is a strategic driver for companies pushing downstream (refining, smelting, HPAL). That dynamic was referenced widely in Q3 commentary.

Cost & capex profile matter companies that kept unit costs low (efficient coal producers, miners with stable energy & logistic costs) produced better operating cash flow resiliency. Companies facing smelter/export restrictions (e.g., Amman) or heavy smelter-related capex saw much weaker reported profitability.

FX & currency context most companies report and incur costs in IDR but sell commodities priced in USD or indexed prices. The IDR moved in mid-Nov 2025 around the mid-16,60016,800 range; that exchange-rate path influenced USD-equivalents of rupiah earnings and balance-sheet translation.

4) Outlook for Q4 2025 and beyond

Near-term (Q4 2025): Expect continued earnings dispersion. Coal producers will track thermal coal benchmark movements and domestic demand patterns; metal miners will closely watch nickel and copper price dynamics and any additional downstream export/permit developments. Companies with near-term downstream capacity (smelters, HPAL) may highlight commissioning progress and capex phasing in Q4 disclosures (MDKA was explicit about HPAL and downstream progress in Q3 materials).

Medium-term (2026+): Indonesias policy tilt to favor domestic processing and value-added project developers should benefit miners investing in processing/refining inside Indonesia. That said, successful execution (permitting, financing, technical commissioning) is critical companies that can scale processing while maintaining low unit costs stand to capture higher value.

Risks: commodity price volatility (global demand for coal and metals), regulatory or export-permit shocks (Ammans Q3 case), operational incidents, and capex overruns for large greenfield processing projects.

5) Conclusion

Q3 2025 confirmed the Indonesian mining sectors dual character: large, cash-generative coal names (Adaro, Bayan, ITMG, PTBA) and commodity-specific metal/mineral plays (Antam, Merdeka, Vale, Timah) which are shaped strongly by global commodity prices and domestic processing/permit dynamics. Company-level performance in Q3 varied widely from strong profits at some coal majors and Antam, to significant losses at Amman where smelter/export issues compressed sales so the sector remains both an opportunity and a test of execution. The direction into Q4 2025 will depend on commodity price moves and how quickly downstream projects / regulatory changes are digested by the market.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Mining Public Companies Q3 2025 Revenue & Performance here

News-ID: 4313560 • Views: …

More Releases from QY Research

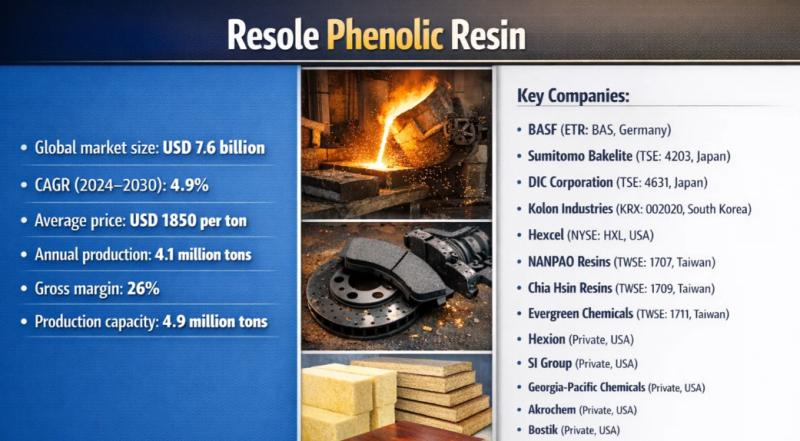

From Slow Cure to High Performance: Weyerhaeuser's Shift to Resole Phenolic Resi …

Problem

Weyerhaeuser Company using conventional thermoplastic binders or novolac-type phenolic systems faced limited heat resistance, slower curing, and additional curing-agent requirements. In applications such as wood panels, insulation, abrasives, refractories, and molded components, these limitations led to longer press cycles, insufficient thermal stability, and inconsistent mechanical performance under high-temperature or fire-exposed conditions.

