Press release

Key Trends Reshaping the AI in FinTech Market: Advancements in AI-Infused Banking Platforms Transforming the Fintech Landscape Industry Transformation

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.AI in FinTech Market Size Growth Forecast: What to Expect by 2025?

The magnitude of the ai in fintech market has expanded significantly in the past few years. Its projection is to grow from $14.13 billion in 2024 to $17.69 billion in 2025, boasting a compound annual growth rate (CAGR) of 25.2%. The progression over the past years can be associated with factors such as the enhancement of customer service, risk management, fraud deterrence, automation of mundane tasks, data analytics playing a role in decision-making, and algorithmic trading and investment.

How Will the AI in FinTech Market Size Evolve and Grow by 2029?

The market size for AI in fintech is predicted to undergo rapid expansion in the following years, eventually reaching $51.08 billion in 2029 with a compound annual growth rate of 30.4%. The uptick during this forecast period can be credited to a greater employment of chatbots and virtual assistants, a heightened attention to regulatory compliance, and the use of robo-advisors for wealth management. Expected trends for this period also include the automation of regulatory compliance, alternative models for credit scoring, recommendations for cross-selling and upselling, enhancements in cybersecurity through AI, and automation in decentralized finance (DeFi).

View the full report here:

https://www.thebusinessresearchcompany.com/report/ai-in-fintech-global-market-report

What Drivers Are Propelling the Growth of AI in FinTech Market Forward?

The growth of AI in the fintech market is being driven by the demand for fraud detection in the financial sector. Machine learning algorithms, or artificial intelligence, have the capability to gather new information from the data they process - the more data they handle, the more they learn. This permits banks to gain more profound insights using AI technology. One of the major benefits of AI is that as it gets deployed, the algorithm begins to expand by accumulating more information and understanding its application. This growth process begins instantly after deployment and keeps on improving without any interruptions. PricewaterhouseCoopers's 2022 survey stated that in the preceding 24 months, 46% of the surveyed organizations reported fraud, corruption, or other financial crimes. Additionally, according to FintechNews in September 2021, banks are investing in AI solutions at a never-before-seen pace. They have spent more than $217 billion on AI applications in middle-office operations, which include fraud prevention and risk analysis. This necessity for fraud detection in fintech propels the AI market in that sector.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6240&type=smp

Which Emerging Trends Are Transforming the AI in FinTech Market in 2025?

Prominent businesses in the AI in fintech market are concentrating on generating innovative advancements, such as AI-powered banking platforms, to elevate client service quality and simplify operations through customized services, fraud identification, and heightened risk management. The goal of these advancements is to create more effective and secure financial solutions. An AI-powered financial platform uses artificial intelligence to bolster services like personalized offerings, fraud identification, and customer support. It refines operations and augments decision-making procedures through sophisticated data analysis and automation. For instance, in May 2024, Temenos, a software firm based in Switzerland, unveiled Responsible Generative AI Solutions, which boosted operational effectiveness and decision-making via data-informed insights while maintaining ethical procedures, transparency, and risk minimization. These solutions promote innovation and personalization, helping organizations remain competitive in a fast-paced evolving market.

What Are the Key Segments in the AI in FinTech Market?

The ai in fintechmarket covered in this report is segmented -

1) By Type: Solutions, Services

2) By Deployment: Cloud, On-premise

3) By Application: Asset Management, Risk Investigation, Business Analytics, Regulatory Compliance, Data Collection, Predictive Analytics, Virtual Assistance, Other Applications

Subsegments:

1) By Solutions: Fraud Detection and Prevention Solutions, Credit Scoring And Risk Assessment Tools, Algorithmic Trading Platforms, Robo-Advisors For Investment Management, Customer Service Chatbots

2) By Services: AI Consulting Services, Implementation and Integration Services, Maintenance and Support Services, Training And Education Services, Managed Services For AI Systems

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=6240&type=smp

Who Are the Key Players Shaping the AI in FinTech Market's Competitive Landscape?

Major companies operating in the AI in fintech market include Alphabet Inc., Microsoft Corporation, Klarna Inc., Amazon Web Services Inc., Intel Corporation, International Business Machines Corporation, PayPal Holdings Inc., Square Inc., Salesforce.com Inc., Stripe Inc., Social Finance Inc., Robinhood Markets Inc., Nuance Communications Inc., Affirm Inc., Revolut Ltd., Adyen N.V., Ant Financial Services Group, On Deck Capital Inc., Kabbage Inc., Plaid Inc., IPsoft Inc., Onfido Limited, Betterment LLC, Funding Circle Limited, Wealthfront Corporation, Kensho Technologies Inc., Inbenta Technologies Inc., Trifacta Inc., Next IT Corporation, Zeitgold GmbH, ZestFinance Inc., Ayasdi Inc., FeedzAI inc., Numerai LLC, Riskified Ltd., Oscar Health Inc., Ripple Labs Inc., Chainalysis Inc., ThetaRay Ltd., Darktrace Limited, TruValue Labs Inc., Wealthsimple Inc., TrueAccord Corporation

What Geographic Markets Are Powering Growth in the AI in FinTech Market?

