Press release

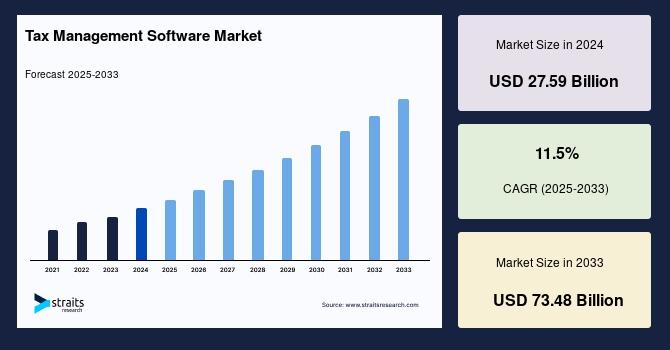

Tax Management Software Market Size Worth USD 73.48 Billion by 2033 | Growing at a CAGR of 11.5% - Straits Research

According to a new report published by Straits Research, the global tax management software market was valued at USD 27.59 billion in 2024 and is projected to grow from USD 30.76 billion in 2025 to reach USD 73.48 billion by 2033, registering a compound annual growth rate (CAGR) of 11.5% during the forecast period (2025-2033).The tax management software market is witnessing robust expansion as enterprises increasingly adopt digital platforms to streamline tax calculation, compliance, and reporting. These solutions are designed to manage multiple tax revenue streams, automate invoicing, enable e-billing, and integrate with account management systems for better receivables tracking. Additionally, the software provides real-time insights into property taxes, exemption tracking, and discovery management, empowering organizations to meet compliance requirements efficiently.

Download Exclusive Research Report PDF Sample: (Including Full TOC, List of Tables & Figures, Chart) : https://straitsresearch.com/report/tax-management-software-market/request-sample

Rapid Digitalization Driving Market Growth

One of the key growth drivers of the global tax management software market is the rapid adoption of digitalization across industrial verticals. Digital transformation initiatives are reshaping business models across finance, manufacturing, retail, and public sectors. According to the Reserve Bank of India (RBI), digital transaction value grew by 19.5% during 2018-2019, indicating a strong shift toward digital finance management. The adoption of tax management software helps improve transparency, minimize manual errors, and enhance compliance efficiency in this evolving digital ecosystem.

Regional Insights

North America currently dominates the tax management software market, driven by continuous tax reforms and regulatory changes. The region hosts several major players such as Avalara, Intuit, Automatic Data Processing (ADP), and Wolters Kluwer, which contribute to steady market growth. In the United States, business tax reforms and evolving fiscal policies have further stimulated demand for automated tax compliance systems.

The Asia-Pacific (APAC) region is expected to record the fastest growth rate during the forecast period. The rising adoption of process automation and cloud-based compliance systems across industries is fueling regional market expansion. For example, a multi-state cooperative bank in Maharashtra (India) adopted Avalara's GST compliance system to manage tax invoices and improve reporting accuracy.

For more insights and detailed analysis on the Market, visit :https://straitsresearch.com/report/tax-management-software-market

Segmental Overview

By Component: The software segment is expected to dominate due to continuous changes in global tax and accounting laws. Tax software enables real-time monitoring of business activities, identification of tax obligations, and automation of compliance processes.

By Tax Type: The indirect tax segment holds the largest market share, driven by increasing trade activities and government-led initiatives such as Make in India, which encourage import-export growth.

By Deployment Mode: The cloud-based segment is anticipated to grow significantly, offering scalability, cost efficiency, and enhanced data security.

By Organization Size: Small and Medium Enterprises (SMEs) are increasingly adopting tax management software to reduce compliance costs and ensure accurate tax filing.

By Industry Vertical: The Banking, Financial Services, and Insurance (BFSI) sector dominates due to the growing need for process automation and customer data management in financial operations.

Download Exclusive Research Report PDF Sample: (Including Full TOC, List of Tables & Figures, Chart) : https://straitsresearch.com/report/tax-management-software-market/request-sample

Competitive Landscape

Wolters Kluwer N.V (the Netherlands)

Intuit (the U.S.)

H&R Block (the U.S.)

SAP SE (Germany)

Blucora (the U.S.)

Vertex (the U.S.)

Sailotech (the U.S.)

Defmacro Software (India)

DAVO Technologies (the U.S.)

Xero (New Zealand)

TaxSlayer (the U.S.)

Taxback International (Ireland)

TaxCloud (the U.S.)

Drake Enterprises (the U.S.)

Canopy Tax (the U.S.)

TaxJar (the U.S.)

Browse More Insights & Reports :

Advanced Airport Technologies Market : https://straitsresearch.com/report/advanced-airport-technologies-market

Apparel Management Software Market : https://straitsresearch.com/report/apparel-management-software-market

Church Management Software Market : https://straitsresearch.com/report/church-management-software-market

Cloud-Based Dental Practice Management Software Market : https://straitsresearch.com/report/cloud-based-dental-practice-management-software-market

Continuous Performance Management Software Market : https://straitsresearch.com/report/continuous-performance-management-software-market

About Us

For over a decade, Straits Research has been a trusted partner to more than 2,000 small and large enterprises, empowering senior leaders and decision-makers with actionable intelligence to navigate complex markets. Our structured syndicate reports, published year-round, cover critical sectors such as chemicals, materials, food and beverage, healthcare, pharmaceuticals, automotive, technology, aerospace, and defense. Combined with our custom research tailored to client-specific needs, we deliver insights that drive business progress and informed decision-making.

