Press release

Philippines Family Offices Market Worth USD 592.01 Million During 2025-2033

The latest report by IMARC Group, "Philippines Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033," provides an in-depth analysis of the Philippines family offices market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines family offices market size reached USD 412.00 million in 2024 and is projected to grow to USD 592.01 million by 2033, exhibiting a growth rate of 4.11% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 412.00 Million

Market Forecast in 2033: USD 592.01 Million

Growth Rate (2025-2033): 4.11%

Philippines Family Offices Market Overview:

The Philippines family offices market is experiencing steady growth driven by increasing wealth accumulation among affluent families creating demand for sophisticated wealth management and multigenerational succession planning, growing adoption of technology and digital solutions with advanced portfolio management software, AI, and cloud platforms enabling better investment tracking and real-time reporting, and emphasis on sustainable and impact investments focusing on renewable energy, green bonds, and ESG-friendly funds balancing profitability with social objectives. The market demonstrates consistent momentum fueled by professionalization and outsourcing of advisory services as families engage wealth managers, tax consultants, and legal advisors for complex financial and regulatory needs, structured governance systems including family constitutions and investment committees ensuring disciplined decision-making across generations, and younger generation involvement requesting greater transparency and ease of use positioning family offices as evolving financial management solution.

Request For Sample Report: https://www.imarcgroup.com/philippines-family-offices-market/requestsample

Philippines Family Offices Market Trends:

• Digital Transformation accelerating through portfolio management software, AI, and cloud platforms improving tracking and reporting

• ESG Integration expanding with investments in renewable energy, green bonds, and social businesses supporting sustainability

• Professional Services increasing through outsourcing to wealth managers, tax consultants, and investment planners

• Governance Structures strengthening via family constitutions and investment committees ensuring continuity

• Multi-Asset Management advancing across geographies requiring sophisticated compliance and security systems

• Impact Investing growing as families align wealth management with environmental and social objectives

• Next-Gen Engagement intensifying as younger generations demand transparency, accessibility, and modern solutions

Philippines Family Offices Market Drivers:

• Wealth Accumulation creating fundamental demand as affluent Filipino families require sophisticated management services

• Technology Adoption enabling efficiency through fintech solutions for risk assessment and automated reporting

• Sustainability Focus driving capital allocation toward ESG investments aligned with global climate awareness

• Succession Planning necessitating structured approaches for multigenerational wealth transfer and governance

• Regulatory Complexity requiring professional advisory services to navigate compliance and legal requirements

• Portfolio Diversification expanding across asset classes including alternatives, bonds, equities, and commodities

• Operational Efficiency improving through outsourced solutions providing advanced analytics and asset management

Market Challenges:

• High Setup Costs constraining market entry as establishing family offices requires substantial capital investment

• Talent Shortage limiting growth due to scarcity of experienced wealth management professionals in Philippines

• Regulatory Uncertainty creating compliance challenges with evolving financial regulations and reporting requirements

• Family Conflicts complicating governance as differing investment philosophies and succession expectations arise

• Limited Scale affecting smaller family offices unable to achieve economies of scale for operational efficiency

• Data Security posing risks as digitalization increases vulnerability to cyber threats and information breaches

• Market Volatility impacting portfolio performance and requiring sophisticated risk management strategies

Market Opportunities:

• Virtual Family Offices offering cost-effective solutions through technology-enabled services without physical infrastructure

• ESG Advisory providing specialized guidance on sustainable investments and impact measurement frameworks

• Digital Platforms developing comprehensive wealth management systems integrating analytics and reporting tools

• Education Programs establishing training initiatives for family members and next-generation wealth stewards

• Multi-Family Office Models enabling smaller families to access professional services through shared resources

• Alternative Investments expanding into private equity, real estate, and venture capital for diversification

• Philanthropy Services structuring charitable giving strategies and foundation management supporting social impact

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-family-offices-market

Philippines Family Offices Market Segmentation:

By Type:

