Press release

Self-Healing Polymers for Aerospace Market to Reach CAGR 13,3% by 2031 Top 10 Company Globally

Self-healing polymers for aerospace applications are engineered polymer systems that autonomously repair microfaults, delaminations, and other damage modes that occur in polymer matrices and polymer-matrix composites used on airframes, secondary structures, interiors, and some specialty avionics housings. These materials use approaches such as microencapsulated healing agents, vascular networks, reversible covalent chemistry, and dynamic non-covalent bonds to restore mechanical integrity and slow fault propagation without manual intervention. The aerospace value proposition centers on increased safety margins, reduced inspection and maintenance frequency, lower life-cycle cost, and improved damage tolerance for both in-service commercial fleets and high-value defense/space platforms. Research and early commercialization efforts emphasize integration with fiber-reinforced composites and surface coatings where the benefit-to-weight payoff and maintenance savings are greatest.The global market for self-healing polymers tailored to aerospace applications is estimated at USD 176 million in 2024 with a compound annual growth rate of 13.3% through 2031 reaching market size USD 420 million by 2031. An average selling price is USD 500 per kilogram, which implies an estimated total volume sold globally of approximately 352,000 kg in 2024. On a manufacturing economics basis, a representative factory gross margin is set at 28%, producing a factory gross profit per kg of USD 140 and a cost of goods sold per kg of USD 360. The COGS breakdown is: raw materials, processing/chemistry, overhead & utilities, and packaging/logistics. A single line full-machine production capacity for a dedicated polymer line operating at commercial scale is estimated at 2,500 kg per line per year. Downstream demand is concentrated in commercial aviation followed by defense and space.

Latest Trends and Technological Developments

The past 12 to 24 months show a mixture of academic breakthroughs and industry partnerships moving technology closer to certification-grade use. In July 2024 the EU-funded research portfolio published news on biologically inspired self-repair concepts using fungal/bacterial systems for adaptive materials that can autonomously respond to damage work that signals novel biohybrid pathways into aerospace surface and non-structural systems (July 2024). NASA and U.S. research centers released technical reviews in 2024 documenting advances in thermoplastic composites and their compatibility with self-healing chemistries, highlighting manufacturing automation and material design that reduce part count and improve durability (NASA technical reports, 2024). Industry commercial trackers and specialized chemical firms reported in 2024 to 2025 that major specialty-chemicals suppliers and coatings firms have expanded investment and pilot lines for self-healing formulations aimed at high-value transport markets; these announcements indicate accelerating scale-up and supplier consolidation (reports and company summaries through 2024 to 2025). Additionally, earlier public demonstrations and consortium efforts by aerospace primes (including publicly reported Airbus R&D work on living polymer composites) have continued to drive technology validation in representative structural and non-structural test articles (Airbus demonstration coverage, 2023 to 2024). These technological developments suggest that while full FAA/EASA certification for primary structural self-healing composites remains a multi-step process, near-term commercialization will first appear in secondary structures, coatings, and MRO repair systems.

Asia is both a major consumption center for new aircraft and an expanding innovation base for self-healing polymer technologies. Large aerospace OEM supply chains in China, Japan, South Korea, India, and Southeast Asian manufacturing hubs have increasing demand for materials that reduce lifecycle costs as fleet sizes grow. China and India are investing in domestic polymer R&D and pilot production for advanced composites and responsive materials; academic and government labs through 2024 to 2025 have published scalable room-temperature self-healing formulations, lowering the practical energy and process barriers for adoption. The Asia Pacific regional growth drivers include strong aircraft build rates through local MRO and completion centers, government incentives for advanced materials manufacturing, and the presence of major chemical producers able to co-invest in scale-up. At the same time, region-specific regulatory pathways and certification collaboration with global authorities will be required for structural adoption, creating both opportunity for local suppliers to capture early non-structural applications and a challenge for firms aiming at certified primary structure use.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5183721

Self-Healing Polymers for Aerospace Applications by Type:

Elastomers

Thermosetting Polymers

Thermoplastic Polymers

Others

Self-Healing Polymers for Aerospace Applications by Healing Mechanism:

Extrinsic Self Healing Systems

Intrinsic Self Healing Systems

Self-Healing Polymers for Aerospace Applications by Usage:

