Press release

Australia Managed Services Market Projected to Reach USD 11,437.62 Million by 2033

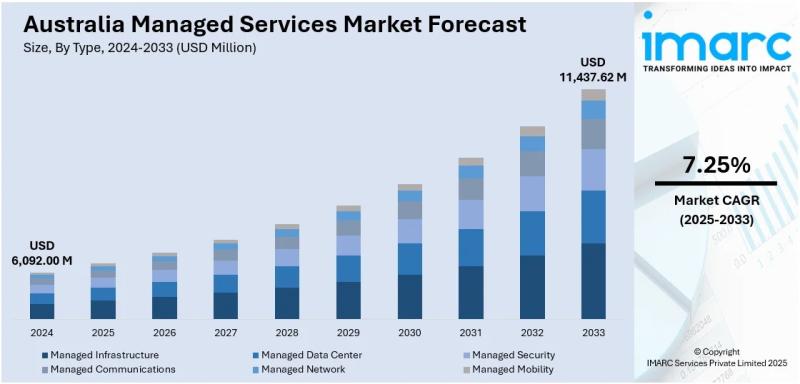

The latest report by IMARC Group, titled "Australia Managed Services Market Report by Type (Managed Infrastructure, Managed Data Center, Managed Security, Managed Communications, Managed Network, Managed Mobility), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End Use (IT and Telecommunication, BFSI, Healthcare, Entertainment and Media, Retail, Manufacturing, Government, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia managed services market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia managed services market size reached USD 6,092.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,437.62 Million by 2033, exhibiting a CAGR of 7.25% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 6,092.00 Million

Market Forecast in 2033: USD 11,437.62 Million

Market Growth Rate (2025-2033): 7.25%

Australia Managed Services Market Overview

The Australia managed services market is experiencing robust growth driven by rising reliance on managed service providers to monitor cloud performance and ensure regulatory compliance, growing adoption of cloud computing across diverse industries, increasing smartphone penetration supporting mobile workforce requirements, expanding remote work models requiring continuous infrastructure management, escalating cybersecurity threats demanding specialized security services, and digital transformation initiatives across finance, healthcare, education, and retail sectors. The market expansion is supported by bring-your-own-device (BYOD) workplace practices, hybrid cloud environment complexities, 24/7 support requirements, and cost optimization priorities reducing capital expenses through managed solutions. Enhanced service portfolios including disaster recovery, data analytics, real-time troubleshooting, and compliance management are positioning Australia's managed services market for sustained growth and critical business infrastructure support.

Australia's managed services industry demonstrates strong technological capabilities through comprehensive IT infrastructure management, advanced cybersecurity solutions, and scalable service delivery models addressing diverse organizational needs across enterprise sizes and industry verticals. The market maintains broad application across IT and telecommunications, banking and financial services, healthcare, entertainment and media, retail, manufacturing, and government sectors with specialized services addressing specific operational requirements and regulatory compliance obligations. The proliferation of cloud-based collaboration tools, mobile device integration, and hybrid infrastructure deployment is creating favorable market conditions, requiring substantial investments in security protocols, monitoring systems, and technical support capabilities. Australia's strategic focus on digital transformation acceleration, combined with growing recognition of managed services as essential business enablers rather than cost centers, makes it an increasingly dynamic market for IT service innovation and enterprise technology optimization.

Request For Sample Report:

https://www.imarcgroup.com/australia-managed-services-market/requestsample

Australia Managed Services Market Trends

• Cloud computing adoption acceleration: Rapid transition to cloud-based systems creating complex hybrid environment management requirements, with businesses depending on managed service providers for performance monitoring, resource management, and local and international regulatory compliance assurance.

• Remote work infrastructure expansion: Growing prevalence of remote work arrangements driving demand for cloud-based collaboration tools, mobile workforce support, and continuous infrastructure management ensuring service availability and employee productivity across distributed teams.

• Cybersecurity service prioritization: Escalating cyber threat landscape compelling organizations to engage managed security service providers offering specialized expertise, real-time threat monitoring, incident response capabilities, and comprehensive data protection solutions.

• Mobile workforce management growth: Rising smartphone penetration with 3.98 million units sold in first half of 2024 (8% increase) driving managed mobility services addressing device security, application management, and BYOD policy implementation.

• Digital transformation imperative: Comprehensive business modernization initiatives across finance, healthcare, education, and retail sectors requiring managed services support for technology implementation, system integration, and operational optimization.

• Cost optimization focus: Organizations prioritizing capital expense reduction through managed services adoption enabling access to enterprise-grade infrastructure, expertise, and support without substantial upfront investments in technology and specialized personnel.

Market Drivers

• Cloud infrastructure complexity: Increasing adoption of hybrid and multi-cloud environments creating management challenges including data security, performance optimization, resource allocation, and compliance assurance requiring specialized managed service provider expertise.

