Press release

Philippines Cement Market Worth USD 12,870.52 Million From 2025 to 2033

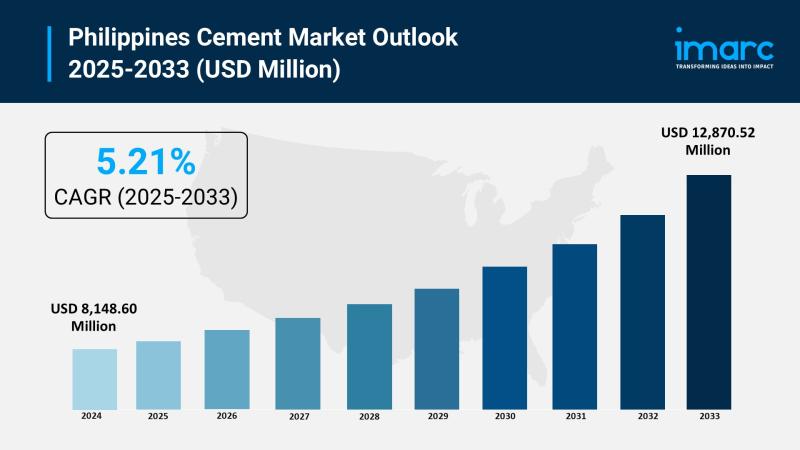

The latest report by IMARC Group, "Philippines Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033," provides an in-depth analysis of the Philippines cement market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines cement market size reached USD 8,148.60 million in 2024 and is projected to grow to USD 12,870.52 million by 2033, exhibiting a robust growth rate of 5.21% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 8,148.60 Million

Market Forecast in 2033: USD 12,870.52 Million

Growth Rate (2025-2033): 5.21%

Philippines Cement Market Overview:

The Philippines' cement industry is propelled by government infrastructure projects. One project, the USD 1.7 billion Laguna Lakeshore Road Network, was said by the ADB to reduce travel time by 25% for 3.4 million people. With increased environmental standards, sustainable cement products such as Holcim's Excel ECOPlanet and Optimo are increasing in popularity. Urbanization is occurring along with growing construction. Public-private partnerships fuel residential and commercial buildings so the construction market should grow to PHP 1.94 trillion in 2025 at 8.4%. The cement industry supports national development it has 179 active cement manufacturer licensees meeting quality standards and specifications.

Request For Sample Report: https://www.imarcgroup.com/philippines-cement-market/requestsample

Philippines Cement Market Trends:

Philippines cement market developments include progress towards sustainable solutions with Holcim Philippines renewing its partnership with Megawide Construction by supplying low-carbon Excel ECOPlanet and Optimo for green buildings and sustainable projects in Luzon. CHP has commissioned a new production line with an additional capacity of 1.5 million tons, increasing its capacity by 26% to 7.2 million tons, to accommodate demand. Ordinary Portland Cement was re-introduced for large-scale projects. Vietnam and Japan benefit from temporary 200-day provisional safeguard tariff measures restricting imports. These measures potentially protect domestic producers. Smart city projects have high construction costs. These projects include modern housing, transport infrastructure, and energy-efficient buildings for people. Also, when plants modernize through energy-efficient equipment or alternative fuels, and when they integrate with digital systems, these actions can help create greater efficiencies throughout the supply chain and plant operations.

Philippines Cement Market Drivers:

Philippines cement industry is driven by government infrastructure spending in totality. In 2024, the Asian Development Bank approved a USD 1.7 billion loan for a 37.5 km long expressway around the Laguna Lakeshore which is expected to have heavy cement demand for embankments, bridges & roads. The construction market is expected to be PHP 1.94 trillion by 2025, growing at a CAGR of 8.4%. Infrastructure market is expected to grow at a CAGR of 7.59% under the Build Better More program. With the CHP expansion underway, the 1.5-million-tonne line will be commissioned in April 2025 for 26% added capacity. Holcim also disclosed PHP 1.6 billion investment in La Union plant (February 2025) for alternative fuels to produce low carbon cement. In September 2025, DTI-BPS recorded 179 cement manufacturer licensees compliant with Philippine National Standards. Urbanization has increased residential and commercial construction in the Philippines. Real estate is growing, expanding industrial zones with new housing. Infrastructure and housing development is rising to meet the new middle class.

