Press release

Australia Contact Lenses Market: Industry Trends, Share | 2025-2033

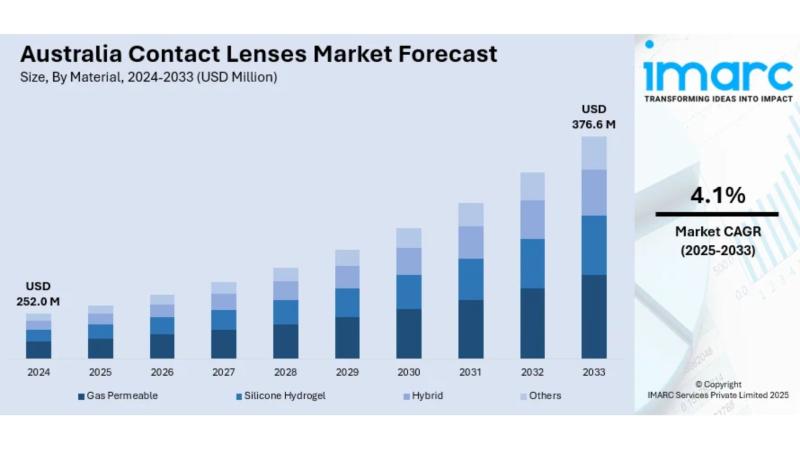

The latest report by IMARC Group, titled "Australia Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channel, and Region, 2025-2033," offers a comprehensive analysis of the Australia contact lenses market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia contact lenses market size reached USD 252.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 376.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033.Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 252.0 Million

• Market Forecast in 2033: USD 376.6 Million

• Market Growth Rate 2025-2033: 4.1%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-contact-lenses-market/requestsample

How Is AI Transforming the Contact Lenses Market in Australia?

• AI-powered virtual try-on technology is revolutionizing cosmetic lens selection with augmented reality enabling customers to visualize different colored lenses digitally before purchase

• Smart contact lens development is advancing with research into AI-integrated lenses monitoring glucose levels for diabetics and measuring intraocular pressure for glaucoma patients

• Personalized prescription recommendations are improving through machine learning algorithms analyzing patient history, lifestyle factors, and eye health data to suggest optimal lens types

• Tele-optometry platforms are expanding access with AI-assisted remote eye examinations and consultations improving healthcare delivery for regional and remote Australian communities

• Automated inventory management systems are optimizing supply chains with predictive analytics forecasting demand patterns and reducing stockouts by 35%

• Computer vision quality control is enhancing manufacturing with AI detecting defects and ensuring consistent product quality across production batches

Australia Contact Lenses Market Overview

• Johnson & Johnson Vision Care maintains market leadership through ACUVUE brand innovations in daily disposable and silicone hydrogel technologies

• CooperVision demonstrates strong growth with Biofinity and clariti product lines capturing significant market share in monthly and daily disposable segments

• Alcon leads premium presbyopia solutions through Air Optix and Dailies Total1 multifocal lens offerings

• Bausch + Lomb competes effectively with Ultra and SofLens daily disposable and monthly replacement options

• Visioneering Technologies appointed Gelflex as Australian distributor for NaturalVue Multifocal contact lenses in August 2024

• Johnson & Johnson's TECNIS Odyssey intraocular lens received Australian approval in September 2024 for presbyopic and cataract patients

Key Features and Trends of Australia Contact Lenses Market

• Daily disposable lenses are dominating market growth with hygiene-conscious consumers preferring single-use convenience over cleaning regimens

• Cosmetic and colored lenses are entering mainstream adoption with social media influencers and young adults using patterned lenses for aesthetic enhancement

• Silicone hydrogel materials are becoming industry standard through superior oxygen permeability and all-day comfort for extended wear

• Multifocal lens innovations are attracting geriatric consumers with advanced designs addressing presbyopia and reducing reading glass dependence

• E-commerce subscription models are transforming distribution with home delivery platforms enabling convenient repeat purchases and automatic refills

• UV-blocking and moisture-retention technologies are gaining popularity among Australia's outdoor-oriented population in coastal regions

• Toric lens improvements are addressing astigmatism more effectively with enhanced stability and wider prescription ranges

• Orthokeratology lenses are emerging for myopia control in children with overnight wear reshaping corneas for daytime clear vision

Growth Drivers of Australia Contact Lenses Market

• Digital Eye Strain Epidemic: Prolonged screen time from remote work and online learning in Sydney, Melbourne, and Brisbane driving demand for moisture-retentive daily disposables

