Press release

Protective Wrapping Paper Market to Reach USD 6,377 Million by 2031 Top 20 Company Globally

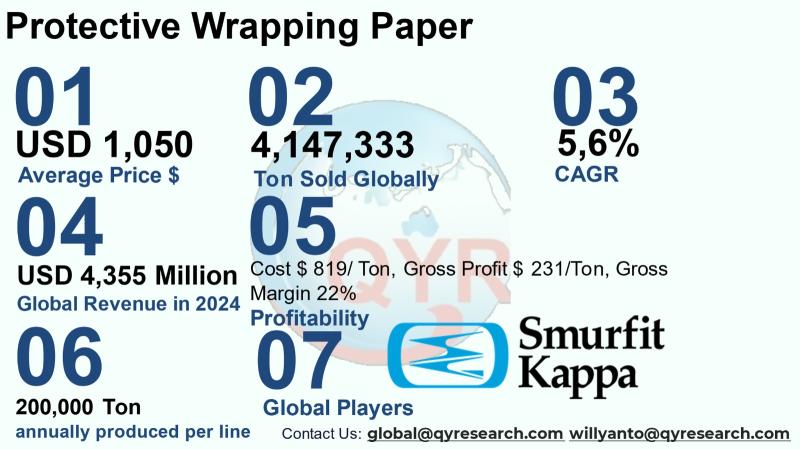

Protective wrapping paper is a specialized segment of paper-based protective packaging used to cushion, separate and protect goods across supply chains from e-commerce parcels and electronics to furniture and industrial components. The product range spans lightweight tissue and kraft interleaving papers up to heavier basis weights used as void fill or surface protection; formulations include virgin fiber, recycled content and surface treatments that improve barrier and strength performance. Demand drivers are the twin pressures of rising e-commerce volumes and brand/consumer preference for recyclable, lower-plastic packaging solutions, while supply factors are governed by pulp/paper feedstock availability, energy costs and the capital intensity of paper machine lines.The global protective wrapping paper market size in 2024 amounted to USD 4,355 million, with a forecast compound annual growth rate of 5.6% through 2031, reaching market size USD 6,377 million by 2031. As demand shifts toward paper-based protective solutions and away from single-use plastic fillers. An average selling price of USD 1,050 per ton, total global volume sold in 2024 was in the order of 4,147,333 tons. On a factory level the industrywide reported factory gross margin is approximately 22%; this translates into a typical factory gross profit USD 231 per ton in the industry and a corresponding cost of goods sold USD 819 per ton. A single line full machine capacity production around 200,000 tons per line per year. Downstream demand split is weighted heavily toward e-commerce/parcel & logistics, with food & beverage, electronics and furniture/industrial making up most of the remainder.

Operational and cost detail (numbers)

The average selling price used in this study is USD 1,050 per ton. Total volume sold globally (2024) is reported here as approximately 4,147,600 metric tons. Industry COGS per ton is presented at USD 819 per ton and factory gross profit per ton at USD 231 per ton, consistent with a factory gross margin of 22%. The breakdown of COGS by component (percentage of COGS) is presented as: raw material (pulp/secondary fiber) 60.0%, energy & steam 12.0%, transportation & logistics 6.0%, labor and direct manufacturing wages 8.0%, chemicals/additives/coating materials 6.0%, maintenance & spare parts 4.0%, and manufacturing overhead & other 4.0% (these percentages sum to 100% of COGS). Translated into USD per ton (component amounts rounded): raw material ~USD 491/ton, energy & steam ~USD 98/ton, transportation & logistics ~USD 49/ton, labor ~USD 66/ton, chemicals/additives ~USD 49/ton, maintenance ~USD 33/ton, overhead/other ~USD 33/ton. Representative full machine production capacity per single paper line used for packaging/wrapping grades typically ranges from approximately 100,000 to more than 600,000 metric tons per year depending on machine width and speed; recent new builds and modernized lines commonly target 300,000 to 520,000 tpy as economically efficient benchmarks. Downstream industry demand by application is allocated in this report as follows (percent of global protective wrapping paper consumption): e-commerce & retail cushioning 38%, food & beverage (surface protection and interleaving) 25%, industrial/manufacturing protective wrapping 12%, electronics & fragile goods 10%, automotive & components 5%, other (furnishings, medical, conversions) 10%. These downstream percentages are derived from a synthesis of recent papers and sector reports showing a large share for e-commerce and significant contributions from food and general packaging.

