Press release

Real-Time Payments Market Landscape to 2034: Key Forces Shaping the Next Decade of Growth

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Real-Time Payments Market Size By 2025?

The scale of the real-time payments market has experienced a significant surge in recent years. The market, which is projected to expand from $37.22 billion in 2024 to approximately $48.61 billion in 2025, will see a compound annual growth rate (CAGR) of 30.6%. Factors contributing to this historic growth period include an increased consumer thirst for immediate satisfaction, widespread uptake of mobile products and digital wallets, global and cross-border trade, legislative interventions, and the rise of e-commerce.

How Big Is the Real-Time Payments Market Size Expected to Grow by 2029?

The market for real-time payments is anticipated to experience a surge in the coming years, reaching a size of $166.18 billion by 2029, growing at a compound annual growth rate (CAGR) of 36.0%. Factors such as the growing need for business efficiency, evolving customer habits, improved security protocols, increased efforts towards financial inclusion, and the emergence of central bank digital currencies (CB*DCS) are likely to contribute to the growth seen in the forecast period. Key trends to look out for during this period include the integration of open banking and APIs, the rise of peer-to-peer (P2P) and social payments, the application of blockchain and distributed ledger technology, the increased use of real-time payroll and business payments, and enhancements in customer experience.

View the full report here:

https://www.thebusinessresearchcompany.com/report/real-time-payments-global-market-report

Which Key Market Drivers Powering Real-Time Payments Market Expansion and Growth?

The surge in smartphone use is anticipated to spur on the growth of the real-time payment market. Smartphones are hand-held electrical devices that synergize computer capabilities with advanced features previously not seen in telephones, such as an operating system, internet access, and the ability to run software applications. The global popularity of smartphones has eased the process of real-time payment transactions, making smartphone payments a preferred option for many individuals. As an example, as per the GSMA, a non-profit organization based in the U.K., as of October 2023, 4.6 billion people are utilizing mobile internet, almost 4 billion of which use smartphones, thereby encompassing almost half, 49%, of the world's population. To add on, about 600 million people, equating to 8% of the world's population, are accessing the internet through feature phones. This underscores the crucial role of mobile devices in connecting the world. There is an apparent preference for smartphones over feature phones for accessing the internet. Consequently, the escalating proliferation of smartphones is fueling the growth of the real-time payment market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6864&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Real-Time Payments Market?

The rise of technological innovations has become a notable trend in the real-time payments market. Numerous dominant corporations in this sector are prioritizing the advancement of new technologies to maintain their market foothold. For instance, in April 2022, IBM, a prominent US tech company involved in the real-time payments industry, introduced a next-gen mainframe equipped with artificial intelligence. This latest IBM z16 processor is able to facilitate deep learning-based fraud detection for all transactions.

What Are the Emerging Segments in the Real-Time Payments Market?

The real-time paymentsmarket covered in this report is segmented -

1) By Component: Solutions, Services

2) By Type: Person-To-Person (P2P), Person-To-Business (P2B), Business-To-Person (B2P), Others (Business-To-Government (B2G), Government-To-Business (G2B), Business-To-Business (B2B), Person-To-Government (P2G), And Government-To-Person (G2P))

3) By Enterprise Size: Small And Medium-Sized Enterprises (SMEs), Large Enterprises

4) By Deployment: On-Premise, Cloud

5) By End Users: Retail And E-commerce, Government And Utilities, Healthcare, Telecom And IT, Travel And Hospitality, BFSI, Other End-Users

Subsegments:

1) By Solutions: Payment Processing Solutions, Payment Gateway Solutions, Fraud Detection And Prevention Solutions, Real-Time Payment Systems

2) By Services: Consulting Services, Integration Services, Maintenance And Support Services, Managed Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=6864&type=smp

Who Are the Global Leaders in the Real-Time Payments Market?

Major companies operating in the real-time payments market include ACI Worldwide Inc., FIS Corporation, Fiserv Inc., Mastercard Inc., Visa Inc., Temenos AG, Wirecard AG, Capgemini SE, Finastra Limited, Montran Corporation Ltd., Ripple Labs Inc., PelicanFast, IntegraPay Pty Ltd., Worldpay Inc., Volante Technologies Inc., PayPal Holdings Inc., Square Inc., Stripe Inc., Worldline SA, Global Payments Inc., Adyen N. V., Ant Financial Services Group, Apple Inc., Google LLC, Samsung Electronics Co. Ltd., Tencent Holdings Limited, Paytm (One97 Communications Ltd. ), PayU (Naspers Ltd. ), Dwolla Inc., TransferWise Ltd.

