Press release

Insurance Brokerage Business Plan for Startups (2025): Everything You Need to Know

IMARC Group's "Insurance Brokerage Business Plan and Project Report 2025: Industry Trends, Business Setup, Revenue Model, Investment Opportunities, Income, Expenses, and Profitability" provides a detailed roadmap for establishing a successful insurance brokerage business. This comprehensive report outlines market dynamics, operational strategies, financial feasibility, and regulatory frameworks. It serves as a complete guide for entrepreneurs, investors, and financial organizations aiming to enter the rapidly growing insurance services sector.What is an Insurance Brokerage?

An insurance brokerage acts as an intermediary between insurance companies and clients, providing tailored insurance solutions across life, health, property, and commercial segments. Brokers assess client needs, recommend suitable insurance products, and facilitate policy management. With increasing risk awareness, rising regulatory requirements, and a growing insurance market, brokerage services have become vital for both individual and corporate clients. The sector offers opportunities to provide financial advisory, risk management, and customized insurance planning.

Insurance Brokerage Business Setup:

Setting up an insurance brokerage requires careful planning, regulatory compliance, and a strong operational framework. The key steps include obtaining licenses from insurance regulatory authorities, establishing office infrastructure with CRM and policy management systems, and hiring trained insurance professionals. Collaborations with multiple insurance carriers ensure a diverse product portfolio. Entrepreneurs must invest in marketing strategies, client relationship management, and compliance monitoring to maintain credibility and long-term growth.

See the Data First: Download Your Sample Report: https://www.imarcgroup.com/insurance-brokerage-business-plan-project-report/requestsample

Report Coverage:

The Insurance Brokerage Business Plan covers:

• Business Model & Operations Plan

• Technical & Regulatory Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Legal & Compliance Framework

Business Model & Operations Plan:

Insurance brokerage operates through multiple models:

• Independent Brokerage: Offers products from multiple insurance carriers.

• Captive Brokerage: Exclusive tie-ups with one insurance company.

• Online/Hybrid Model: Combines digital platforms with traditional brokerage services.

Revenue streams include:

• Commission Income: Earned from insurance carriers for policy sales.

• Service Fees: Advisory or policy management charges.

• Value-added Services: Risk assessment, claims assistance, and portfolio management.

Operational workflows involve client consultation, policy recommendation, application submission, premium collection, and claims support. Maintaining compliance with ISO standards and local insurance regulations ensures trust and operational excellence.

Technical & Regulatory Feasibility:

Establishing feasibility involves integrating robust technology and ensuring regulatory compliance.

• Infrastructure Requirements: Office setup, secure data storage, and CRM systems.

• Technology: Policy management software, online quotation tools, and client portals.

• Human Resources: Certified insurance advisors, compliance officers, and support staff.

• Compliance: Adhering to regulatory requirements, anti-money laundering laws, and data protection standards.

Financial Feasibility:

The report provides a comprehensive financial assessment:

• Capital Investment: Office space, IT infrastructure, licensing, and marketing.

• Operating Costs: Salaries, software subscriptions, client acquisition, and administration.

• Revenue Projections: Based on commission and service fee models.

• Profit & Loss Analysis: Financial forecast for the first five years.

• ROI and Sensitivity Analysis: Evaluates profitability under varying market conditions.

Market Insights & Strategy:

The insurance brokerage sector is growing due to increasing insurance awareness, digital adoption, and regulatory support.

• Industry Trends: Growth in online insurance platforms, personalized coverage plans, and risk advisory services.

• Regional Insights: North America, Europe, and Asia-Pacific lead the market due to insurance penetration and consumer awareness.

• Competitive Landscape: Key players include Marsh & McLennan, Aon, Willis Towers Watson, and local broker networks.

• Marketing Strategy: Client education programs, partnerships with insurance carriers, and digital marketing campaigns for lead generation and brand positioning.

Speak to an Expert: Submit Your Question Now: https://www.imarcgroup.com/request?type=report&id=43181&flag=C

Capital & Operational Expenditure Breakdown

The report provides detailed expenditure analysis:

• Capital Expenditure (CapEx): Office setup, IT systems, compliance certification, and marketing launch.

• Operational Expenditure (OpEx): Staff salaries, software maintenance, client acquisition, and administrative costs.

Effective cost management ensures sustainable growth and scalability.

Profitability Projections

Profitability forecasts include:

• Five-year projections of revenue, expenses, and net profit.

• Annual profitability margins and cash flow analysis.

• Long-term value creation through expanded client base, digital offerings, and strategic partnerships.