North America was the largest region in the AI in fintech market in 2024. The regions covered in the AI in fintech market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6240

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Trends Reshaping the AI in FinTech Market: Advancements in AI-Infused Banking Platforms Transforming the Fintech Landscape Industry Transformation here

News-ID: 4228333 • Views: …

More Releases from The Business Research Company

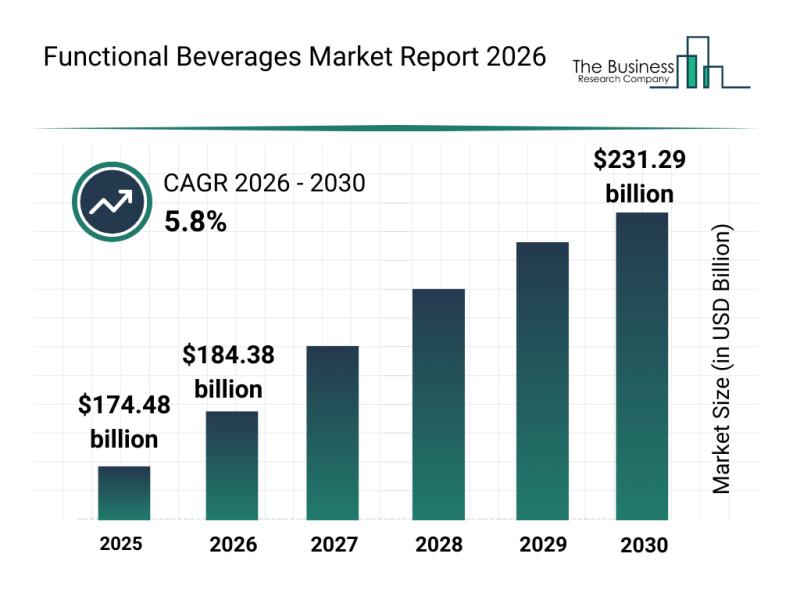

Trends in Growth, Segment Analysis, and Competitive Approaches Influencing the F …

The functional beverages sector is gaining significant traction as consumers increasingly seek drinks that offer added health benefits beyond basic hydration. Innovations, evolving consumer preferences, and expanding online channels are all contributing to the promising outlook for this market. Let's explore the market size projections, key players, prevailing trends, and segmented insights shaping the future of functional beverages.

Projected Market Value and Growth Trajectory for the Functional Beverages Market

The…

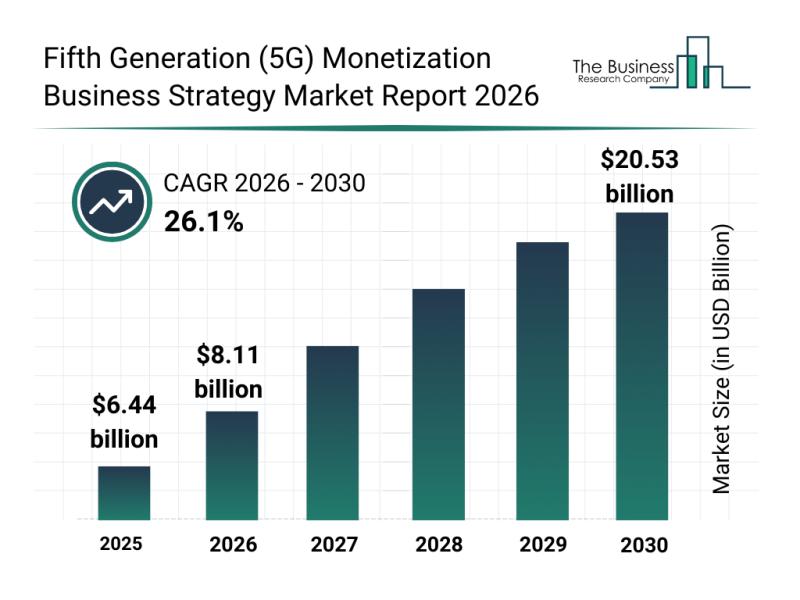

Global Trends Overview: The Rapid Evolution of the Fifth Generation (5G) Monetiz …

The rapid evolution of 5G technology is opening up vast opportunities in monetization strategies that companies are eager to tap into. With advancements in network capabilities and growing application demands, the fifth generation (5G) monetization business strategy market is set for remarkable growth in the coming years. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its future trajectory.

