Press release

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

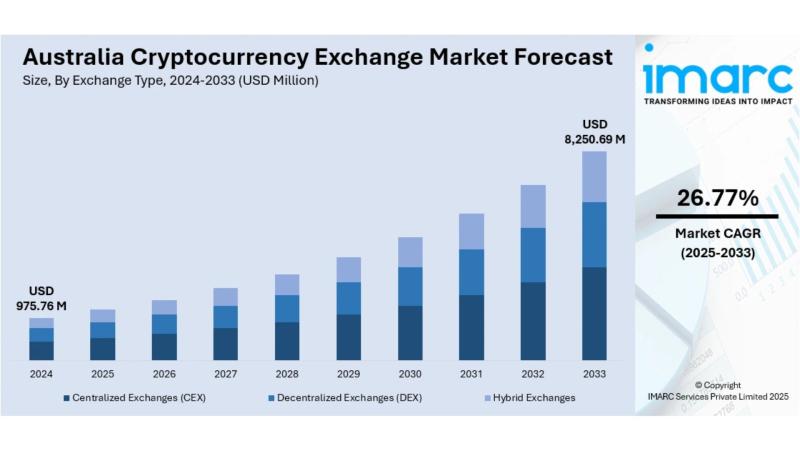

Australia Cryptocurrency Exchange Market OverviewMarket Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a CAGR of 26.77% during 2025-2033.

How Automation and Institutional Adoption are Transforming Australia's Crypto Trading Landscape

• Automated Trading Revolution: OKX Australia introduced two innovative bots in February 2025 - the Spot Grid Bot and DCA Martingale Bot - enabling users to automate strategies, trade 24/7, and manage risks better, with Australian trading volumes doubling following the advent of automated trading tools.

• Institutional Derivatives Milestone: Kraken launched its licensed crypto derivatives product for wholesale clients in November 2024, enabling institutional investors to trade crypto-based derivatives without holding underlying assets, with multi-collateral support and comprehensive risk management options strengthening Australia's position as an institutional crypto destination.

• Cryptocurrency Ownership Surge: The Independent Reserve Cryptocurrency Index revealed that 32.5% of Australians currently own or have owned cryptocurrency, marking a record high in adoption, with 57.3% of crypto investors reporting profits and 20.5% investing USD 500 or more monthly.

• International Exchange Expansion: WhiteBIT, Europe's largest cryptocurrency exchange by traffic, officially launched in Australia in April 2025, registered with AUSTRAC as a Digital Currency Exchange Provider, targeting the 9.6% of Australians already owning digital assets with fast, secure transactions and comprehensive trading tools.

• Regulatory Framework Excellence: The Australian government's clear regulatory guidelines through ASIC and AUSTRAC covering cryptocurrency taxation, exchange licensing, anti-money laundering protocols, and consumer protections have enhanced market stability, investor confidence, and eliminated fraudulent entities while building credibility.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-cryptocurrency-exchange-market/requestsample

Australia Cryptocurrency Exchange Market Trends & Drivers:

Australia's cryptocurrency exchange sector is experiencing explosive growth driven by technological innovations that are fundamentally changing how Australians trade digital assets. The introduction of OKX's Spot Grid Bot and DCA Martingale Bot in February 2025 represents more than just new features - it's a paradigm shift enabling retail traders to implement sophisticated strategies previously available only to professional investors. These automated tools allow users to set specific parameters for buying and selling based on price ranges, executing trades continuously without human intervention. The doubling of Australian trading volumes following automated tool adoption demonstrates massive pent-up demand for accessible, efficient trading solutions. This automation trend reflects broader market evolution where investors seek maximum returns with minimal active management, reducing entry barriers for newcomers while empowering experienced traders with institutional-grade capabilities through user-friendly interfaces.

The institutional investment wave sweeping through Australia's crypto market is transforming the industry from speculative retail playground to legitimate asset class attracting sophisticated capital. Kraken's November 2024 launch of licensed derivatives products for wholesale clients marks a watershed moment - institutional investors can now trade crypto-based derivatives with multi-collateral support and comprehensive risk management without directly holding volatile underlying assets. This development, combined with stringent regulatory compliance and adherence to local frameworks, establishes trust among institutional players including banks, hedge funds, and asset managers previously hesitant about crypto exposure. The Independent Reserve data showing 32.5% cryptocurrency ownership among Australians, with 57.3% reporting profits and significant monthly investments, demonstrates that

Australia has moved beyond early adoption phase into mainstream acceptance. This institutional participation brings increased liquidity, price discovery efficiency, and market maturity that attracts additional capital and talent.