• Single Family Office

• Multi-Family Office

• Virtual Family Office

By Office Type:

• Founder's Office

• Multi-Generational Office

• Investment Office

• Trustee Office

• Compliance Office

• Philanthropy Office

• Shareholder's Office

• Others

By Asset Class:

• Bonds

• Equalities

• Alternatives Investments

• Commodities

• Cash or Cash Equivalents

By Service Type:

• Financial Planning

• Strategy

• Governance

• Advisory

• Others

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Family Offices Market News:

October 2025: Philippines family offices market witnessed increased adoption of digital wealth management platforms as affluent families sought enhanced portfolio tracking and real-time reporting capabilities supporting data-driven investment decisions.

September 2025: Sustainable and impact investing gained momentum with family offices allocating larger portions of portfolios to ESG-friendly funds, renewable energy projects, and social businesses aligning financial returns with environmental objectives.

September 2025: Multi-family office models expanded across Metro Manila and key provincial cities offering shared professional services enabling smaller wealthy families to access sophisticated wealth management at reduced costs.

August 2025: Family offices increased engagement with third-party advisory services for succession planning, tax optimization, and regulatory compliance as younger generations assumed greater wealth management responsibilities.

Key Highlights of the Report:

• Market analysis projecting growth from USD 412.00 million (2024) to USD 592.01 million (2033) with 4.11% CAGR

• Technology adoption accelerating through AI, portfolio management software, and cloud platforms

• ESG integration expanding with focus on renewable energy, green bonds, and sustainable investments

• Professionalization increasing through outsourcing to wealth managers and specialized advisors

• Type segmentation covering single family office, multi-family office, and virtual family office models

• Service evaluation including financial planning, strategy, governance, and advisory offerings

• Regional assessment across Luzon, Visayas, and Mindanao with varying wealth concentration patterns

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines family offices market growth to USD 592.01 million by 2033?

A1: The market is driven by increasing wealth accumulation creating demand for sophisticated management services, technology adoption through AI and cloud platforms enabling better tracking and reporting, and emphasis on sustainable investments in renewable energy and ESG funds. Professionalization through outsourced advisory services, multigenerational succession planning, and younger generation involvement contribute to the 4.11% growth rate.

Q2: How is technology transforming the Philippines family offices landscape?

A2: Technology accelerates modernization through advanced portfolio management software, AI, and cloud platforms enabling real-time reporting and better decision-making. Digital solutions help manage multi-asset portfolios across geographies with enhanced compliance and security while fintech integration improves risk assessment and automated reporting enhancing operational efficiency aligned with younger generation expectations.

Q3: What opportunities exist for family office stakeholders in emerging Philippines market segments?

A3: Stakeholders can capitalize on virtual family office models offering cost-effective technology-enabled services, ESG advisory providing specialized sustainable investment guidance, and digital platform development integrating analytics tools. Multi-family office models enabling smaller families to access professional services, education programs for next-generation stewards, and alternative investment expansion represent significant opportunities alongside philanthropy services structuring charitable strategies.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=41964&flag=C

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Family Offices Market Worth USD 592.01 Million During 2025-2033 here