Projected Growth and Market Size of the Fifth…

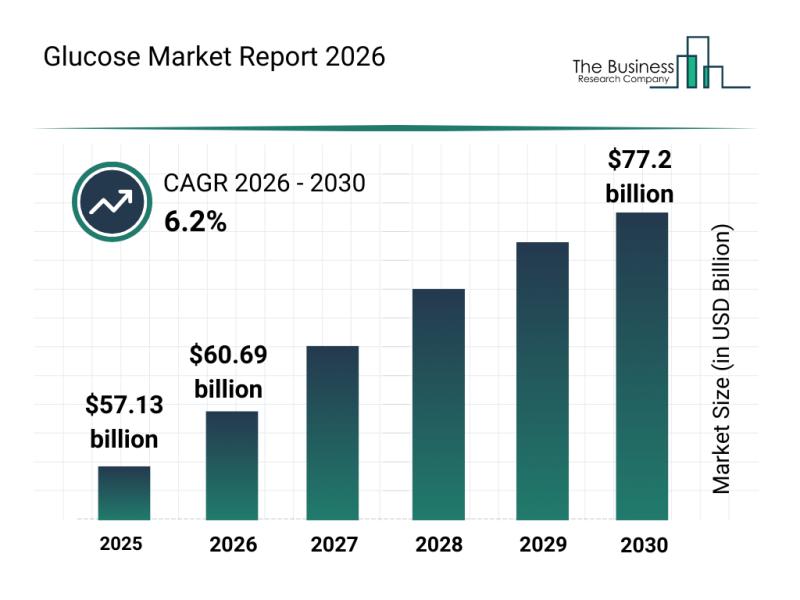

Market Trend Analysis: The Impact of Recent Innovations on the Glucose Market

The glucose market is witnessing rapid expansion driven by diverse applications and evolving consumer preferences. As demand for specialized nutrition and innovative glucose products grows, the industry is set for considerable advancement. Let's explore the projected market size, key players, influencing trends, and segmentation details that define this dynamic sector.

Projected Growth and Market Size of the Glucose Market by 2030

The glucose market is forecasted to experience substantial growth,…

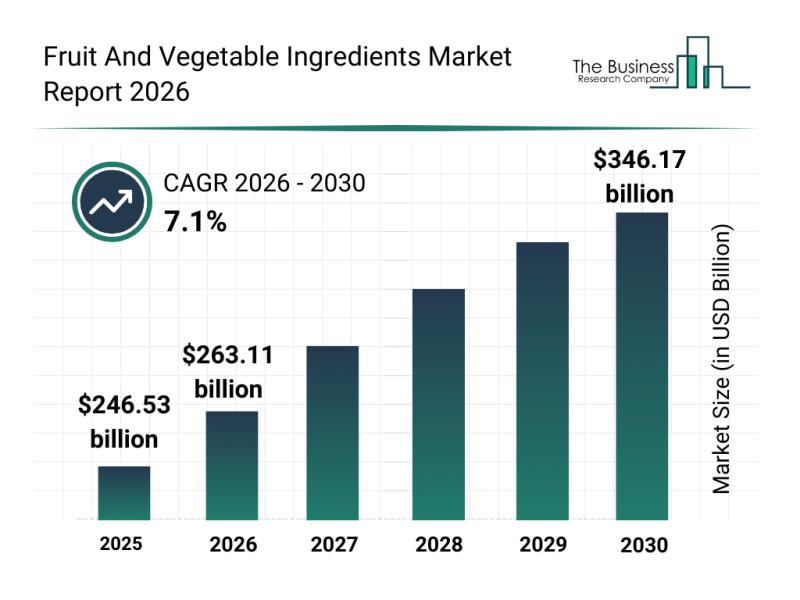

Leading Companies Reinforcing Their Presence in the Fruit and Vegetable Ingredie …

The fruit and vegetable ingredients market is positioned for remarkable expansion over the coming years. Fueled by evolving consumer preferences and innovations in food technology, this sector is set to experience substantial growth as demand for natural and functional ingredients rises across various food applications.

Projected Market Value and Growth Rate of the Fruit and Vegetable Ingredients Market

The fruit and vegetable ingredients market is anticipated to reach a value…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…