Press release

Smartphone with Periscope Lens Market to Reach CAGR 14,6% by 2031 Top 10 Company Globally

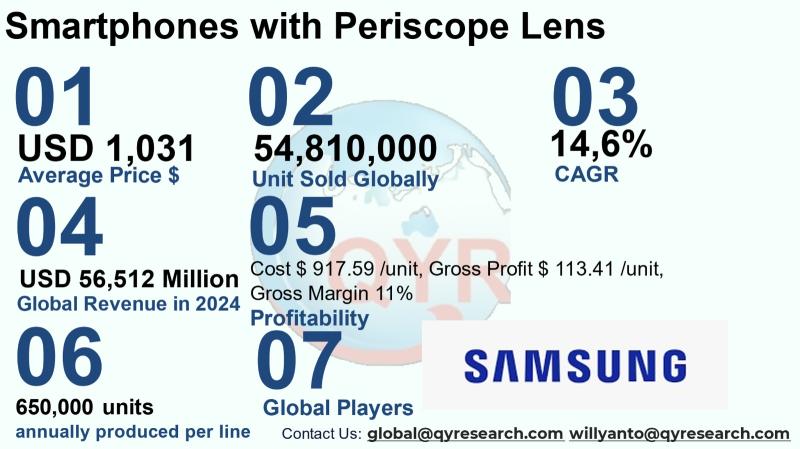

Smartphones equipped with periscope-style telephoto lenses have become a distinct premium feature set in the mobile handset industry, enabling high-multiplication optical zoom without making phones excessively thick. The periscope architecture folds optics inside the phone chassis and uses prisms and layered lens groups to achieve longer focal lengths; combined with advanced image-signal processors and computational photography, these modules have shifted premium buyer expectations for zoom and distant-subject imaging. Manufacturers design periscope modules both as a user-facing differentiator (photography, travel, sports) and as a capability for professional/creator workflows that increasingly rely on mobile hardware. The segment therefore sits at the intersection of optics suppliers, specialist module integrators, camera sensor makers, and smartphone OEM assembly lines; growth is driven by consumer demand for better zoom, OEM competition in flagship devices, and improvements in miniaturized optics and prism designs.The smartphones with periscope lens market size in 2024 is USD 56,512 million and forecast to reach USD 142,805 with CAGR 14.6% by 2031. An average selling price of USD 1,031 per unit. The implied global units sold in 2024 are approximately 54,810,000 units with an average selling price of USD 1,031 per unit. Total cost of goods sold is approximately 89% of the retail price, the COGS per unit in this model equates to USD 917.59. The internal COGS breakdown is camera module, soc & chipset, display, battery and other. Factory gross profit per handset is USD 113.41, producing a factory gross margin of roughly 11% on the retail price. A typical high-mix smartphone assembly line is modeled here at 650,000 finished units per year per production line. Downstream demand is concentrated in consumer retail, online channels and enterprise.

Latest Trends and Technological Developments

Periscope and telephoto hardware continues to evolve along two parallel axes: hardware innovation (novel prism and folded optics, multi-lens periscope assemblies) and software/computational photography that extracts detail at long range. A notable hardware innovation is Huaweis switchable dual-telephoto approach, announced with the Pura 80 Ultra (reported June 2025), which allows two telephoto lenses to share a single sensor using a movable prism a design that both extends zoom range and reduces component cost/height. Another flagship development: Xiaomis 15 Ultra launched February 2025, which explicitly calls out a 200MP periscope telephoto module to address long-range low-light telephoto imaging. OEMs continue to push smaller periscope footprints (compact folded optics, prism advances) and new module architectures such as triple-prism and multi-focal periscopes, enabling combinations of 310× optical segments plus high-quality sensor crop/stacking for extended reach. These device launches and module innovations reinforce two commercial facts: (1) periscope capability is a strategic feature for flagship positioning; and (2) periscope module design is rapidly iterating to trade off cost, thickness, and zoom range.

