Press release

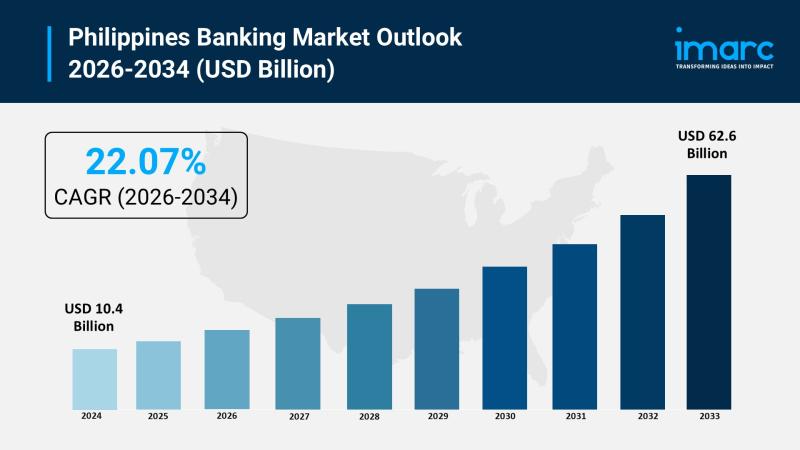

Philippines Banking Market 2026 | Projected to Reach USD 62.6 Billion by 2034 | At a 22.07% CAGR

Market OverviewThe Philippines banking market reached a size of USD 10.4 Billion in 2025 and is projected to expand to USD 62.6 Billion by 2034, exhibiting a growth of 22.07% CAGR. This growth is supported by rising financial inclusion, a growing middle class, and strong remittance inflows that boost household finances. Innovations in digital banking and fintech, supported by government policies promoting financial inclusion and cashless transactions, are transforming the sector. These drivers enhance accessibility and competitiveness, continuously growing the Philippines banking market.

Request a Sample Report with the Latest 2026 Data & Forecasts: https://www.imarcgroup.com/philippines-banking-market/requestsample

How AI is Reshaping the Future of Philippines Banking Market:

• AI-powered personalized financial services are increasingly utilized by banks, providing tailored banking experiences that boost customer satisfaction and retention.

• Government initiatives like the National Strategy for Financial Inclusion encourage adoption of AI-driven microfinancing and simplified digital services in remote areas.

• AI integration enhances digital payment systems, facilitating secure and efficient transactions via mobile wallets such as GCash with over 90 million users.

• Banks leverage machine learning algorithms for better credit risk assessment and fraud detection, increasing lending efficiency and financial security.

• AI-enabled chatbots and virtual assistants improve customer service by offering 24/7 support and instant query resolution, reducing operational costs.

• Collaborations between fintech firms and traditional banks utilize AI to create integrated platforms, expanding financial service accessibility and supporting a cashless economy.

Market Growth Factors

The rapid shift toward digitalization is a major driver of the Philippines banking market. Increased smartphone availability and improved internet connectivity, with imports of mobile phones reaching around USD 3.93 Billion, promote mobile and online banking adoption. These digital platforms enable consumers to conduct transactions efficiently, driving demand for digital payments, mobile wallets, and apps. Additionally, banks' investment in advanced technologies like AI and machine learning allows delivery of personalized financial services, improving accessibility. This robust digital transformation is expanding banking services across urban and semi-urban areas, fostering market growth supported also by consumer preference for convenience.

The rise of fintech solutions significantly propels the market by addressing underserved and unbanked populations. Fintech firms deliver innovative financial services, filling gaps in traditional banking, especially in accessibility. Integration between fintech companies and established banks enhances financial platforms' reach and convenience. Notably, GCash surpassed 90 million users, and Maya Bank's deposit balances rose to USD 588 Million, highlighting fintech's market impact. These collaborations enhance payment systems, enabling individuals to make payments and transfers without traditional bank accounts, fostering financial inclusion and expanding the banking sector.

