Press release

Buy Now Pay Later Market Expands from USD 42.78 Billion in 2024 to USD 238.56 Billion by 2033

The Global Buy Now Pay Later (BNPL) Market reached USD 35.47 billion in 2023. It increased to USD 42.78 billion in 2024 and is expected to hit USD 238.56 billion by 2033.This growth represents a compound annual growth rate (CAGR) of 21.04% from 2025 to 2033. The rising demand for flexible payment options among consumers, especially in e-commerce and retail, drives this growth. BNPL services make purchases more affordable, encourage higher sales volumes, and help merchants retain customers. Factors like increasing smartphone use, digital financial services, and the popularity of online shopping play a significant role in moving the market forward.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://www.datamintelligence.com/download-sample/buy-now-pay-later-market?ram

Key Developments:

United States:

- October 2025: A major BNPL provider announced a multi-billion-dollar funding deal to buy incoming installment-loan receivables. This move aims to strengthen its capital base and support significant U.S. growth.

- September 2025: A large fintech company launched a 5% cash-back promotion linked to its "Pay-in-4" BNPL service. This initiative is designed to encourage adoption among merchants and consumers by providing rebates on installment purchases.

- August 2025: A survey found that more than a quarter of U.S. consumers used a BNPL service in the past year; BNPL loans financed a growing share of everyday purchases like clothing and groceries.

- July 2025: The CEO of a leading BNPL lender publicly requested legislative limits on late fees for BNPL services. He argued that fee-based revenue models pose risks for consumers and distract from underwriting quality.

Japan:

- October 2025: Japanese e-commerce platforms and BNPL providers announced enhanced integrations of installment-payment options at checkout. This initiative aims to reduce cart abandonment and increase transaction volumes.

- September 2025: A Japanese fintech and major insurer launched the country's first embedded-insurance offering for BNPL transactions. This allows customers to buy optional coverage when choosing installment payments.

- August 2025: Domestic BNPL providers accelerated their entry into point-of-sale financing for offline retail, marking a move from online-only transactions to in-store purchases.

- July 2025: International BNPL companies expanded partnerships with Japanese retailers, pushing local players to offer zero-interest installments, loyalty rewards, and better merchant-analytics features.

Recent Mergers and Acquisitions (M&A):

United States:

- August 2025: A leading BNPL firm secured a significant strategic financing and partnership deal with a student-loan servicer. This enables the purchase of billions of dollars in BNPL receivables, effectively converting consumer-installment loans into investments.

Japan:

- September 2025: A Japanese BNPL platform formed a strategic partnership with a financial institution to expand its installment-loan offerings and improve underwriting skills, positioning itself for market consolidation.

- July 2025: A major Japanese payments fintech announced plans for an IPO in Tokyo in 2025, supported by capital from a large bank, with the goal of growing through future acquisitions in the BNPL sector.

Key Players:

=> Affirm, Inc., Klarna Inc., Splitit USA Inc., Sezzle, Perpay Inc., Zip Co. Ltd., Afterpay, Openpay, PayPal Holdings, Inc., and LatitudePay Financial Services.

Market Dynamics and Growth Drivers:

-E-commerce growth and digital payments have created a strong environment for BNPL solutions. Retailers that adopt BNPL at checkout see lower cart abandonment and higher conversion rates.

-Consumer interest in flexible payment options is on the rise. Many, especially millennials and Gen Z, prefer alternatives to traditional credit cards and loans. BNPL allows consumers to buy now and pay later, often without interest, with minimal upfront costs.

-Technological advancements in fintech-like AI-driven credit assessments, real-time data analytics, mobile wallet integration, and embedded APIs-are improving user experiences and increasing BNPL adoption.

-Retailers view BNPL as a way to boost average order value, drive repeat purchases, and enhance customer loyalty. Consequently, BNPL providers are forming more partnerships with both online platforms and physical stores.

-In regions with low credit card use or where consumers hesitate to rely on traditional credit, BNPL provides an accessible alternative. This creates opportunities in emerging markets and among younger consumers.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=buy-now-pay-later-market?ram

Growth Forecast Projected:

The Global Buy Now Pay Later Market is expected to grow significantly between 2024 and 2031. In 2023, the market is expanding steadily. With key players increasing their strategies, growth is anticipated to continue through the projected period.

Research Process:

The Global Buy Now Pay Later Market research report uses both primary and secondary data sources. During the research, various factors affecting the industry are examined, including government regulations, market conditions, competition levels, historical data, technological improvements, upcoming developments, market volatility, and potential challenges.

Key Segments:

➥ By Channel: Online, POS

➥ By Enterprise Size: Large Enterprises, SMEs

➥ By End User: BFSI, Consumer Electronics, Fashion & Lifestyle, Healthcare, Retail, Media & Entertainment, Others

Talk to Our Analyst for Customization According to Your Needs: https://www.datamintelligence.com/customize/buy-now-pay-later-market?ram

Benefits of the Report:

Chapter 1: Introduces the report's coverage, summarizes key market segments by region, product type, and application. It presents a snapshot of market sizes, growth potential across segments, and the anticipated short- and long-term evolution of the industry.