Asia especially Greater China, South Korea, and Taiwan remains the technological and manufacturing nucleus for periscope-enabled smartphones, driven by local OEMs (Samsung, Huawei, Xiaomi, OPPO, Vivo) that both develop module concepts and buy advanced components from regional suppliers (prism and precision optics firms, camera sensor manufacturers). China in particular functions as both a major demand center and an R&D/production hub for periscope modules: Chinese OEMs are integrating increasingly large sensors and higher-multiplication periscopes into mainstream flagships, not only niche ultra-expensive models. Component suppliers in East Asia benefit from economies of scale and cluster effects (optics, precision molding, stabilization motors, prism suppliers), which compress lead times and improve cost control for OEMs deploying periscopes at scale. Policy and trade dynamics occasionally influence component sourcing and international availability, but the regions deep supply chain keeps it at the center of near-term innovation and production.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5171934

Smartphone with Periscope Lens by Type:

Three Cameras

Four Cameras

Five Cameras

Smartphone with Periscope Lens by Application:

Online Sales

Offline Sales

Global Top 10 Key Companies in the Smartphone with Periscope Lens Market

Samsung

Huawei

OPPO

Xiaomi

Apple

Vivo

HONOR

Sony

Asus

Regional Insights

Within Southeast Asia, adoption follows broader smartphone upgrade cycles: premium buyers in Singapore and Thailand adopt flagships earlier, while Indonesia, Vietnam, Philippines and Malaysia show rapid uptake of mid-to-upper-mid devices that increasingly include premium camera features. Indonesia is a major volume market for global OEMs regional strategies: localized pricing, financing, and channel partnerships mean that flagship devices with periscope modules are targeted at urban enthusiasts, creators, and enterprise buyers seeking improved remote-imaging capabilities (media, field inspection, certain enterprise uses). E-commerce channels and operator bundles are a key pathway for penetration in Indonesia; local demand is strongly seasonal around festival and year-end upgrade cycles. Market reports and region chapters in public research note that Southeast Asia is an important incremental growth region for periscope-capable handsets even if overall per-capita take rate lags East Asia.

The segment faces several challenges. First, periscope modules add cost and complexity: precision prisms, larger or stacked sensors, and specialized autofocus/OIS systems increase BOM (bill of materials) cost and can amplify supply-chain risk if a single optics supplier is constrained. Second, the physical tradeoff between slim device design and long focal length is non-trivial; makers that prioritize thinness must compromise zoom range or accept novel mechanical designs. Third, software-driven improvements lower the perceptual gap between optical and hybrid zoom, meaning future competitive advantage depends on integrated hardware + software stacks rather than optics alone. Finally, geopolitical supply constraints and export controls on certain advanced sensors or manufacturing equipment could intermittently affect component sourcing. These challenges create execution risk for OEMs that ramp periscope capabilities without securing module supply and integration expertise.

Manufacturers should prioritize modular partnerships with optics specialists to secure consistent supply and to co-engineer cost-sensitive periscope designs that target the mid-premium tiers (where most incremental volume lies). Suppliers who can reduce optical stack thickness or combine dual-focal periscope elements that share a sensor (cost savings via shared imaging hardware) will be in strong bargaining positions. For investors, key signals include: reported periscope module win rates at top OEMs, roadmap disclosures for sensor sizes and optical zoom grades, and contract manufacturing capacity additions focused on premium flagship lines. Monitoring these indicators gives an early read on whether the segments high average selling price sustainability (premium positioning) will convert into durable volume growth.

Product Models

Periscope lens technology has revolutionized smartphone photography by enabling incredible optical zoom capabilities without increasing device thickness.

hree-camera smartphones usually include a main sensor, an ultra-wide lens, and a periscope telephoto lens for optical zoom. Notable products include:

Huawei P30 Pro One of the pioneers of periscope zoom, offering exceptional low-light and zoom performance.

OPPO Reno 10x Zoom Introduced OPPOs periscope technology with smooth hybrid zoom.

HONOR Magic5 Pro Incorporates a periscope telephoto lens with advanced image stabilization.

Sony Xperia 1 III The first smartphone with a variable periscope telephoto lens.

