Press release

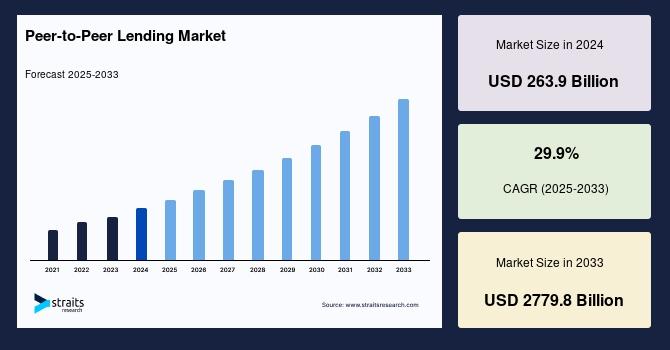

Peer-to-Peer Lending Market to Reach USD 2,779.8 Billion by 2033, Growing at a CAGR of 29.9% | Straits Research

According to a new report by Straits Research, the Global Peer-to-Peer (P2P) Lending Market size was valued at USD 263.9 billion in 2024 and is projected to grow from USD 342.8 billion in 2025 to reach USD 2,779.8 billion by 2033, expanding at a robust CAGR of 29.9% during the forecast period (2025-2033).Peer-to-peer lending is a financial innovation that enables individuals or businesses to obtain loans directly from other individuals or investors without the involvement of traditional banks. This lending model allows borrowers to access both secured and unsecured loans, although unsecured personal loans dominate the market. With minimal overhead costs and online-based operations, P2P lending platforms offer borrowers lower rates while providing investors with diversified and potentially lucrative investment opportunities.

Get your Sample Report to Boost Your Industry Knowledge for Valuable Insights : https://straitsresearch.com/report/peer-to-peer-lending-market/request-sample

The global peer-to-peer lending market is driven by several factors, including lower operational costs, reduced market risk, and increasing digitization within the financial sector. The transparency and efficiency provided by online lending platforms are transforming how borrowers and investors engage in financial transactions. Moreover, as conventional banking systems often impose strict eligibility criteria, P2P lending platforms offer alternative financial solutions to individuals and businesses with limited credit histories or poor credit ratings.

Key Market Growth Factors

Low Operating Costs and Reduced Market Risk

Unlike traditional banks, P2P lending platforms operate digitally, eliminating the need for large workforces and physical infrastructure. These platforms generate revenue by charging minimal fees to borrowers and investors, resulting in lower lending costs. The digitized structure enhances market transparency, reduces administrative expenses, and mitigates risks associated with interest rate fluctuations and unemployment, further boosting market growth.

Technological Advancements and Transparency

The global surge in smartphone penetration and internet usage has accelerated the growth of digital lending. P2P platforms use advanced technologies like artificial intelligence, machine learning, and big data analytics to assess creditworthiness and determine interest rates efficiently. This technological edge allows platforms to make quick, transparent, and data-driven lending decisions, which have fueled the rapid adoption of peer-to-peer lending globally.

For more insights and detailed analysis on the Market, visit : https://straitsresearch.com/report/peer-to-peer-lending-market/

Market Challenges

Despite its advantages, the P2P lending market faces challenges such as potential investor losses, fraud risks, and evolving government regulations. The relatively new and decentralized nature of online lending exposes investors to higher default risks, while regulatory uncertainties in some regions continue to restrict full-scale adoption. Additionally, intense competition from major technology companies such as Amazon, Facebook, and Google is reshaping the lending landscape, further influencing market dynamics.

Emerging Opportunities

China and Asia-Pacific Leading the Growth

Asia-Pacific is expected to experience the fastest growth in the global P2P lending market, led by China, India, and Bangladesh. Government initiatives promoting cashless economies and digital finance are accelerating adoption across these regions. In China, limited bank penetration, a large population base, and high traditional lending rates are creating favorable conditions for P2P lending platforms. Moreover, the increasing use of smartphones and mobile banking in the region is expected to fuel small and medium-sized enterprise (SME) lending through P2P channels.

