Press release

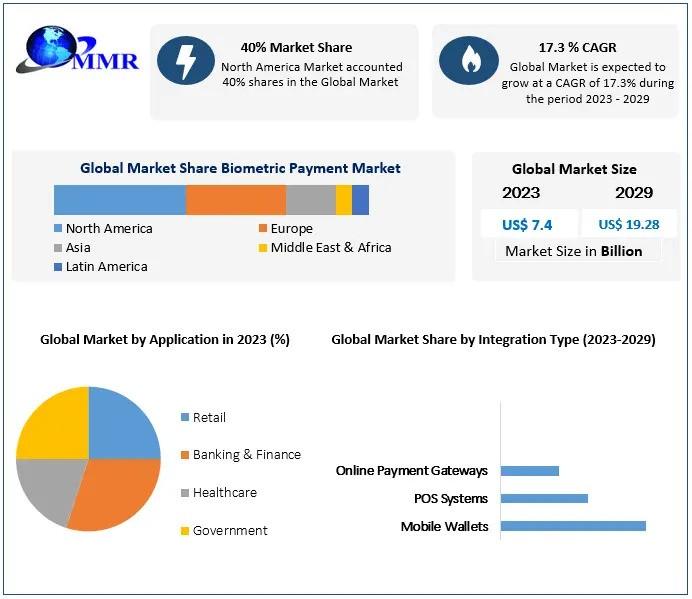

Biometric Payment Market Outlook: From USD 7.4 Billion in 2022 to USD 19.28 Billion by 2029

Biometric Payment Market was valued at USD 7.4 billion in 2022 and is projected to reach USD 19.28 billion by 2029, growing at a CAGR of 17.3% during the forecast period.Biometric Payment Market Overview:

The biometric payment market has experienced significant growth in recent years, driven by the increasing need for secure, fast, and convenient payment solutions. Biometric payment systems utilize unique physiological traits, such as fingerprints, facial recognition, iris scans, and voice patterns, to authenticate transactions, reducing the risk of fraud and identity theft. The rising adoption of smartphones, tablets, and point-of-sale (POS) systems integrated with biometric authentication is further fueling market expansion. Consumers and businesses alike are seeking seamless payment experiences that eliminate the need for physical cards or cash, enhancing convenience and operational efficiency. The increasing preference for contactless payments, accelerated by the COVID-19 pandemic, has also contributed to the growing popularity of biometric payment solutions. As technology continues to evolve, biometric payment systems are expected to become more accurate, user-friendly, and widely integrated across retail, banking, e-commerce, and other sectors.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/190525/

Biometric Payment Market Outlook and Future Trends:

The outlook for the biometric payment market remains highly promising, supported by rapid technological advancements and evolving consumer behavior. The integration of artificial intelligence and machine learning into biometric authentication systems is enhancing accuracy and reducing false acceptance rates. Cloud-based biometric payment platforms are emerging, providing scalability, flexibility, and improved data management for financial institutions and merchants. Additionally, the demand for multi-modal biometric solutions, which combine two or more biometric identifiers for added security, is gaining traction. The rise of digital wallets, mobile banking apps, and contactless payment methods is expected to drive further adoption of biometric payment technologies. Regulatory support for secure digital transactions and increasing cybersecurity awareness among consumers are also contributing to market growth. Overall, the market is poised for substantial expansion as organizations seek innovative ways to enhance transaction security and streamline the payment experience.

Biometric Payment Market Dynamics:

The dynamics of the biometric payment market are influenced by several factors, including technological innovation, consumer adoption, and security concerns. The growing demand for fast, frictionless, and secure transactions is pushing businesses to implement biometric payment solutions across retail, banking, and e-commerce platforms. Technological advancements, such as 3D facial recognition, vein pattern scanning, and fingerprint sensors with enhanced sensitivity, are improving accuracy and user experience. However, challenges such as high implementation costs, data privacy concerns, and regulatory compliance requirements can hinder market growth. Conversely, opportunities exist in emerging markets where smartphone penetration and digital payment adoption are increasing. Partnerships between technology providers and financial institutions, as well as investments in research and development, are driving innovation. These factors collectively shape the market, emphasizing the balance between security, convenience, and scalability in biometric payment solutions.

Biometric Payment Market Key Recent Developments:

Recent developments in the biometric payment market highlight a focus on innovation, adoption, and strategic collaborations. Leading technology providers have introduced advanced biometric scanners and software capable of multi-factor authentication, improving both speed and security of transactions. Financial institutions and retailers are increasingly partnering with biometric solution providers to integrate authentication technologies into mobile wallets, POS systems, and online payment platforms. The adoption of AI and machine learning algorithms is enhancing fraud detection and reducing errors in authentication processes. Additionally, contactless biometric payment solutions are gaining popularity, offering safer and more hygienic transaction methods. Governments and industry bodies are also supporting the implementation of secure biometric systems through guidelines and standards. These developments underscore the market's emphasis on enhancing user convenience, strengthening security, and fostering widespread adoption across retail, banking, and digital commerce sectors.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/190525/

