Press release

Australia Family Offices Market Size, Share, Trends and Forecast by 2025-2033

Australia Family Offices Market OverviewMarket Size in 2024: USD 412.0 Million

Market Size in 2033: USD 596.1 Million

Market Growth Rate 2025-2033: 4.19%

According to IMARC Group's latest research publication, "Australia Family Offices Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia family offices market size was valued at USD 412.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 596.1 Million by 2033, exhibiting a CAGR of 4.19% during 2025-2033.

How AI is Reshaping the Future of Australia Family Offices Market

• Revolutionizing Portfolio Management and Analytics: AI-powered investment platforms analyze market data, risk factors, and alternative asset opportunities for Australian family offices because they process over 2.5 million data points daily, improve investment decision accuracy by 48%, and enable real-time portfolio rebalancing across equities, private equity, and digital assets worth billions in combined holdings.

• Enhancing Digital Asset Management: Advanced machine learning algorithms support cryptocurrency and blockchain investment strategies for family offices because they monitor 850+ digital assets, predict market volatility with 82% accuracy, and enable secure custody solutions as 31% of Australians invest in cryptocurrencies with Bitcoin capturing 70% market preference.

• Powering Personalized Wealth Planning: Intelligent financial planning systems create customized strategies for multi-generational wealth preservation because they integrate tax optimization, estate planning, and succession scenarios, reduce planning complexity by 55%, and serve ultra-high-net-worth families across Australia's major wealth centers in Sydney, Melbourne, and Perth.

• Streamlining ESG and Impact Investment Analysis: AI-driven ESG scoring platforms evaluate sustainability metrics and social impact for investment opportunities because they track 1,200+ environmental and governance indicators, identify impact investments aligned with family values, and support the 52% of next-generation family members prioritizing ESG criteria in wealth allocation decisions.

• Supporting Risk Management and Compliance: Machine learning systems monitor regulatory requirements, tax obligations, and fiduciary responsibilities because they automate compliance reporting across multiple jurisdictions, reduce operational risks by 42%, and ensure adherence to Australian Taxation Office requirements for complex wealth structures managing hundreds of millions in assets.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-family-offices-market/requestsample

Australia Family Offices Market Trends & Drivers:

Australia's family offices market is experiencing steady expansion because generational wealth transfer drives increasing demand for sophisticated wealth management structures as baby boomers transition assets to younger generations. This intergenerational shift creates substantial opportunities because younger beneficiaries prefer professional governance models, clear succession strategies, and alignment with personal values including sustainability and impact investing. The Independent Reserve Cryptocurrency Index 2025 reveals that 95% of Australians demonstrate awareness of cryptocurrencies while 31% actively invest in digital assets, with Bitcoin capturing 70% preference, indicating family offices are well-positioned to strengthen portfolios through digital asset integration. Family offices provide centralized mechanisms for managing complex financial portfolios, estate planning, tax optimization, and philanthropic goals, making them preferred vehicles for long-term wealth stewardship.

Diversification into alternative assets accelerates market growth because family offices expand portfolios through private equity, venture capital, and real estate investments seeking higher returns and lower correlation to volatile public equities. Australian real estate market projects 3.99% CAGR from 2025 to 2033, attracting family office capital into property investments, while Deloitte's Family Office Trends 2024 report shows APAC family offices allocate 25% to equities, 21% to private equity and direct lending, 19% to real estate, and 19% to fixed income, accounting for over 84% of average portfolios. Many family offices co-invest with institutional players or form syndicates to access exclusive deals, while rising interest in niche sectors including agribusiness, healthcare innovation, and fintech capitalizes on Australia's strong growth prospects.

Rising demand for personalized financial and lifestyle services differentiates family offices from traditional investment firms because ultra-high-net-worth families seek integrated solutions blending wealth management with legal, tax compliance, education planning, and global mobility services. Family offices act as single points of contact providing confidential, concierge-style services tailored to each family's legacy, culture, and long-term objectives, appealing particularly where privacy, control, and long-term vision remain paramount. Impact and philanthropic investing gains prominence as Australian family offices align wealth strategies with social responsibility by allocating capital to measurable environmental and social returns, with generational differences showing 68% of respondents highlighting digital asset investment variations and 52% noting ESG and impact investing approach differences between family generations.

