Press release

USA Fintech as a Service Market Projected to Reach $1.06 Trillion by 2032 | Fueled by Digital Transformation & API Innovation

DataM Intelligence announces its comprehensive report, "Fintech as a Service Market: Size, Share, Trends & Forecast 2025-2032." According to the analysis, the Fintech as a Service (FaaS) Market reached USD 321.04 billion in 2024 and is projected to grow at a CAGR of 16.10%, achieving USD 1,059.78 billion by 2032. In 2025, the market is witnessing robust expansion as financial institutions and enterprises increasingly embed financial capabilities such as payments, lending, and insurance through API-driven models instead of developing standalone infrastructure.Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-

https://www.datamintelligence.com/download-sample/fintech-as-a-service-market?sai-v

Market Segmentation & Drivers :

The Fintech as a Service Market is segmented by Type, Deployment, Technology, Application, and Region :

By Type: Payments as a Service, Banking as a Service (BaaS), Lending as a Service, Insurance as a Service, and others.

By Deployment: Cloud-based, On-premises, and Hybrid models.

By Technology: API integration, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA).

By Application: Banks & Financial Institutions, Insurance Companies, Fintech Startups, eCommerce & Retail, Telecom Enterprises, and Government Organizations.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=fintech-as-a-service-market?sai-v

Key Drivers :

The rise of embedded finance across industries enabling non-financial companies to offer integrated payment and lending services.

Increasing regulatory support for open banking and API frameworks.

Growth in cloud and AI-driven financial infrastructure, enabling scalability and speed.

Rising emphasis on fraud prevention, KYC automation, and digital compliance.

Regional Insights: USA & Japan :

United States:

The USA leads global adoption, supported by a mature fintech ecosystem, open-banking policies, and strong venture capital investments. In 2025, American firms are integrating payment APIs, digital banking solutions, and risk management services to enhance customer experience and speed innovation.

Japan:

Japan is rapidly evolving as a strategic market in Asia-Pacific. Financial institutions and technology providers are collaborating to offer API-based banking and insurance solutions. Regulatory sandboxes and digital transformation initiatives are driving adoption across banks, eCommerce platforms, and telecom operators.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/fintech-as-a-service-market?sai-v

Recent Developments (2025) :

U.S. fintechs expanded FaaS offerings to include comprehensive digital banking and compliance modules.

Investment in AI-powered risk assessment and fraud prevention tools surged.

Japanese firms entered strategic alliances with global API providers to accelerate embedded finance.

Blockchain and cloud-native architectures were integrated to enhance security and operational efficiency.

Competitive Landscape & Strategic Outlook :

The market is moderately fragmented with players such as Finastra, Stripe, Rapyd, Solid Financial Technologies, Synctera, SAP Fioneer, TCS BaNCS, PayMate, and Backbase. These firms compete on API scalability, security, regulatory compliance, and regional customization.

Strategic Outlook :

Expansion of vertical integration for end-to-end financial infrastructure.

Increased collaborations between fintechs and traditional banks.

Investments in AI for real-time fraud detection and personalized banking.

Digital marketing and eCommerce integration to reach new customer segments.

Benefits of the Report :

Verified market forecast (2025-2032) with segment-wise breakdown.

Insight into emerging FaaS technologies and business models.

Competitive intelligence and regional growth outlook for USA and Japan.

Strategic guidance on innovation, compliance, and investment opportunities.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-

subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global

investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataMIntelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology. Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release USA Fintech as a Service Market Projected to Reach $1.06 Trillion by 2032 | Fueled by Digital Transformation & API Innovation here

News-ID: 4213620 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

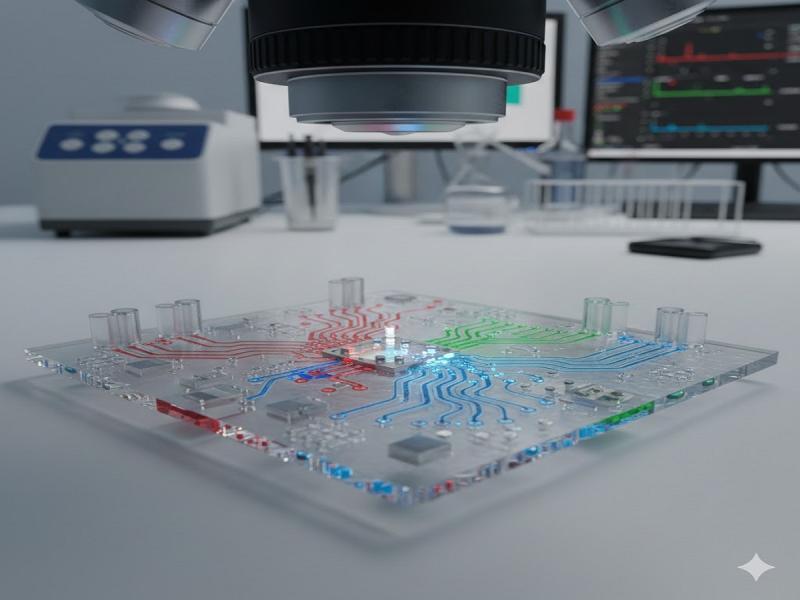

Lab-on-a-Chip Market to Reach US$ 14.66 Billion by 2032 | CAGR 10.12% | North Am …

Lab-on-a-Chip Market Overview

The global Lab-on-a-Chip (LoC) market reached US$ 6.78 billion in 2024 and is projected to reach US$ 14.66 billion by 2032, growing at a CAGR of 10.12% during the forecast period (2025-2032). The market growth is primarily driven by the rising demand for quick, portable, and cost-effective diagnostic solutions in medical, pharmaceutical, and research sectors. Lab-on-a-chip devices integrate multiple laboratory functions onto a single microchip, enabling real-time disease…

Network Security Sandbox Market to Reach US$ 368.48 Billion by 2032 | CAGR 53.46 …

Network Security Sandbox Market Overview

The global Network Security Sandbox (NSS) Market reached US$ 11.98 billion in 2024 and is projected to surge to US$ 368.48 billion by 2032, growing at a remarkable CAGR of 53.46% during the forecast period 2025-2032. The rapid expansion is driven by the rising prevalence of cyber threats worldwide, including advanced persistent threats (APTs), zero-day attacks, ransomware, phishing, and malware, which are often undetected by traditional…

AI in Edge Computing Market to Reach US$ 83.86 Billion by 2032 | CAGR 22.5% | No …

AI in Edge Computing Market Overview

The global AI in Edge Computing market reached US$ 16.54 billion in 2024 and is projected to grow to US$ 83.86 billion by 2032, expanding at a CAGR of 22.50% during the forecast period 2025-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/ai-in-edge-computing-market?Juli

The market is witnessing rapid growth, driven by the increasing demand for real-time data processing, low-latency applications,…

Kidney Transplant Market to Reach US$ 10.99 Billion by 2033 | CAGR 3.7% | North …

Kidney Transplant Market

The global kidney transplant market reached US$ 7.91 billion in 2024 and is projected to grow to US$ 10.99 billion by 2033, registering a CAGR of 3.7% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/kidney-transplant-market?Juli

The market growth is primarily driven by the rising prevalence of end-stage renal disease (ESRD) and chronic kidney disorders worldwide. Advances in…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…