• Aging Population Demographics: Australia's growing geriatric population adopting multifocal lenses as comfortable alternatives to reading glasses and bifocals

• Active Outdoor Lifestyle: UV-blocking and water-resistant lenses popular among Queensland and South Australia beach communities and outdoor enthusiasts

• Cosmetic Adoption Surge: Young adults and social media influencers using colored lenses for special occasions, photography, and everyday aesthetic enhancement

• Retail Accessibility Expansion: Multichannel distribution through optometry clinics, retail chains, department stores, and online platforms improving product availability

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-contact-lenses-market

Innovation & Market Demand of Australia Contact Lenses Market

• Extended depth of focus technology is revolutionizing presbyopia management with Visioneering's NaturalVue lenses providing both myopia control and presbyopia correction

• Smart lens development is progressing with research into glucose-monitoring contact lenses for diabetic patients and drug-delivery systems for glaucoma treatment

• Biocompatible materials are advancing with next-generation silicone hydrogels offering improved oxygen transmission and reduced protein deposits

• Scleral lens innovations are expanding treatment options for keratoconus and irregular cornea patients with larger diameter lenses vaulting over corneal irregularities

• Myopia control technologies are gaining traction with orthokeratology and specialty soft lenses slowing progression in Australian children and teenagers

• Hydration technologies are improving comfort with moisture-locking formulations and bio-inspired surface treatments reducing dry eye symptoms

• UV protection integration is becoming standard with embedded UV blockers protecting eyes from Australia's high solar radiation levels

• Antimicrobial coatings are emerging to reduce infection risks with surface treatments preventing bacterial adhesion on lens surfaces

Australia Contact Lenses Market Opportunities

• Regional and Remote Expansion: Tele-optometry and home-delivery services can reach underserved communities in Northern Territory, regional Queensland, and rural Western Australia where traditional optometry access is limited

• Custom and Specialty Lenses: Growing demand for scleral lenses, orthokeratology, and custom toric designs addressing complex vision disorders and irregular corneas presents premium segment opportunities

• Sustainability Innovation: Eco-conscious consumers in urban centers like Hobart, Canberra, and Byron Bay seeking biodegradable lens materials, recyclable packaging, and lens recycling programs

• Sports and Performance Lenses: Active Australian population requiring specialized lenses for swimming, surfing, cycling, and outdoor activities with enhanced stability and UV protection

• Pediatric Myopia Control: Parents and optometrists increasingly adopting orthokeratology and specialty soft lenses for children's long-term eye health and myopia progression prevention

• Corporate Wellness Programs: Workplace vision care initiatives providing employee lens benefits and vision screening programs creating B2B partnership opportunities

Australia Contact Lenses Market Challenges

• Price Sensitivity Issues: Premium daily disposable lenses commanding higher costs creating affordability barriers for budget-conscious consumers compared to monthly replacement options

• Professional Fitting Requirements: Contact lens fitting requiring qualified optometrists limiting direct-to-consumer sales and creating regulatory compliance complexity

• Competition from Alternatives: Laser vision correction and improved eyeglass technologies providing viable alternatives reducing contact lens adoption among certain demographics

• Compliance and Safety Concerns: Improper lens care and overwear leading to eye infections requiring continuous consumer education and professional monitoring

• Supply Chain Vulnerabilities: Global manufacturing dependencies creating product availability issues during disruptions and increasing costs through international shipping

• Regulatory Compliance Complexity: Therapeutic Goods Administration requirements for medical devices creating approval delays and operational costs for new product introductions

Australia Contact Lenses Market Analysis

• Market concentration shows Johnson & Johnson, CooperVision, Alcon, and Bausch + Lomb controlling approximately 75% of total market share

• Competitive dynamics reveal daily disposable segment growing fastest at 8.2% annually while monthly replacement lenses show slower 2.1% growth

• Technology evolution demonstrates silicone hydrogel materials capturing 62% of soft lens market share through superior comfort and oxygen permeability

• Distribution patterns indicate optometry clinics maintaining 48% market share despite e-commerce channel growing at 12.7% annually

• Price segmentation shows premium lenses (above $50/box) representing 34% of revenue despite accounting for only 22% of unit volume

• Consumer behavior shifts toward daily disposables driven by convenience, hygiene awareness, and reduced long-term costs despite higher per-lens pricing

Australia Contact Lenses Market Segmentation:

