Press release

Silicon Anode Materials Market to Reach CAGR 40,1% by 2031 Top 20 Company Globally

Silicon-based anode materials are advanced negative-electrode materials developed to replace or supplement graphite in lithium-ion batteries, offering substantially higher theoretical capacity and enabling higher energy density, faster charging and lighter battery packs. The industry spans engineered silicon powders, silicon-carbon composites (Si-C), nano-silicon, prelithiated materials, and the process equipment and integration services required to convert powders into electrode slurries and coated anodes. Manufacturers sit at the intersection of specialty chemicals, precision materials processing and battery cell supply chains; their customers are cell makers, pack integrators and EV/OEMs who demand scalable volumes, repeatable quality and stable cycle life.The global market size for silicon anode materials in 2024 is USD 507 million, with an assumed compound annual growth rate of 40.1% through 2031, reaching market size USD 4,701 million by 2031. This places silicon anode materials among the fastest growing segments in battery materials, driven by EV electrification, high-performance portable electronics and growing interest in grid-scale and fast-charge applications. Average selling price is around USD 300 per kg depending on grade, particle architecture and manufacturing route. Using the 2024 market value and prevailing price ranges, the implied total global units sold in 2024 is 1,690,000 kilograms. Cost of goods sold per quantity is USD 210 per kg. Factory COGS breakdowns for silicon-based anode materials vary by process but a representative profile is: raw materials 40 to 55%, energy and consumables 15 to 25%, manufacturing overhead and labor 15 to 25%, and depreciation/maintenance 5 to 10%. Factory gross profit per unit is USD 90 per kg, or a 30% profit margin. The single line full machine targeted at 50,000 kg per line per year depends on the chosen process, cycle time and downstream milling/coating throughput. Downstream demand for silicon anode materials is concentrated in passenger EVs, portable electronics and other mobility / industrial applications.

Latest Trends and Technological Developments

Commercial scale-up and licensing deals accelerated in 2024 to 2025 as third-party materials specialists and traditional chemical groups announced partnerships to localize silicon-carbon production for battery supply chains. In May 2025 Sicona and Indias Himadri Speciality Chemicals signed a transformational licensing and strategic investment agreement to localize Siconas SiCx® silicon-carbon technology in India, marking a major step toward an India-based commercial plant and signaling increasing regionalization of silicon anode supply chains (May 2025). Meanwhile, multiple silicon-anode specialists reported plant commissioning and ramp milestones in 2025 as players moved toward automotive-scale output; companies such as Sila reported commissioning activities and progress toward automotive-scale production in 2025 (company communications, AprilSeptember 2025). Technology trends include consolidation toward silicon-carbon composite blends (to control expansion and improve cycle life), increased focus on scalable spray/thermal processes rather than purely CVD nanoscale routes, and intensified work on prelithiation and binder/additive chemistries to correct first-cycle loss and enable faster integration into existing electrode manufacturing lines.

Asia remains the epicenter for silicon anode materials demand and manufacturing investment because of the regions dominant battery cell and EV supply chains, established chemical processing ecosystems and competitive energy/value chain inputs. China continues to host many of the incumbents and a large share of pilot and early commercial capacities, with local majors and specialized start-ups advancing their Si-C offerings and scaling projects. India is moving rapidly from pilot to commercial thanks to technology licensing and strategic investments most notably the SiconaHimadri partnership announced in May 2025 which aims to establish significant SiCx® production capacity in India and reduce import dependence for next-gen anode materials. Japan, South Korea and Taiwan maintain strong R&D and pilot capabilities, focusing on high-performance grades and integration with cell makers; these markets also act as a bridge between Western OEM technical requirements and China/India manufacturing scale. Across Asia, producers emphasize co-location with cell manufacturers to shorten downstream integration times and logistics costs.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5171770

Silicon Anode Materials by Type:

SiO/C

Si/C

Silicon Anode Materials by Application:

Automotive

Consumer Electronics

Power Tools

Others

Global Top 20 Key Companies in the Silicon Anode Materials Market

BTR

Shin-Etsu Chemical

Daejoo Electronic Materials

IOPSILION

Luoyang Lianchuang

Shanshan Corporation

Lanxi Zhide Advanced Materials

Guangdong Kaijin New Energy

Group14

Jiangxi Zhengtuo Energy

Posco Chemical

Shida Shenghua

Resonac

Chengdu Guibao

Shanghai Putailai (Jiangxi Zichen)

Hunan Zhongke Electric (Shinzoom)

Shenzhen XFH

iAmetal

Guoxuan High-Tech

Nexeon

Regional Insights

Southeast Asia is increasingly a focal point for battery materials and battery cell investments because of strong EV vehicle assembly growth, incentives and an emerging skilled workforce. Indonesia, already a major player in upstream battery raw materials (nickel and precursor capacity), has begun moving downstream through partnerships and localized processing initiatives. While large-scale silicon anode production in ASEAN is still at an early stage compared with China and Korea, the region's strategic role in refining and cell assembly makes ASEAN countries attractive for joint ventures and second-wave investment localization reduces freight, shortens time-to-market for regional OEMs and mitigates supply chain risks. Expect Indonesia to emerge as a regional hub for battery materials integration projects where raw material availability (nickel, carbon feedstocks) and government incentives support downstream movement into active materials over the mid term.

