Press release

Vietnam Bancassurance Market to Hit USD 9,494.85 Million by 2033 with a Robust CAGR of 5.18%

Vietnam Bancassurance Market OverviewBase Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 6,026.84 Million

Market Forecast in 2033: USD 9,494.85 Million

Market Growth Rate 2025-2033: 5.18%

The Vietnam bancassurance market size reached USD 6,026.84 Million in 2024. Looking forward, the market is projected to reach USD 9,494.85 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The market is driven by exclusive bank-insurer alliances, expanding middle-class purchasing power, and rapid digital transformation. Financial literacy initiatives and bundled offerings are improving adoption in both urban and emerging markets. Technology integration through APIs, AI tools, and mobile onboarding, has streamlined sales and claims processes, further strengthening distribution efficiency, thereby augmenting the Vietnam bancassurance market share.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/vietnam-bancassurance-market/requestsample

Vietnam Bancassurance Market Trends and Drivers:

The Vietnamese bancassurance landscape is undergoing a fundamental paradigm shift, moving beyond the initial phase of mere distribution channel utilization. The market is maturing beyond simplistic, high-volume, savings-linked product pushes, which characterized its early growth. Leading banks and insurers are now forging deeply integrated, strategic partnerships focused on creating long-term customer value and enhancing lifetime engagement. This evolution is driven by heightened regulatory scrutiny aimed at ensuring product suitability and transparent sales practices, compelling institutions to prioritize customer needs over short-term commission gains. The focus is now on developing sophisticated, needs-based advisory models where bank staff act as certified financial advisors, leveraging advanced customer relationship management systems and data analytics to provide holistic portfolio reviews. This shift is fostering the development of more innovative and relevant product suites, including standalone protection products like critical illness and permanent health insurance, which are sold on their own merits rather than as ancillary additions to a savings plan. This strategic deepening of partnerships is not just a regulatory response but a crucial competitive differentiator, as financial institutions recognize that sustainable, profitable growth in bancassurance is intrinsically linked to customer trust and perceived value, ultimately securing a more resilient and loyal deposit base for the banks.

Digital transformation is no longer an aspirational goal but a core operational imperative reshaping the delivery and consumption of bancassurance in Vietnam. The integration of Application Programming Interfaces (APIs) is creating seamless, embedded insurance experiences within mobile banking platforms, allowing customers to purchase, manage, and claim on micro-insurance or simple protection products in a few clicks. This is giving rise to the dominant "phygital" model, which strategically blends digital efficiency with human expertise. For instance, a customer might receive an AI-driven personalized insurance need analysis through their banking app, followed by an automated invitation to a face-to-face consultation with a bancassurance specialist at their local branch for complex financial planning. This hybrid approach optimizes the customer journey, using technology for education, initial quotes, and administrative ease, while reserving human interaction for high-value advisory, complex case underwriting, and claims support. Furthermore, insurers are leveraging the banks' vast transactional data through sophisticated analytics and machine learning to move from reactive selling to predictive modeling, identifying life events-such as a mortgage approval, a car loan, or a surge in savings-that signal a specific insurance need, enabling hyper-personalized, timely, and relevant product offerings that significantly increase conversion rates and customer satisfaction.

The future growth trajectory of Vietnam's bancassurance market is increasingly dependent on significant product innovation and a strategic diversification beyond the traditional dominance of single-premium, savings-linked life policies. While these products were instrumental in initial market penetration, a saturation point is being approached in certain customer segments, prompting a push towards more specialized and granular risk protection solutions. A clear trend is the rapid expansion of the non-life or general insurance segment within bank channels, particularly in areas like mortgage protection insurance, personal accident, travel, and comprehensive health insurance products. This is complemented by the creation of bespoke offerings for the bank's affluent and mass-affluent segments, including unit-linked insurance plans (ULIPs) that combine investment and protection, and annuity products targeting the nascent but rapidly growing retirement planning sector. Concurrently, there is a burgeoning demand for cyber insurance for SMEs and customized commercial lines for corporate banking clients, representing a high-growth, high-margin frontier. This strategic broadening of the product portfolio is essential for tapping into underpenetrated market segments, mitigating the cyclical risks associated with a mono-product focus, and building a more stable and diversified revenue stream for both banks and their insurance partners, ensuring long-term market vitality.