Contact Us

Office 515 A, Amanora Chambers,

Amanora Park Town, Hadapsar,

Pune 411028, Maharashtra, India.

+1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

sales@straitsresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Software Market Size Worth USD 73.48 Billion by 2033 | Growing at a CAGR of 11.5% - Straits Research here

News-ID: 4235194 • Views: …

More Releases from Straits Research

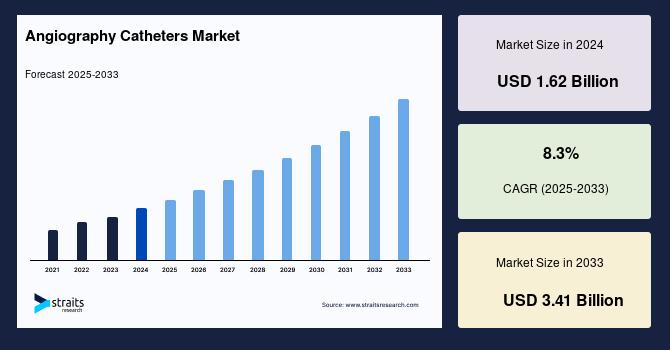

Angiography Catheters Market Size to Reach USD 3.41 Billion by 2033, Driven by R …

The global angiography catheters market is experiencing strong momentum, driven by the growing burden of cardiovascular diseases (CVDs), rising preference for minimally invasive diagnostic and interventional procedures, and ongoing innovations in catheter-based imaging technologies. Industry estimates indicate that the market is expected to expand from USD 1.8 billion in 2025 to USD 3.41 billion by 2033, progressing at a compound annual growth rate (CAGR) of 8.3% over the forecast period.

Angiography…

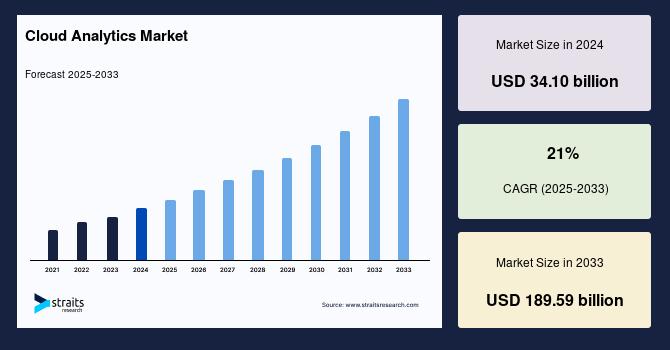

Cloud Analytics Market Size Set to Surge to USD 189.59 Billion by 2033 | Massive …

The global cloud analytics market is poised for exceptional growth as organisations leverage the power of the cloud to collect, analyse and visualise large volumes of data for actionable business insights. According to recent research, The global cloud analytics market size was worth USD 34.10 billion in 2024 and is estimated to reach an expected value of USD 189.59 billion by 2033, growing at a CAGR of 21% during the…

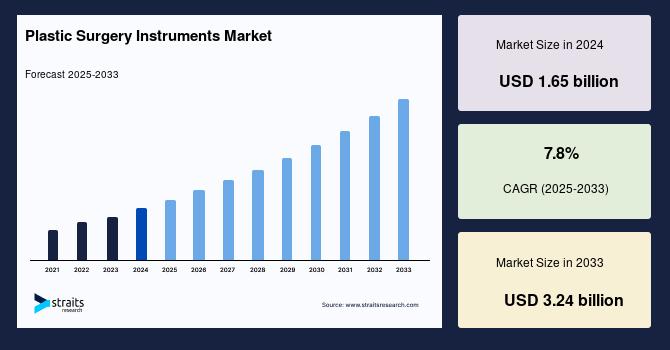

Plastic Surgery Instruments Market Size to Reach USD 3.24 Billion by 2033 | Glob …

The global plastic surgery instruments market is witnessing robust expansion, driven by the rising demand for cosmetic and reconstructive surgeries worldwide. According to a new study by Straits Research, the market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 3.24 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period (2025-2033).

The rising popularity of aesthetic enhancement procedures…

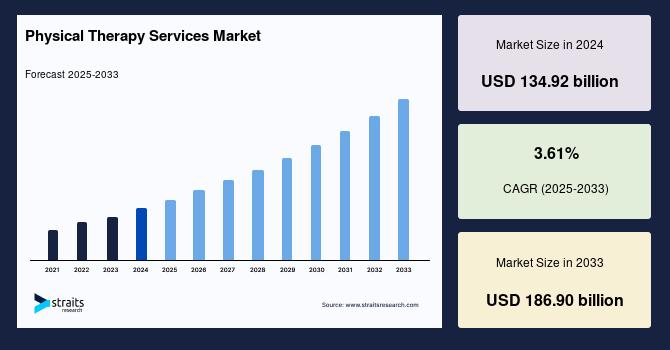

Physical Therapy Services Market Outlook 2025-2033: Rise of Home-Based Care and …

The global physical therapy services market is witnessing significant expansion, fueled by the growing prevalence of chronic diseases, increasing sports-related injuries, and technological innovations such as tele-rehabilitation and AI-based therapy platforms. According to Straits Research, the global market size is estimated at USD 140.69 billion in 2025 and is projected to reach USD 186.90 billion by 2033, exhibiting a steady CAGR of 3.61% during the forecast period.

Read the full report…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…