Press release

Cultured Meat Market to Reach USD 564 Million by 2031 Top 10 Company Globally

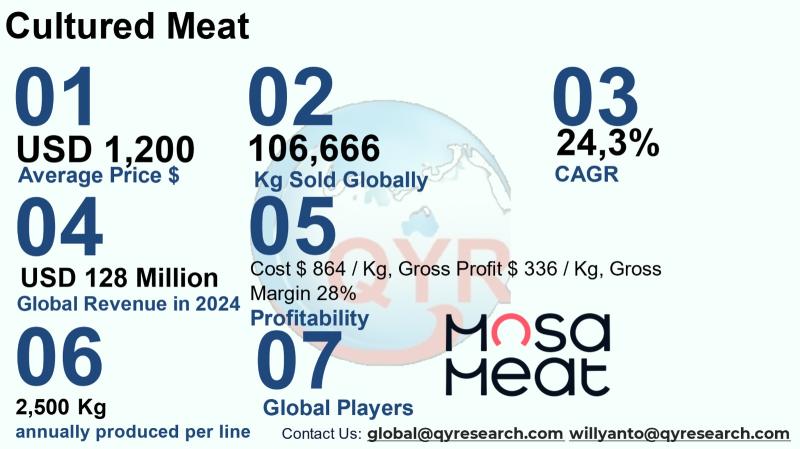

Cultured meat (also called cultivated or cell-based meat) is animal muscle and related tissues produced by growing animal cells in controlled, food-grade bioreactors rather than by raising and slaughtering animals. The industry encompasses upstream cell line development and media formulation, midstream bioprocessing and scaffolding for structured tissues, and downstream food formulation, processing and distribution for consumer products that mimic conventional meat in flavor and texture. The value proposition is that cultured meat can potentially deliver the same organoleptic properties of traditional meat while dramatically reducing animal use, and depending on scale and energy sources lowering emissions and land use. The sector combines biotech R&D, food manufacturing, and regulated food commercialization and therefore faces both life-sciences and food-industry constraints as it moves from pilots to commercial scale. For an overview of the field and recent consolidated industry analysis, see the State of the Industry and cultivated-meat briefings referenced below.The global cultured meat market size of USD 128 million in 2024 and a compound annual growth rate of 24.3% through 2031, reaching market size USD 564 million by 2031. Average retail price per kilogram is around USD 1,200 per kg. er distribution and taxes but before retail markups. Total units sold globally in 2024 is about 106,666 kgs. Cost of goods sold approximately USD 864 per kg. The COGS breakdown is growth media and reagents, bioprocess utilities and consumables, scaffolding and structure materials, labor, QA/QC, Downstream processing, packaging and cold chain. Factory gross profit is USD 336 per kg, roughly 28% factory gross margin. A full machine production capacity production is around 2,500 kg per line per year. Downstream demand is concentrated in foodservice and premium restaurants: followed by food ingredients and blended products, Retail specialty and online. Institutional / hospitality and R&D, ingredient supply for pet food or pharma adjacencies.

Latest Trends and Technological Developments

The cultivated-meat sector in 20242025 has been defined by regulatory steps, scaling investments, technological breakthroughs in perfusion and tissue thickness, and contrasting political responses across jurisdictions. On June 2025, industry coverage noted expanded commercial rollouts in Australia and Singapore and highlighted Vow Foods menu placements as a marker of growing restaurant acceptance. On April 2025 a research team at the University of Tokyo published/was covered for a hollow-fiber perfusion approach enabling nugget-sized chicken tissues an important step toward thicker, structured cuts and lower reliance on expensive scaffolding. In mid-2025 several cultivated companies completed or expanded pilot plants and gained regulatory clearances or favorable pre-market consultations in jurisdictions including the United States and Singapore, and trade coverage in July 2025 reported additional FDA premarket milestones for a fifth company. These approvals are accelerating limited commercial availability even as several U.S. states and other national jurisdictions debate or enact bans on sale or manufacture, creating a patchwork regulatory landscape. Investment into scale-focused capital projects and into growth-factor substitution (plant-based serum alternatives) continues to be the most prominent cost-reduction pathway public companies emphasize.

