Press release

Australia Construction Market 2025 | Worth USD 588 Billion by 2033

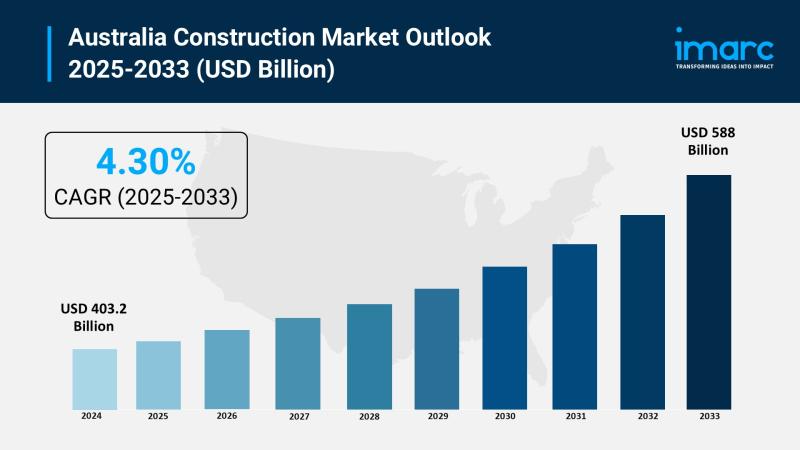

The latest report by IMARC Group, "Australia Construction Market Size, Share, Trends and Forecast by Sector and Region, 2025-2033," provides an in-depth analysis of the Australia construction market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia construction market size reached USD 403.2 billion in 2024 and is projected to grow to USD 588 billion by 2033, exhibiting a steady growth rate of 4.30% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 403.2 Billion

Market Forecast in 2033: USD 588 Billion

Growth Rate (2025-2033): 4.30%

Australia Construction Market Overview:

The Australia construction market is experiencing steady growth driven by growing government infrastructure spending with FY 2024-25 Budget providing AUD 16.5 billion over 10 years for priority road and rail infrastructure projects, economic expansion leading to construction of commercial, residential, and mixed complexes, and advanced technologies including Building Information Modeling (BIM), drones, and 3D printing revolutionizing project execution. The market demonstrates robust momentum fueled by population growth creating sustained demand for housing with 4.6% increase in dwelling commencements and urbanization driving infrastructure needs in major cities, sustainability trends promoting energy-efficient buildings and eco-friendly materials with RESIN8 facility transforming plastics into building materials, and Believe Housing Australia's AUD 14 million affordable rental housing project addressing affordability challenges. Strategic expansion is supported by public-private partnerships leveraging private capital for transport, healthcare, and education infrastructure, Build-to-Rent developments gaining momentum as institutional investment class offering professionally managed housing, and Saint-Gobain's July 2024 acquisition of CSR enhancing foothold in Asia-Pacific construction materials market.

Request For Sample Report: https://www.imarcgroup.com/australia-construction-market/requestsample

Australia Construction Market Trends:

• Advanced Technology Integration transforming efficiency through Building Information Modeling enabling real-time collaboration, drones enhancing site surveys and safety, and robotics deployed for bricklaying and material handling

• Sustainability Practices accelerating as green building adoption increases with recycled steel, timber, eco-concrete, renewable energy systems integration, and rainwater harvesting technologies

• Build-to-Rent Expansion gaining momentum as institutional investors and superannuation funds allocate resources to professionally managed long-term rental housing with modern amenities and energy efficiency

• Smart Infrastructure advancing with IoT devices, predictive maintenance sensors, and intelligent building systems enabling real-time monitoring and operational optimization

• Modular and Prefabricated Construction growing with government AUD 54 million investment in March 2025 accelerating housing through advanced manufacturing of prefabricated homes

• Major Transport Projects progressing including Sydney to Newcastle High-Speed Rail and Melbourne Metro Tunnel Expansion incorporating smart technologies and sustainable systems

• Renewable Energy Infrastructure expanding as shift toward clean energy drives construction of solar farms, wind facilities, and modernized power grids supporting sustainability targets

Australia Construction Market Drivers:

• Government Infrastructure Investment creating substantial demand through National Infrastructure Plan and AUD 16.5 billion FY 2024-25 allocation for road and rail projects improving connectivity

• Economic Growth supporting commercial and industrial development as business expansion stimulates office space, warehouse, and manufacturing facility construction nationwide