Which are the Top Profitable Regional Markets for the Real-Time Payments Industry?

Asia-Pacific was the largest region in the real-time payments market in 2024.North America is expected to be the fastest-growing region in the forecast period. The regions covered in the real-time payments market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6864

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Real-Time Payments Market Landscape to 2034: Key Forces Shaping the Next Decade of Growth here

News-ID: 4224234 • Views: …

More Releases from The Business Research Company

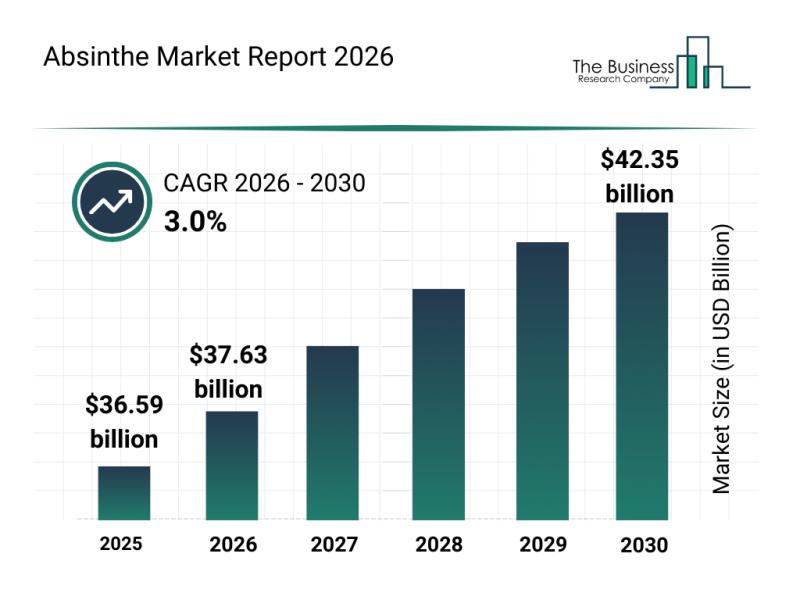

Future Perspective: Key Trends Shaping the Absinthe Market Up to 2030

The absinthe market is poised for steady expansion as consumer interest in unique and premium spirits grows. With evolving tastes and a surge in cocktail culture, the demand for absinthe is increasing, supported by innovations and a renewed appreciation for traditional and craft variants. The following analysis explores the market size forecast, leading companies, emerging trends, and segmentation details shaping this niche alcoholic beverage sector.

Projected Growth Trajectory of the Absinthe…

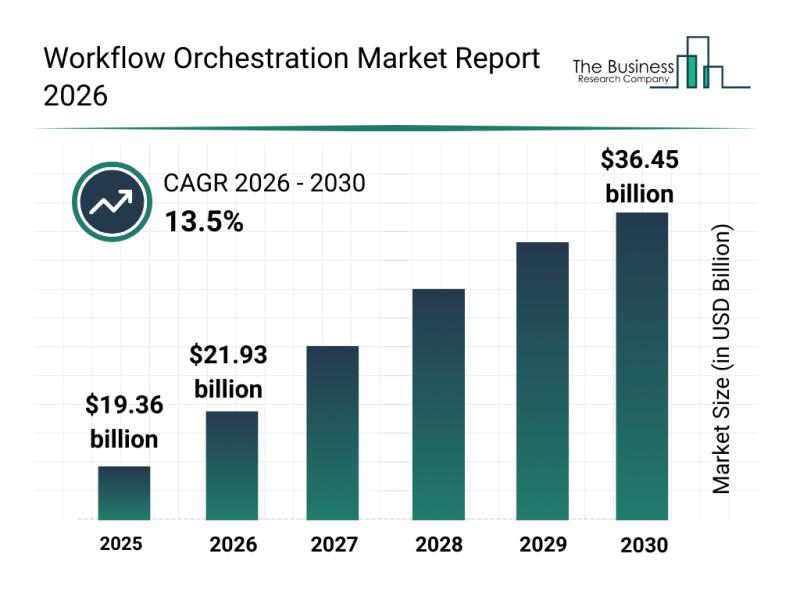

Analysis of Key Market Segments Driving the Workflow Orchestration Market

The workflow orchestration market is positioned for significant expansion over the coming years, driven by technological advancements and evolving business needs. As organizations increasingly seek to automate and streamline processes, this sector is attracting substantial investment and innovation. Let's explore the market's expected growth, key players, emerging trends, and main segments shaping its future.