Asia is a strategic growth region for cultivated meat owing to high meat consumption, dynamic foodservice sectors, and regulatory openness in leading markets. The Asia-Pacific region was identified by several industry reports in 2024 as the largest regional market by early revenue share, driven by Singapores early approval pathway and active R&D clusters in Israel, Japan and Australia supporting supply and knowledge transfer. In Southeast Asia, Singapore has been the leading commercial test bedhaving issued early market approvals and hosted multiple product launcheswhile Japan and Australia are seeing research breakthroughs and pilot scale-ups. Market dynamics in Asia combine strong urban foodservice demand (which prefers premium, chef-led introductions) and growing investor interest in local production to reduce reliance on imported conventional meat and seafood. These patterns have encouraged both foreign entrants and domestic startups across East and Southeast Asia.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5171760

Cultured Meat by Type:

Chicken

Beef

Pork

Seafood

Others

Cultured Meat by Application:

Meat Products

Fresh Meats

Global Top 10 Key Companies in the Cultured Meat Market

Eat Just

Mosa Meat

Upside Foods (formerly known as Memphis Meats)

Future Meat

BlueNalu

Aleph Farms

Meatable

MeaTech 3D

SuperMeat

Integriculture

Regional Insights

Within ASEAN, Singapore is the clear leader for commercial availability and regulatory clarity, having allowed the sale of some cultivated products earlier than most peers and serving as a distribution and testing hub for the region. Indonesia, the largest ASEAN market by population, has active interest from investors and local food companies but (as of the latest public record) has not yet enacted a formal pathway for cultivated-meat approval equivalent to Singapores; Indonesias regulatory approach is evolving and will be shaped by food safety regulators, halal-certification discussions, and domestic agricultural policy. Several ASEAN markets (Thailand, Malaysia, Vietnam, the Philippines) present strong foodservice channels and export potential for value-added cultivated ingredients or blended products. Strategically, companies targeting ASEAN often use Singapore as a launchpad and then pursue regulatory or halal certification pathways to access Indonesia and other large Muslim-majority markets. Published industry briefings indicate strong consumer curiosity in ASEAN combined with cautious willingness to pay for premium or novelty products in urban centers.

Despite momentum, the sector faces four enduring challenge categories. First, scaling manufacturing while cutting media and reagent costs remains the single largest technical and economic barrier; many companies are focused on developing plant-based serum replacements and lower-cost recombinant growth factors. Second, regulatory fragmentation where some areas rapidly approve products while others ban or restrict production/sale creates market uncertainty and uneven commercialization opportunities. Third, product formation and texture for whole cuts (not just minced or formed products) require further advances in scaffolds and perfusion to produce thicker tissue inexpensively. Fourth, consumer acceptance and labeling debates (is it meat?) demand careful communication and retail/foodservice strategies, especially in culturally sensitive markets. These challenges are being attacked through targeted capital investment, strategic pilot partnerships with restaurants and ingredient makers, and public-policy engagement.

Investors and companies should treat the cultivated-meat sector as an innovation-intensive food-manufacturing opportunity where value will concentrate around (1) feedstock and media cost reduction, (2) scalable bioreactor and downstream forming platforms, (3) cell lines and IP that lower validation costs, and (4) go-to-market partnerships with the premium foodservice and ingredient markets. Early commercial returns will likely come from foodservice, ingredients and blended products rather than mass retail. Investors should also stress-test portfolios against regulatory fragmentation scenarios and prepare for multi-jurisdictional approvals and potential legal/policy headwinds in some geographies. Partnerships with established food companies and co-location near existing food clusters (e.g., Singapore, select APAC biotech hubs) can accelerate market entry while sharing compliance burdens.

Product Models

Cultured meat is produced by growing animal cells in a controlled environment rather than raising and slaughtering whole animals. As that field advances, multiple types of cultured meat are under development, each aiming to replicate the sensory, nutritional, and functional properties of conventional meats.

Cultured chicken is the most advanced and widely developed form of lab-grown meat. Its made by growing real chicken cells in nutrient-rich media, replicating the texture and flavor of conventional poultry. Notable products include:

GOOD Meat Cultivated Chicken - Eat Just / GOOD Meat: A cultured chicken product line sold under the GOOD Meat brand, approved for sale in Singapore and the U.S.

Upside Foods Cultivated Chicken - Upside Food: Upsides cultured chicken product under development and approved for commercialization by U.S. regulators.

SuperMeat Cultured Chicken - SuperMeat: Israeli startup working on meal-ready cultured poultry products.

