Press release

Usage Based Insurance Market To See Worldwide Massive Growth, COVID-19 Impact Analysis, Industry Trends .

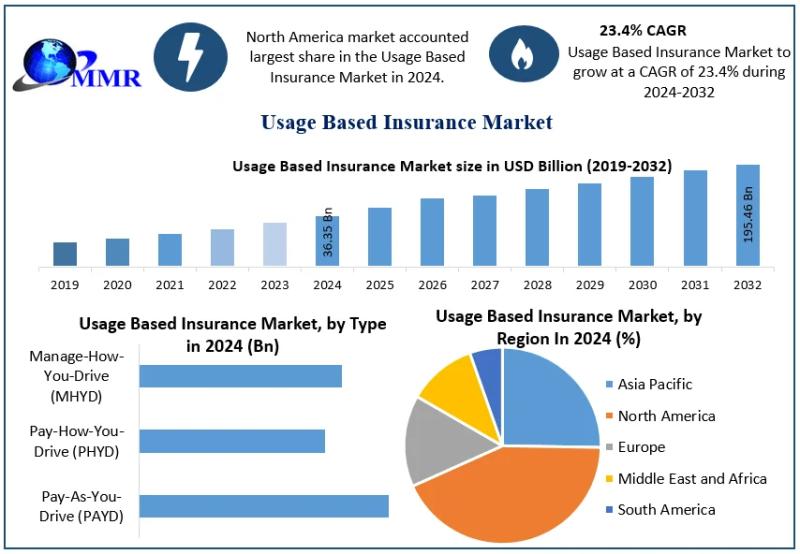

Usage Based Insurance Market size was valued at USD 36.35 Billion in 2024 and the total Usage Based Insurance Market revenue is expected to grow at a CAGR of 23.4% from 2025 to 2032, reaching nearly USD 195.46 Billion by 2032.Usage Based Insurance Market Overview:

The usage-based insurance market is rapidly transforming how motor policies are underwritten by shifting away from flat-rate premiums toward models that reflect actual driving behaviour. By leveraging telematics, in-vehicle sensors and smartphone apps, insurers are now able to gather data on metrics such as mileage, speed, braking, acceleration and time of driving to more accurately assess risk and calibrate premiums. This evolution is driven both by consumer demand for fairness and lower cost for safe or low-usage drivers, and by insurers' desire to reduce claims costs and improve risk segmentation. As a result, the UBI model is establishing itself as a key innovation in the auto insurance sector.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/14665/

Usage Based Insurance Market Outlook and Future Trends:

Looking ahead, the UBI market is poised for significant growth as the convergence of connected-car technologies, increasing smartphone penetration, and rising consumer appetite for personalised insurance solutions gain momentum. Models such as pay-how-you-drive and manage-how-you-drive (which give real-time feedback) are gaining traction alongside the more established pay-as-you-drive approach. Additionally, emerging mobility trends including electric vehicles, ride-sharing and fleet telematics are creating new opportunities for tailored coverage. Insurers will increasingly harness artificial intelligence and big data analytics to refine risk models, while regulatory shifts and partnerships with automakers will drive wider adoption. The future therefore points to more flexible, usage-centric insurance offerings that better align premiums with actual usage and behaviour.

Usage Based Insurance Market Dynamics:

The dynamics of the UBI market are shaped by a mix of strong growth drivers, emerging opportunities and notable constraints. Key drivers include the rapid adoption of vehicle telematics and connected-car infrastructure, as well as consumer demand for fairer, usage-based pricing. Opportunities arise in expanding UBI models into commercial fleets, EVs and mobility-as-a-service segments. On the flip side, the market faces challenges such as concerns around data privacy and security, the high cost of telematics hardware and integration, and limited awareness or infrastructure in some emerging markets. Navigating these forces effectively will determine which insurers successfully scale UBI offerings.

Usage Based Insurance Market Key Recent Developments:

Recent developments in the UBI market illustrate how insurers and other ecosystem participants are adapting to the new paradigm. Strategic partnerships between insurers and automakers or telematics providers are enabling embedded UBI programs at vehicle point-of-sale, eliminating the need for aftermarket devices. Smartphone-based UBI platforms are reducing deployment cost and widening accessibility. Meanwhile, insurers are rolling out models that reward safe driving behaviour, provide real-time feedback to drivers, and apply analytics and machine learning for refined underwriting. At the same time, regulatory attention to data protection is increasing as usage-based models become more data-intensive. These developments are collectively accelerating the transition toward behaviour-driven insurance.

Usage Based Insurance Market Regional Insights:

Regionally, the UBI market exhibits distinct patterns: mature markets such as North America and Europe lead in adoption due to high vehicle connectivity, advanced telematics infrastructure and favourable regulatory frameworks, while regions such as Asia-Pacific and Latin America are emerging as high-growth frontiers powered by expanding vehicle ownership, mobile penetration and favourable technology economics. For instance, North America currently holds a substantial share of the global market, while Asia-Pacific is expanding at a faster rate as insurers and OEMs capitalise on smartphone-based telematics solutions. These regional differences mean that market strategies must be tailored: in mature markets, innovation and value-added services dominate, whereas in emerging markets, the focus is on cost-effective rollout and awareness building.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/14665/

Usage Based Insurance Market Segmentation:

by Type

Pay-As-You-Drive (PAYD)

Pay-How-You-Drive (PHYD)

Manage-How-You-Drive (MHYD)

by Technology Type

OBD-II

Smartphone

Hybrid

Black Box

Others

Some of the current players in the Usage Based Insurance Market are:

