Press release

Global Equity Management Software Market is projected to reach the value of $1508.47 Billion by 2030.

In 2023, the Global Equity Management Software Market was valued at $591.85 Billion, and is projected to reach a market size of $1508.47 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 6.85%.Request Sample @ https://virtuemarketresearch.com/report/equity-management-software-market/request-sample

The global equity management software market is witnessing significant growth, driven by various long-term market drivers. One such driver is the increasing adoption of cloud-based equity management solutions. Cloud technology offers several advantages, including scalability, flexibility, and cost-effectiveness. These benefits have led to a growing preference for cloud-based solutions among organizations looking to streamline their equity management processes. Additionally, the COVID-19 pandemic has further accelerated the adoption of cloud-based solutions, as remote work became the norm. Organizations sought agile and accessible software solutions to manage their equity effectively, driving the demand for cloud-based equity management software.

In the short term, a key driver of the equity management software market is the growing focus on regulatory compliance. With increasing regulatory requirements and complexities, organizations are turning to software solutions to ensure compliance with various regulations and standards. This focus on compliance has created a significant opportunity for software vendors to offer specialized solutions that address the unique needs of organizations in different industries and regions. Additionally, the trend of digital transformation is shaping the equity management software market. Organizations are increasingly digitizing their equity management processes to improve efficiency, reduce errors, and enhance transparency. This trend is driving the adoption of advanced software solutions that offer automation, analytics, and reporting capabilities.

One of the trends observed in the equity management software market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These technologies are being used to enhance the functionality of equity management software, enabling organizations to automate routine tasks, improve decision-making, and gain valuable insights from their equity data. AI and ML are also helping organizations to identify patterns and trends in equity markets, enabling them to make more informed investment decisions. Overall, the integration of AI and ML technologies is expected to drive further innovation in the equity management software market, offering new opportunities for growth and development.

Segmentation Analysis:

The global Equity Management Software Market segmentation includes:

By Type: Basic ($Under 50/Month), Standard ($50-100/Month), Senior ($Above 100/Month).

The Basic segment, priced under $50 per month, currently holds the largest market share and is anticipated to maintain its dominance throughout the forecast period. This is primarily attributed to businesses utilizing basic equity management software tools to track and oversee their company shares, thus driving growth within this segment on a global scale

The Senior segment, priced above $100 per month, is projected to experience the most substantial growth during the forecast period. This growth is anticipated because senior equity management software, priced above $100 per month, offers comprehensive features on a unified platform, enabling companies to efficiently manage shareholder communication, conduct meetings, and generate reports.

By Application: Private Corporation, Start-ups, Listed Company, Others.

Start-ups often face the challenge of efficiently managing their equity assets, and Global Equity Management Software provides a solution by facilitating the monitoring of equity shares, analysis of financial data, and handling of investor relations. This software serves as a valuable tool for start-ups, enabling them to efficiently oversee their equity assets with access to up-to-date financial information and comprehensive tracking capabilities.

Private companies acknowledge the importance of their equity assets; however, many lack the necessary resources for effective management. Global Equity Management Software emerges as a practical solution for evaluating a company's performance and expansion, monitoring current market positions, evaluating the effectiveness of promotional strategies, ensuring the accuracy of financial data, and assessing investor relations.

Enquire Before Buying @ https://virtuemarketresearch.com/report/equity-management-software-market/enquire

Regional Analysis:

North America has achieved the highest growth in the equity management software market, primarily driven by the increasing adoption of equity management software within administrative spheres, thereby fueling overall market expansion in the region. The growing interest in equity management software among large-scale organizations is observed to enhance operational efficiency.

Asia-Pacific is poised to exhibit the most significant growth during the forecast period, attributed to the proliferation of advanced technologies such as digital financial systems and cloud computing, among others, thereby contributing to the global growth of the equity management software market.

Latest Industry Developments:

1. Focus on Integration and Compatibility: Companies in the equity management software market are increasingly focusing on making their solutions compatible with other financial management tools and platforms. This trend is driven by the growing demand for seamless integration of equity management software with existing financial systems, such as accounting and payroll software. By offering compatibility with a wide range of financial tools, companies aim to enhance user experience and attract more customers.

2. Expansion of Product Offerings: Another trend observed in the market is the expansion of product offerings by equity management software providers. Companies are introducing new features and functionalities to cater to the evolving needs of their customers. For example, some providers are integrating advanced analytics and reporting capabilities into their software to provide users with deeper insights into their equity holdings. This trend is driven by the increasing demand for more comprehensive and customizable equity management solutions.

3. Strategic Partnerships and Collaborations: Companies in the equity management software market are also engaging in strategic partnerships and collaborations to enhance their market share. These partnerships allow software providers to expand their customer base and reach new markets. For example, a software provider may partner with a financial institution to offer their equity management solution to the institution's clients. This trend is driven by the recognition that partnerships can help companies gain a competitive edge and accelerate their growth in the market.

Buy Now @ https://virtuemarketresearch.com/checkout/equity-management-software-market

About Us:

Virtue Market Research is a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

103 Kumar Plaza,SRPF Road,

Ramtekadi,Pune,

Maharashtra - 411013

"Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Equity Management Software Market is projected to reach the value of $1508.47 Billion by 2030. here

News-ID: 4237919 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

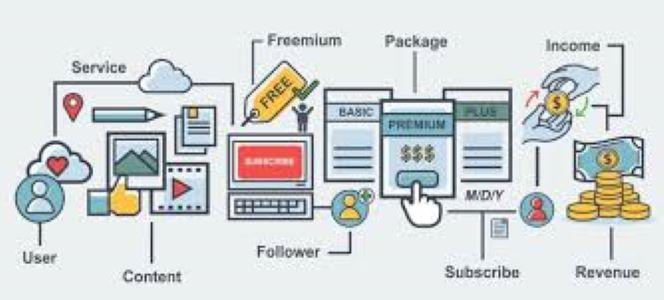

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…