Australia Family Offices Industry Segmentation:

Type Insights:

• Single Family Office

• Multi-Family Office

• Virtual Family Office

Office Type Insights:

• Founder's Office

• Multi-Generational Office

• Investment Office

• Trustee Office

• Compliance Office

• Philanthropy Office

• Shareholder's Office

• Others

Asset Class Insights:

• Bonds

• Equities

• Alternatives Investments

• Commodities

• Cash or Cash Equivalents

Service Type Insights:

• Financial Planning

• Strategy

• Governance

• Advisory

• Others

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Recent News and Developments in Australia Family Offices Market

• February 2025: Goldman Sachs released its 2025 Family Office Investment Insights Report showing public equities allocations increased to 31% from 28% in 2023, while alternatives slightly declined to 42% from 44%, with private equity adjusting to 21% from 26%, reflecting strategic portfolio rebalancing among global family offices including Australian participants.

• March 2025: Australian family offices increased sustainability-focused investments, with prominent wealth holders like Andrew Miller investing in biodiversity tracking company Xylo Systems using AI and data platforms, supporting goals to plant 500,000 trees by 2025 after achieving 414,000 since 2019 through environmental initiatives.

• April 2025: Deloitte's Family Office Trends 2024 report revealed APAC family offices maintain diversified portfolios with 25% in equities, 21% in private equity and direct lending, 19% in real estate, and 19% in fixed income, demonstrating sophisticated asset allocation strategies adopted by Australian family offices managing multi-generational wealth.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask analyst for customized report:

https://www.imarcgroup.com/request?type=report&id=31980&flag=E

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Family Offices Market Size, Share, Trends and Forecast by 2025-2033 here

News-ID: 4203192 • Views: …

More Releases from IMARC Services Private Limited

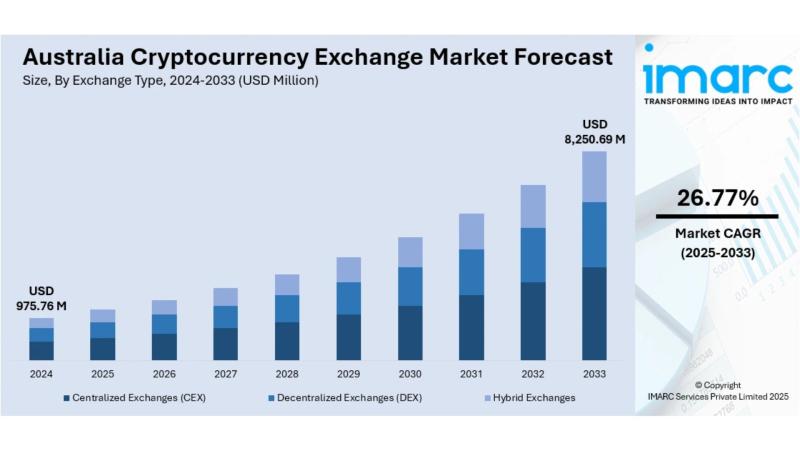

Australia Cryptocurrency Exchange Market Size, Share, Trends 2025-2033

Australia Cryptocurrency Exchange Market Overview

Market Size in 2024: USD 975.76 Million

Market Size in 2033: USD 8,250.69 Million

Market Growth Rate 2025-2033: 26.77%

According to IMARC Group's latest research publication, "Australia Cryptocurrency Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia cryptocurrency exchange market size was valued at USD 975.76 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,250.69 Million by 2033, exhibiting a…