Latest Trends and Technological Developments

Sustainability-driven substitution of plastic fillers with paper-based protective materials continues to be a defining theme: major e-commerce platforms have publicly accelerated paper filler adoption to reduce single-use plastics, exemplified by Amazons public announcement and reporting on a major shift to paper filler in North America dated June 2024. Innovations in recyclable coatings and lignin-based binders designed to make treated paper both water-resistant and recyclable received investor attention when an Australian start-up raised funding to commercialize a lignin-based recyclable coating (news dated October 2024). Industry trade shows and regional hubs for technology transfer including the Paper Chain Southeast Asia Expo co-located with WEPACK Southeast Asia in Jakarta signal focused investment and capacity expansion interest across Southeast Asia (announcements in 2025 for events and cooperation). At the same time, large integrated players are realigning capacity some mill closures and selective conversions were announced in 2024 to 2025 as companies optimize asset mixes and respond to variable demand and higher input costs. These items illustrate both demand-pull for greener cushioning solutions and supply-side restructuring across the global paper industry.

Asia Pacific is the largest regional market for protective wrapping paper by volume and continues to expand faster than developed markets due to its manufacturing base, export-oriented supply chains and accelerating regional e-commerce adoption. Capacity growth in China, Indonesia and India is supported by both domestic converters and exporters serving global brands. Cost pressures in Asia differ by country: mills dependent on imported pulp face more price volatility, while regions with strong recycling collection (e.g., parts of Southeast Asia) can access lower-cost recovered fiber streams for recycled grades. Policy momentum to reduce single-use plastics across several Asian governments and private sustainability commitments from major retailers are increasing the share of paper-based protective solutions. Regional capital investments are concentrated where logistic cost savings and proximity to converters justify new lines; several trade shows and technology forums held in the region in 20242025 have highlighted machine upgrades, automation of converting lines and coating chemistries tailored to recyclable treated paper.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5171782

Protective Wrapping Paper by Type:

90 to 120 GSM

135 to 210 GSM

220 to 450 GSM

above 450 GSM

Others

Protective Wrapping Paper by Application:

E commerce Packaging

Food and Beverages Packaging

Electronics Packaging

Manufacturing Packaging

Others

Global Top 20 Key Companies in the Protective Wrapping Paper Market

Smurfit Kappa

Sealed Air Corporation

Pregis

Sonoco Products Company

International Paper

Berry Global Inc

Ranpak

Storopack

Canson

Bellofy

Pemtalic

Dervent

Srathmore

Mondi Group

Intertape Polymer Group

Ahlstrom Munksjo

Stora Enso Oyj

Klabin S,A.

Nine Dragons Paper

Lee & Man Paper

Regional Insights

Within ASEAN, Indonesia is both a sizeable domestic market and a growing production base for paper packaging and protective papers. Indonesias position benefits from expanding domestic e-commerce, government support for manufacturing clusters and proximate access to Southeast Asia shipping lanes. The WEPACK / Paper Chain Southeast Asia events in 2025hosted in Jakartaunderscore Indonesias role as a regional hub where suppliers, converters and equipment vendors demonstrate investment commitment and technology transfers. Across ASEAN, smaller mills and converters are increasingly partnering with global equipment OEMs to increase line efficiency and reduce unit costs, while converters focus on value-added services (custom die-cutting, protective inserts, printing) to win brand business. These trends create opportunities for mid-sized producers in Indonesia to capture both domestic demand and regional exports, provided they can secure fiber inputs and manage energy costs.

Key challenges for the protective wrapping paper industry are volatility in pulp and recovered fiber prices, energy and steam costs which form a sizable portion of COGS, and the capital intensity and lead times for building or upgrading paper machine lines. Regulatory and standards shifts on recyclability and chemical treatments require ongoing R&D and sometimes retrofit investments. In some mature markets, demand softness or slower inventory turnover among large e-tailers can temporarily depress volumes and pressure mill utilizations, prompting rationalization of high-cost capacity. Logistics bottlenecks and higher freight rates for international shipping affect the competitiveness of exported paper products from Asia to distant markets. Securing skilled operating crew and optimizing machine runnability to reduce waste are also operational constraints for many converters and mills.