1. By Material:

• Gas Permeable

• Silicone Hydrogel

• Hybrid

• Others

2. By Design:

• Spherical

• Toric

• Multifocal

• Others

3. By Usage:

• Daily Disposable

• Disposable

• Frequently Replacement

• Traditional

4. By Application:

• Corrective

• Therapeutic

• Cosmetic

• Prosthetic

• Lifestyle-Oriented

5. By Distribution Channel:

• E-Commerce

• Eye Care Practitioners

• Retail Stores

6. By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & South Australia

• Western Australia

Australia Contact Lenses Market News & Recent

Developments:

August 2024: Visioneering Technologies Inc. appointed Gelflex as exclusive distributor in Australia and New Zealand for NaturalVue Multifocal contact lenses featuring extended depth of focus design for myopia progression and presbyopia management.

September 2024: Johnson & Johnson's TECNIS Odyssey intraocular lens received Australian regulatory approval, highlighting growing demand for advanced vision correction options beyond contact lenses for presbyopic and cataract patients.

Australia Contact Lenses Market Key Players:

• Johnson & Johnson Vision Care (ACUVUE)

• CooperVision (Biofinity, clariti)

• Alcon (Air Optix, Dailies)

• Bausch + Lomb (Ultra, SofLens)

• Visioneering Technologies (NaturalVue)

• Menicon Co. Ltd.

• SEED Co. Ltd.

• Hoya Corporation

• Carl Zeiss Vision

• Contamac Ltd.

• SynergEyes Inc.

• X-Cel Specialty Contacts

• Gelflex Pty Ltd

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter's Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32225&flag=E

FAQs: Australia Contact Lenses Market

Q1: What is driving the growth of Australia's contact lenses market? A: The market is primarily driven by digital eye strain from increased screen time, aging population demographics adopting multifocal lenses, active outdoor lifestyles requiring UV protection, cosmetic adoption among young adults, and improved retail accessibility through multichannel distribution.

Q2: Which type of contact lenses is growing fastest in Australia? A: Daily disposable lenses are experiencing fastest growth at 8.2% annually driven by hygiene consciousness, convenience preferences, and improved silicone hydrogel materials offering superior comfort and oxygen permeability.

Q3: How are smart technologies transforming the contact lens market? A: AI-powered virtual try-on, tele-optometry platforms, smart lens development for glucose monitoring, personalized prescription algorithms, and automated inventory management are revolutionizing product selection, access, and supply chain efficiency.

Q4: What opportunities exist in regional and remote Australian markets? A: Tele-optometry and home-delivery services present significant opportunities in underserved areas like Northern Territory, regional Queensland, and rural Western Australia where traditional optometry access is limited through mobile clinics and online prescription services.

Q5: Which companies dominate the Australian contact lens market? A: Johnson & Johnson Vision Care (ACUVUE), CooperVision (Biofinity), Alcon (Air Optix), and Bausch + Lomb (Ultra) control approximately 75% of market share, with recent entrants like Visioneering Technologies gaining ground through innovative multifocal designs.

Conclusion of Report:

• Australia's contact lenses market is experiencing steady transformation with 4.1% annual growth driven by digital lifestyle changes, demographic shifts, and technological innovations addressing diverse vision correction needs

• Daily disposable lenses are revolutionizing the market with 8.2% growth rate as consumers prioritize hygiene, convenience, and comfort over traditional monthly replacement options

• Aging population adoption of multifocal lenses combined with youth cosmetic lens trends is diversifying the customer base and creating premium segment opportunities

• Technological advancements including extended depth of focus designs, smart lens development, and AI-powered solutions are reshaping product offerings and distribution channels

• Strategic expansion into regional markets through tele-optometry, sustainability innovations, and specialty lens solutions will be essential for capturing growth opportunities in Australia's evolving contact lens landscape

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Contact Lenses Market: Industry Trends, Share | 2025-2033 here

