Press release

Risk Analytics Market Size, Industry Trends, Growth Factors and Forecast 2025-2033

IMARC Group, a leading market research company, has recently releases a report titled "Risk Analytics Market Report by Component (Solution, Services), Deployment Mode (On-premises, Cloud-based), Organization Size (Large Enterprises, Small and Medium Enterprises), Application (Strategic Risks, Financial Risks, Operational Risks, Compliance Risks), Industry Vertical (BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, and Others), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global risk analytics market share, size, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.Risk Analytics Market Highlights:

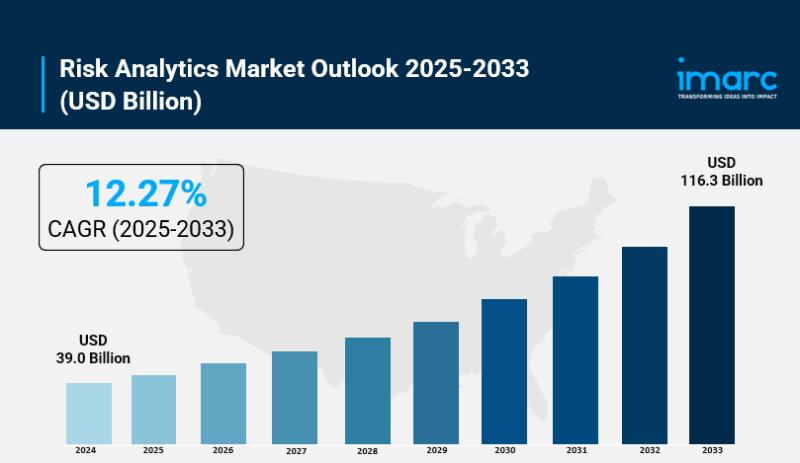

• Risk Analytics Market Size: Valued at USD 39.0 Billion in 2024.

• Risk Analytics Market Forecast: The market is expected to reach USD 116.3 billion by 2033, growing at an impressive rate of 12.27% annually.

• Market Growth: The risk analytics market is experiencing robust growth driven by the expanding volume and variety of data requiring systematic risk evaluation and the increasing adoption of cloud-based solutions.

• Technology Integration: The integration of artificial intelligence and machine learning is revolutionizing risk assessment processes, enabling more dynamic and predictive approaches to risk management.

• Regional Leadership: North America commands the largest market share, fueled by a robust financial industry and stringent regulatory requirements emphasizing compliance and transparency.

• Security Enhancement: Rising cyber threats and data privacy concerns are driving organizations to invest heavily in sophisticated risk analytics solutions.

• Key Players: Industry leaders include IBM Corporation, SAP SE, Oracle Corporation, and SAS Institute Inc., which dominate the market with cutting-edge solutions.

• Market Challenges: Complex regulatory landscapes and the need for seamless integration with existing IT infrastructure present ongoing challenges.

Request for a sample copy of the report: https://www.imarcgroup.com/risk-analytics-market/requestsample

Our report includes:

• Market Dynamics

• Market Trends and Market Outlook

• Competitive Analysis

• Industry Segmentation

• Strategic Recommendations

Industry Trends and Drivers:

• Explosive Growth in Data-Driven Risk Management:

Organizations worldwide are facing an unprecedented surge in data volumes that require sophisticated analysis. The shift toward data-driven decision-making has become critical as businesses navigate increasingly complex operational environments. Modern enterprises are dealing with diverse risk factors spanning financial, operational, strategic, and compliance domains. According to NIST, the U.S. government released its AI Risk Management Framework in July 2024, specifically addressing generative AI risks, which reflects the growing recognition of technology-driven risk factors. This framework guides organizations in identifying unique risks posed by emerging technologies and implementing appropriate risk management actions. Companies are now investing heavily in analytics platforms that can process vast datasets in real-time, providing actionable insights that enable proactive rather than reactive risk management strategies.

• Revolutionary AI and Machine Learning Integration:

The risk analytics landscape is being transformed by artificial intelligence and machine learning technologies. These advanced tools are enabling organizations to automate complex risk assessments that previously required intensive manual analysis. AI-driven systems can now analyze massive datasets, identify subtle patterns, and predict potential risks before they materialize. Recent industry analysis indicates that AI-powered risk management tools can detect anomalies in network traffic and financial transactions, signaling potential cybersecurity breaches or fraud before they escalate. The technology allows for continuous monitoring and real-time risk scoring across multiple business functions. Organizations implementing these solutions are experiencing enhanced accuracy in risk prediction and significantly faster response times to emerging threats. This technological evolution is particularly impactful in sectors like banking and finance, where split-second decisions can have substantial consequences.

• Cloud-Based Solutions Driving Market Accessibility:

The adoption of cloud-based risk analytics solutions is democratizing access to sophisticated risk management tools across organizations of all sizes. Small and medium enterprises, which previously couldn't afford expensive on-premises infrastructure, can now leverage powerful analytics capabilities through scalable cloud platforms. These solutions offer flexibility in deployment, enabling seamless data integration from multiple sources and providing accessibility from various locations. The cloud environment supports collaboration across different organizational levels and geographical boundaries, making it easier for global enterprises to maintain consistent risk management practices. Cloud-based platforms also reduce the need for heavy capital investments in IT infrastructure, allowing businesses to allocate resources more efficiently. The ability to scale computing resources up or down based on demand ensures that organizations only pay for what they use, making advanced risk analytics economically viable for a broader range of businesses.