Producers should prioritize mixed strategies that combine cost discipline with targeted investments in flexible converting capacity and recyclable treatments. Securing long-term fiber contracts and investing in energy efficiency and on-site cogeneration will materially reduce COGS volatility. Moving downstream into value-added converting (pre-formed cushions, printed interleaving, engineered wraps) improves margins and reduces exposure to commoditized paper pricing. Partnerships with e-commerce platforms and fulfillment operators to supply optimized, right-sized paper protection solutions can create sticky contracts and higher volume certainty. For new entrants in ASEAN, focus on modular lines and converting agility to serve rapidly evolving demand patterns while keeping capital intensity manageable. Finally, investing in validated recycling/recyclability claims and third-party certifications can unlock procurement preferences among multinational brand customers.

Product Models

Protective wrapping paper comes in a range of basis weights (GSM = grams per square meter), each suited to different cushioning, bridging, or surface-protection roles.

90120 GSM) are generally used for light wrapping, interleaving, or void fill. Notable products include:

Eco4plan Honeycomb Packing Paper 90 GSM - Eco4plan: a biodegradable honeycomb wrap paper that expands into cushioning mesh.

PadPak Paper Roll 90 GSM - Ranpak: converts into protective pads for fragile items in cartons.

Kraft Paper Roll 90 GSM (900 mm × 200 m) - Hub Packaging: standard kraft roll for wrapping or base layering.

Sealed Air Embossed Paper (≈ 100 GSM range) - Sealed Air: light embossed paper cushioning line.

Pregis Easypack Single-Ply 90 GSM - Pregis: single-ply protective paper for manual wrapping

135-210 GSM offer more stiffness and tear resistance, often used as buffer layers or inner wraps. Examples include:

Sealed Air Paper Kushion Kraft (mid grade) - Sealed Air: padded kraft in mid weights for cushioning heavier items.

G&J Waxed Kraft 135210 GSM - G&J Paper: waxed kraft in that GSM range for moisture resistance.

Seaman Paper Packing Paper / Kraft (mid weight lines) - Seaman Paper: Seaman Papers craft / packaging portfolio includes mid-weight kraft lines.

Pregis Medium EasyPack Paper - Pregis: middle grade from their on-demand paper suite.

Sealed Air Embossed Paper (mid variant) - Sealed Air: embossed cushioning paper in the heavier mid ranges.

220450 GSM provide structural support and shock resistance, suitable for heavier items or multilayer protection. Notable products include:

Industrial Heavy Kraft Board 400 GSM from Sealed Air: offers rigid protection for large fragile goods during transit.

Food Safe 350 GSM Brown Kraft Paper Roll by BMPAPER: is a durable, PE-coated wrapping paper ideal for packaging that needs moisture resistance and structural strength.

Waxed Kraft 220 GSM - G&J Paper: heavy waxed kraft ideal for bulk packaging or moisture protection

PadPak SR - Ranpak: pads produced from thicker kraft: Ranpaks paper grades used with PadPak can be specified for robust protection

TechniPaper heavy kraft rolls- Smurfit kappa: a range of heavier kraft/liner grades used for structural wrap and board inserts

above 450 GSM are used in demanding applications like industrial dunnage, rigid panels, or molded protective inserts. Examples include:

Smurfit Kappa Solid Board / heavy folding carton board (500gsm+): used as rigid protective panels, stiff inserts and laminated dunnage.

Sealed Air laminated/heavy paperboard solutions (industrial protective sheets): custom heavy paperboard used where rigid protection is required (often supplied as laminated boards rather than single-ply paper).

Jumbo Roll Tearproof White Stone Wrapping Paper by Guangzhou BMPAPER Co., Ltd (490560 GSM): is a stone-based wrapping material that offers exceptional tear resistance and waterproof qualities, making it ideal for packaging that must endure moisture and rough handling.

High Grammage Stone Paper for Box Bags from Guangzhou BMPAPER Co., Ltd (450600 GSM): provides superior durability and moisture resistance, designed for luxury box bags and durable wrapping applications.

Recyclable Environmental Stone Paper Series (up to 600 GSM): combining eco-friendliness with heavy-duty protection, suitable for robust inserts and protective covers.