• Regulatory compliance requirements: Stringent local and international data protection, privacy, and industry-specific regulations demanding continuous monitoring, documentation, and compliance management services ensuring organizational adherence and risk mitigation.

• IT resource constraints: Limited internal IT team capacity struggling with expanding technology requirements, 24/7 support demands, and specialized skill needs driving outsourcing to managed service providers for comprehensive infrastructure management.

• Business continuity priorities: Growing recognition of disaster recovery, backup systems, and business continuity planning importance requiring managed services providing redundancy, rapid recovery capabilities, and operational resilience assurance.

• Smartphone integration requirements: Widespread mobile device adoption for business operations requiring managed mobility services ensuring secure access, data privacy, application updates, and seamless integration with enterprise systems and policies.

• Digital customer experience enhancement: Rising consumer expectations for seamless digital interactions compelling businesses to invest in managed services supporting customer-facing applications, real-time troubleshooting, and performance optimization for competitive differentiation.

Challenges and Opportunities

Challenges:

• Vendor dependency concerns with organizations relying heavily on external managed service providers creating potential risks related to service quality variability, contract lock-in scenarios, and limited control over critical business infrastructure

• Data security and privacy vulnerabilities associated with third-party access to sensitive business information and systems requiring robust security protocols, comprehensive service level agreements, and continuous oversight to maintain trust

• Service quality inconsistency across different managed service providers and service tiers creating selection difficulties for businesses evaluating vendor capabilities, pricing structures, and support quality before making long-term commitments

• Integration complexity with existing legacy systems and customized business applications requiring substantial coordination, technical expertise, and potential infrastructure modifications to ensure seamless managed service implementation

• Cost escalation risks with initial managed services pricing potentially increasing over time through contract renewals, scope expansion, and additional service requirements challenging budget planning and total cost of ownership calculations

Opportunities:

• Small and medium enterprise expansion targeting underserved SME segment requiring affordable, scalable managed services enabling access to enterprise-grade technology, cybersecurity protection, and expert support without large IT team investments

• Industry-specific solution development creating specialized managed services addressing unique requirements of healthcare, finance, retail, and manufacturing sectors including regulatory compliance, data handling protocols, and operational workflow optimization

• Artificial intelligence integration implementing AI-powered automation, predictive analytics, and intelligent monitoring systems enhancing managed service efficiency, reducing response times, and enabling proactive issue resolution before disruptions occur

• Cybersecurity services expansion responding to escalating threat landscape with comprehensive managed security offerings including threat intelligence, penetration testing, incident response, and compliance management for increasingly vulnerable organizations

• Hybrid work environment support developing specialized services addressing remote and hybrid workforce requirements including secure access solutions, collaboration platform management, and distributed infrastructure optimization supporting organizational flexibility

Australia Managed Services Market Segmentation

By Type:

• Managed Infrastructure

• Managed Data Center

• Managed Security

• Managed Communications

• Managed Network

• Managed Mobility

By Deployment Mode:

• On-premises

• Cloud-based

By Enterprise Size:

• Large Enterprises

• Small and Medium-sized Enterprises

By End Use:

• IT and Telecommunication

• BFSI (Banking, Financial Services, and Insurance)

• Healthcare

• Entertainment and Media

• Retail

• Manufacturing

• Government

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-managed-services-market

Australia Managed Services Market News (2024-2025)

• First Half 2024: Smartphone market recovery accelerated with sales rising 8% compared to 2023, reaching 3.98 million units, driving increased demand for managed mobility services addressing device security, application management, and BYOD policy implementation across organizations.

• 2024: Cloud computing adoption expanded significantly across finance, healthcare, education, and retail sectors, with Australia cloud computing market projected to reach USD 30.24 billion by 2032 at 10.60% CAGR, fueling managed services demand for infrastructure management.

• 2024: Remote work infrastructure investment accelerated as organizations implemented cloud-based collaboration tools requiring continuous management, security monitoring, and technical support from managed service providers ensuring operational continuity and employee productivity.

• 2024: Cybersecurity services prioritization intensified with escalating cyber threat landscape compelling businesses to engage managed security service providers offering specialized expertise, real-time monitoring, and comprehensive data protection solutions.

• 2024: Digital transformation initiatives expanded across industries with organizations leveraging managed services for technology implementation, system integration, legacy modernization, and operational optimization supporting competitive positioning and customer experience enhancement.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type, Deployment Mode, Enterprise Size, and End Use Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=33742&flag=F

Q&A Section

Q1: What drives growth in the Australia managed services market?

A1: Market growth is driven by cloud infrastructure complexity requiring specialized management expertise, regulatory compliance requirements demanding continuous monitoring and documentation, IT resource constraints limiting internal team capacity, business continuity priorities emphasizing disaster recovery, smartphone integration requirements supporting mobile workforce, and digital customer experience enhancement supporting competitive differentiation.

Q2: What are the latest trends in this market?