Major industry challenges are technical (managing silicons large volumetric expansion to avoid rapid capacity fade), economic (bridging the cost gap to graphite at scale), and logistical (securing reliable, low-cost feedstocks and energy while meeting environmental and safety requirements). Scale-up risk remains material: pilot success does not guarantee cost-competitive mass production, and many technologies require capital-intensive steps with long lead times. Supply chain concentration for precursor silicon and sophisticated process equipment can create bottlenecks and price volatility. Additionally, cell makers remain conservative about qualification timelines; that slows adoption and creates demand uncertainty that can impact investment and project finance for new production lines.

Companies that combine proven performance (cycle life and first-cycle efficiency) with a clear, low-cost scale-up pathway will command premium offtake and faster adoption. Strategic moves to localize production near major cell factories (Asia and ASEAN hubs) will reduce logistic premiums and improve responsiveness. Licensing and joint venture models (technology licensors + established chemical manufacturers) are an attractive de-risking mechanism: licensors provide IP and process know-how while local partners provide capex, feedstock access and regulatory navigation. For buyers, multi-sourcing and technical qualification programs staged across grades (starting with partial silicon blends) lower integration risk. For investors, focus on companies with demonstrable ramp milestones, long-term offtake letters and modular/upgradable production lines.

Product Models

Silicon-based anode materials represent promising pathways beyond pure silicon or graphite. The idea is to harness silicons high capacity (~ 3,5004,200 mAh/g theoretical) while mitigating its large volume changes during lithiation/delithiation.

SiO/C composites, silicon oxide (SiO or sub-oxide SiOx) is embedded in or coated by carbon to buffer expansion and maintain electrical connectivity. Notable products include:

MSE PRO SiOx/C Composite Anode Powder MSE Supplies: A lab-scale composite of silicon oxide and carbon, with low volume expansion and improved cycling.

SM5121 Silicon Oxide-Carbon Composite Anode SAMaterials: A SiOC composite with good capacity and cycling performance offered for research use.

KSC-series SiO (carbonized) Anode Material Shin-Etsu Chemical: Shin-Etsus SiO series with conductivity modified by proprietary method.

SiO-1800 Putailai: A product from Putailais lineup, described as silicon oxide type with high specific capacity.

SiO SiC Composite Powder Gelon / Lib: A composite combining SiO (or SiOx) and SiC with carbon coating for Li-ion anode use.

Si/C composites, silicon (or nano-silicon) is intimately mixed or coated with carbon, often in core-shell or interpenetrating architectures, to provide both conductivity and mechanical stability. Examples include:

Titan Silicon (Si/C anode) Sila Nanotechnologies: A drop-in Si/C composite powder that replaces graphite in commercial cells.

SCC55 (SiC composite) Group14 Technologies: A patented silicon-carbon composite material used in high energy density lithium-ion cells.

Si/C Composite Anode Material (Type A / B) ACS Material: Research-grade Si/C composite powders with different silicon loadings and properties.

NovaLIB-Si/C-HC Novarials: A Si/C composite material (high capacity variant) offered for battery R&D.

Lib-SC450B MTI (Silicon/Carbon composite powder): A Si/C composite anode powder (Si:C = 1:9) with ~420470 mAh/g performance

Silicon anode materials are at an inflection point: technical advances, licensing deals and first commercial lines in 20242025 confirm the pathway from promising lab results to manufactured products, but the industry still must solve scale-up economics and qualification timelines to become a dominant anode choice. Asia will remain the center of gravity for scaling and demand, while Southeast Asia and India are accelerating downstream localization through partnerships and incentives. For stakeholders this means large upside potential paired with execution and timing risk; prudent players will prioritize partnerships, staged volume qualification and feedstock security.

