Press release

Digital Lending Market Forecast to Reach USD 889.99 Billion by 2030, Driven by Consumer Lending and AI Underwriting Trends

Mordor Intelligence has published a new report on the Digital Lending Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Overview of the Digital Lending Market

According to the Mordor Intelligence, the Digital Lending Market reached a value of USD 507.27 billion in 2025 and is forecast to climb to USD 889.99 billion by 2030, translating into an 11.9% CAGR. North America currently holds the largest Digital Lending Market share, while Asia-Pacific is emerging as the fastest-growing region, supported by increasing smartphone penetration and mobile-first lending solutions.

The Digital Lending Market trends indicate a shift toward faster loan approvals, lower processing costs, and more flexible financing options for both consumers and enterprises.

Report Overview: https://www.mordorintelligence.com/industry-reports/digital-lending-market?utm_source=openpr

Key Trends in the Digital Lending Market

1. Smartphones as the New Lending Channel

The widespread use of smartphones and internet access allows lenders to reach customers directly through mobile apps. In Asia-Pacific, digital-wallet transactions are creating an environment ripe for in-app credit offers.

2. Real-Time Loan Approvals Through Automation

Digital lending platforms now provide nearly immediate loan approvals. Automated underwriting engines process borrower data in real time, often granting approvals within minutes without extensive documentation.

3. Frictionless Onboarding with Open Banking & e-KYC

Digital identity systems, such as e-KYC interfaces, enable onboarding in under a minute, improving operational efficiency and borrower satisfaction.

4. Digitally Empowering MSMEs with Flexible Credit

Small and medium enterprises face significant funding gaps, which digital lenders address through revenue-based financing and invoice factoring. Real-time sales data allows rapid disbursement of working-capital loans, supporting businesses in Latin America, Southeast Asia, and North America.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/digital-lending-market?utm_source=openpr

Market Segmentation of the Digital Lending Market

By Type:

Consumer

Enterprise / SME

By Loan Type:

Personal Loans

Auto Loans

Student Loans

Mortgage / Home Equity

Small Business Working-Capital Loans

By Deployment Mode:

Cloud-Based Platforms

On Premise Solutions

Hybrid

By Business Model:

Peer-to-Peer (Marketplace) Lending

Balance-Sheet (Direct) Lending

Embedded-Finance / BNPL Lending

Crowdfunding and Revenue-Based Financing

By Technology:

AI / Machine-Learning-Driven Underwriting

API and Open-Banking Platforms

Blockchain-Based Lending

Big-Data Analytics

By Geography:

North America: United States, Canada, Mexico

Europe: Germany, United Kingdom, France, Russia, Rest of Europe

Asia-Pacific: China, Japan, India, South Korea, Australia, Rest of Asia-Pacific

Middle East and Africa: Middle East (Saudi Arabia, United Arab Emirates, Rest of Middle East), Africa (South Africa, Egypt, Rest of Africa)

South America: Brazil, Argentina, Rest of South America

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports - https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=openpr

Key Players in the Digital Lending Market

Funding Circle Limited (Funding Circle Holdings PLC): A leading peer-to-peer lending platform focused on providing loans to small and medium-sized enterprises globally.

On Deck Capital Inc.: Offers online lending solutions for small businesses, specializing in term loans and lines of credit.

Prosper Marketplace, Inc.: One of the first peer-to-peer lending marketplaces in the U.S., connecting borrowers with individual and institutional investors.

Bizfi LLC: Provides small-business financing through online lending platforms, including term loans and merchant cash advances.

LendInvest Plc: A UK-based online platform offering property finance, including buy-to-let and bridging loans.

Explore more insights on Digital Lending Market competitive landscape: https://www.mordorintelligence.com/industry-reports/digital-lending-market/companies?utm_source=openpr

Conclusion on the Digital Lending Market

The Digital Lending Market size is set for substantial growth as digital-first lending solutions continue to gain acceptance among consumers and enterprises. The increasing use of smartphones, automation in underwriting, and favorable regulatory frameworks are driving the expansion of digital loan offerings.

Digital Lending Market statistics indicate that emerging regions, particularly in Asia-Pacific and Africa, while North America remains a significant contributor to market size.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/digital-lending-market?utm_source=openpr

Industry Related Reports:

United States Digital Lending Market

The United States Digital Lending Market reached USD 303.07 billion in 2025 and is projected to grow to USD 560.97 billion by 2030, registering a CAGR of 13.1%. Growth is driven by the increasing adoption of mobile-first lending platforms and AI-powered underwriting, along with rising demand for faster, flexible loan approval processes among consumers and small businesses.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-digital-lending-market?utm_source=openpr

Payday Lending Market

The Payday Lending Market was valued at USD 41.12 billion in 2025 and is expected to reach USD 51.68 billion by 2030, growing at a CAGR of 4.68%. The market is driven by increasing demand for short-term, quick-access credit and the growing integration of digital platforms that simplify loan application and approval processes for consumers.