International exchange expansion into Australia signals global recognition of the country's exceptional regulatory environment and sophisticated investor base. WhiteBIT's April 2025 launch exemplifies this trend - Europe's largest exchange by traffic specifically chose Australia for its AUSTRAC registration, targeting the 9.6% of Australians owning digital assets. This international influx creates competitive pressure driving innovation, reducing fees, and improving service quality across the ecosystem. The clear regulatory framework established by ASIC and AUSTRAC provides certainty that international operators require when entering new markets. Guidelines covering taxation, licensing, anti-money laundering protocols, and consumer protections create level playing field where legitimate exchanges thrive while fraudulent operators are eliminated. This regulatory clarity, combined with Australia's fintech ecosystem strength, advanced digital infrastructure, and tech-savvy population, positions the country as Asia-Pacific's premier cryptocurrency trading hub attracting continued investment from global exchange operators seeking stable, growth-oriented markets.

Australia Cryptocurrency Exchange Industry Segmentation:

The report has segmented the market into the following categories:

Exchange Type Insights:

• Centralized Exchanges (CEX)

• Decentralized Exchanges (DEX)

• Hybrid Exchanges

Cryptocurrency Type Insights:

• Bitcoin (BTC)

• Ethereum (ETH)

• Stablecoins

• Altcoins

• Meme Coins and Emerging Tokens

User Type Insights:

• Retail Traders

• Institutional Investors

• High-Frequency Traders

Revenue Model Insights:

• Transaction Fees

• Subscription-Based Models

• Listing Fees

• Staking and Yield Farming Services

Trading Services Insights:

• Spot Trading

• Futures and Derivatives Trading

• Margin Trading

• Peer-to-Peer (P2P) Trading

Breakup by Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Recent News and Developments in Australia Cryptocurrency Exchange Market

• February 2025: OKX Australia introduced two innovative automated trading bots - the Spot Grid Bot and DCA Martingale Bot - enabling users to automate strategies, trade 24/7, and manage risks better, with Australian trading volumes doubling following adoption of these automated trading tools.

• April 2025: WhiteBIT, Europe's largest cryptocurrency exchange by traffic, officially launched its platform in Australia after registering with AUSTRAC as a Digital Currency Exchange Provider, offering fast, secure transactions and comprehensive trading tools targeting the 9.6% of Australians already owning digital assets.

• November 2024: Kraken launched its licensed crypto derivatives product catering to wholesale clients, enabling institutional investors to trade crypto-based derivatives without holding underlying assets, with multi-collateral support and comprehensive risk management options strengthening Australia's institutional crypto infrastructure.

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask analyst for customized report:

