Press release

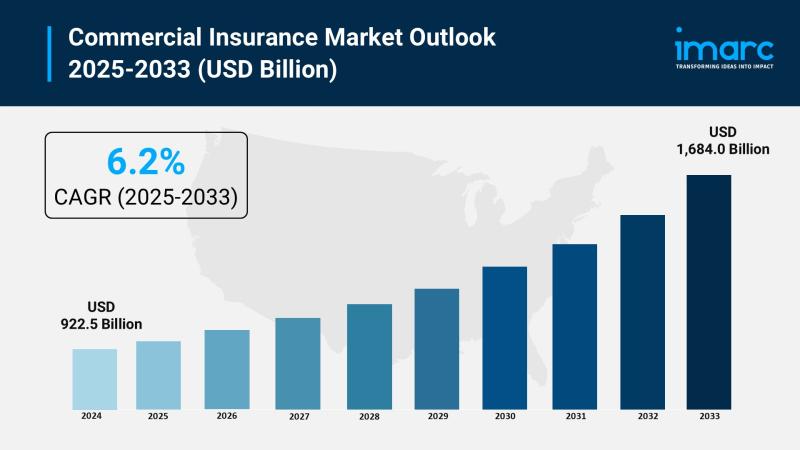

Commercial Insurance Market Size Worth USD 1,684.0 Billion Globally by 2033 at a CAGR of 6.2%

Market Overview:The commercial insurance market is experiencing rapid growth, driven by digital transformation reshaping, evolving risk landscape, demand for customization. According to IMARC Group's latest research publication, "Commercial Insurance Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global commercial insurance market size was valued at USD 922.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,684.0 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/commercial-insurance-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends And Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Factors Affecting the Growth of the Commercial Insurance Market:

● Digital Transformation Reshaping

Technology adoption is transforming the commercial insurance market worldwide. AI-powered claim assessment tools are speeding up processing in the US, while Europe leverages IoT sensors for real-time property monitoring. Cloud-based platforms enable insurers to scale operations efficiently, and blockchain solutions in Australia reduce fraud risk and enhance trust. Digital marketing via social media, webinars, and professional networks boosts client engagement. Urban centers lead in adopting digital tools, but smaller towns face affordability challenges. By 2033, digital transformation will ensure insurers deliver faster, more transparent services while improving operational efficiency and customer satisfaction across global markets.

● Evolving Risk Landscape

Emerging risks are reshaping commercial insurance offerings globally. Climate-related events, such as floods and wildfires, are driving demand for property coverage in the US and Europe. Cyber threats, including ransomware and phishing attacks, are pushing firms to adopt specialized policies. Geopolitical uncertainties and trade risks in Japan and Asia create new coverage needs. Autonomous vehicles, drone operations, and emerging tech liabilities in Australia are generating innovative insurance products. Companies increasingly require adaptive, multi-faceted policies that respond to fast-changing hazards. By 2033, insurers who can anticipate and manage these evolving risks will secure a competitive edge in dynamic markets.

● Demand for Customization

Businesses are seeking tailored insurance solutions to match unique operational needs. Modular policies in the US allow firms to select specific coverage, while European tech companies demand cyber-specific plans. Parametric insurance models in Japan offer fast payouts for pre-defined risks. Risk consulting and advisory services in Australia help firms minimize losses, enhancing the value of customized policies. Startups and SMEs increasingly prefer flexible offerings that balance coverage and cost. Insurers leveraging personalization, digital tools, and adaptive packages can cater to diverse sectors. Regulatory guidance ensures clarity and compliance, supporting the growth of customized insurance globally through 2033.

Key Trends in the Commercial Insurance Market:

● Increased Focus on Cyber Insurance

Cybersecurity concerns are driving significant growth in commercial insurance demand. Companies of all sizes are vulnerable to ransomware, data breaches, and phishing attacks. Insurers now offer coverage for data recovery, legal expenses, and crisis management. Cloud adoption, remote work, and connected devices make cyber risks more complex, increasing the need for specialized policies. For instance, financial institutions and retail chains hit by large-scale breaches highlight the importance of protection. This trend is making cyber insurance a core business necessity, not an optional add-on. By 2033, insurers providing proactive cyber risk coverage will gain strategic market advantage.

● Data-Driven Underwriting

Advanced analytics and AI are transforming underwriting processes. Insurers leverage big data from IoT devices, telematics, and operational metrics to assess risk more accurately. Businesses with monitored assets or smart logistics systems benefit from personalized premiums and predictive coverage. Automated platforms streamline claim assessment, detect fraud, and improve risk evaluation speed. This approach not only increases operational efficiency but also enhances customer satisfaction. Insurers adopting data-driven strategies can offer tailored pricing, rapid claims resolution, and proactive risk mitigation. By 2033, data-centric underwriting will become a standard practice, enabling insurers to compete effectively in a tech-enabled insurance ecosystem.

● Integrated Risk Management Solutions

Commercial clients are demanding holistic solutions beyond standard policies. Insurers are bundling coverage with digital tools, consultancy, and real-time monitoring to help organizations manage risk proactively. Services include safety audits, compliance guidance, and predictive analytics for sectors like manufacturing, healthcare, and logistics. Such integrated offerings position insurers as strategic partners rather than claim processors. Companies benefit from reduced operational disruptions, faster incident response, and improved regulatory compliance. By 2033, comprehensive risk management solutions will redefine market expectations, making insurers key collaborators in corporate risk strategy and long-term business resilience.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=5295&flag=E

Leading Companies Operating in the Global Commercial Insurance Industry:

● Allianz SE

● American International Group Inc.

● Aon plc

● Aviva plc

● Axa S.A.

● Chubb Limited

● Direct Line Insurance Group plc

● Marsh & McLennan Companies Inc.

● Willis Towers Watson Public Limited Company

● Zurich Insurance Group Ltd.

Commercial Insurance Market Report Segmentation:

Breakup By Type:

● Liability Insurance

● Commercial Motor Insurance

● Commercial Property Insurance

● Marine Insurance

● Others

Liability insurance represents the largest segment because businesses face various risks related to third-party injuries, damages, or legal claims, making liability coverage essential for protecting operations.

Breakup By Enterprise Size:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share as they typically require more extensive coverage for their complex operations, higher assets, and greater exposure to risks.

Breakup By Distribution Channel:

● Agents and Brokers

● Direct Response

● Others

Agents and brokers exhibit a clear dominance in the market owing to their personalized services, expert advice, and businesses navigation insurance products.

Breakup By Industry Vertical:

● Transportation and Logistics

● Manufacturing

● Construction

● IT and Telecom

● Healthcare

● Energy and Utilities

● Others

Transportation and logistics hold the biggest market share due to the significant risks associated with the movement of goods, including accidents, delays, and cargo loss.

Breakup By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America enjoys the leading position in the commercial insurance market on account of its established insurance infrastructure, rising demand from diverse industries, and a robust regulatory framework.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Insurance Market Size Worth USD 1,684.0 Billion Globally by 2033 at a CAGR of 6.2% here

News-ID: 4222860 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…