Market Challenges:

• High Energy Costs constraining profitability with coal and electricity intensive production

• Environmental Concerns requiring cleaner technologies and carbon emission reduction investments

• Raw Material Volatility affecting clinker, limestone, and fuel pricing stability

• Import Competition pressuring domestic manufacturers despite safeguard tariffs

• Capital Requirements limiting smaller producers' modernization capabilities

• Regulatory Compliance necessitating adherence to environmental and quality standards

• Supply Chain Disruptions impacting raw material availability and logistics

Market Opportunities:

• Green Cement Production developing low-carbon alternatives using industrial by-products

• Smart City Projects capitalizing on planned urban development construction demands

• Rural Infrastructure Growth expanding into underserved regions requiring connectivity improvements

• Alternative Fuels Integration reducing production costs and environmental footprint

• Export Markets leveraging ASEAN connectivity for regional distribution

• Plant Modernization implementing energy-efficient technologies improving operational efficiency

• Blended Cement Innovation creating value-added sustainable products commanding premium pricing

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-cement-market

Philippines Cement Market Segmentation:

By Type:

• Blended

• Portland

• Others

By End Use:

• Residential

• Commercial

• Infrastructure

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Cement Market News:

September 2025: DTI Bureau of Product Standards reported 179 active cement manufacturer licensees including 95 for Portland cement, 81 for blended hydraulic cement, and 3 for masonry cement all complying with Philippine National Standards ensuring quality infrastructure materials.

August 2025: Construction market valued at USD 43.44 billion projected to reach USD 60.05 billion by 2030 at 6.69% CAGR with infrastructure work forecasting 7.59% CAGR driven by Build Better More program roads, railways, and bridges.

April 2025: CHP commissioned new 1.5-million-ton production line boosting annual capacity 26% to 7.2 million tons and reintroduced Ordinary Portland Cement serving large-scale projects nationwide supporting infrastructure and construction demand.

March 2025: Philippines implemented 200-day provisional safeguard tariff on cement imports through mid-September 2025 during Tariff Commission investigation primarily affecting Vietnam and Japan while exempting China and Indonesia protecting domestic manufacturers.

February 2025: Holcim Philippines announced PHP 1.6 billion investment in La Union plant expanding production capacity and integrating alternative fuels for low-carbon cement supporting sustainable construction materials transition.

Key Highlights of the Report:

• Market analysis projecting growth from USD 8,148.60 million (2024) to USD 12,870.52 million (2033) with 5.21% CAGR

• Construction market projected to reach PHP 1.94 trillion in 2025 growing 8.4% annually

• CHP expanding capacity 26% with 1.5-million-ton line operational April 2025

• Holcim investing PHP 1.6 billion in La Union plant February 2025 for sustainable production

• 179 active cement manufacturer licensees reported September 2025 complying with national standards

• Infrastructure segment driving demand through government Build Better More program

• Luzon leading regional distribution with highest construction activity and infrastructure concentration

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines cement market growth to USD 12,870.52 million by 2033?

A1: The market is driven by government infrastructure investments with Asian Development Bank sanctioning USD 1.7 billion for Laguna Lakeshore expressway in 2024 reducing travel time 25%, construction market projected to reach PHP 1.94 trillion in 2025 growing 8.4% annually with infrastructure forecasting 7.59% CAGR, and capacity expansion with CHP commissioning 1.5-million-ton line operational April 2025 increasing capacity 26%. Holcim investing PHP 1.6 billion in La Union plant February 2025 for sustainable production, 179 active manufacturer licensees maintaining quality standards, and urbanization driving residential and commercial construction contribute to the 5.21% growth rate.

Q2: How are sustainability initiatives and government support transforming the Philippines cement landscape?

A2: Holcim Philippines renewed partnership with Megawide Construction in 2024 providing sustainable Excel ECOPlanet and Optimo low-carbon products supporting infrastructure projects throughout Luzon addressing environmental standards. Holcim announced PHP 1.6 billion La Union plant investment February 2025 integrating alternative fuels for low-carbon cement production. Government implemented 200-day provisional safeguard tariff March 2025 protecting domestic manufacturers while DTI-BPS reported 179 active licensees September 2025 complying with Philippine National Standards. Build Better More program drives infrastructure work forecasting 7.59% CAGR with flagship roads, railways, and bridges creating sustained demand positioning sustainability and regulatory support as fundamental transformation drivers.

Q3: What opportunities exist for cement stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on green cement production developing low-carbon alternatives using industrial by-products reducing embodied carbon, smart city projects capitalizing on planned urban development requiring modern housing and transport networks, and rural infrastructure growth expanding into underserved regions requiring connectivity improvements. Alternative fuels integration reducing production costs and environmental footprint, export markets leveraging ASEAN connectivity for regional distribution, and plant modernization implementing energy-efficient technologies represent significant opportunities alongside blended cement innovation creating value-added sustainable products commanding premium pricing addressing ESG criteria and green building procurement requirements.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=37574&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Cement Market Worth USD 12,870.52 Million From 2025 to 2033 here

News-ID: 4224587 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…