Google Pixel 7 Pro Delivers crystal-clear zoom through a 5x optical periscope telephoto lens.

our-camera smartphones add an extra sensor often for depth, macro, or monochrome imaging enhancing versatility. Examples include:

Samsung Galaxy S22 Ultra Features a 10x periscope telephoto lens with remarkable image quality.

Xiaomi 12S Ultra Integrates Leica optics with a periscope telephoto sensor for true-to-life images.

Apple iPhone 16 Pro Max Expected to bring enhanced periscope zoom capability within a four-camera system.

Vivo X70 Pro+ Features an advanced periscope telephoto camera for long-range shots.

Huawei Mate 50 Pro Offers a periscope zoom lens with variable aperture for dynamic shots.

Five-camera smartphones represent the pinnacle of mobile photography, combining main, ultra-wide, macro, depth, and periscope telephoto sensors. Notable products include:

Huawei P50 Pro+ Five-camera flagship combining periscope zoom with ultra-wide and monochrome sensors.

Xiaomi Mi Note 10 The worlds first 108MP five-camera setup, including a periscope telephoto lens.

Vivo X100 Pro+ Equipped with a periscope lens supported by ZEISS optics for maximum zoom performance.

HONOR Magic Ultimate Offers a five-camera array with a periscope module for hybrid zoom imaging.

Huawei Mate X3 Foldable flagship with periscope lens integrated into its five-camera setup.

The smartphone periscope lens segment sits at a favorable intersection of user demand for superior zoom, OEM willingness to differentiate flagship devices, and steady optical & computational innovation. With a 2024 modeled market value of USD 56,512 million and an average handset price in this analysis of USD 1,031, the category already represents a significant, specialized premium market. Continued advances in compact prism systems, sensor sharing, and software image synthesis should broaden adoption from flagship-only devices toward a larger slice of the upper-mid market over the forecast horizon. Execution risks come from supply bottlenecks, BOM inflation, and shifting consumer tradeoffs between thin designs and zoom capability; nevertheless, the strategic value of high-margin camera differentiation means periscopes will remain a competitive feature for top OEMs in Asia and beyond

Investor Analysis

Investors should view the periscope-lens smartphone segment as a premium, technology-led submarket that offers margin expansion opportunities and clear product differentiation for OEMs that win module design and supply partnerships. What to monitor: periscope module cost trends (camera module price, prism suppliers), OEM flagship roadmap cadence, and production capacity expansions (CM/EMS announcements). How it benefits investors: higher ASPs for periscope-equipped handsets translate into larger revenue per unit and potentially higher gross margins if COGS are contained through supplier optimization; investors in optics, sensor manufacturers, and specialized module integrators could capture component-level upside independent from handset cyclical risk. Why it matters: periscope adoption signals where premium consumer spending and creator-market demand are headed companies that secure IP, supply agreements, or production advantages are likely to enjoy durable pricing power and preferential OEM win rates, making them attractive acquisition or public-equity targets in the medium term.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5171934

5 Reasons to Buy This Report

Consolidated, unit-level modeling of the 2024 periscope smartphone market that converts value to implied global unit volumes.

Component-level COGS breakdown and factory margin modeling to support valuation and margin scenario analysis.

Regional focus on Asia and Southeast Asia with on-the-ground insights for Indonesia and ASEAN channels.

A curated, dated list of recent flagship device launches and module innovations that validate short-term adoption signals.

Strategic recommendations and investor monitoring checklist to convert technical trends into tangible investment indicators.

5 Key Questions Answered

What is the implied global unit volume given a periscope-smartphone market and ASP?

What is a reasonable per-unit COGS and how does that COGS break down by camera module, chipset, display, battery and other components?

What are the factory gross profit per unit and gross margin implications for OEMs/manufacturers?

How is demand distributed regionally, with specific attention to Asia and ASEAN channels?