• Enhanced Focus on Data Protection and Regulatory Compliance:

The regulatory landscape for data protection has become increasingly stringent, with frameworks like GDPR imposing substantial requirements on how organizations handle consumer information. Both large corporations and smaller businesses are under mounting pressure to ensure full compliance with international and local privacy laws. Non-compliance can result in hefty financial penalties and severe reputational damage. This heightened regulatory scrutiny has elevated risk analytics from a nice-to-have tool to a business necessity. Organizations are using analytics platforms to identify potential compliance gaps, monitor data handling processes, and generate audit trails that demonstrate adherence to regulations. The public's growing concern over data privacy has also created expectations that businesses will prioritize security and transparency. In this environment, risk analytics has become indispensable for building customer trust and navigating complex legal requirements. Companies that effectively leverage these tools can transform compliance from a cost center into a competitive advantage, demonstrating their commitment to protecting stakeholder interests.

Checkout Now: https://www.imarcgroup.com/checkout?id=4156&method=1670

Risk Analytics Market Report Segmentation:

Breakup by Component:

• Solution

• Services

Solution dominates with the largest market share, as organizations prioritize comprehensive tools that facilitate real-time analysis of various risk factors and enable streamlined approaches to compliance and decision-making.

Breakup by Deployment Mode:

• On-premises

• Cloud-based

On-premises holds the majority of the market share, reflecting the preference of many organizations for greater control over data and systems, particularly those with stringent security and regulatory requirements.

Breakup by Organization Size:

• Large Enterprises

• Small and Medium Enterprises

Large enterprises account for the majority of the total market share due to the complexity and breadth of their operations, requiring sophisticated analytics tools to consolidate risk information from various departments and geographies.

Breakup by Application:

• Strategic Risks

• Financial Risks

• Operational Risks

• Compliance Risks

Operational risks dominate the market as organizations increasingly focus on monitoring and managing risks associated with day-to-day business activities and maintaining operational continuity in volatile business environments.

Breakup by Industry Vertical:

• BFSI

• IT and Telecom

• Retail

• Healthcare

• Energy and Utilities

• Manufacturing

• Government and Defense

• Others

BFSI accounts for the majority of the market share, driven by the rising complexity of financial regulations, the need for transparent compliance processes, and the necessity to assess and manage various financial risks including credit, market, and liquidity risks.

Breakup By Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

• BRIDGEi2i Analytics

• Capgemini SE

• FIS

• International Business Machines Corporation

• Moody's Analytics Inc. (Moody's Corporation)

• Oracle Corporation

• Risk Edge Solutions Private Limited

• SAP SE

• SAS Institute Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4156&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Risk Analytics Market Size, Industry Trends, Growth Factors and Forecast 2025-2033 here

News-ID: 4217728 • Views: …

More Releases from IMARC Group

Graphene Battery Manufacturing Plant DPR - 2026: Investment Cost, Market Growth …

Setting up a graphene battery manufacturing plant positions investors within one of the most technologically advanced and high-growth segments of the global energy storage industry, driven by accelerating electric vehicle adoption, expanding renewable energy integration, and rising demand for high-performance consumer electronics. Graphene-enhanced batteries offer superior conductivity, faster charging capabilities, improved thermal stability, and longer lifecycle performance compared to conventional lithium-ion systems, positioning them at the forefront of next-generation energy…

Calcium Chloride Production Plant Cost 2026: Plant Layout, Machinery and Raw Mat …

Setting up a Calcium Chloride Production Plant positions investors in one of the most stable and essential segments of the industrial chemicals and infrastructure maintenance value chain, backed by sustained global growth driven by increasing demand for de-icing solutions, dust control applications, oil and gas drilling fluids, and moisture-absorbing agents across construction, infrastructure, and industrial sectors. As urbanization accelerates, infrastructure investments expand globally with foreign direct investment inflows in India's…

Chlorine Gas Production Plant Cost 2026: Comprehensive Project Report and Indust …

Setting up a Chlorine Gas Production Plant positions investors in one of the most stable and essential segments of the industrial chemicals and water treatment value chain, backed by sustained global growth driven by increasing demand for safe drinking water and wastewater treatment infrastructure, expansion in PVC consumption for construction materials, growth in pharmaceuticals and agrochemicals manufacturing, and the integrated chlor-alkali value chain advantages of simultaneous caustic soda and hydrogen…

Tomato Powder Manufacturing Plant Cost Analysis Report 2026: Setup Details, Capi …

Setting up a tomato powder manufacturing plant positions investors within one of the most versatile and value-enhancing segments of the global food processing industry, supported by rising demand for convenient, shelf-stable ingredients, expanding packaged food consumption, and increasing utilization of dehydrated vegetable products across quick-service restaurants, snack manufacturers, and ready-to-cook meal producers. Tomato powder, produced through advanced dehydration and milling processes, serves as a concentrated flavouring and coloring agent widely…

More Releases for Risk

The Risk Side of Crypto Trading: Safety Tips + Risk Management

The Risk Side of Crypto Trading: Safety Tips + Risk Management

Cryptocurrency trading can be exciting, fast-moving, and potentially profitable. But it also carries serious risks that many beginners underestimate.

From dramatic price swings in Bitcoin to rapid market shifts in Ethereum, crypto markets are among the most volatile financial environments in the world.

If you're entering crypto trading - especially short-term or automated trading - understanding the risk side is not optional.

In…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…