Press release

Can AI and Accounts Receivable Automation Help Reduce DSO?

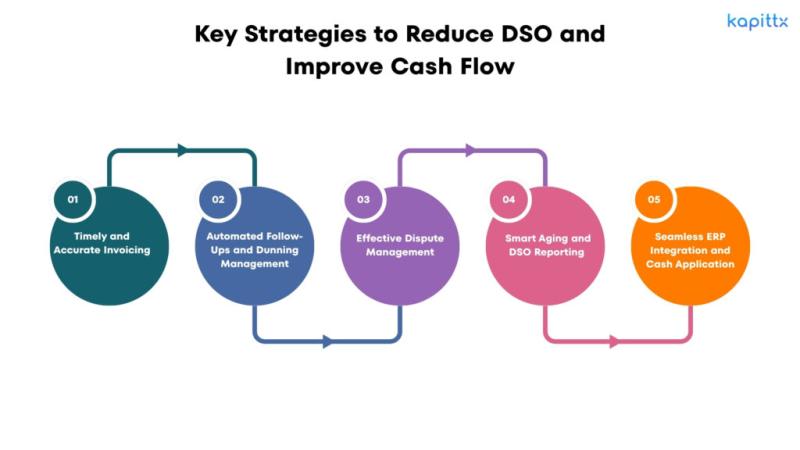

As businesses face increasing pressure to maintain liquidity and financial stability, reducing Days Sales Outstanding (DSO) has become a top strategic priority for CFOs. The growing adoption of AI-driven Accounts Receivable (AR) automation is emerging as a critical solution to streamline collections, accelerate cash inflows, and enhance working capital efficiency.According to industry analysts, companies that leverage AI in their receivables processes report an average DSO reduction of 20-30%, compared to organizations still relying on manual or semi-automated systems. Platforms like Kapittx, which integrate artificial intelligence into AR management, are helping finance teams shift from reactive follow-ups to predictive and proactive collection strategies.

Understanding the DSO Challenge

Days Sales Outstanding (DSO) measures the average number of days it takes a company to collect payments after a sale. High DSO levels indicate delayed collections, impacting cash flow and limiting a company's ability to reinvest in growth.

In many organizations, DSO remains high due to fragmented data, manual reconciliation, inconsistent follow-ups, and lack of visibility into outstanding invoices. CFOs and credit controllers often struggle with limited tools for forecasting payment behavior or identifying at-risk accounts early enough.

This is where AI and automation are reshaping the landscape.

How AI-Powered Accounts Receivable Automation Reduces DSO

Predictive Payment Forecasting:

AI models analyze customer payment histories and behavioral trends to predict when invoices are likely to be paid - allowing finance teams to focus collection efforts where they matter most.

Automated Payment Reminders:

Intelligent automation tools send reminders tailored to customer profiles and payment patterns, ensuring timely follow-ups without manual intervention.

Real-Time Data and Visibility:

AI-driven dashboards provide CFOs with a unified view of outstanding receivables, overdue accounts, and cash inflows, enabling faster decision-making.

Risk-Based Prioritization:

Machine learning algorithms assess payment risks in real time, helping finance leaders prioritize high-risk accounts and prevent bad debt accumulation.

Faster Reconciliation and Cash Application:

By automating payment matching across bank data, remittance advices, and ERP systems, AI accelerates reconciliation and eliminates human error - reducing the lag between payment receipt and posting.

A Shift from Reactive to Predictive Finance

Finance experts note that AI is transforming AR teams from back-office processors to strategic enablers. By automating repetitive workflows and providing predictive insights, organizations are not only improving their DSO metrics but also enhancing their ability to forecast cash positions accurately.

"Reducing DSO is no longer just a collections function - it's a data-driven finance strategy," says Kumar Karpe, CEO of Kapittx. "AI and automation give CFOs the visibility and foresight to make faster, smarter cash flow decisions."

The Broader Business Impact

The impact of AI-enabled AR automation extends beyond faster collections. Improved working capital allows businesses to reinvest in operations, reduce borrowing costs, and strengthen customer relationships through transparent, error-free invoicing.

As more finance departments modernize their receivables processes, AI-based automation is set to become a cornerstone of digital transformation in financial operations.

For more information on how Kapittx enables companies to optimize AR performance, visit: www.kapittx.com

Bootstart coworking, VCC Vantage 9, Pashan Rd, Baner, Pune

In Business-to-Business (B2B) firms, Accounts Receivable remain among the top three tangible assets on the books; yet it is highly under-managed, leading to cash getting locked in the balance sheet.