https://www.imarcgroup.com/request?type=report&id=36213&flag=E

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033 here

News-ID: 4228545 • Views: …

More Releases from IMARC Services Private Limited

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

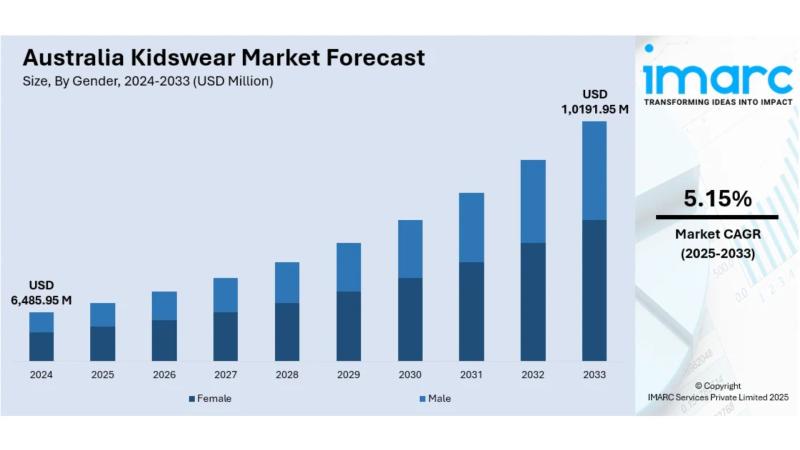

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

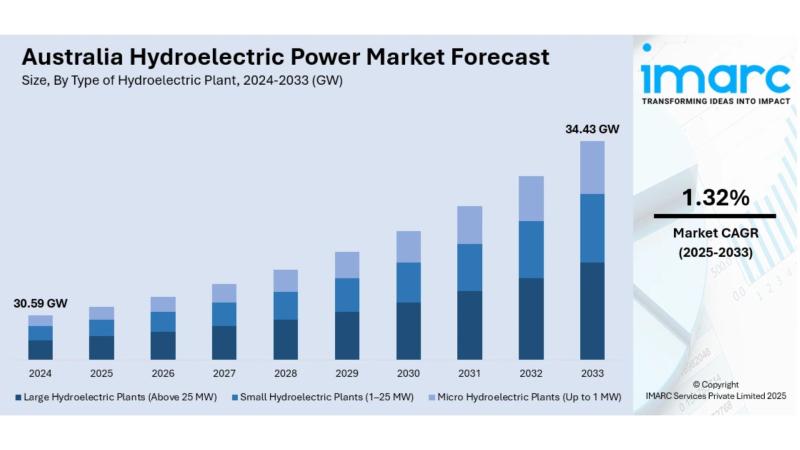

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

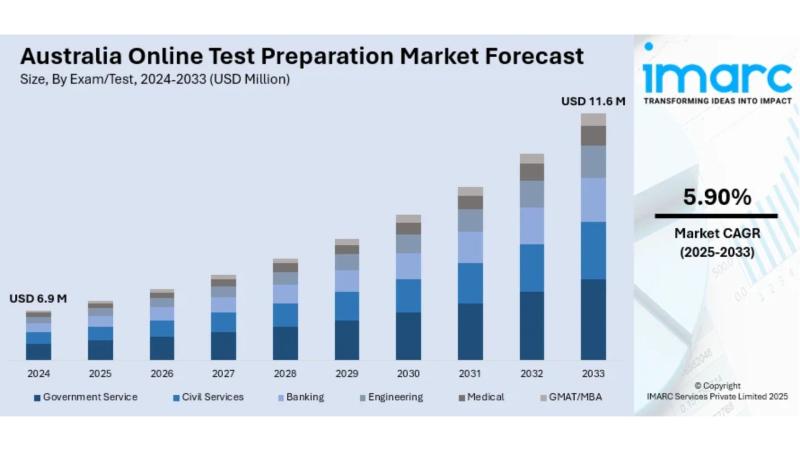

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

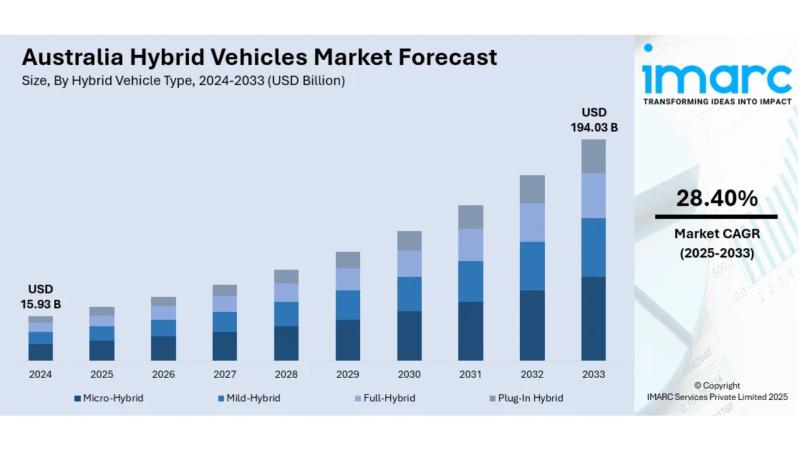

Australia Hybrid Vehicles Market: Industry Trends, Share | 2025-2033

Market Size in 2024: USD 15.93 Billion

Market Size in 2033: USD 194.03 Billion

Market Growth Rate 2025-2033: 28.40%

According to IMARC Group's latest research publication, "Australia Hybrid Vehicles Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia hybrid vehicles market size was valued at USD 15.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 194.03 Billion by 2033, exhibiting a CAGR of 28.40% during…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…