Biometric Payment Market Segmentation:

by Biometric Mode

1. Fingerprint Recognition

2. Facial Recognition

3. Voice Recognition

4. Iris Scans

by Application

1. Retail

2. Banking And Finance

3. Healthcare

4. Transportation

5. Government

by End-User

1. Individual Consumers

2. Businesses

3. Government Institutions

by Integration Type

1. Mobile Wallets

2. Point-Of-Sale (Pos) Systems

3. Online Payment Gateways

Some of the current players in the Biometric Payment Market are:

North America:

1. Apple Inc. (United States)

2. Google LLC (United States)

3. Mastercard Incorporated (United States)

4. Visa Inc. (United States)

5. PayPal Holdings, Inc. (United States)

Europe:

6. IDEMIA (France)

7. Gemalto (Netherlands)

8. Fingerprint Cards AB (Sweden)

9. Verifone Systems, Inc. (Republic of Ireland)

10. Payconiq International SA (Luxembourg)

Asia Pacific:

11. Alibaba Group Holding Limited (China)

12. Samsung Electronics Co., Ltd. (South Korea)

13. Tencent Holdings Limited (China)

14. Paytm (India)

15. Ant Group (China)

Latin America:

16. MercadoPago (Argentina)

17. PagSeguro Digital Ltd. (Brazil)

18. StoneCo Ltd. (Brazil)

19. Cielo S.A. (Brazil)

20. Rappi (Colombia)

Middle East and Africa:

21. Network International Holdings plc (United Arab Emirates)

22. PayTabs (Saudi Arabia)

23. Mada (Saudi Arabia)

24. Emerging Markets Payments (EMP) Africa (Egypt)

25. iVeri Payment Technologies (South Africa)

For additional reports on related topics, visit our website:

♦ Contact Lenses Market https://www.maximizemarketresearch.com/market-report/global-contact-lenses-market/20661/

♦ Hydrogen Peroxide Market https://www.maximizemarketresearch.com/market-report/global-hydrogen-peroxide-market/50652/

♦ Global Aloe Vera Extract Market https://www.maximizemarketresearch.com/market-report/global-aloe-vera-extract-market/24071/

♦ Global Ceramic Tableware Market https://www.maximizemarketresearch.com/market-report/global-ceramic-tableware-market/83118/

♦ Global Retort Pouches Market https://www.maximizemarketresearch.com/market-report/global-retort-pouches-market/64537/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a trusted market intelligence and consulting firm, known for delivering detailed insights and actionable strategies across diverse sectors such as healthcare, automotive, technology, and pharmaceuticals. The company specializes in comprehensive research, future-oriented trend forecasting, and competitive landscape analysis, helping businesses uncover opportunities, reduce risks, and drive sustainable growth. With a strong emphasis on data accuracy and strategic clarity, Maximize Market Research empowers organizations to make informed decisions, improve performance, and expand their presence in competitive markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biometric Payment Market Outlook: From USD 7.4 Billion in 2022 to USD 19.28 Billion by 2029 here

News-ID: 4218073 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

Water Purifier Market to Reach USD 95.16 Billion by 2032, Driven by Smart Techno …

The global Water Purifier Market is witnessing significant expansion, reflecting the urgent need for safe, clean, and sustainable drinking water solutions worldwide. According to the latest industry analysis, the Water Purifier Market size was valued at USD 44.07 Billion in 2024 and is projected to grow at a robust CAGR of 10.1% from 2025 to 2032, reaching nearly USD 95.16 Billion by 2032.

The water purifier industry plays a critical role…

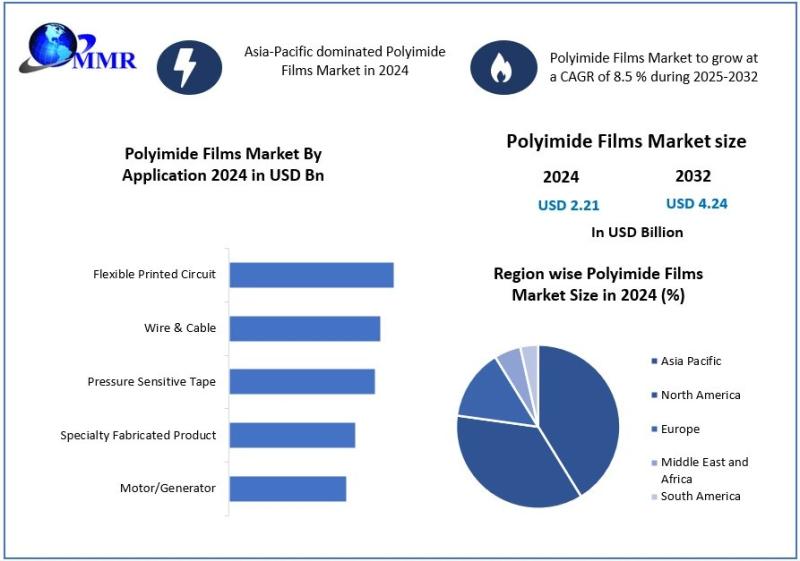

Polyimide Films Market Outlook: USD 2.21 Billion in 2024, Projected Growth to US …

Polyimide Films Market size was valued at USD 2.21 Billion in 2024 and the total Polyimide Films Market revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 4.24 Billion.

Polyimide Films Market Overview:

The polyimide films market is experiencing robust growth due to the increasing demand for high-performance materials in industries such as electronics, automotive, aerospace, and renewable energy. Polyimide films are known for…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…