Primary Structural

Secondary Structural

Coatings and Surface Layers

Space and defense Systems

Others

Self-Healing Polymers for Aerospace Applications by Shape:

Laminate Form

Coating Form

Beam Form

Fiber Reinforced Structures

Others

Self-Healing Polymers for Aerospace Applications by Application:

Commercial Aviation

Military and Defense

General Aviation

Space Systems

Others

Global Top 10 Key Companies in the Self-Healing Polymers for Aerospace Applications Market

Autonomic Materials Inc

Arkema

Evonik Industries AG

BASF SE

Solvay SA

Nei Corporation

Covestro AG

Dow Chemical

Huntsman

Akzo Nobel

Regional Insights

Within Southeast Asia, ASEAN shows a heterogeneous picture: Singapore and Malaysia host advanced materials R&D and composite manufacturing competence that can accelerate pilot production and prototyping; Indonesia and Thailand are stronger in component manufacturing and are building MRO and regional completion capacity. Indonesia specifically is becoming a target market for MRO upgrades and replacement components for expanding domestic and regional carriers; local universities and institutes have active materials research groups exploring low-cost self-healing chemistries appropriate for repair patches and protective coatings. For ASEAN adoption, initial commercial traction is expected in MRO consumables, anti-corrosion and interior panels, and small structural patches for lower-stress parts applications that provide rapid ROI without the long certification lead time required for primary structural parts. Regional supply-chain opportunities include local compounding and encapsulation service providers, and partnerships between chemical majors and ASEAN composite fabricators to co-locate pilot production.

Technical scalability and certification remain the two dominant challenges. Many self-healing chemistries that perform well at lab scale face processing incompatibilities with high-throughput composite prepreg lines or require curing cycles that conflict with existing airframe manufacturing processes. Long-term durability in operational environments (temperature cycles, UV, humidity, salt spray, long flight hours) and demonstrable, repeatable healing performance under realistic damage spectra are prerequisites for fleet adoption. Cost is another hurdle: specialty monomers and microencapsulation steps add to raw material and process cost versus incumbent polymers and coatings. Finally, supply chain fragmentation the need to integrate chemical suppliers, composite converters, and aerospace integrators means that cross-industry partnerships or vertically integrated players will be necessary to move from pilot demonstrations to certified use.

Suppliers should focus on near-term revenue pathways: coatings, surface sealants, MRO repair patches, and non-primary structural interior composites where certification hurdles are lower and value capture from reduced downtime is immediate. Partnerships with composite OEMs and MRO networks in Asia and ASEAN will accelerate real-world testing and create reference fleets. For companies targeting higher margins, investing in integrated supply (compounding + prepreg + localized finishing) and in demonstrating long-term durability through accelerated environmental testing will strengthen certification dossiers. Investors and buyers should value firms that can demonstrate pilot production at line rates of ~120,000 kg/year per line or can show licensed manufacturing relationships in Asia to secure low-cost feedstock and proximity to fast-growing end markets.

Product Models

Self-healing polymers have emerged as a transformative class of materials in aerospace engineering, providing enhanced durability, reduced maintenance needs, and extended service life for critical components. These materials can autonomously repair damage caused by mechanical stress, fatigue, or environmental exposure, ensuring structural integrity in demanding aerospace conditions.

Elastomers are flexible polymeric materials with elastic properties that allow them to stretch and return to their original shape after deformation. Notable products include:

DuraHeal Elastomer BASF SE: A self-healing silicone-based elastomer designed for vibration dampening and sealing in aircraft components.

ElastoHeal A50 3M Company: Used in anti-vibration mounts, this elastomer recovers from minor mechanical damage.

PolyHeal AeroRubber Momentive Performance Materials: A fluorosilicone elastomer resistant to jet fuels and able to self-heal small tears.

ASHA-Elastomer Oak Ridge National Laboratory (ORNL): an elastomer that self-heals without external stimuli, maintaining adhesion strength even after damage.

Metal Rubber NanoSonic Inc: A flexible, durable elastomeric / nanocomposite which is highly stretchable and maintains properties under harsh conditions.