Investor Analysis

This report highlights the core commercial levers investors should watch: (1) technology risk versus cost roadmaps the faster a supplier proves both cycle life and a clear low-cost route to metric tonnes/year, the greater the potential valuation uplift; (2) offtake and licensing agreements binding offtake, JV and licensing deals materially de-risk revenue forecasts and accelerate plant financing; (3) regional positioning assets co-located with major cell manufacturers or in regions offering subsidies reduce execution risk; (4) feedstock and energy exposure securing long-term feedstock and energy contracts protects margins; (5) manufacturing modularity and upgradeability firms whose lines can be economically scaled or repurposed to adjacent chemistries command higher strategic optionality. Investors can use the metrics in this report (market baseline, price bands, capacity benchmarks, COGS profile and downstream demand mix) to stress-test business models, structure milestone-based financing, and prioritize portfolio companies with clear commercial milestones and regional strategic advantages.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5171770

5 Reasons to Buy This Report

Get a concise market baseline using an agreed 2024 market value and a clear growth trajectory to underpin financial models.

Access regionally focused insights for Asia and ASEAN highlighting where manufacturing and demand are coalescing.

Obtain practical manufacturing benchmarks (per-line capacity bands, COGS breakdown ranges and margin guidance) to evaluate capex and unit economics.

Read up-to-date commercial developments and licensing deals that show real commercial momentum and localizations.

Use the investor analysis to translate technical and commercial signals into financeable milestones and sourcing strategies.

5 Key Questions Answered

What was the implied global market size for silicon anode materials in 2024 and what growth rate should we model to 2031?

What are current market price ranges per kilogram for engineered silicon and Si-C anode powders?

What are representative COGS breakdowns, factory gross margins and per-line production capacity ranges for commercial lines?

Which Asian and ASEAN countries are emerging as manufacturing and demand hubs, and what notable partnerships are shaping regional capacity?

Who are the leading technology players and what commercial milestones should investors monitor?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendations

Global Silicon Anode Materials Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5171770/silicon-anode-materials

Silicon Anode Materials - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5171769/silicon-anode-materials

Global Silicon Anode Materials Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5171768/silicon-anode-materials

Global Silicon Anode Materials Market Research Report 2025

https://www.qyresearch.com/reports/3425493/silicon-anode-materials

Global CVD Silicon Anode Material Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4813617/cvd-silicon-anode-material

Global Silicon-Based Anode Material Market Research Report 2025

https://www.qyresearch.com/reports/4259390/silicon-based-anode-material

Silicon Oxide Anode Material- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/3462838/silicon-oxide-anode-material

Global Silicon Anode Active Material Market Research Report 2025

https://www.qyresearch.com/reports/3557384/silicon-anode-active-material

Global Silicon Anode Battery Material Market Research Report 2025

https://www.qyresearch.com/reports/3800008/silicon-anode-battery-material

Global Siliconcarbon Anode Material Market Research Report 2025

https://www.qyresearch.com/reports/3971630/silicon---carbon-anode-material

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Silicon Anode Materials Market to Reach CAGR 40,1% by 2031 Top 20 Company Globally here

News-ID: 4217239 • Views: …

More Releases from QY Research

Top 30 Indonesian Steel Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Krakatau Steel Tbk

PT Steel Pipe Industry of Indonesia Tbk

PT Gunung Raja Paksi Tbk

PT Gunawan Dianjaya Steel Tbk

PT Betonjaya Manunggal Tbk

PT Pelat Timah Nusantara Tbk

PT Saranacentral Bajatama Tbk

PT Lionmesh Prima Tbk

PT Super Iron & Steel Tbk

PT Indo Kordsa Tbk

PT Surya Esa Perkasa Tbk

PT Indah Kiat Pulp & Paper (steel fittings)

PT KRAH Grand Kartech Tbk

PT Keyprint Tbk

PT Singaraja Putra Tbk

PT Prima Alloy Steel Tbk

PT Akebono…

Coloring the Future: Market Dynamics and Opportunities in Dual Tip Alcohol Marke …

The Dual Tip Alcohol Marker market is a dynamic segment within the broader art and creative stationery industry, driven by demand from artists, designers, students, hobbyists, and creative professionals worldwide. Dual tip markers with broad and fine ends offer multifunctional use for detailed illustration and coverage work, blending artistic precision with vibrant color performance. Alcohol markers more broadly (which include dual tip varieties) continue to expand as art supplies gain…

Acupressure Pillow Market Report 2026: Asia & ASEAN Growth, Trends, and Investme …

The global acupressure pillow industry encompasses products designed to provide therapeutic pressure relief, stress reduction, muscle relaxation, and wellness benefits. These pillows, often integrated with acupressure points or ergonomic contours, attract both health-conscious consumers and wellness-oriented markets seeking non-pharmaceutical solutions for pain management and quality of sleep. Unlike broader pillow segments such as sleeping or cervical pillows, the acupressure pillow niche blends traditional healing principles with contemporary lifestyle and wellness…