Vietnam Bancassurance Market Industry Segmentation:

Product Type Insights:

Life Bancassurance

Non-Life Bancassurance

Model Type Insights:

Pure Distributor

Exclusive Partnership

Financial Holding

Joint Venture

Regional Insights:

Northern Vietnam

Central Vietnam

Southern Vietnam

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Request Customization: https://www.imarcgroup.com/request?type=report&id=41534&flag=E

Key highlights of the Report:

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter's Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Vietnam Bancassurance Market to Hit USD 9,494.85 Million by 2033 with a Robust CAGR of 5.18% here

News-ID: 4222591 • Views: …

More Releases from IMARC Group

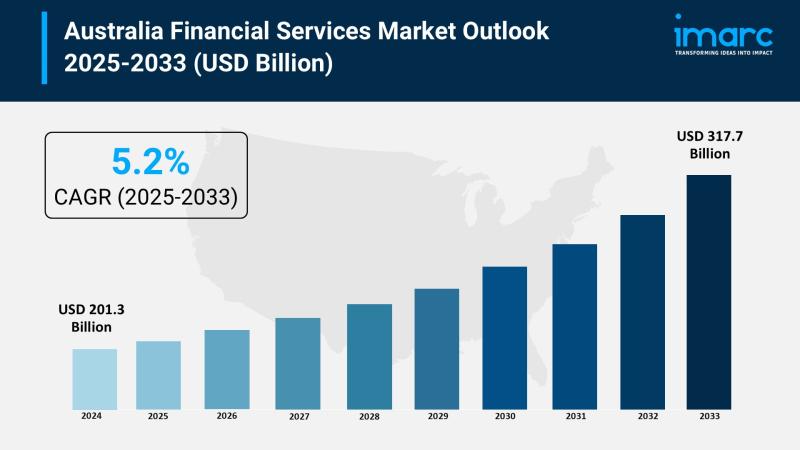

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

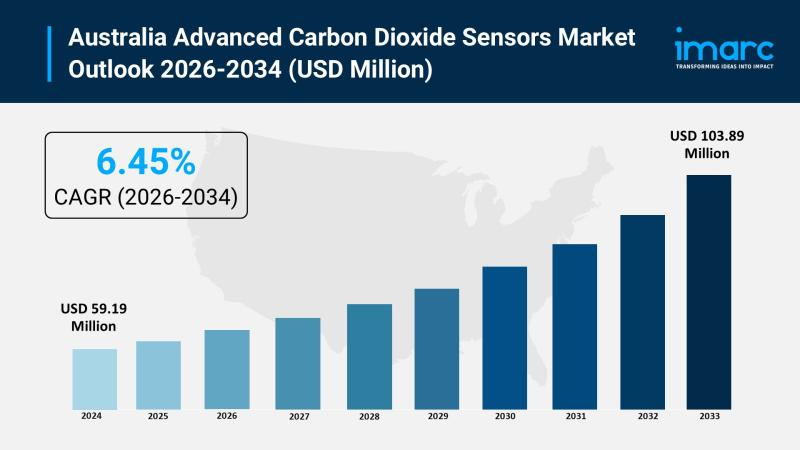

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

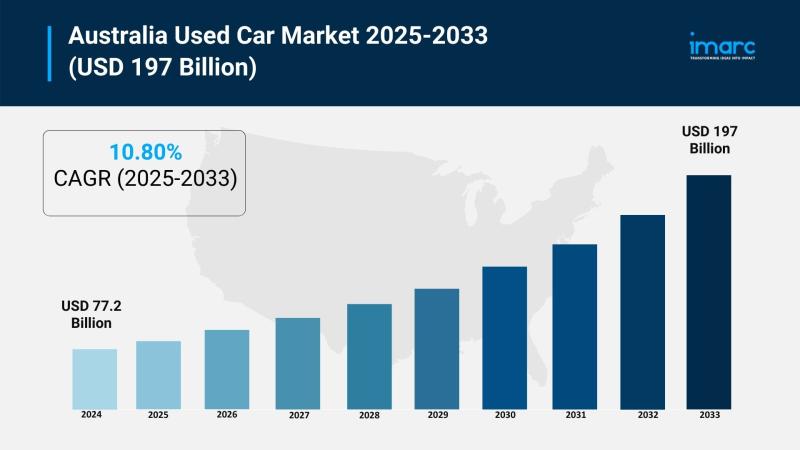

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

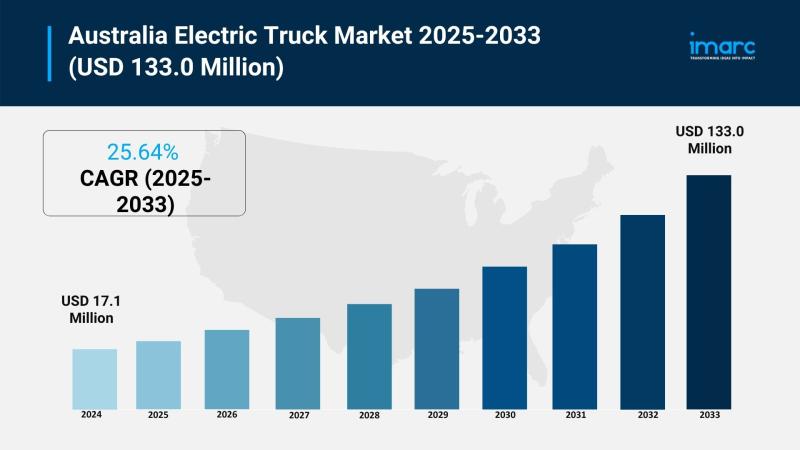

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Vietnam

Vietnam Marvel Travel: Redefining Premium Travel Experiences Across Vietnam

Vietnam Marvel Travel, a leading premium travel agency in Vietnam, is redefining how international and domestic travelers explore the country through high-quality tours, luxury cruises, and tailor-made travel experiences. With a strong focus on service excellence, comfort, and authenticity, the company helps travelers discover Vietnam's most iconic landscapes and cultural destinations with ease and confidence.

Vietnam, 29th Dec 2025 - Vietnam Marvel Travel's vision is to become a trusted premium travel…

Vietnam beverages Market : Key Findings for Market Analysis and Business Plannin …

Vietnam beverages Market Analysis and Forecast, 2019-2028

The Vietnam beverages market was over US$ 2.5 billion in 2019 and is expected to grow at a CAGR of around 14.2% over the forecast period of 2022-2028.