Thermosetting polymers are materials that irreversibly harden when heated or cured, forming a rigid three-dimensional network. Once set, they cannot be remelted or reshaped. Examples include:

EpoxHeal 2000 Hexcel Corporation: A self-healing epoxy resin system used in aerospace composite matrices.

HealMat RX Huntsman Advanced Materials: Features embedded microcapsules that release healing agents upon fault formation.

AeroBond SH-Resin Solvay Composite Materials: Epoxy-based thermoset with reversible cross-link bonds for in-flight repairs.

SmartRes 5H Mitsubishi Chemical Corporation: High-temperature thermoset with built-in microvascular healing channels.

ReBond Aerospace Henkel AG & Co. KGaA: Structural epoxy system designed for long-term fatigue resistance and faultk repair.

Thermoplastic polymers soften when heated and harden upon cooling, allowing them to be reshaped multiple times without significant degradation. Notable products include:

Healyn TPA-100 Victrex plc: A PEEK-based self-healing polymer for aerospace structural panels.

Reflow PEEK-SH Solvay Specialty Polymers: Designed for damage-tolerant aircraft components with heat-triggered repair.

PolyMend T-90 Toray Advanced Composites: A thermoplastic matrix with embedded reversible DielsAlder bonds for easy repair.

SmartPEEK-R Evonik Industries AG: Capable of healing microfaults during flight through reversible bond reformation.

ThermoMend PEKK-200 Arkema: Polyetherne with excellent self-healing and mechanical recovery under thermal load.

Self-healing polymers for aerospace are transitioning from laboratory novelty to a set of commercialized, high-value applications concentrated in coatings, MRO repair systems, and non-primary structures. The 2024 market base (USD 176 million) and a projected mid-teens CAGR through 2031 indicate a substantial growth runway; Asia and ASEAN are key regions both for manufacturing scale-up and accelerating adoption due to rising fleet sizes, growing MRO demand, and active regional R&D. While primary structural adoption will require extended validation and regulatory collaboration, near-term commercial returns are achievable for companies and regions that focus on realistic entry points, demonstrate production scalability, and partner with aerospace integrators.

Investor Analysis

What to watch: market sizing, unit economics, and concentrated volume reveal both the current niche scale and attractive per-kg margins for high-value applications. How to act: prioritize investments in firms that show pilot production capacity and partnerships with aerospace OEMs or MRO networks, or firms that can be roll-up targets to provide integrated compounding + finishing in Asia. Why it matters: the technology addresses a structural pain point for aerospace reducing maintenance frequency and enabling longer in-service intervals so early positioning in coatings and MRO consumables can yield rapid commercial returns while longer-term bets on structural qualification offer higher upside once certification barriers are cleared. Investors should value proven scale (production lines, supply partnerships in Asia/ASEAN) and defensible IP that maps to demonstrable fleet trials.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5183721

5 Reasons to Buy This Report

Consolidated market sizing and unit economics for 20242031 focused specifically on aerospace applications.

Asia and ASEAN regional demand and supply-chain analysis that identifies near-term commercialization routes.

Technology and certification risk assessment with practical strategic recommendations for suppliers and investors.

A curated list of top industry players and partnership targets to accelerate market entry.

Latest news and research references (EU projects, NASA/agency technical reviews, aerospace prime demonstrations) to ground investment decisions.

5 Key Questions Answered

What is the 2024 market size and unit volume for self-healing polymers in aerospace?

What are the representative price and per-kg economics (COGS, gross profit, margin) for manufacturers?

Which Asia and ASEAN markets and use cases will adopt the technology first?

What are the main technical, scale-up, and certification barriers and how can they be mitigated?