Expanding middle-class populations drive increased demand for diverse financial products such as savings accounts, loans, and mortgages. Rising household incomes enable consumers to seek banking services that match evolving lifestyle needs, encouraging digital and mobile banking adoption for convenience. This growth is evident not only in urban centers but also in semi-urban areas, where banking activity is rising to support financial security aspirations. Banks respond by consolidating consumer bases and ensuring sustainable growth through tailored products. This demographic expansion is a critical contributor to the Philippines banking market's sustained progress.

Browse the Latest 2026 Edition Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-banking-market

Market Segmentation

Banking Services Insights:

• Retail Banking

• Commercial Banking

• Investment Banking

• Corporate Banking

• Others

End User Insights:

• Individual Consumers

• Small and Medium Enterprises (SMEs)

• Large Corporations

• Government and Public Sector Entities

Regional Insights:

• Luzon

• Visayas

• Mindanao

Key Players

• CTBC Bank Philippines

Recent Development & News

• July 2025: The Bangko Sentral ng Pilipinas (BSP) issued Circular No. 1198, Series of 2024, establishing regulatory policies for merchant payment acceptance activities (MPAA) to secure user funds and protect merchant rights through regulated practices with operators of payment systems.

• May 2025: CTBC Bank Philippines announced a strategic partnership with Hitachi Asia to upgrade its mobile banking applications and web interface to offer enhanced digital financing services, facilitating improved financial inclusion.

• October 2025: The Philippines banking market has experienced heightened digital payment adoption driven by government initiatives promoting a cashless economy, supported by over 90 million users of mobile wallet services like GCash.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask an Analyst for Your Customized Sample Report Latest 2026 Edition: https://www.imarcgroup.com/request?type=report&id=28671&flag=C

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Banking Market 2026 | Projected to Reach USD 62.6 Billion by 2034 | At a 22.07% CAGR here

News-ID: 4310766 • Views: …

More Releases from IMARC Group

Tungsten Price Trend Report Showcases Index Fluctuations and Long-Term Pricing C …

North America Tungsten Prices Movement Q4 2025:

Tungsten Prices Movement in the USA:

Tungsten prices in the USA averaged USD 67,954 per metric ton in Q4 2025, driven by steady demand from the manufacturing and aerospace sectors. Limited domestic production increased reliance on imports, mainly from China. Energy costs and logistics challenges influenced pricing, while buyers prioritized long-term contracts to secure stable supply amidst global market fluctuations and rising industrial demand.

Get the…

Updated Tantalum Price Index Report Highlights Latest Trends and Historical Char …

North America Tantalum Prices Movement Q4 2025:

Tantalum Prices in United States:

Tantalum prices in the USA reached USD 502 per kilogram in Q4 2025, reflecting steady demand from the electronics and aerospace industries. Domestic production remained limited, increasing reliance on imports from Africa and Asia. Supply chain constraints and higher energy costs contributed to price firmness. Buyers focused on long-term contracts to hedge against potential market fluctuations and ensure stable sourcing.

Get…

Indonesia Payments Infrastructure Market to Reach USD 3,585.7 Million by 2034 | …

Indonesia Payments Infrastructure Market Overview

According to IMARC Group's report titled "Indonesia Payments Infrastructure Market Size, Share, Trends and Forecast by Traditional Payment Infrastructure, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The Indonesia payments infrastructure market size reached USD 627.2 Million in 2025. The market is expected to grow significantly, reaching USD 3,585.7 Million by 2034, exhibiting a robust…

Polylactic Acid Prices in January 2026: Trend Analysis & Forecast

The Polylactic Acid (PLA) Price Index indicates evolving global momentum driven by feedstock cost shifts, bioplastic demand, and regional supply balances. Recent Polylactic Acid (PLA) Prices have reflected moderate volatility across Asia, Europe, and North America due to changing corn-based feedstock economics and sustainable packaging adoption. This report provides a detailed review of the Polylactic Acid (PLA) price trend analysis 2026, Polylactic Acid (PLA) historical price data, and the Polylactic…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…