Market Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market for the historical period of 2019-2021 and the forecast…

Vietnam beverages Market | Outlook and Opportunities: A Forecast of Growth, Inve …

Vietnam beverages Market Analysis and Forecast, 2022-2028

The Vietnam beverages market was US$ 480 Bn in 2021 and is expected to grow at a CAGR of around 12.5% over the forecast period of 2022-2028.

Download PDF Sample of beverages Market report @ https://www.themarketinsights.com/request-sample/280160

Market Scope & Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market…

Vietnam beverages market Key Information By Top Key Player | Sabeco, Heineken Vi …

The Vietnam beverages market was over US$ 2.5 billion in 2019 and is expected to grow at a CAGR of around 14.2% over the forecast period of 2022-2028.

Market Scope & Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market for the historical period of 2019-2021 and the forecast period of 2022-2028 based…

Vietnam Agriculture Market, Vietnam Agriculture Industry, Vietnam Agriculture Li …

Agriculture has always been of pronounced importance for Vietnam, as feeding the realm’s largest population is not a relaxed task. The Vietnam government has been associate the agriculture industry with a number of policies, demanding to alleviate the output and seeking methods to ensure the sector is developing healthily and sustainably. The Vietnam federal government has been decidedly supportive of agriculture for decades, and there is extensive political consensus as…

The Baby Food Sector in Vietnam, 2018 Key Trends and Opportunities By Vietnam Da …

"The Baby Food Sector in Vietnam, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Vietnamese market.

Vietnamese mothers have prepared fresh food for their babies but, as the economy has developed and more women have been drawn into the urban workplace, these mothers have increasingly found they have less time to spend preparing food and to spend with their…