A2: Key trends include cloud computing adoption acceleration creating hybrid environment management needs, remote work infrastructure expansion requiring collaboration tool support, cybersecurity service prioritization addressing escalating threats, mobile workforce management growth driven by smartphone penetration, digital transformation imperative across multiple industries, and cost optimization focus reducing capital expenses.

Q3: What challenges do companies face?

A3: Major challenges include vendor dependency concerns creating control and quality risks, data security and privacy vulnerabilities associated with third-party access, service quality inconsistency across providers affecting selection decisions, integration complexity with legacy systems requiring substantial coordination, and cost escalation risks challenging long-term budget planning.

Q4: What opportunities are emerging?

A4: Emerging opportunities include small and medium enterprise expansion offering affordable scalable solutions, industry-specific solution development addressing unique sector requirements, artificial intelligence integration enhancing automation and predictive capabilities, cybersecurity services expansion responding to threat landscape, and hybrid work environment support addressing distributed workforce needs.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Managed Services Market Projected to Reach USD 11,437.62 Million by 2033 here

News-ID: 4222416 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

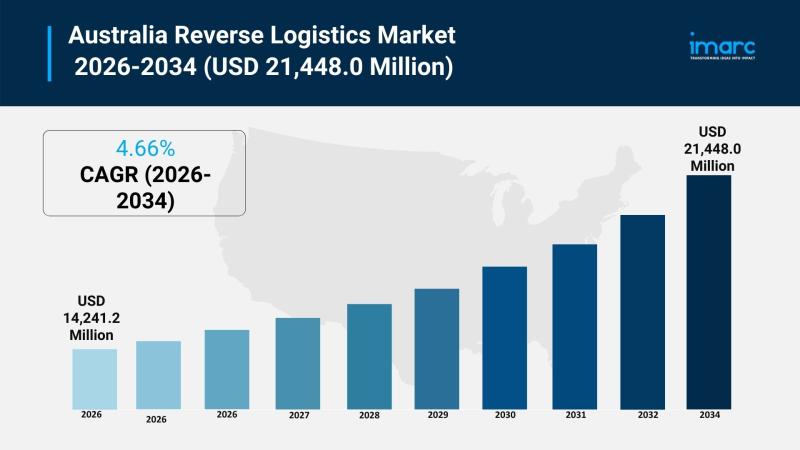

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for Managed

Managed IT Infrastructure Services Market by Solution (Managed Data Center, Mana …

Managed IT infrastructure services is an approach that combines together knowledge, procedures, and technology, which finally power the services that support business processes. Managed IT infrastructure services offer a sound business understanding to deploy or replace existing IT infrastructure. Without clearly defining business goals and process functionalities, selecting the right systems, applications, and technologies that meet business requirement, managed IT infrastructure services drives most of the critical tasks and thereby…

Managed Security Services Market Outlook to 2025 – Managed Firewall, Managed I …

Managed Security Services Market is expected to grow from US$ US$ 17716.7 Million in 2017 to US$ 61855.5 Million by 2025 at a CAGR of 16.9% between 2017 and 2025.

Worldwide Managed Security Services Market Analysis to 2025 is a specialized and in-depth study of the Managed Security Services Market with a focus on the global market trend. The report aims to provide an overview of global Managed Security Services Market…

IOT Managed Services Market By Type (Managed Security Services, Managed Device S …

IoT Managed Services Market is expected to grow at a CAGR of 23% during the forecast period 2017–2023. The market is growing due to the expansion of IoT throughout worldwide. IoT Managed Services Market is segmented by: managed Service Types, Verticals, and Regions. The major players included in this report such as Google, Apple, IBM, AT&T, Intel, Microsoft, Accenture, and many more.

IoT (Internet of Things) provides immense growth opportunity for…

IOT Managed Services Market By Type (Managed Security Services, Managed Device S …

IoT Managed Services Market is expected to grow at a CAGR of 23% during the forecast period 2017–2023. The market is growing due to the expansion of IoT throughout worldwide. IoT Managed Services Market is segmented by: managed Service Types, Verticals, and Regions. The major players included in this report such as Google, Apple, IBM, AT&T, Intel, Microsoft, Accenture, and many more.

IoT (Internet of Things) provides immense growth opportunity for…

Managed Network Services Market will reach nearly US$ 120 Bn in revenues by 2028 …

Increasing need for significant operational cost reductions, growing adoption of business analytics and cloud coupled with rising complexities in operations across several end use industries continue to influence demand for managed network services. The adoption of managed network services is also being influenced with a number of industry-specific factors including but not limited to growing need for high efficiency in business processes and customer satisfaction. Fact.MR envisages that the demand for…

Global IOT Managed Services Market By Type (Managed Security Services, Managed D …

IoT (Internet of Things) provides immense growth opportunity for managed service providers. Rising digital technology in the connected world will involve nearly 33 billion by 2023 and in this connected world managed services would be a critical component. Rising adoption of smart technologies in various verticals has generated IoT technologies. Moreover, growing number of connected devices will generate high demand for managed services. The IoT ecosystem includes devices, security, applications,…