Press release

PVC/PCTFE Pharmaceutical Composite Rigid Sheets Market to Reach USD 1,128 Million by 2031 Top 10 Company Globally

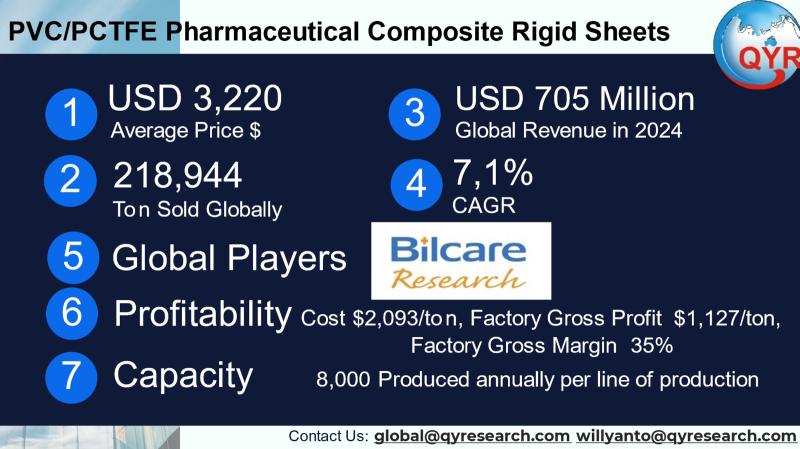

Pharmaceutical composite rigid sheets based on PVC and PCTFE are engineered sheet materials used primarily for blister/PTP packaging, sterile trays and specialised pharma device housings where clarity, formability, and barrier performance (especially moisture barrier for lyophilised or moisture-sensitive drugs) are required. PVC-based rigid sheets remain the workhorse for cost-sensitive blister applications due to their formability and price; PCTFE (Aclar®/HydroBlock®-type films) is used where ultra-high moisture-barrier and chemical resistance are necessary (e.g., oncology, lyophilised vials, specialty dosage forms). The industry mixes commodity thermoplastic extrusion and specialised fluoropolymer film/laminate processes to deliver multi-layer composite sheets that balance cost, barrier and regulatory compliance for the pharmaceutical supply chain. Honeywell, Daikin, Arkema, Klöckner Pentaplast (kp) and established regional PVC sheet producers (Japanese and Chinese specialist sheetmakers and converters) are visible across the value chain.The global market value for PVC/PCTFE pharmaceutical composite rigid sheets in 2024 is USD 705 million, with a forecasted CAGR of 7.1% through 2031, reaching value of USD 1,128 million in 2031. The implied global sales volume at the specified average selling price of USD 3,220 per ton corresponds to approximately 218,944 tons sold worldwide in 2024. Cost of goods sold at the factory level is estimated at USD 2,093 per ton, composed of raw materials, additives, energy, labor, packaging & logistics, and quality/maintenance spend. The factory-level gross profit per ton is therefore approximately USD 1,127 per ton, giving an average factory gross margin at the sheet production level of about 35%. Typical full-machine (extrusion/lamination) production capacity per dedicated production line for rigid sheet/extrusion in an industrial setup is commonly within the order of 8,000 tons per year per line. Downstream demand for these composite rigid sheets is dominated by blister/PTP pharmaceutical packaging and related sterile packaging forms; a realistic downstream split for pharmaceutical-focused sheet demand is presented later in the report.

.

Latest Trends and Technological Developments

The industry is being shaped by a push for higher-barrier solutions for moisture-sensitive biologics and lyophilised drugs, which benefits PCTFE film laminates and Aclar®-type specialty films (Honeywell/Aclar branding). A market analysis published on March 2025 highlights PCTFE films dominant films segment and Asia-Pacific leadership in PCTFE sales in 2024. Recent press and trade reporting show continued investment into film/formulation R&D and barrier laminates for lifesaving drugs. In parallel, sustainability and recyclability are influencing material choice: alternatives such as mono-PP blister systems and recyclable PET rigid films have attracted attention (Packaging Digest reported new recyclable mono-PP blister solutions on September 2024), which creates a competitive and substitution dynamic for PVC in some markets. Chemical and specialty-material makers in Europe and worldwide have reported mixed demand in 2025, with regional capacity and price volatility affecting feedstock and conversion economics (Chemical & Engineering News coverage, late September 2025). Regionally in Asia, packaging producers are continuing investments and capacity builds across film/film-conversion lines (e.g., major flexible film players expanding capacities in 2024 to 2025), supporting near-term demand for pharmaceutical-grade rigid sheets from local converters.