Believer Meats Chicken Strips - Believer Meats: A proposed cultured chicken strips product under development by Believer Meats.

Hybrid Chicken Nuggets - Eat Just / GOOD Meat: A hybrid product combining cultured chicken cells with plant protein, aimed to lower cost and improve texture.

Cultured beef focuses on replicating red meat products like burgers and steaks. Its made by growing muscle and fat cells from cattle in bioreactors to mimic the taste, marbling, and texture of traditional beef. Examples include:

Mosa Meat Cultivated Beef Burger - Mosa Meat: The company behind the first lab-grown burger (prototype) and is now targeting commercial cell-cultivated beef.

Aleph Farms Steak - Aleph Farms: A cultured steak product being developed by Aleph Farms.

Orbillion Bio Premium Beef Cuts Orbillion Bio: A startup aiming to cultivate premium beef cuts, such as ribeye and filet.

Ohayo Valley Wagyu Cultured Beef Ohayo Valley: A project working on a scaffold-free platform for Wagyu cultured beef.

Steakholder (MeaTech) Cell-Cultured Beef MeaTech / Steakholder: developing cultured beef as part of its portfolio.

Cultured pork is created by growing pig cells in controlled environments to produce products such as sausages, bacon, and pork chops. Its valued for its versatility and global popularity, especially in Asian and European cuisines. Notable products include:

Meatable Cultured Pork Sausage Meatable: developed a proof-of-concept cultured pork sausage (with 28% cultured pork fat).

Meatable Cultivated Pork Fat / Pork Product Meatable: Their internal development toward full pork cuts and fat blends.

Believer Meats Pork / Bacon Prototypes Believer Meats: aims to expand into pork / bacon cultured variants.

Ivy Farms Cultured Pork / Mince Ivy Farms: works on cultured beef & pork mince / sausage formulations.

MeaTech / Steakholder Pork Alternatives MeaTech / Steakholder: which handles multiple cell-meat types also includes pork development.

Cultured seafood involves growing fish or shellfish cells to create fillets, sushi-grade cuts, or crustacean meats without ocean harvesting. It helps address overfishing, pollution, and mercury concerns while providing sustainable seafood options. Examples include:

Wildtype Sushi-Grade Salmon (Saku Salmon) (Wildtype Foods): A cultivated salmon product targeted for sushi / raw consumption.

BlueNalu Cultured Seafood (e.g. fish / tuna flesh) (BlueNalu): BlueNalu develops cell-cultured fish / seafood fillets / flesh alternatives.

Forsea Cultured Unagi (Eel) (Forsea Foods): A pioneer cell-cultured freshwater eel (unagi) product.

Shiok Meats Cultured Shrimp / Crustaceans (Shiok Meats): Singapore-based company focusing on shrimp, crab, and other shellfish cell products.

Atlantic Fish Company Cultured Fish (Atlantic Fish Company): A company working on cultivated seafood strains and products.

Cultivated meat has moved from laboratory curiosity into an early commercial industry characterized by high per-kilogram pricing, concentrated pilot production, and rapid technical progress. Asia and within it Singapore functions as an essential early market and testbed, while ASEAN markets such as Indonesia are attractive high-growth targets that will require regulatory clarity and cultural engagement. The path to mainstream, price-competitive supply depends on continued success in reducing media costs, engineering scalable bioreactors and achieving regulatory harmonization. For investors, the sector presents asymmetric upside if one can identify and back the narrow technology or manufacturing platforms that fault cost curves and regulatory acceptance.

Investor Analysis

investors need from this report is a concise synthesis of (1) the current commercial scale and market sizing (baseline USD 564M in 2024), (2) where value capture is likely (media supply, cell lines, bioreactor OEMs and downstream formulation partners), (3) regulatory and geographic risk (patchwork approval and bans), and (4) realistic production and margin assumptions to stress test investment cases. How investors use the information: build scenario models that stress test COGS declines, unit economics at scale, time to breakeven per facility line, and regulatory-timing scenarios across Asia and ASEAN. Why this matters: cultivated meat investments are capital intensive and technology-dependent; identifying the specific levers (e.g., growth-factor substitution, scalable perfusion lines, strategic foodservice partnerships in Singapore/ASEAN) substantially de-risks portfolio decisions and helps allocate capital to the companies or categories most likely to capture long-term margins. This reports operational estimates (price, COGS, factory margin, per-line capacity and demand breakdown) enable immediate scenario modeling for valuation, capex planning and exit planning.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5171760

5 Reasons to Buy This Report

You receive a synthesized, Asia-forward view tying regulatory moves to commercial rollout opportunities.