Protective wrapping paper is a growing, strategic niche within the larger paper packaging complex driven by e-commerce growth and sustainability trends that favor paper over single-use plastics. The market is sizeable and expanding, but it is simultaneously shaped by volatile input costs, high capital intensity and a need for continuous product and process innovation. Asia and Southeast Asia, led by countries such as China and Indonesia, will remain central to global supply and demand dynamics. Companies that combine cost competitiveness, capital efficiency, and demonstrable recyclable solutions are best positioned to capture long-term value.

Investor Analysis

This report highlights measurable industry economics and structural drivers that investors should monitor. What investors need to see is the size of the addressable market and the volume dynamics implied by the average unit price, since volume trends signal utilization and pricing power. How investors can use these insights is by screening companies for margin resilience (evidence of stable or improving factory gross margin, access to low-cost fiber, energy efficiency, and downstream contracting with large e-tailers) and capital allocation discipline (targeted capacity investments rather than broadscale expansion). Why these metrics matter is straightforward: companies that can protect or grow gross margin per ton while prudently expanding converting and client relationships will compound cash flows faster and trade at premium multiples; conversely, firms exposed to raw material inflation without mitigation strategies are at higher risk of margin compression. For private equity and strategic investors, opportunities exist in selectively consolidating regional converters, investing in coating/chemistry start-ups that enable recyclable coatings, and financing energy modernization projects that lower unit costs. The combination of sustainable demand tailwinds and industry consolidation creates multiple, actionable investment pathways.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5171782

5 Reasons to Buy This Report

Provides a concise quantified market size and volume baseline tied to an industry price point.

Presents unit economics per ton for quick margin analysis.

Offers regionally focused insights for Asia and covering demand drivers and capacity signals.

Summarizes latest, investible trends and recent industry news that affect near-term valuation and M&A activity.

Recommends strategic actions and investor use cases that link operational levers to value creation.

5 Key Questions Answered

What was the global market size for protective wrapping paper in 2024 and what CAGR is expected through 2031?

How many metric tons were sold globally in 2024 at the stated average price, and what is the implied factory gross profit per ton?

What is the cost structure per ton and the percentage breakdown of the main cost components?

What machine capacities and capital intensities should buyers and investors expect when evaluating new lines or mill upgrades?

Which downstream sectors account for the largest shares of demand, and how concentrated is demand in Asia and ASEAN?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Protective Wrapping Paper Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5171779/protective-wrapping-paper

Global Protective Wrapping Paper Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5171780/protective-wrapping-paper

Protective Wrapping Paper - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5171781/protective-wrapping-paper

Global Paper Protective Packaging Market Research Report 2025

https://www.qyresearch.com/reports/4028729/paper-protective-packaging

Global Food Wrapping Paper Market Research Report 2025

https://www.qyresearch.com/reports/4157013/food-wrapping-paper

Global Honeycomb Protective Paper Market Research Report 2025

https://www.qyresearch.com/reports/3799138/honeycomb-protective-paper

Global Expandable Honeycomb Protective Paper Market Research Report 2025

https://www.qyresearch.com/reports/3821161/expandable-honeycomb-protective-paper

Global Paper Wrap Market Research Report 2025

https://www.qyresearch.com/reports/3967957/paper-wrap

Global Kraft Paper for Industrial and Protective Packaging Market Research Report 2025

https://www.qyresearch.com/reports/4350129/kraft-paper-for-industrial-and-protective-packaging

Global Protective Flexible Paper Bags Market Research Report 2024

https://www.qyresearch.com/reports/3193769/protective-flexible-paper-bags

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Protective Wrapping Paper Market to Reach USD 6,377 Million by 2031 Top 20 Company Globally here

News-ID: 4210682 • Views: …

More Releases from QY Research

Top 30 Indonesian Coal Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Alamtri Resources Indonesia Tbk (formerly Adaro Energy)

PT Bumi Resources Tbk

PT Bayan Resources Tbk

PT Indo Tambangraya Megah Tbk

PT Bukit Asam Tbk (PTBA)

PT Golden Energy Mines Tbk (GEMS)

PT Dian Swastatika Sentosa Tbk (DSSA)

PT Indika Energy Tbk (INDY)

PT Akbar Indo Makmur Stimec Tbk (AIMS)

PT Atlas Resources Tbk (ARII)

PT Borneo Olah Sarana Sukses Tbk (BOSS)

PT Baramulti…

From Sugar to Profit: Economics of the Global Ready-to-Roll Icings Industry

Ready-to-roll icings (also known as rolled fondant or sugar paste) are pre-formulated sugar-based sheets used for cake covering, decorative modeling, and bakery finishing in commercial and artisan baking.