• Population and Urbanization driving housing needs particularly in Sydney, Melbourne, and Brisbane requiring residential developments, apartments, and supporting infrastructure

• Sustainability Mandates motivating green building practices as government policies, energy-saving regulations, and corporate targets encourage eco-friendly construction and renewable systems

• Technology Advancement improving productivity through automation, BIM collaboration, and smart construction techniques addressing labor shortages while enhancing precision and speed

• Public-Private Partnerships enabling large-scale project funding as PPP models reduce fiscal burden while ensuring efficient delivery of transport, healthcare, and education infrastructure

• Regional Development facilitating decentralization through "Building Better Regions Fund" investments in non-metropolitan infrastructure supporting local industries and quality of life improvements

Market Challenges:

• Escalating Project Costs constraining budgets as material price volatility, labor expenses, fuel costs, and inflation push construction expenses higher causing budget overruns and delays

• Regulatory and Planning Delays hindering progress as complex federal, state, and local requirements, environmental assessments, and stakeholder consultations extend timelines and inflate costs

• Aging Workforce creating talent shortages as significant portion nearing retirement with insufficient apprenticeship enrollment and declining youth interest in construction careers

• Supply Chain Disruptions affecting material availability and pricing as unpredictable global logistics, energy market instability, and international dependencies create project uncertainties

• Labor Shortages limiting capacity as construction unemployment reaching record low 3.2% in early 2025 with BuildSkills Australia warning sector needs 90,000 additional workers

• Skilled Worker Gaps particularly acute in specialized roles including project management, structural engineering, carpentry, electrical work, and advanced equipment operation

• Regulatory Variability complicating multi-jurisdiction projects as inconsistent requirements across states create administrative burdens and legal challenges for developers

Market Opportunities:

• Regional Infrastructure Development targeting underserved areas through government initiatives like Building Better Regions Fund creating demand for transport, utilities, and social infrastructure

• Indigenous and Social Infrastructure expanding investment in Aboriginal and Torres Strait Islander community housing, education, health facilities, and aged-care addressing equity goals

• Education Facility Expansion capitalizing on growing student population and international enrollments requiring new schools, universities, campus modernizations, and technology-integrated learning spaces

• Innovative Financing leveraging REITs, green bonds, infrastructure funds, and institutional capital enabling faster project rollouts and ESG-aligned developments

• Construction Technology adopting robotics automation as demonstrated by Laing O'Rourke and John Holland partnership with Robotics Australia Group enhancing safety and productivity

• Sustainable Materials developing recycled and eco-friendly solutions like RESIN8 facility processing 1 metric ton of plastic hourly into building materials addressing waste challenges

• E-Commerce Infrastructure meeting logistics demand through warehouse, distribution center, and data center construction particularly in urban areas and port locations

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/australia-construction-market

Australia Construction Market Segmentation:

By Sector:

• Residential

• Commercial

• Industrial

• Infrastructure

• Energy and Utilities

By Regional Distribution:

• Australian Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Construction Market News:

August 2025: Australian construction output projected to grow 3.8% in 2025 fueled by transport infrastructure, manufacturing, housing, and renewable energy investments with annual growth of 3% forecast from 2026-2029.

April 2025: Notable projects including Sydney to Newcastle High-Speed Rail and Melbourne Metro Tunnel Expansion advancing with smart infrastructure technologies and sustainable transport systems aligning with environmental goals.

March 2025: Australian Government announced AUD 54 million investment to accelerate housing construction through advanced manufacturing of prefabricated and modular homes addressing supply challenges.

February 2025: Building costs expected to rise 4.5-6% across most cities in 2025 with infrastructure costs averaging 5.5%, Brisbane experiencing highest escalation at 6.5% while Canberra sees moderate increases.

Early 2025: Construction unemployment fell to record low 3.2% leaving Sydney and Melbourne projects short of carpenters, electricians, and project managers with BuildSkills Australia warning sector needs 90,000 additional workers.

Key Highlights of the Report:

• Comprehensive market analysis projecting steady growth from USD 403.2 billion in 2024 to USD 588 billion by 2033 with 4.30% CAGR

• Detailed examination of government infrastructure spending with AUD 16.5 billion FY 2024-25 Budget allocation over 10 years for priority road and rail projects

• Strategic assessment of major transport projects including Sydney to Newcastle High-Speed Rail and Melbourne Metro Tunnel Expansion incorporating smart sustainable technologies

• In-depth analysis of sustainability trends with RESIN8 facility processing 1 metric ton of plastic hourly into building materials and green building practices adoption

• Regional market evaluation covering Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia

• Labor market insights revealing record low 3.2% unemployment with 90,000 worker shortage requiring immediate workforce development and recruitment initiatives

• Technology integration assessment featuring BIM, drones, robotics automation through partnerships like Laing O'Rourke-Robotics Australia Group collaboration

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Australia's construction market growth to USD 588 billion by 2033?