The report provides operational unit economics (price per kg, COGS per kg, factory margins) ready for investor modeling.

It contains regionally specific strategic insights for ASEAN and Indonesia market entry timing and risks.

It highlights technology milestones and recent news events with dates to ground timing assumptions.

The document identifies the most promising value capture nodes (media, bioreactors, cell lines, downstream channels) for targeted investment.

5 Key Questions Answered

What was the global cultured-meat market size in 2024 and what growth rate does this research use through 2031?

What are the modeled ex-factory price, COGS per kilogram and factory gross margin at early commercial scale?

How many kilograms of cultivated product were sold globally in 2024 and what is the downstream demand mix by channel?

Which Asia and ASEAN markets are most commercially attractive now, and what regulatory steps matter most for Indonesia?

Which company types and technological areas (media substitutes, perfusion/scaffolding, reactor OEMs) are likely to capture the majority of sector value?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Cultured Meat - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5171761/cultured-meat

Global Cultured Meat Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5171760/cultured-meat

Global Cultured Meat Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5171759/cultured-meat

Global Cultured Meat Market Research Report 2025

https://www.qyresearch.com/reports/3423710/cultured-meat

Global Meat Cultures Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4988313/meat-cultures

Global Animal Cell Cultured Meat Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5168510/animal-cell-cultured-meat

Global Cultivated Meat Cell Culture Media Market Research Report 2025

https://www.qyresearch.com/reports/4608760/cultivated-meat-cell-culture-media

Global Cell Cultured Meat Market Insights, Forecast to 2030

https://www.qyresearch.com/reports/3120057/cell-cultured-meat

Global Synthetic (Cultured) Meat Market Research Report 2025

https://www.qyresearch.com/reports/4329483/synthetic--cultured--meat

Global Meat Starter Culture Market Research Report 2025

https://www.qyresearch.com/reports/3440192/meat-starter-culture

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cultured Meat Market to Reach USD 564 Million by 2031 Top 10 Company Globally here

News-ID: 4217223 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Meat

Increasing Meat Consumption Fuels Growth Of The Cultivated Meat Market: Strategi …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Cultivated Meat Market Size By 2025?

The market size for cultivated meat has seen a speedy expansion in the last few years. Its size is projected to rise from $9.31 billion in 2024 to $10.99 billion in 2025, marking a compound annual growth rate (CAGR)…

Emerging Trends Influencing The Growth Of The Binders and Scaffolders for Meat A …

The Binders and Scaffolders for Meat And Meat Substitutes Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Binders and Scaffolders for Meat And Meat Substitutes Market Size Expected to Be by 2034?

There has been robust growth in the market size of…

Top Factor Driving Cultivated Meat Market Growth in 2025: Increasing Meat Consum …

How Are the key drivers contributing to the expansion of the cultivated meat market?

The surge in meat product consumption is predicted to be a significant catalyst for the expansion of the cultivated meat market. Created either wholly or in part from animal carcass meat or other components, meat products are recognized as food for human consumption. Cultivated meat offers a sustainable way to boost meat consumption by increasing food availability…

Vegan Meat Market is Going to Boom | Beyond Meat, Unilever, Kelloggs

Market Research Forecast published a new research publication on "Vegan Meat Market Insights, to 2032" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Vegan Meat market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Malaysia Meat Market Size Is Booming Worldwide | Darabif Meat Company, Meat Fact …

Malaysia meat market is growing at a high CAGR because of the increasing per capita income of the consumers. Moreover, the growing consumption of red meat in Malaysia is driving the growth of the market

A recent study conducted by the strategic consulting and market research firm Report Ocean revealed that the Malaysia meat market was worth USD 2.14 billion in 2020. According to the study, the market is estimated to…

Global Meat Slicers Market, Global Meat Slicers Industry, Covid-19 Impact Global …

Meat slicers can be utilized for more than just meat. With meat slicer can generate perfectly uniform onion slicer, pepper rings and several others. Anything you can cut with a mandoline, you can cut with a meat slicer. It functions high for anything you want to cut ultra-thin-much better than a knife. A meat slicer, also called a slicing machine, deli slicer or simply a slicer, is a tool utilized…