Which OEMs and module innovators are most likely to shape the next wave of periscope improvements and why?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Smartphone with Periscope Lens - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5171934/smartphone-with-periscope-lens

Global Smartphone with Periscope Lens Market Research Report 2025

https://www.qyresearch.com/reports/3524622/smartphone-with-periscope-lens

Global Smartphone with Periscope Lens Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4806479/smartphone-with-periscope-lens

Global Smartphone with Periscope Lens Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4929608/smartphone-with-periscope-lens

Global Smartphones with Periscope Telephoto Lens Market Research Report 2025

https://www.qyresearch.com/reports/4355321/smartphones-with-periscope-telephoto-lens

Global Smartphones Market Research Report 2025

https://www.qyresearch.com/reports/4065811/smartphones

Global Smartphone TV Market Research Report 2025

https://www.qyresearch.com/reports/4301420/smartphone-tv

Global 5G Smartphone Market Research Report 2025

https://www.qyresearch.com/reports/4122745/5g-smartphone

Global Smartphone VCM Market Insights, Forecast to 2031

https://www.qyresearch.com/reports/4782157/smartphone-vcm

Global Periscope Lens Market Research Report 2025

https://www.qyresearch.com/reports/3685569/periscope-lens

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Smartphone with Periscope Lens Market to Reach CAGR 14,6% by 2031 Top 10 Company Globally here

News-ID: 4219007 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for OEM

OEM Partnership Guide: Working with a Touch-free Automatic Kitchen Garbage Can O …

With increasing global demand for smart home solutions, Sinoware International Ltd, a top provider in household products industry, is pleased to unveil expanded OEM partnership initiatives.

Sinoware has established itself in Jiangmen--China's premier stainless steel industry zone--as an indispensable touch-free automatic kitchen garbage can OEM manufacturer for global brands seeking to incorporate high-tech sanitation solutions into their portfolios.

By combining their decades-old tradition of metal craftsmanship with cutting-edge infrared and…

Revolutionizing OEM Coatings With Sustainable Solutions Trend: A Crucial Influen …

Which drivers are expected to have the greatest impact on the over the oem coatings market's growth?

The surge in requirements from final consumer industries is forecasted to boost the expansion of the OEM coatings market. These coatings, referred to as OEM, are utilized during the integration of other firms' products into the substrate process or application. They prove to be beneficial for a variety of end-user sectors, including automotive and…

OEM Technology Partnerships Launches Brokerage Specializing in 100+ OEM Technolo …

San Francisco, California, USA - February 13, 2025 - OEM Technology Partnerships is thrilled to announce the launch of its specialized brokerage focused on connecting businesses with a comprehensive portfolio of over 100 Original Equipment Manufacturer (OEM) technologies. This new venture is poised to revolutionize how companies access and implement cutting-edge solutions across diverse industries.

Leveraging deep industry expertise and a vast network of OEM partners, OEM Technology Partnerships offers a…

OEM or ODM Watches? What's the Difference?

When searching for a watch manufacturer for your store or watch brand, you may come across the terms OEM and ODM. But do you truly understand the difference between them? In this article, we will delve into the distinctions between OEM and ODM watches to help you better grasp and choose the manufacturing service that suits your needs.

Image: https://www.naviforce.com/uploads/15a6ba3911.png

What's OEM / ODM Watches [https://www.naviforce.com/products/]

OEM (Original Equipment Manufacturer) watches are produced…

OEM Partnership with Extreme Networks

ComputerVault announces an OEM partnership with Extreme Networks and has certified its switches for use with ComputerVault enterprise software to deliver virtual desktop infrastructure (VDI).

Extreme Networks industry leading switches deliver ComputerVault Virtual Desktops at faster than PC speeds in the LAN and WAN.

“ComputerVault is very excited to work with Extreme Networks. Not only are their switches very reliable, but their exceptional performance guarantees a great user experience”, said Marc…

Humidity Measurement Module for OEM Applications

The EE1900 humidity module from E+E Elektronik is optimised for the measurement of relative humidity (RH) or dew point temperature (Td) in climate and test chambers. With outstanding temperature compensation across the working range from -70 °C to 180 °C (-94 °F to 356 °F) and the choice of stainless steel and plastic probes, the module is suitable for a wide range of applications.

High Accuracy in Harsh Environment

The excellent…