Asia accounts for the largest and fastest-growing regional share for both PVC and PCTFE pharmaceutical sheet demand, driven by local pharmaceutical manufacturing growth, contract packaging site expansions, and more on-shoring of formulation and primary packaging for APAC markets. China is the single largest national market within Asia for rigid pharma sheet consumption, supported by a large base of converters and blister-pack manufacturers. Japan plays an outsized role in high-spec, high-quality rigid sheets (suppliers such as Sumitomo / Sumibe and Sekisui supply mono- and laminated high-barrier sheets), while India and South Korea combine growing pharmaceutical production with rising converter investments. Price sensitivity in many Asian markets sustains PVC-based solutions for standard oral solid dose blistering, while premium biologics and exported formulations drive incremental PCTFE/Aclar laminate adoption for high-barrier needs. Investment news from film and packaging players in India and other parts of Asia in 20242025 confirms capacity builds that will support continued regional demand.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5055573

PVC/PCTFE Pharmaceutical Composite Rigid Sheets by Type:

Transparent

Opaque

PVC/PCTFE Pharmaceutical Composite Rigid Sheets by Application:

Capsules

Tablets

Others

Global Top 10 Key Companies in the PVC/PCTFE Pharmaceutical Composite Rigid Sheets Market

Bilcare

Liveo Research

Mitsubishi Chemical

Klöckner Pentaplast

Sumitomo Bakelite

Tekni-Plex

ACG Pharmapack

Sichuan Hui Li Industry

Jiangxi Chunguang New Materials

HySum Flexibles

Regional Insights

Within Southeast Asia, demand growth is concentrated in Indonesia, Thailand, Vietnam and Malaysia as pharmaceutical manufacturing and regional packaging hubs expand. Indonesias pharmaceutical and consumer health sectors are undertaking steady growth, attracting converters for blister and PTP packaging; capacity additions in regional flexible packaging firms (e.g., film and laminated film producers) indirectly raise demand for rigid sheet suppliers and composite sheets. Price sensitivity and regulatory alignment across ASEAN favour locally sourced PVC rigid sheets for standard blistering, while specialized PCTFE laminates are imported or supplied by regional distributors for high-barrier applications. Supply chain resilience, lead time reduction and regulatory documentation (e.g., pharma-grade certifications and traceability) are decisive purchasing criteria for ASEAN contract packagers and pharmaceutical manufacturers.

The market faces several headwinds. First, material substitution and sustainability initiatives (e.g., mono-PP blister technologies and recyclable rigid PET solutions) create potential demand erosion for PVC in markets where recyclability and single-material streams are prioritized. Second, feedstock price volatility and regional differences in PVC/PCTFE availability create margin pressure for converters; specialty PCTFE supply is concentrated among a small set of suppliers which can create price and availability risk for high-barrier laminates. Third, regulatory/regulatory documentation expectations for pharmaceutical-grade materials (e.g., extractables/leachables testing, DMFs) raise the bar for new entrants and increase conversion costs. Finally, the higher unit price of PCTFE relative to PVC limits its use to premium or high-risk formulations, constraining faster uptake despite superior barrier performance.

Manufacturers should prioritize dual-track strategies: (1) optimize PVC-sheet cost and recyclability credentials to defend commodity blister business; and (2) move up-value by offering PCTFE/laminate-based high-barrier solutions and validated DMFs/technical support for biologics and lyophilised products. Converters and contract packagers should secure long-term supply access to PCTFE and consider local lamination capability investments to reduce lead times for high-barrier jobs. Firms should also monitor mono-PP and recyclable PET adoption in developed markets and prepare modular lines that can handle alternate mono-material rigid films to retain customers shifting for sustainability reasons. For ASEAN-focused operators, forming local partnerships or JVs with global fluoropolymer suppliers can be a faster path to serve premium segments. Industry players should also invest in regulatory dossiers and accelerate quality certifications to win long-term tenders from multinational pharma companies.

Product Models

PVC/PCTFE pharmaceutical composite rigid sheets are widely used in blister packaging for tablets, capsules, and other sensitive drugs. They provide excellent moisture and oxygen barrier properties, ensuring drug stability and extended shelf life.

Transparent which allow visibility of packaged products. Notable products include:

Bilcare Clear Barrier Sheet Bilcare Research: Transparent sheet providing protection against moisture for oral solid dosage.

Rollprint ClearForm® Rollprint Packaging Products: Transparent film ideal for unit-dose packaging requiring visibility.

Klockner Pentapharm® PVdC/PCTFE Transparent Klöckner Pentaplast: Designed for transparent blister packs with strong moisture protection.

SteriPack Barrier Transparent Film SteriPack Group: Clear barrier sheet suited for blister packs in sterile environments.

Perlen Packaging Transparent Blister Sheet Perlen Packaging: Transparent PVC/PCTFE sheets for solid dosage forms with clarity.

Opaque which protect light-sensitive drugs while maintaining barrier performance. Examples include:

Bilcare Opaque Barrier Film Bilcare Research: Opaque sheet providing UV protection for light-sensitive medications.

Klockner Pentapharm® White Sheet Klöckner Pentaplast: Opaque PVC/PCTFE sheet for photolabile drug packaging.

Perlen Packaging Opaque Blister Sheet Perlen Packaging: Opaque PVC/PCTFE film for protecting drugs from light degradation.

Südpack Medica Opaque Film Südpack Medica: White opaque film designed for high-barrier blister packaging.

Shanghai CNBM Opaque Film CNBM Plastics: Opaque PVC/PCTFE sheet engineered for long-term drug stability.