Get your Sample Report to Boost Your Industry Knowledge for Valuable Insights : https://straitsresearch.com/report/peer-to-peer-lending-market/request-sample

Regional Insights

North America currently holds the largest market share and is expected to maintain dominance with a CAGR of 26.8% during the forecast period. The region's growth is attributed to high awareness among investors and borrowers, widespread use of online financial services, and the ongoing digital transformation of lending processes in the United States.

Europe is anticipated to expand at a CAGR of 34.8%, driven by increased digitalization in banking systems and the rapid adoption of alternative financing solutions. Countries such as the United Kingdom, Germany, and France are leading the shift toward secure and transparent online lending models.

Asia-Pacific will emerge as the fastest-growing regional market due to rapid digitalization, the expansion of SMEs, and favorable government policies supporting fintech development in countries like China and India.

For more insights and detailed analysis on the Market, visit : https://straitsresearch.com/report/peer-to-peer-lending-market/

Segmental Highlights

By Business Model: The Traditional Lending segment is expected to hold the largest share, growing at a CAGR of 29.3%, while Alternate Marketplace Lending continues to expand as borrowers seek flexible online credit options.

By Loan Type: The Business loan segment dominates the market with a CAGR of 29.5%, driven by rising demand for SME financing and startup funding through online channels.

By End-User: Small Business Loans lead the market, followed by Real Estate Loans, as entrepreneurs and younger borrowers increasingly prefer digital lending solutions.

Key Players in the Peer-to-Peer Lending Market

Avant Inc.

Funding Circle Limited

Kabbage Inc.

Lending Club Corporation

LendingTree, LLC

On Deck Capital, Inc.

Prosper Marketplace Inc.

RateSetter

Social Finance Inc.

Zopa Limited

Browse More Insights & Reports :

Energy Blockchain Market : https://straitsresearch.com/report/energy-blockchain-market

Content Delivery Network Market : https://straitsresearch.com/report/content-delivery-network-market

Cryptocurrency Exchange Platform Market : https://straitsresearch.com/report/cryptocurrency-exchange-platform-market

Loan Origination Software Market : https://straitsresearch.com/report/loan-origination-software-market

Commercial Real Estate Brokerage and Management Market : https://straitsresearch.com/report/commercial-real-estate-brokerage-and-management-market

Contact Us

Office 515 A, Amanora Chambers,

Amanora Park Town, Hadapsar,

Pune 411028, Maharashtra, India.

+1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

sales@straitsresearch.com

About Us

For over a decade, Straits Research has been a trusted partner to more than 2,000 small and large enterprises, empowering senior leaders and decision-makers with actionable intelligence to navigate complex markets. Our structured syndicate reports, published year-round, cover critical sectors such as chemicals, materials, food and beverage, healthcare, pharmaceuticals, automotive, technology, aerospace, and defense. Combined with our custom research tailored to client-specific needs, we deliver insights that drive business progress and informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer Lending Market to Reach USD 2,779.8 Billion by 2033, Growing at a CAGR of 29.9% | Straits Research here

News-ID: 4219650 • Views: …

More Releases from Straits Research

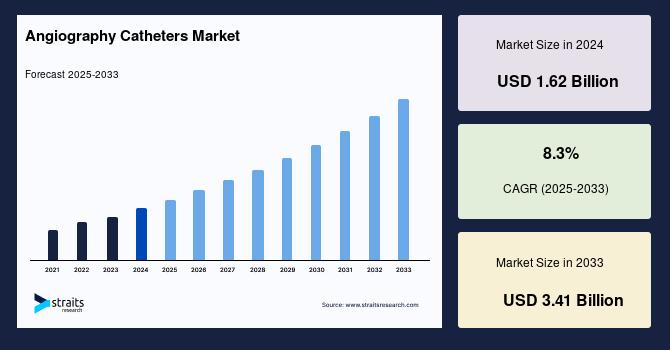

Angiography Catheters Market Size to Reach USD 3.41 Billion by 2033, Driven by R …

The global angiography catheters market is experiencing strong momentum, driven by the growing burden of cardiovascular diseases (CVDs), rising preference for minimally invasive diagnostic and interventional procedures, and ongoing innovations in catheter-based imaging technologies. Industry estimates indicate that the market is expected to expand from USD 1.8 billion in 2025 to USD 3.41 billion by 2033, progressing at a compound annual growth rate (CAGR) of 8.3% over the forecast period.