Who are the leading companies and partnership candidates to watch for commercialization and MRO roll-outs?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Self-Healing Polymers for Aerospace Applications - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5183722/self-healing-polymers-for-aerospace-applications

Global Self-Healing Polymers for Aerospace Applications Market Research Report 2025

https://www.qyresearch.com/reports/5183721/self-healing-polymers-for-aerospace-applications

Global Self-Healing Polymers for Aerospace Applications Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5183720/self-healing-polymers-for-aerospace-applications

Global Self-Healing Polymers for Aerospace Applications Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5183719/self-healing-polymers-for-aerospace-applications

Global Self-Healing Polymers Market Research Report 2025

https://www.qyresearch.com/reports/4772764/self-healing-polymers

Global Extrinsic Self-Healing Polymers Market Research Report 2025

https://www.qyresearch.com/reports/4780829/extrinsic-self-healing-polymers

Global Intrinsic Self-Healing Polymers Market Research Report 2025

https://www.qyresearch.com/reports/4772973/intrinsic-self-healing-polymers

Global Polymer Seals for Aerospace Market Research Report 2025

https://www.qyresearch.com/reports/3630909/polymer-seals-for-aerospace

Global Thermoplastic Polymers Market Research Report 2025

https://www.qyresearch.com/reports/4158999/thermoplastic-polymers

Global Thermosetting Polymer Market Research Report 2025

https://www.qyresearch.com/reports/3416726/thermosetting-polymer

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Self-Healing Polymers for Aerospace Market to Reach CAGR 13,3% by 2031 Top 10 Company Globally here

News-ID: 4230050 • Views: …

More Releases from QY Research

From Drift to Precision: How Manganin Thin Film Redefines Stability in Aerospace …

Problem

Thales Group (France) relying on conventional metal films or bulk alloy resistors faced resistance drift, temperature sensitivity, and poor long-term stability in precision measurement and sensing applications. In current sensing, strain gauges, and high-accuracy electronics, temperature fluctuations and thermal cycling caused signal noise, calibration drift, and reduced measurement accuracy-especially in aerospace, power electronics, and scientific instrumentation.

Solution

Isabellenhütte adopted Manganin Thin Film, a precision alloy film composed primarily of Cu-Mn-Ni, deposited using…

Global and U.S. LiDAR Sensors for Self-Driving Market Report, Published by QY Re …

QY Research has released a comprehensive new market report on LiDAR Sensors for Self-Driving, high-resolution 3D sensing systems that enable autonomous vehicles to perceive their surroundings with precise distance, shape, and motion detection. By emitting laser pulses and measuring time-of-flight or phase shift, LiDAR sensors generate real-time 3D point clouds essential for object detection, localization, mapping, and safe navigation. As autonomous driving advances toward Level 3-Level 4 deployment, this report…

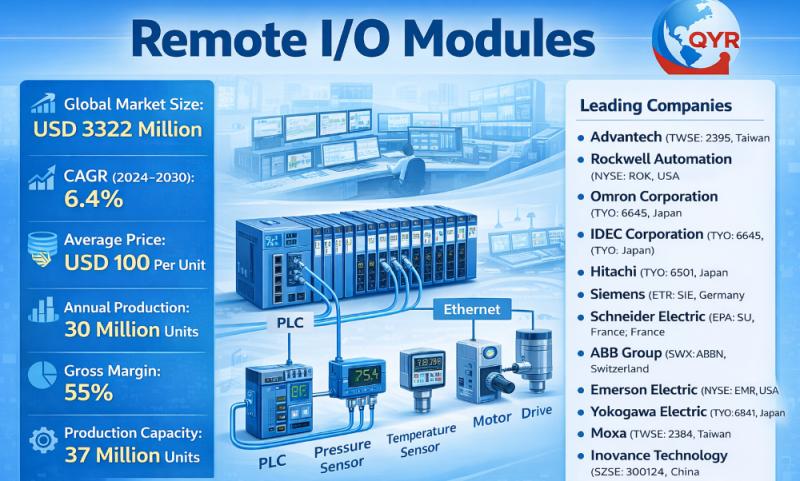

Global and U.S. Remote I/O Modules Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Remote I/O Modules, an industrial automation device that interfaces sensors, actuators, and field devices with a central controller (PLC, DCS, or PAC) over a network, allowing control and monitoring of distributed field devices without needing direct wiring to the main control cabinet. These modules transmit digital and analog signals between field devices and the central system, often using industrial communication…

Top 30 Indonesian Glass Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Asahimas Flat Glass Tbk (AMFG)

PT Mulia Industrindo Tbk (MLIA)

PT Arwana Citramulia Tbk (ARNA) related building materials

PT Cahayaputra Asa Keramik Tbk (CAKK) tile & partial glass products

PT Intikeramik Alamasri Industri Tbk (IKAI) ceramics & glass adjacencies

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Surya Toto Indonesia Tbk (TOTO)