About Us:

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Brokerage Business Plan for Startups (2025): Everything You Need to Know here

News-ID: 4227466 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

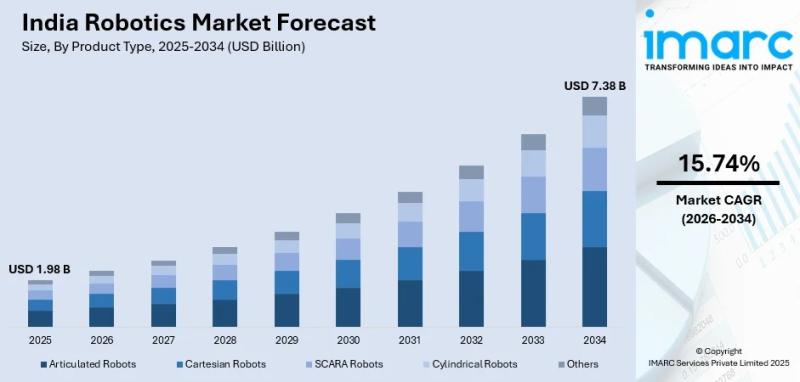

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

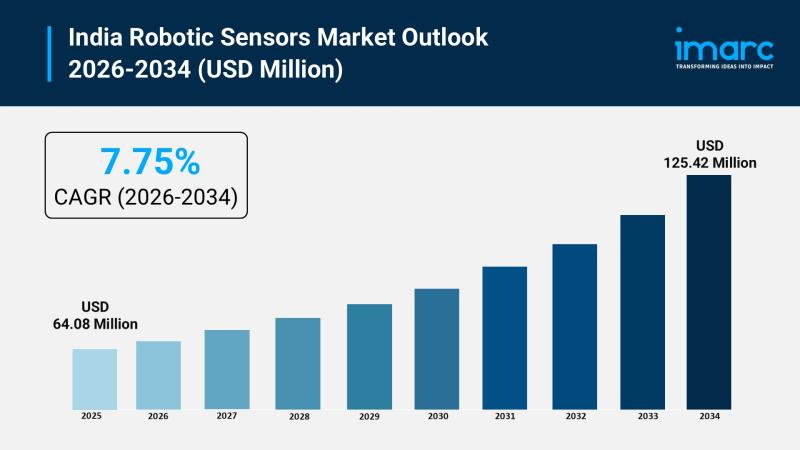

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

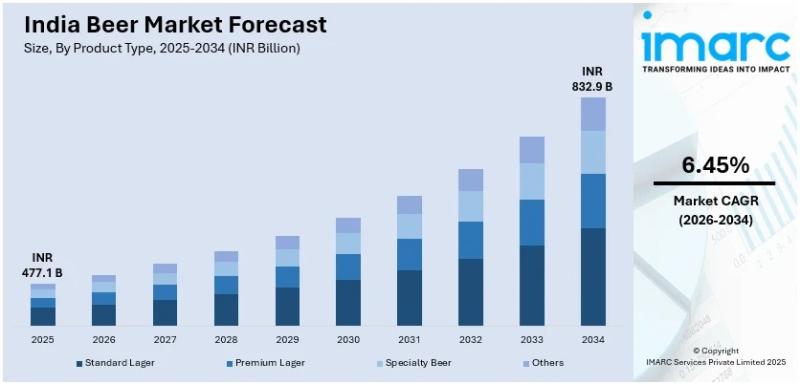

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Brokerage

Prominent Mortgage Brokerage Services Market Trend for 2025: Technological Advan …

How Are the key drivers contributing to the expansion of the mortgage brokerage services market?

The increasing need for personalized financial guidance is likely to fuel the growth of the mortgage brokerage services market in the coming years. Personalized financial guidance involves creating financial strategies based on an individual's financial needs and goals. This demand is growing due to factors such as inflation, economic growth, interest rates, and technological progress. Mortgage…

Prediction market Kalshi launches brokerage integrations

Image: https://www.globalnewslines.com/uploads/2025/01/1738333447.jpg

New York, NY - Feb 3, 2025 - Kalshi, America's largest regulated prediction market, today announced the capability to integrate prediction markets with traditional financial brokerages.

The ability to integrate event contracts with brokerages significantly increases the number of Americans who will have access to prediction markets, signifying that further growth for the industry is imminent.

"A few years ago, prediction markets were a niche corner of the internet. We built…

Insurance Brokerage Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Insurance Brokerage Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Insurance Brokerage Market Size and Scope

The insurance brokerage market is substantial and continues to expand, driven by the increasing demand for insurance solutions across various…

Online Financial Brokerage Market Next Big Thing | Major Giants- Financial Broke …

Advance Market Analytics published a new research publication on "Online Financial Brokerage Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online Financial Brokerage market was mainly driven by the increasing R&D spending across the world.

Some of the key players…

Online Financial Brokerage Market, Online Discount Brokerage Market: Ken Researc …

Financial Brokerage Market –during the recent trend the financial market across the Philippines is one of the most fortunate financial markets in the South-Asia region with the very few financial products recommended for trading at recent but will enhance during a few years. In addition, the Trading activities across the Philippines region is exceedingly delimited owing to very low trading capacity and reasonably fewer trading accounts, most of the brokerage…

Cloud Services Brokerage Market Report 2018: Segmentation by Service Type (Catal …

Global Cloud Services Brokerage market research report provides company profile for Accenture (Ireland), DoubleHorn (US), Jamcracker (US), IBM (US), HPE (US), RightScale (US), Dell (US), Wipro (India), Arrow Electronics (US), ActivePlatform (Belarus), Cloudmore (Sweden) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…