News-ID: 4219789 • Views: …

More Releases from IMARC Group

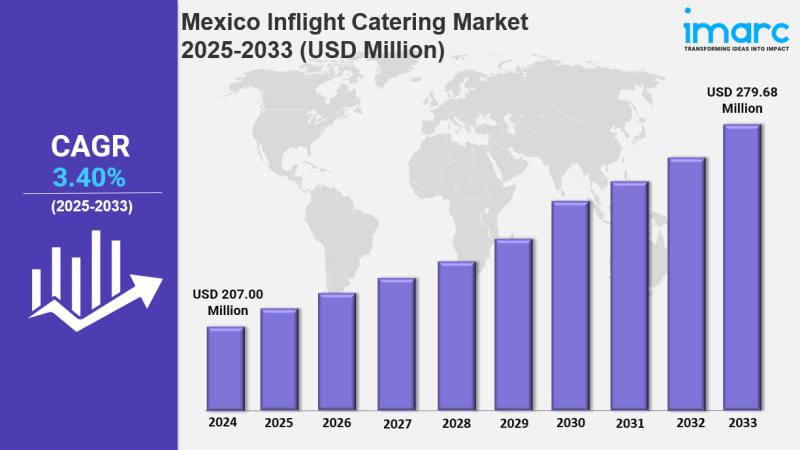

Mexico Inflight Catering Market Size, Trends, Growth and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Inflight Catering Market Size, Share, Trends and Forecast by Food Type, Flight Service Type, Aircraft Seating Class, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico inflight catering market size reached USD 207.00 Million in 2024. The market is…

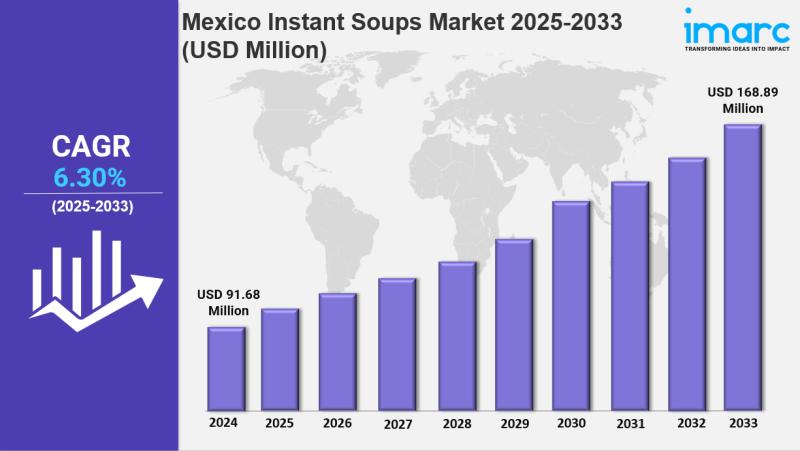

Mexico Instant Soups Market Size, Share, Latest Insights and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico instant soups market size reached USD 91.68 Million in 2024 and is projected to…

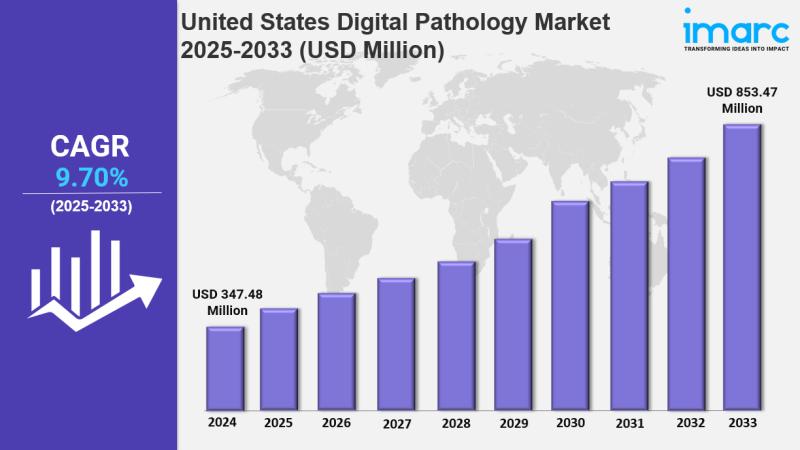

United States Digital Pathology Market : Trends, Drivers, and Growth Opportuniti …

IMARC Group has recently released a new research study titled "United States Digital Pathology Market Size, Share, Trends and Forecast by Product, Type, Delivery Model, Application, End User, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States digital pathology market size was valued at USD 347.48 Million in 2024…