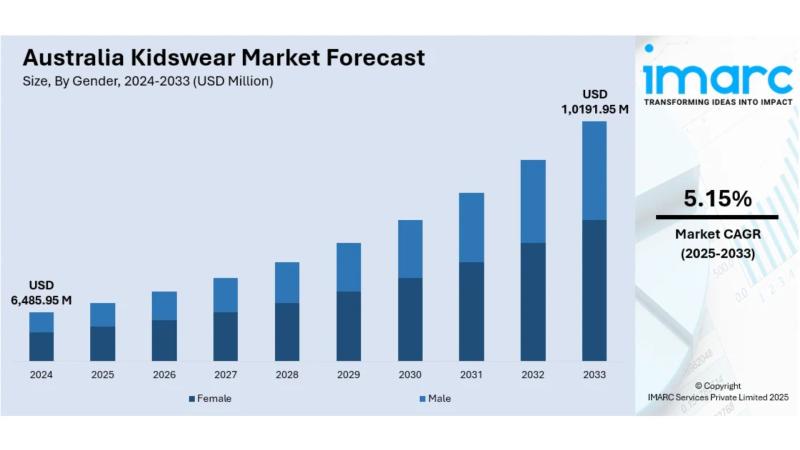

Australia Kidswear Market Size, Share, Trends and Forecast by 2025-2033

Australia Kidswear Market Overview

Market Size in 2024: USD 6,485.95 Million

Market Size in 2033: USD 10,191.95 Million

Market Growth Rate 2025-2033: 5.15%

According to IMARC Group's latest research publication, "Australia Kidswear Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Australia kidswear market size was valued at USD 6,485.95 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,191.95 Million by 2033, exhibiting a CAGR of 5.15%…

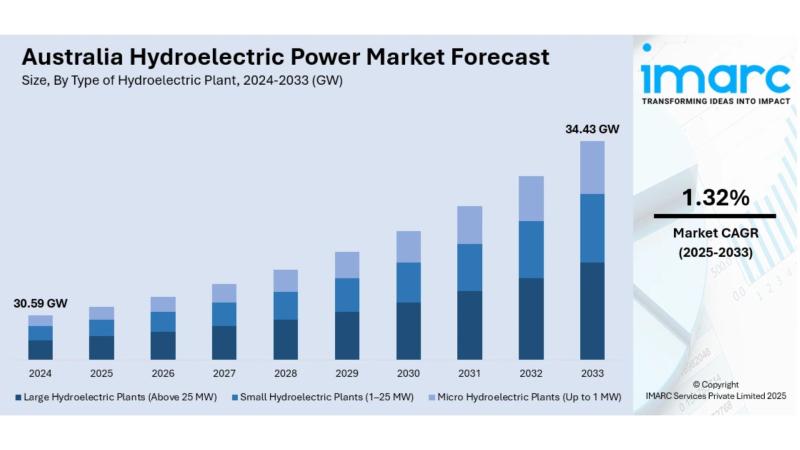

Australia Hydroelectric Power Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Hydroelectric Power Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia hydroelectric power market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia hydroelectric power market size reached 30.59 GW in 2024. Looking forward, IMARC Group expects the market to reach 34.43 GW…

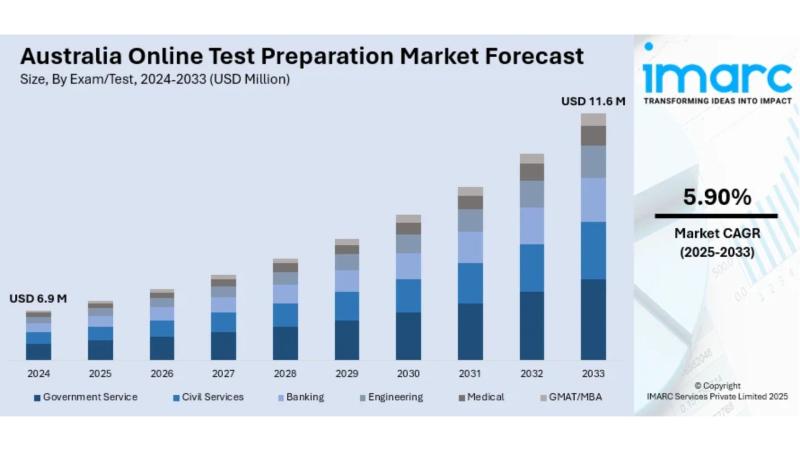

Australia Online Test Preparation Market Size, Share, Trends | 2025-2033

The latest report by IMARC Group, titled "Australia Online Test Preparation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033," offers a comprehensive analysis of the Australia online test preparation market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…