Businesses end up spending hours on manual, repetitive tasks, updating multiple spreadsheets, preparing cash flow reports, handling invoice disputes, or manually reconciling invoices. Delayed payments impact revenue assurance, cash flow planning, and finance productivity.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Can AI and Accounts Receivable Automation Help Reduce DSO? here

News-ID: 4224915 • Views: …

More Releases from Kapittx

CFOs Turn to AR Automation to Combat Rising DSO Challenges

As global businesses continue to face cash flow pressures, Chief Financial Officers (CFOs) are adopting advanced accounts receivable (AR) automation tools to address one of the most persistent challenges in finance: reducing Days Sales Outstanding (DSO). Recent shifts in credit cycles, customer payment behaviors, and increased operational costs have intensified the urgency for CFOs to modernize their receivables management strategies.

According to industry research, companies that rely on manual AR processes…

Five Trends Reshaping Accounts Receivable Automation

As digital transformation accelerates across finance functions, accounts receivable automation is undergoing a significant shift. According to insights from Kapittx, an enterprise-grade AR automation platform, five major trends are expected to define the future of receivables management in 2025 and beyond.

With economic volatility, elongated payment cycles, and a renewed focus on cash flow, businesses are turning to advanced AR tools to enhance predictability and resilience. Kapittx's latest analysis highlights five…

More Releases for DSO

Dental Services Organization (DSO) market is predicted to expand to nearly USD 3 …

The global Dental Services Organization (DSO) market is estimated to be valued at around USD 15 billion in 2024 and is projected to grow to approximately USD 32 billion by 2034, reflecting a compound annual growth rate (CAGR) of about 9.7% from 2025 to 2034.

Download Full PDF Sample Copy of Market Report @ https://exactitudeconsultancy.com/request-sample/50105

Market Segmentation Highlights

• By Product/Service Type: General dentistry, orthodontics, cosmetic dentistry, oral surgery.

• By Application: Preventive care, restorative care,…

CFOs Turn to AR Automation to Combat Rising DSO Challenges

As global businesses continue to face cash flow pressures, Chief Financial Officers (CFOs) are adopting advanced accounts receivable (AR) automation tools to address one of the most persistent challenges in finance: reducing Days Sales Outstanding (DSO). Recent shifts in credit cycles, customer payment behaviors, and increased operational costs have intensified the urgency for CFOs to modernize their receivables management strategies.

According to industry research, companies that rely on manual AR processes…

Accounts Receivable Outsourcing Services by IBN Technologies Leverage Analytics …

Businesses in Oregon are adopting accounts receivable outsourcing services from IBN Technologies to improve cash flow and financial clarity. These services streamline receivables management through real-time reporting, expert follow-ups, and transparent dashboards, helping companies reduce manual tasks and accelerate collections. With enhanced accuracy and operational efficiency, Oregon firms are strengthening financial workflows and growth prospects

Miami, Florida - 28 May, 2025 - In a major development today, authorities confirmed that a…

IBN Technologies' Outsourcing Accounts Receivable Services Reduce DSO for Financ …

This news highlights the growing trend of U.S. companies adopting outsourcing accounts receivable services as a key strategy for financial agility and growth. It explores how businesses are moving beyond traditional AR processes to leverage data-driven, customized solutions that improve cash flow, streamline operations, and strengthen financial stability in an evolving market landscape.

Miami, Florida - May 22, 2025 - Market watch outcomes without in-house solutions reveal that Texas businesses and…

Dental Service Organizations (DSO) Market Future Trends for 2025

The Dental Service Organizations (DSO) market plays a pivotal role in the dental care industry, providing essential support services to dental practices. This market encompasses a range of operations, from administrative tasks to clinical support, enabling dental professionals to focus on patient care. The DSO model allows for streamlined operations and enhanced service delivery, making it an attractive option for many dental practitioners.

In recent years, the DSO market has experienced…

Dental Service Organizations(DSO) Market Size And Booming Worldwide From 2024-20 …

The Global "Dental Service Organizations(DSO) Market" 2024 Research Report presents a professional and complete analysis of the Global Dental Service Organizations(DSO) Market in the current situation. The Dental Service Organizations (DSO) market exhibits potential as dental practices seek operational efficiency and growth opportunities. With changing patient demographics and evolving dental care needs, there's a rising demand for comprehensive dental services. DSOs offering centralized management, economies of scale, and enhanced clinical…