News-ID: 4224278 • Views: …

More Releases from IMARC Services Private Limited

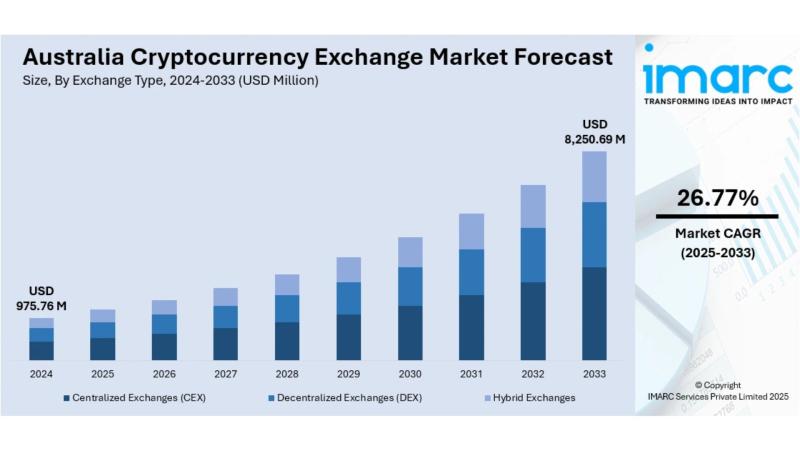

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

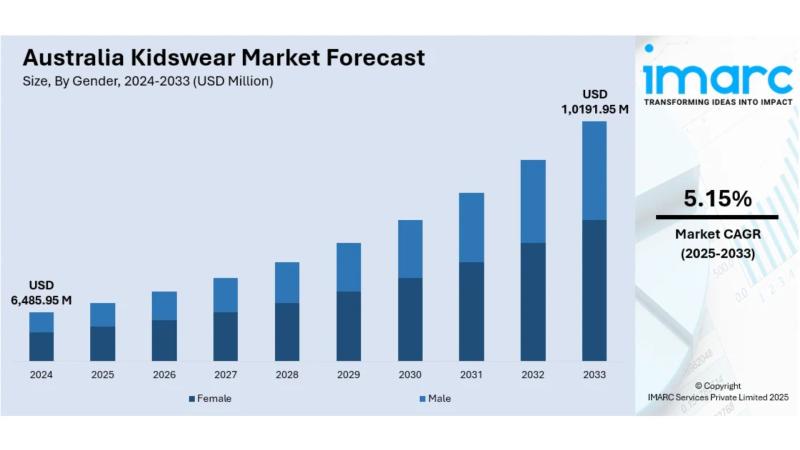

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

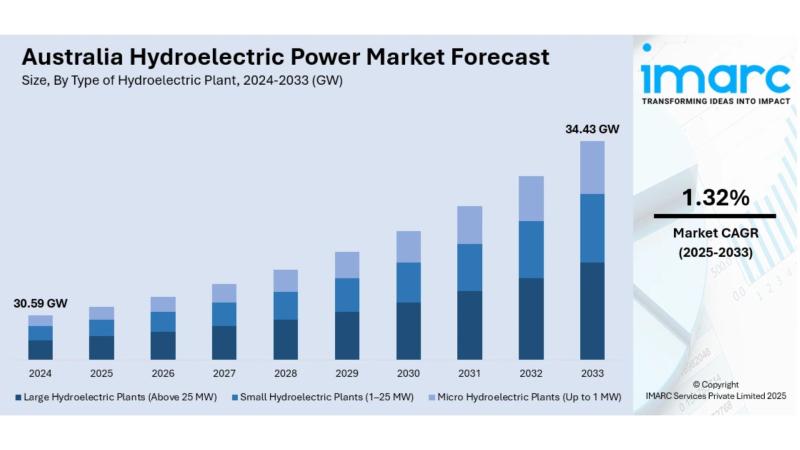

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

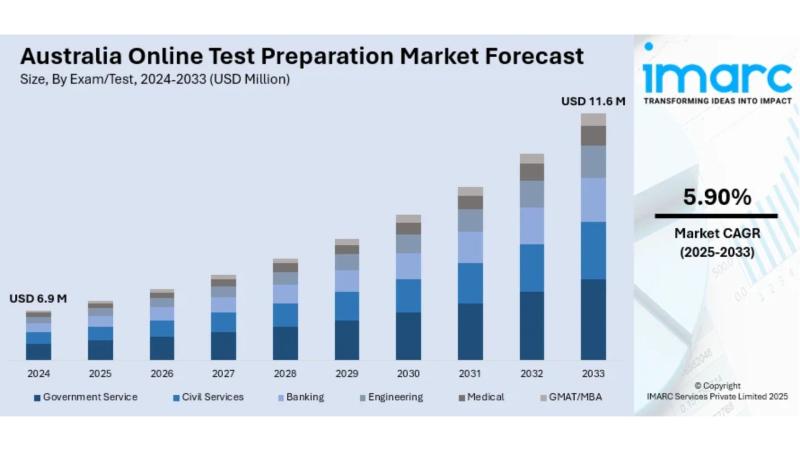

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…