Solution

Hexion adopted Resole Phenolic Resin, a thermosetting phenolic resin synthesized under alkaline conditions with a formaldehyde-to-phenol ratio greater than 1.…

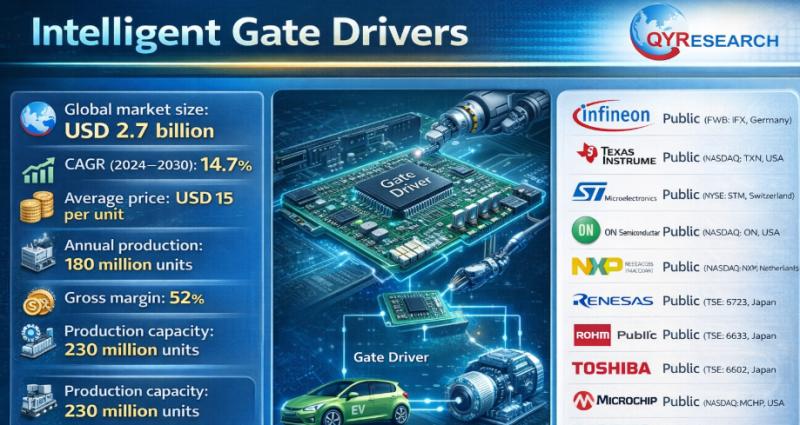

Global and U.S. Intelligent Gate Drivers Market Report, Published by QY Research …

QY Research has released a comprehensive new market report on Intelligent Gate Drivers, advanced semiconductor control components that integrate gate-driving, protection, sensing, and communication functions to manage power transistors such as IGBTs, MOSFETs, SiC MOSFETs, and GaN HEMTs. Unlike conventional gate drivers, intelligent gate drivers embed real-time monitoring, fault protection, and adaptive control, enabling higher efficiency, reliability, and safety in modern power electronic systems. As electrification accelerates across EVs, renewable…

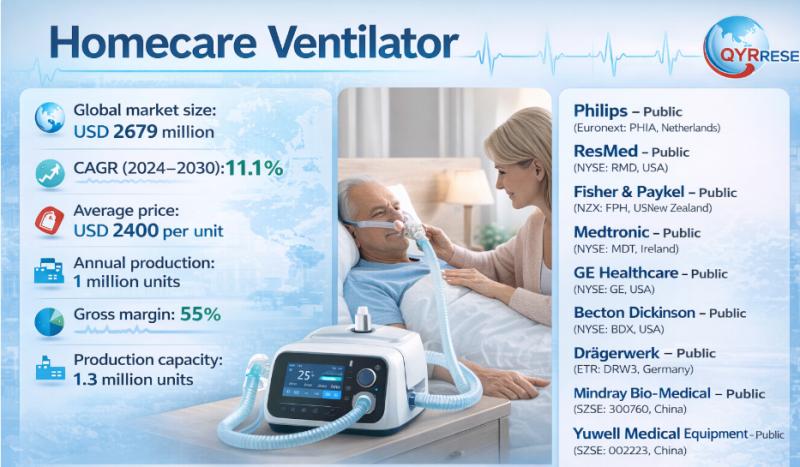

Global and U.S. Homecare Ventilator Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Homecare Ventilator, a medical device that assists or takes over a person's breathing outside of a hospital setting. Designed for long‐term respiratory support, these ventilators are used by people with chronic respiratory conditions such as COPD, neuromuscular disease, spinal injuries, or sleep‐related breathing disorders. Homecare ventilators are typically portable, quieter, and easier to operate than ICU ventilators.

Core Market Data

Global market…

Top 30 Indonesian Battery Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aneka Tambang Tbk (ANTM) diversified metals (nickel & battery feedstock)

Bayan Resources Tbk (BYAN) large mining & metal revenue

AlamTri Resources / Adaro Energy Tbk (ADRO) diversified mining & metals

Indo Tambangraya Megah Tbk (ITMG) mining including metals exposure

PT Bukit Asam Tbk (PTBA) minerals/coal & metals linkage

Vale Indonesia Tbk (INCO) nickel & concentrates

PT Timah…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…