Chapter 2: Highlights important market insights and reveals significant emerging trends shaping the industry.

Chapter 3: Provides an in-depth look at the competitive landscape among BNPL producers, including revenue shares, strategic movements, and recent mergers and acquisitions.

Chapter 4: Presents detailed profiles of major market players, covering aspects such as revenue, profit margins, product lines, and company milestones.

Chapters 5 & 6: Analyze BNPL revenue at both regional and country levels, offering quantitative assessments of market sizes, growth opportunities, and development prospects worldwide.

Chapter 7: Focuses on different market segments by type, looking at their sizes and potential, guiding readers toward high-impact, untapped areas.

Chapter 8: Examines segmentation by application, evaluating growth potential in various downstream markets and identifying promising sectors for expansion.

Chapter 9: Provides a detailed review of the industry's supply chain, mapping upstream and downstream activities.

Chapter 10: Wraps up with a summary of the report's key findings and emphasizes the most critical takeaways for industry participants.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Enhance your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one location.

- Competitive Landscape

- Sustainability Impact Analysis

- KOL / Stakeholder Insights

- Unmet Needs, Positioning, Pricing & Market Access Snapshots

- Market Volatility & Emerging Risks Analysis

- Live Market & Pricing Trends

- Import-Export Data Monitoring

Check out our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later Market Expands from USD 42.78 Billion in 2024 to USD 238.56 Billion by 2033 here

News-ID: 4233508 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Japan Data Center Cooling Market (2026-2033) | Top Companies 2026 - Vertiv Group …

Market Size and Growth

Japan's data center cooling market is expected to grow steadily over the coming years, driven by rising data center capacity, cloud adoption, and advanced cooling technology deployment.

Download Free Custom Research: https://www.datamintelligence.com/custom-research?kbdc

• ICT Leadership: Japan hosts major ICT players like Sony, Panasonic, Fujitsu, NEC, and Toshiba, driving the country's digital infrastructure growth.

• Cloud Adoption: PaaS and IaaS see rapid uptake due to low CAPEX and flexible, on-demand usage.

•…

Cardiac Arrhythmia Monitoring Devices Market (2026): North America Holds 38% Mar …

Market Size and Growth

Cardiac Arrhythmia Monitoring Devices market is estimated to grow at a CAGR of 5.65% during the forecast period 2024-2031.

United States: Recent Industry Developments

✅ February 2026: Abbott launched the next-gen continuous cardiac rhythm monitoring device with AI-enabled arrhythmia detection.

✅ January 2026: Medtronic expanded its remote cardiac monitoring services to improve patient follow-up and reduce hospital visits.

✅ December 2025: iRhythm Technologies received FDA clearance for enhanced Zio XT patch…

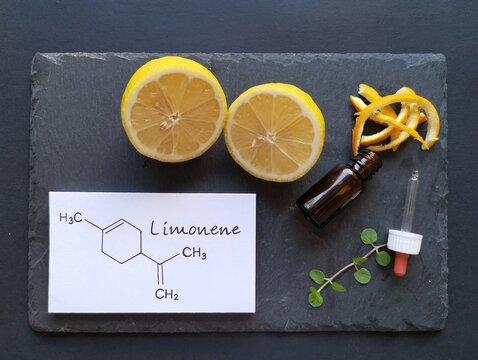

D-Limonene Industry Growth & Market Forecast (2026-2033) for Flavor, Fragrance & …

Market Size and Growth

D-Limonene Market is estimated to reach at a CAGR of 4.4% within the forecast period 2026-2033.

United States: Recent Industry Developments

✅ February 2026: U.S.-based citrus processors expanded D-Limonene extraction capacity to meet rising demand from bio-based solvent manufacturers.

✅ January 2026: Specialty chemical companies introduced high-purity D-Limonene grades for use in eco-friendly cleaning products and industrial degreasers.

✅ December 2025: Growth in natural flavor applications drove new supply agreements between…

Photorejuvenation Devices Market Report (2026) | Growth Analysis, Competitive La …

Market Size and Growth

Photorejuvenation market is growing at a CAGR of 7.2% during the forecast period (2024-2031).

United States: Recent Industry Developments

✅ February 2026: Cutera launched next-generation photorejuvenation systems with enhanced IPL technology for skin revitalization.

✅ January 2026: Cynosure introduced AI-assisted devices for precise photorejuvenation targeting hyperpigmentation and fine lines.

✅ December 2025: FDA approved new photorejuvenation lasers with reduced downtime and improved patient comfort.

Download Free Sample PDF Report (Get Higher Priority…

More Releases for BNPL

Abzer Expands UAE Digital Payment Capabilities Through BNPL Collaboration with T …

Abzer, an enterprise technology company delivering digital payment, invoicing, and revenue automation platforms, has announced a strategic collaboration with Tamara to introduce Buy Now, Pay Later (BNPL) capabilities across its payment ecosystem in the United Arab Emirates.

The collaboration is designed to support enterprises and small-to-medium businesses seeking greater flexibility within their customer payment journeys. By integrating Tamara's BNPL functionality into Abzer's Payment Orchestration and Invoicing Suite, businesses can offer installment-based…

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…