Get more insights: https://www.mordorintelligence.com/industry-reports/payday-lending-market?utm_source=openpr

Europe Crowdlending and Crowd Investing Market

The Europe Crowdlending and Crowd Investing Market is estimated at USD 13.68 billion in 2025 and is projected to reach USD 14.92 billion by 2030, growing at a CAGR of 1.76%. Growth is supported by the rising adoption of online investment platforms and increased participation from retail and institutional investors seeking alternative financing options.

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-crowd-lending-and-crowd-investing-market?utm_source=openpr

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Market Forecast to Reach USD 889.99 Billion by 2030, Driven by Consumer Lending and AI Underwriting Trends here

News-ID: 4206977 • Views: …

More Releases from Mordor Intelligence

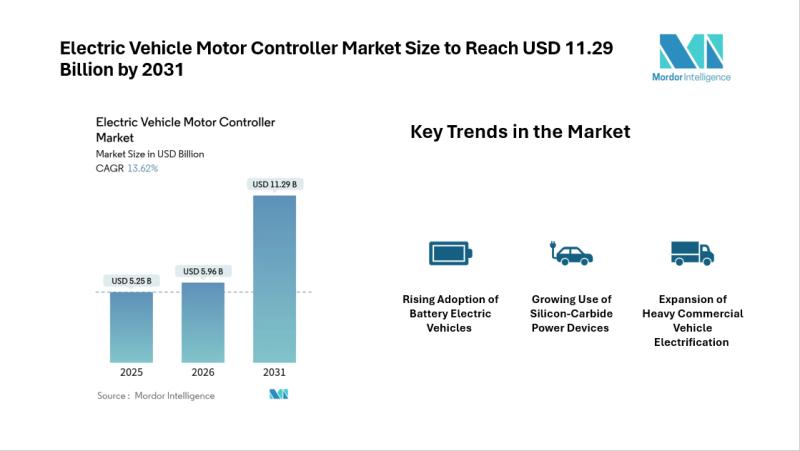

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

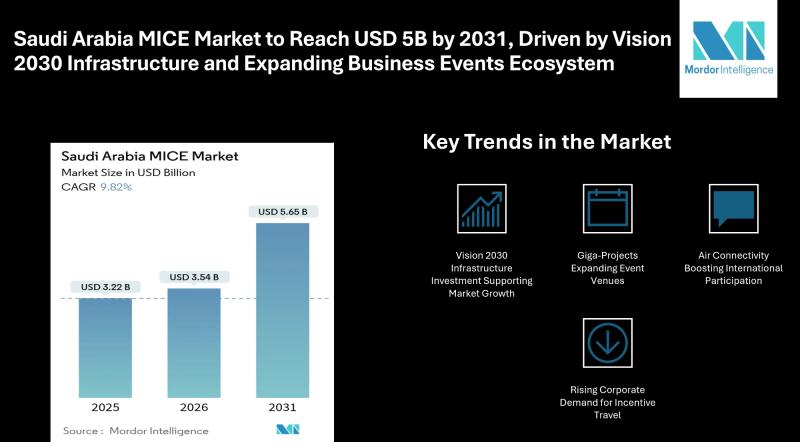

Saudi Arabia MICE Market to Reach USD 5B by 2031, Driven by Vision 2030 Infrastr …

Mordor Intelligence has published a new report on the Saudi Arabia MICE market, offering a comprehensive analysis of trends, growth drivers, and future projections

Saudi Arabia MICE Market Overview

According to Mordor Intelligence, the Saudi Arabia MICE market was valued at USD 3.22 billion in 2025 and is estimated to grow from USD 3.54 billion in 2026 to reach USD 5.65 billion by 2031, registering a CAGR of 9.82%…

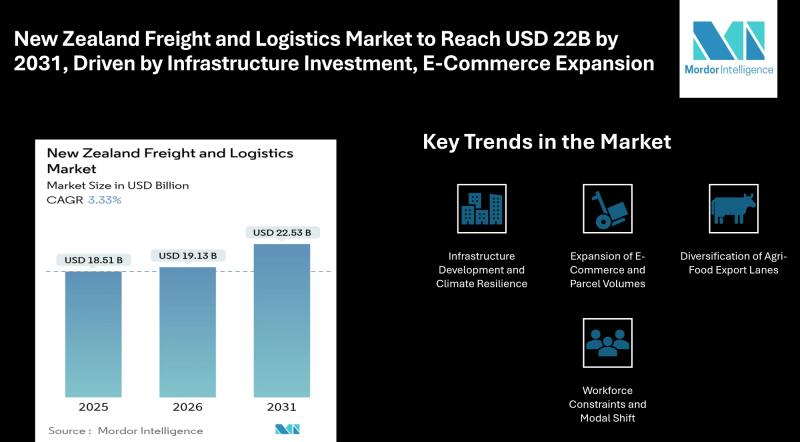

New Zealand Freight and Logistics Market to Reach USD 22.53 Billion by 2031, Dri …

Mordor Intelligence has published a new report on the New Zealand freight and logistics market, offering a comprehensive analysis of trends, growth drivers, and future projections

Overview of the New Zealand Freight and Logistics Market

The New Zealand freight and logistics market is projected to reach USD 22.53 billion by 2031, growing from USD 19.13 billion in 2026, at a CAGR of 3.33%. The steady rise reflects continued infrastructure…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…