PT Mark Dynamics Indonesia Tbk (MARK)

PT Indopoly Swakarsa Industry Tbk (IPOL) polymers for coatings

PT Sumi…

More Releases for Polymer

MDR Certificate For Single Polymer Clip Applier And Multiple Polymer Clip Applie …

EU Quality Management System Certificate

Regulation (EU)2017/745, Annex Ix Chapter I and III

MDR 804963 R000

Manufacturer: Hangzhou Sunstone Technology Co., Ltd

Address:

2nd Floor of Building 1,

#460 Fucheng Rd, Qiantang Area

Hangzhou

Zhejiang

310018

China

Single Registration Number: CN-MF-000040501

EU Authorised Representative: MedPath GmbH

Address:

Mies-van-der-Rohe-Strasse 8

80807

Munich

Germany

Scope: See attached Device Schedule

On the basis of our examination of the quality system in accordance with Regulation (EU) 2017/745, Annex IX

Chapter I and lll, the quality system meets the requirements of the Regulation. For the…

Acrylic Polymer Market

𝐓𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐚𝐜𝐫𝐲𝐥𝐢𝐜 𝐩𝐨𝐥𝐲𝐦𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 𝐚𝐩𝐩𝐫𝐨𝐱𝐢𝐦𝐚𝐭𝐞𝐥𝐲 𝐔𝐒𝐃 𝟐𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟐 𝐚𝐧𝐝 𝐢𝐬 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟑𝟔.𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟐, 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐚𝐭 𝐚 𝐜𝐨𝐦𝐩𝐨𝐮𝐧𝐝 𝐚𝐧𝐧𝐮𝐚𝐥 𝐠𝐫𝐨𝐰𝐭𝐡 𝐫𝐚𝐭𝐞 (𝐂𝐀𝐆𝐑) 𝐨𝐟 𝟔.𝟒% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟑 𝐭𝐨 𝟐𝟎𝟑𝟐.

𝐀𝐜𝐫𝐲𝐥𝐢𝐜 𝐏𝐨𝐥𝐲𝐦𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The acrylic polymer market has experienced significant growth due to its versatile applications across various industries, including paints and coatings, adhesives, textiles, and construction. Acrylic polymers are favored for…

Polymer Processing Aids: Enhancing Efficiency and Quality in Polymer Manufacturi …

Introduction

Polymer Processing Aids (PPAs) are indispensable additives used to improve the efficiency, quality, and cost-effectiveness of polymer manufacturing. These aids, often added in small quantities, significantly enhance polymer production by reducing surface defects, improving flow properties, and reducing wear on manufacturing equipment. Their role is critical in enabling smooth, uninterrupted processing, leading to higher-quality end products and improved manufacturing productivity. With the ever-growing demand for polymers across industries like automotive,…

What Are Lithium Polymer? Information About Lithium Polymer Batteries Guide

Did people know that Lithium Polymer power over 80% of the drones used in recreational and commercial applications today? Lithium Polymer (LiPo) batteries have become a staple in modern electronics. From powering smartphones and laptops to energizing drones and electric vehicles, these batteries offer a blend of high energy density and flexibility that makes them ideal for a wide range of applications. In this article, we'll dive deep into what…

Custom Polymer Synthesis Market 2023 Will Record Massive Growth, Trend Analysis …

The Custom Polymer Synthesis Market Trends Overview 2023-2030:

A new Report by Stratagem Market Insights, titled "Custom Polymer Synthesis Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2030," offers a comprehensive analysis of the industry, which comprises insights on the Custom Polymer Synthesis market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts,…

Silyl Modified Polymer (MS Polymer) Market Forecast Research Reports Offers Key …

Silyl Modified Polymer (MS Polymer) Market: Introduction

MS polymers, also known as silyl modified polymers or silyl terminated polymers, are polymers with a silane group. A silyl modified polymer (MS polymer) usually refers to a hybrid polymer backbone, usually polyurethane or polyether and a silane end group. Formulators can change the backbone polymer in sealants and adhesives utilizing MS polymers to match the specified application, achieving silicone-like performance while avoiding the…