Projected Market Value and Growth Drivers in the Workflow Orchestration Market

The workflow orchestration market is…

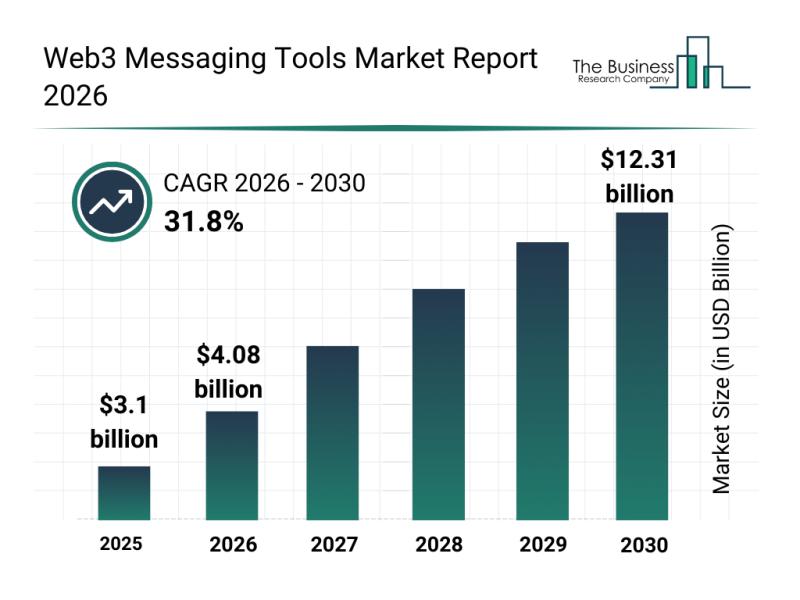

Market Trend Analysis: The Impact of Recent Advances on the Web3 Messaging Tools …

The Web3 messaging tools market is on the brink of remarkable growth, driven by the expanding use of decentralized communication technologies. As businesses and individual users increasingly seek secure, censorship-resistant messaging platforms, this sector is expected to undergo significant transformation. Let's explore the market size projections, leading companies, key trends, and the segmentation that define the future of Web3 messaging tools.

Projected Expansion of the Web3 Messaging Tools Market Size Through…

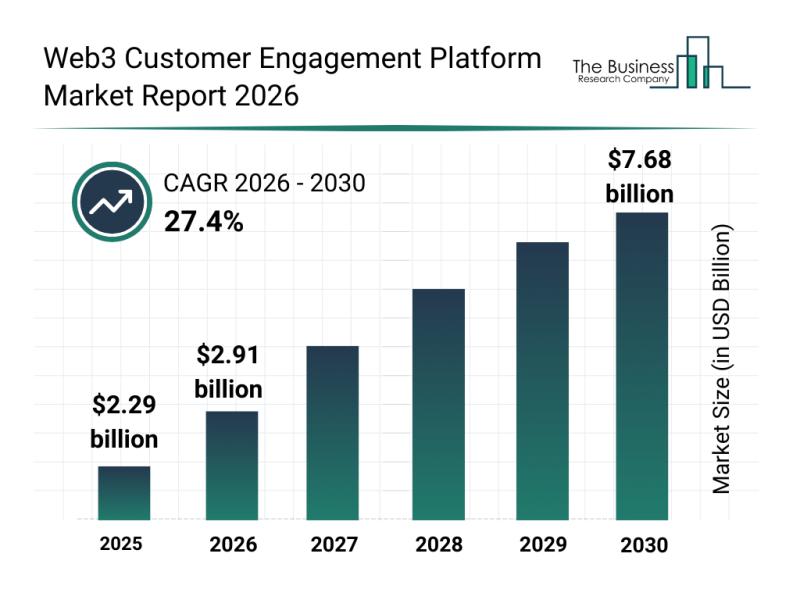

Emerging Growth Patterns, Segment Analysis, and Competitor Approaches Influencin …

The Web3 customer engagement platform sector is on the verge of remarkable growth, driven by increasing interest in decentralized technologies and blockchain applications. This emerging market is rapidly evolving as businesses seek innovative ways to engage customers through new digital experiences. Let's explore the market's projected value, key players, influential trends, and the segment breakdown shaping the future of Web3 engagement platforms.

Projected Market Value and Growth Potential of the Web3…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…