1. Octo Telematics S.p.A.

2. Intelligent Mechatronic Systems

3. Allianz SE

4. Insure the Box Ltd

5. Progressive Corporation

6. Allstate Corporation

7. Desjardins Insurance

8. Generali Group

9. Mapfre S.A.

10. Metromile

11. Aviva plc

12. Watchstone Group

13. Sierra Wireless

14. Mechatronic Systems Inc.

15. TrueMotion

For additional reports on related topics, visit our website:

Camping and Caravanning Market https://www.maximizemarketresearch.com/market-report/camping-and-caravanning-market/188498/

Bed And Bath Furnishings Market https://www.maximizemarketresearch.com/market-report/bed-and-bath-furnishings-market/188962/

Football Equipment Market https://www.maximizemarketresearch.com/market-report/football-equipment-market/189049/

Rugs Market https://www.maximizemarketresearch.com/market-report/rugs-market/190593/

Global Winter Sports Equipment Market https://www.maximizemarketresearch.com/market-report/global-winter-sports-equipment-market/84449/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage Based Insurance Market To See Worldwide Massive Growth, COVID-19 Impact Analysis, Industry Trends . here

News-ID: 4230783 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

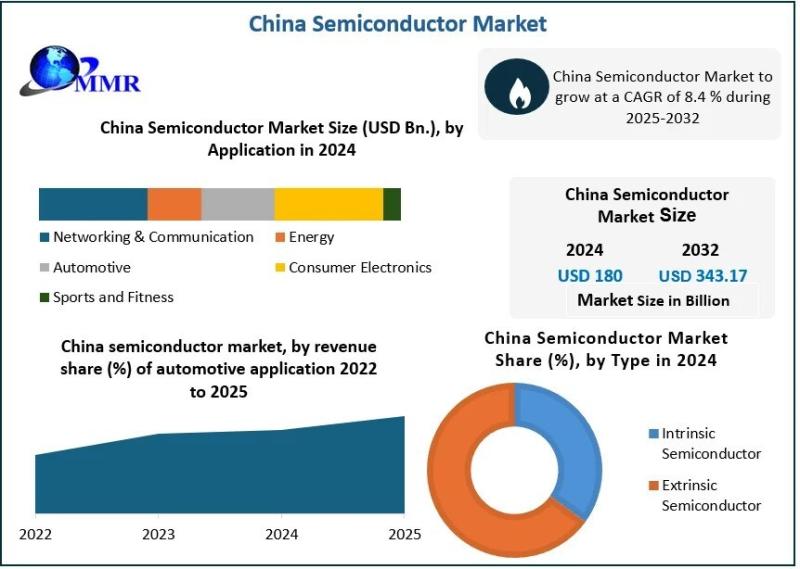

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

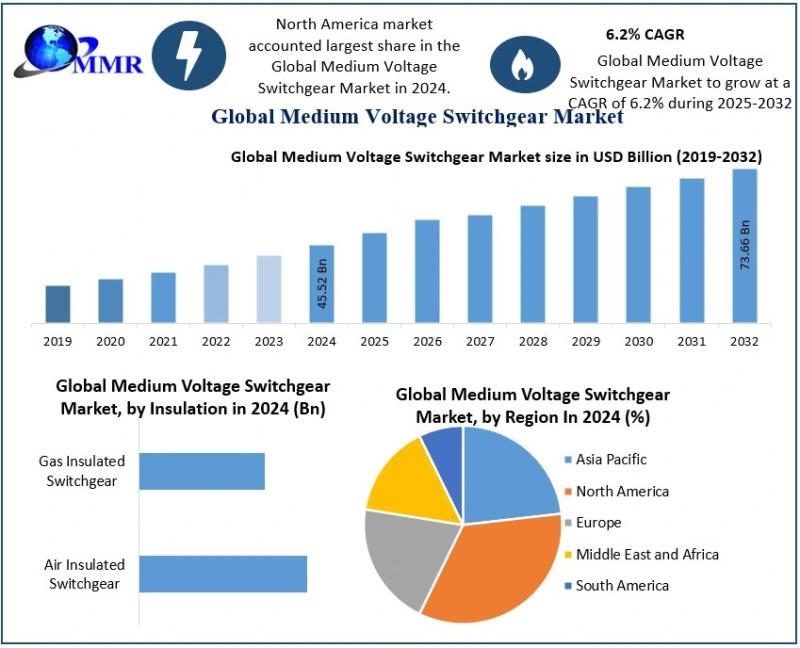

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

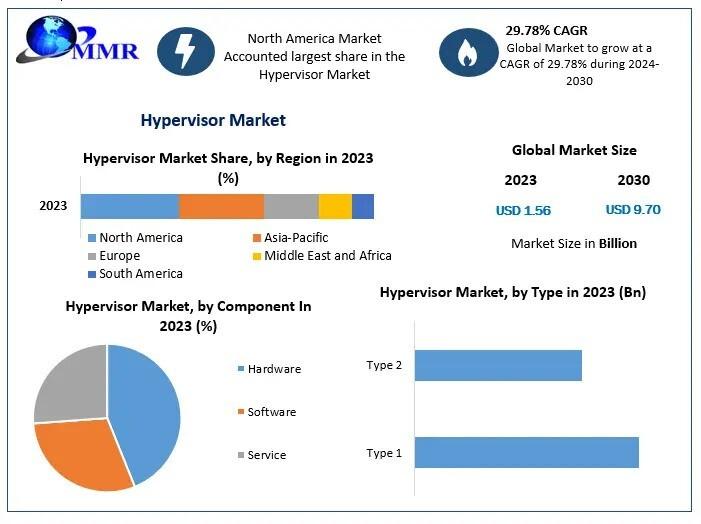

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…