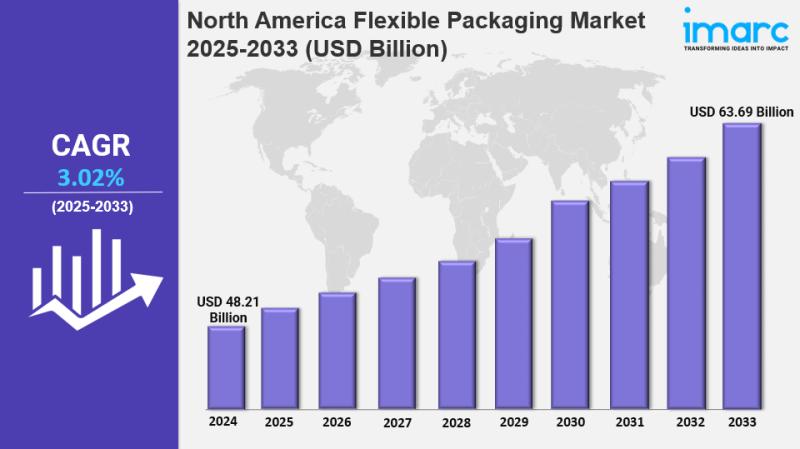

North America Flexible Packaging Market Share, Size, In-Depth Insights, Trends a …

IMARC Group has recently released a new research study titled "North America Flexible Packaging Market Size, Share, Trends and Forecast by Product Type, Raw Material, Printing Technology, Application, and Country, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The North America flexible packaging market was valued at USD 48.21 Billion in 2024 and is…

More Releases for Office

Global Small Office Home Office (SOHO) Servers Market Size by Application, Type, …

According to Market Research Intellect, the global Small Office Home Office (SOHO) Servers market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

The Small Office Home Office (SOHO) servers market is witnessing steady growth due to…

Leading NZ Company Discount Office Expands Office Supplies Range

Discount Office, a leading online office supplies store based In Auckland, has launched ranges of office supplies, including office furniture, office chairs and desks, as more Kiwi offices look to enhance productivity among employees with more staff returning to offices.

Image: https://www.getnews.info/uploads/9d166850141f75e8f2219a6c3e4d29e3.png

As more offices in New Zealand implement return-to-office policies following shifts in workforce dynamics, Discount Office [https://discountoffice.co.nz/] has unveiled its "Back to Office" promotion, offering high-quality office supplies [https://discountoffice.co.nz/collections/office-supplies] and…

Office Suite Tools Market Size in 2023 To 2029 | Apache Open Office, Ashampoo Of …

The primary objective of the Office Suite Tools market report is to offer a comprehensive comprehension of the overall market, ensuring that industry finances are kept up-to-date and informed decisions can be made. Moreover, it furnishes data on market share, market size, growth drivers, and the influence of the COVID-19 pandemic on both small and large-scale industries. Essential market aspects such as distribution channels and industry pricing system, along with…

Open Up Office Virtual Office & Coworking Sapces

We are the Open Up Office family.

The “Customer” and “Solution” based company, Open Up Office was founded in May 2011 and since then adding value by the services it offers to its business partners.

Open Up Office is a community of entrepreneurs and creative professionals. In the Open Up Office where you develop your ideas and are free to work, it is our job to support your creativity and cooperation.

Our clients…

Office Cleaning Sacramento launches 'Clean Office. Happy Office' Campaign

Sacramento, California, USA. April 22, 2012: Office Cleaning Sacramento, one of the leading commercial cleaning services in Sacramento, has announced the launch of its brand new 'Clean Office. Happy Office' campaign and reach out to the various commercial establishments in the city more proactively. The aim of the campaign is to encourage the commercial establishments in the city to provide for a better environment and healthy working conditions to their…

The moving office website, Help Moving Office, offers businesses a valuable Offi …

Help Moving Office, the moving office website, is pleased to announce the launch of its new Office Removals Checklist to help companies manage the actual office removals process. The physical move is a crucial element of the office relocation process – and is very often the part on which the whole office move project gets judged. The essential Office Removals Checklist is the easiest way to get everything done…