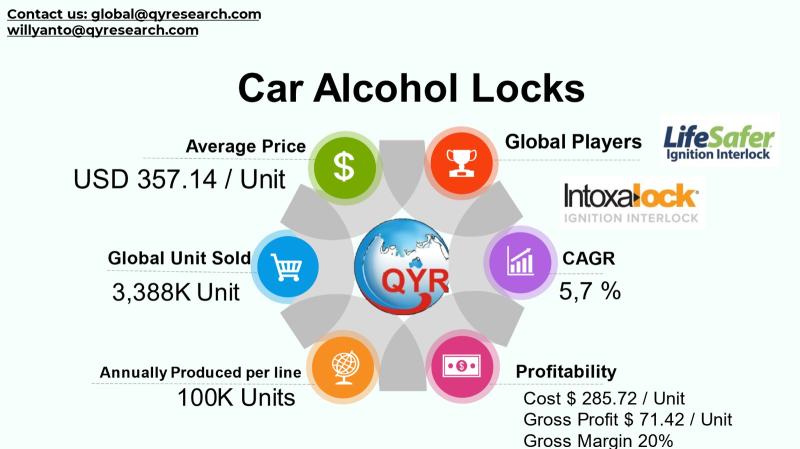

Road Safety Revolution: How Car Alcohol Locks Are Accelerating Adoption in Asia …

The Car Alcohol Lock industry, also known as the Ignition Interlock Device (IID) or Alcohol Interlock Systems market, has emerged as a crucial segment of automotive safety technologies aimed at reducing alcohol-related road accidents and enforcing drunk driving regulations. These systems are primarily in-vehicle alcohol detection devices that require drivers to pass a breath alcohol test before starting the engine, ensuring compliance with safety standards and legal mandates in many…

More Releases for Silicon

Silicon Carbide Ceramics and Silicon Nitride Ceramics

Overview of Silicon Carbide Ceramics [https://www.rbsic-sisic.com/wear-resistant-silicon-carbide-ceramic-tiles-3.html]

Silicon carbide ceramics are a new type of ceramic material made mainly from silicon carbide powder through high-temperature sintering. Silicon carbide ceramics have high hardness, wear resistance, corrosion resistance, and excellent high temperature resistance, with excellent mechanical, thermal, and electrical properties. Silicon carbide ceramics can be divided into compacted sintered silicon carbide ceramics and reaction sintered silicon carbide ceramics due to different firing processes.

Overview of…

High Purity Silicon Metal Market Growth Forecast: Latest Research Unveils Opport …

Global High Purity Silicon Metal Market Overview:

Global High Purity Silicon Metal Market Report 2022 comes with the extensive industry analysis by Introspective Market Research with development components, patterns, flows and sizes. The report also calculates present and past market values to forecast potential market management through the forecast period between 2022-2028.

This research study of High Purity Silicon Metal involved the extensive usage of both primary and secondary data sources. This…

Future Prospects of Silicon Rings and Silicon Electrodes for Etching Market by …

The Silicon Rings and Silicon Electrodes for Etching Market research report provides all the information related to the industry. It gives the outlook of the market by giving authentic data to its client which helps to make essential decisions. It gives an overview of the market which includes its definition, applications and developments and manufacturing technology. This Silicon Rings and Silicon Electrodes for Etching market research report tracks all the…

Silicon Metal Market Global Outlook 2021-2026: Ferroglobe, Mississippi Silicon, …

The Global Silicon Metal Market Research Report 2021-2026 is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand, and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Market study provides comprehensive data which enhances the understanding, scope, and application of this report.

The market…

Global Solar Grade Multi-Crystal Silicon Market Leading Major Players – GCL-Po …

Researchmoz added Most up-to-date research on "Global (United States, European Union and China) Solar Grade Multi-Crystal Silicon Market Research Report 2019-2025" to its huge collection of research reports.

The Solar Grade Multi-Crystal Silicon market report [6 Year Forecast 2019-2025] focuses on Major Leading Industry Players, providing info like company profiles, product type, application and regions, production capacity, ex-factory price, gross margin, revenue, market share and speak to info. Upstream raw materials…

Silicon Metal Market 2018: Top Key Players H.C. Starck, Elkem, Zhejiang Kaihua Y …

Silicon Metal Market Status and Forecast 2025

This Write up presents in detail analysis of Silicon Metal Market especially market drivers, challenges, vital trends, standardization, deployment models, opportunities, future roadmap, manufacturer’s case studies, value chain, organization profiles, Sales Price and Sales Revenue, Sales Market Comparison and strategies.

The Silicon Metal market Report provides a detailed analysis of the Silicon Metal industry. It provides an analysis of the past 5 years and a future forecast till the year…