Angiography…

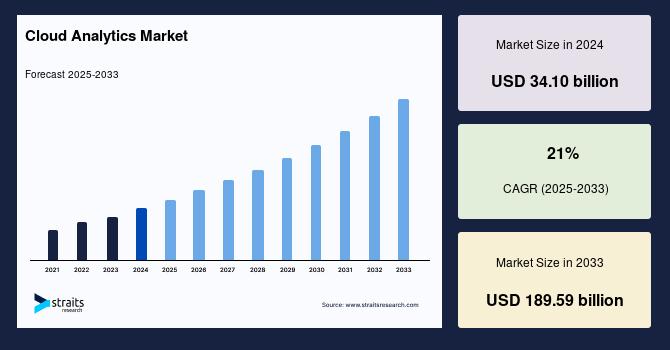

Cloud Analytics Market Size Set to Surge to USD 189.59 Billion by 2033 | Massive …

The global cloud analytics market is poised for exceptional growth as organisations leverage the power of the cloud to collect, analyse and visualise large volumes of data for actionable business insights. According to recent research, The global cloud analytics market size was worth USD 34.10 billion in 2024 and is estimated to reach an expected value of USD 189.59 billion by 2033, growing at a CAGR of 21% during the…

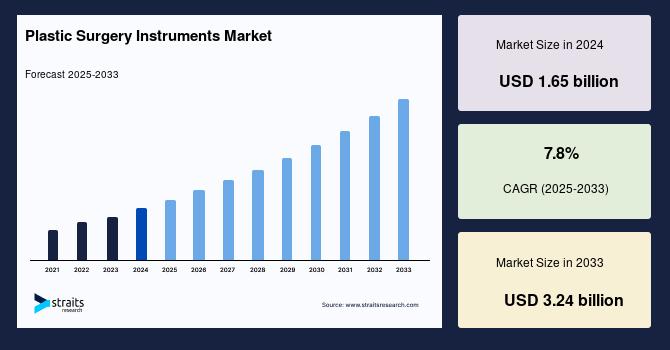

Plastic Surgery Instruments Market Size to Reach USD 3.24 Billion by 2033 | Glob …

The global plastic surgery instruments market is witnessing robust expansion, driven by the rising demand for cosmetic and reconstructive surgeries worldwide. According to a new study by Straits Research, the market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 3.24 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period (2025-2033).

The rising popularity of aesthetic enhancement procedures…

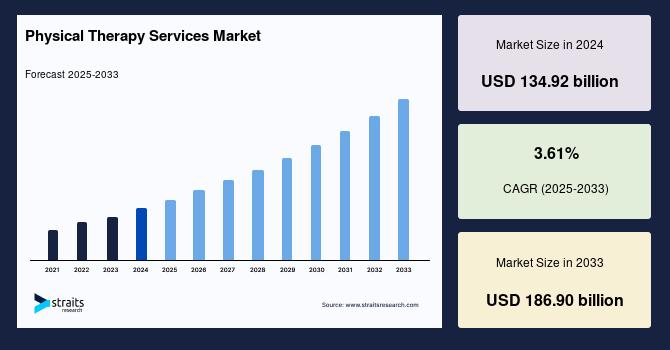

Physical Therapy Services Market Outlook 2025-2033: Rise of Home-Based Care and …

The global physical therapy services market is witnessing significant expansion, fueled by the growing prevalence of chronic diseases, increasing sports-related injuries, and technological innovations such as tele-rehabilitation and AI-based therapy platforms. According to Straits Research, the global market size is estimated at USD 140.69 billion in 2025 and is projected to reach USD 186.90 billion by 2033, exhibiting a steady CAGR of 3.61% during the forecast period.

Read the full report…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…