Products are supplied in bulk slabs, sheets, and blocks and are valued for: Consistent elasticity, Reduced preparation time, Uniform finish, Extended shelf stability.

Industrial buyers include industrial bakeries, frozen dessert processors, QSR chains, supermarkets, and cake studios.

Growing demand for celebration cakes, premium bakery products,…

Sustainable Staples: Why Investors Are Targeting Organic Pulse Processing

Organic dry pulses include organically cultivated lentils, chickpeas, peas, mung beans, pigeon peas, and dry beans produced without synthetic pesticides, fertilizers, or GMOs.

Industry benefits from: Rising plant-protein adoption, Gluten-free and clean-label trends, Soil-friendly nitrogen-fixing crop rotation, Government organic agriculture subsidies across Asia.

Global trade dominated by exporters in India, Australia, Canada, and Turkey

Growing consumption in China, Japan, Indonesia, and Vietnam.

Global Overview

Market size (2025): USD 5,266 million

Market size (2032): USD 8,231 million

CAGR…

Baby Care Boom: USD 9.1B Global Bath & Shower Market Driven by Asia Growth

Baby bath and shower products include liquid cleansers, tear-free shampoos, head-to-toe washes, soaps, bath oils, foam washes, and sensitive-skin dermatological formulations designed specifically for infants and toddlers.

Products emphasize mild surfactants, hypoallergenic formulations, pH-balanced systems (5.56.0), and natural/plant-derived ingredients to minimize irritation and comply with pediatric dermatology standards.

Demand is driven by rising hygiene awareness, premiumization of infant care, urban middle-class expansion, and increased birth rates in emerging Asia.

Strong shift from bar…

More Releases for Paper

Newsprint Paper Market | Alberta Newsprint, BO Paper Group, Daio Paper, Emami Pa …

Introduction:

The introduction to the report serves as a gateway into the comprehensive world of the newsprint paper market. As industries continue to evolve and adapt to changing consumer demands and technological advancements, understanding the market dynamics becomes paramount for industry stakeholders. The report takes on the responsibility of offering a profound and all-encompassing analysis of the newsprint paper market, catering to the needs of a diverse audience that includes manufacturers,…

Paraffin Paper Market to Witness Massive Growth by 2027 | Patty Paper, Dunn Pape …

A new research document released by HTF MI with title "Global Paraffin Paper Market SWOT analysis by Size, Status and Forecast 2022 to 2027" provides a complete assessment of Paraffin Paper Market. The study focuses on changing market dynamics, geopolitical and regulatory policies, key players Strategies to better analyse demand at risk across various product type. Some of the major and emerging players analysed in the study are Dunn Paper,…

Pulp and Paper Market Key Player Analysis By sappi, Lee & Man Paper, Nippon Pape …

Global Pulp and Paper Market Research Report 2018–2025 is a historical overview and in-depth study on the current & future market of the Pulp and Paper Industry. The report represents a basic overview of the market status, competitor segment with a basic introduction of key vendors, top regions, product types and end industries. This report gives a historical overview of the market trends, growth, revenue, capacity, cost structure, and…

Global Waste Paper Recycling Market Forecast 2019-2026 Miami Waste Paper, Dixie …

Market study on Global Waste Paper Recycling 2019 Research Report presents a professional and complete analysis of Global Waste Paper Recycling Market on the current market situation.

Report provides a general overview of the Waste Paper Recycling industry 2019 including definitions, classifications, Waste Paper Recycling market analysis, a wide range of applications and Waste Paper Recycling industry chain structure. The 2019's report on Waste Paper Recycling industry offers the global…

Book Paper Market Report 2018 Companies included Stora Enso, Oji Paper, Nippon P …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…

Global Pulp and Paper Market 2018 Key Players: sappi, Lee & Man Paper, Nippon Pa …

Pulp and Paper Market:

WiseGuyReports.com adds “Pulp and Paper Market 2018 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting 2025” reports tits database.

Executive Summary

Global Pulp and Paper Market valued approximately USD XX billion in 2017 is anticipated to grow with a healthy growth rate of more than XXX% over the forecast period 2017-2025. Pulp and paper producers produces and sells cellulose-based products, derived from wood. Packaging paper, graphic paper and…