A1: The market is driven by growing government infrastructure spending with AUD 16.5 billion FY 2024-25 allocation for road and rail projects, economic expansion stimulating commercial and industrial development, and population growth creating housing demand with 4.6% dwelling commencement increases. Advanced technology integration including BIM, drones, and robotics, sustainability trends promoting green buildings and renewable energy systems, and public-private partnerships enabling large-scale project financing contribute to the steady 4.30% growth rate during the forecast period.

Q2: How are sustainability initiatives transforming the construction sector?

A2: Sustainability initiatives are revolutionizing construction through adoption of eco-friendly materials like recycled steel, timber, and eco-concrete, with RESIN8 facility demonstrating innovation by transforming hard-to-recycle plastics into building materials processing 1 metric ton hourly. Green building practices incorporating renewable energy systems including solar panels and wind turbines, water conservation technologies like rainwater harvesting, and government policies supporting energy-saving regulations are reshaping urban planning toward low-carbon communities. Build-to-Rent developments emphasizing quality finishes and energy efficiency further demonstrate sector commitment to environmental responsibility.

Q3: What opportunities exist for construction market expansion in emerging segments?

A3: Regional infrastructure development through Building Better Regions Fund targeting non-metropolitan areas, Indigenous and social infrastructure addressing Aboriginal community needs, and education facility expansion serving growing student populations represent high-growth opportunities. Innovative financing through REITs and green bonds, construction technology adoption including robotics automation partnerships, and e-commerce infrastructure serving logistics demand provide diverse expansion avenues. Build-to-Rent developments attracting institutional capital, prefabricated housing with AUD 54 million government investment, and renewable energy construction supporting clean energy transition offer significant growth potential across residential, commercial, industrial, infrastructure, and energy sectors.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=21982&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Construction Market 2025 | Worth USD 588 Billion by 2033 here

News-ID: 4206866 • Views: …

More Releases from IMARC Group

Helium Production Plant DPR & Unit Setup Cost- 2026: Machinery Requirements, Cap …

Setting up a Helium Production Plant positions investors in one of the most stable and essential segments of the industrial gas and strategic materials value chain, backed by sustained global growth driven by increasing demand from medical imaging, semiconductor manufacturing expansion, advanced scientific research applications, and the ultra-high purity, reliability, irreplaceable advantages of helium across critical technology sectors. As healthcare infrastructure accelerates, semiconductor fabrication intensifies, and space exploration initiatives expand…

Setting Up a Green Hydrogen Plant in India 2026- Complete Cost Model with CapEx, …

What Does It Cost to Set Up a Green Hydrogen Production Plant in India?

Setting up a 300-ton-per-year green hydrogen plant in India requires a carefully mapped investment across CapEx, OpEx, and long-term profitability. Raw material costs - primarily electricity - run between 60 to 70 percent of operating expenditure. Gross margins project between 25 and 30 percent. And capital investment spans electrolyzer procurement, renewable energy infrastructure, utilities, and compliance -…

Pharmaceutical Formulation Manufacturing Plant DPR & Unit Setup - 2026: Business …

Setting up a pharmaceutical formulation manufacturing plant positions investors in one of the most stable and essential segments of the global healthcare value chain, backed by sustained global growth driven by growing prevalence of chronic diseases, pharmaceutical industry expansion, rising demand for patient-centric dosage forms, and the safety, efficacy, stability advantages of finished medicinal products. As global healthcare spending accelerates, chronic and lifestyle diseases increase, and regulatory frameworks increasingly mandate…

Triple Superphosphate (TSP) Manufacturing Plant DPR & Unit Setup 2026: Demand An …

Setting up a triple superphosphate (TSP) manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This essential high-analysis phosphate fertilizer serves field crop agriculture, horticulture, fertilizer blending, and soil nutrient management programs. Success requires careful site selection, efficient phosphate rock processing, stringent safety protocols, reliable raw material sourcing, and compliance with environmental regulations to ensure profitable and sustainable operations.

Market Overview and Growth Potential:

The global…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…