The global PVC/PCTFE pharmaceutical composite rigid sheet market is a bifurcated opportunity: a large, price-sensitive PVC segment that will remain central for standard blistering, and a smaller but faster-growing premium PCTFE/laminate segment driven by biologics, lyophilised drugs, and high-value sterile packaging. With a 2024 base of USD 705 million and 7,1% CAGR through 2031, the space offers stable volumes and attractive factory-level margins for converters who can control feedstock sourcing, deliver validated pharma documentation, and adapt product portfolios to sustainability pressures and new mono-material offerings. Strategic investments into barrier laminates, quality/regulatory dossiers, and selective capacity expansion in Asia/ASEAN will determine winners in the coming 36 years.

Investor Analysis

What investors should watch: investors should monitor regional capacity builds (especially in ASEAN and China), the concentration of PCTFE resin supply (which affects pricing and margin for high-barrier sheets), and shifts toward recyclable mono-materials that could reconfigure addressable PVC demand. How to use the data: the market size, per-ton economics and capacity metrics in this report let investors model topline scenarios, breakeven and capex payback on incremental extrusion/lamination lines, and sensitivity to feedstock price moves. Why it matters: factory-level gross margins (~35% at the sheet-production level in our snapshot) indicate attractive unit economics for efficient operators; combined with a predictable pharma demand base and pockets of premium high-barrier demand, selective investments (JV with fluoropolymer supplier, converter upgrades, or acquisition of regional converters) can produce defensible returns. In short, this market rewards firms that can secure specialty feedstocks, validate pharma quality, and balance sustainability-driven product shifts while protecting commodity PVC volumes.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5055573

5 Reasons to Buy This Report

To obtain an immediate, quantified 2024 baseline and volume estimate for modelling market share and revenue scenarios.

To access per-ton economics (price, COGS, gross profit, gross margin) for manufacturing investment and margin sensitivity analysis.

To get regional granularity for Asia and ASEAN useful for capex siting and go-to-market plans.

To understand technology trends that affect product strategy.

To see an actionable supplier/competitor map and the strategic levers that drive near-term consolidation or expansion.

5 Key Questions Answered

What was the global market size in 2024 and the implied units sold at the given price point?

What are realistic factory-level economics (COGS, gross profit per ton, gross margin) for PVC/PCTFE rigid sheet production?

How is demand distributed regionally in Asia and across ASEAN, and where are the fastest-growing opportunities?

What technology and material trends should converters and investors prioritize?

Who are the major players/technology owners in PCTFE and pharmaceutical rigid films, and what are the strategic moves to watch?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PVC/PCTFE Pharmaceutical Composite Rigid Sheets Market to Reach USD 1,128 Million by 2031 Top 10 Company Globally here

News-ID: 4202689 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for PCTFE

PCTFE Market Set for Exceptional Growth in the Forecast 2025-2032

Latest Market Overview

The Global PCTFE Market is projected to grow significantly from USD 870 million in 2024 to USD 1.3 billion by 2032, representing a robust CAGR of 5.2% over the forecast period. This growth is driven by increasing demand in industries such as aerospace, electronics, and pharmaceuticals, where PCTFE's unique properties, including chemical resistance and low moisture absorption, play a pivotal role. The report delves into critical insights, offering…

Polychlorotrifluoroethylene (PCTFE) Market to see Huge Growth by 2031

The Polychlorotrifluoroethylene (PCTFE) Market size is expected to grow at an annual average of CAGR 4% during the forecast period (2024-2031). Fluoropolymers are being used in a wide range of applications that span from the aerospace & defense industry to building and construction. Polychlorotrifluoroethylene (PCTFE) can be defined as a thermoplastic chlorofluoropolymer and is popular for the superior properties that the polymer possesses, making it applicable to a wide range…

Polychlorotrifluoroethylene (PCTFE) Market Competitive Research And Precise Outl …

Global Polychlorotrifluoroethylene (PCTFE) Market 2023-2030, report discovers comprehensive insights on key manufacturers with share information, market size and projection, key dynamics, growth factors, and new company profiles. The report provides detailed information about the market overview, prevalent trends, demand, and recent developments impacting the market growth in the coming years. Polychlorotrifluoroethylene (PCTFE) Market opportunities analysis, strategic growth analysis, product launches, marketplace expanding, and technological innovations are also highlighted. The report…

Polychlorotrifluoroethylene (PCTFE) Market Investment Analysis and Growth Opport …

Fact.MR recently published a market study on the global Polychlorotrifluoroethylene (PCTFE) Market. The study provides detailed assessment on the key market dynamics, including drivers, trends, opportunities, restraints, and detailed information about the Polychlorotrifluoroethylene (PCTFE) Market structure. It also presents exclusive information about how the Polychlorotrifluoroethylene (PCTFE) Market will grow during the forecast period of 2019-2029.

PCTFE Market: Introduction

Polychlorotrifluoroethylene commonly referred as PCTFE is a synthetic resin, synthesized by polymerization of chlorotrifluoroethylene.…

Polychlorotrifluoroethylene (PCTFE) Market Key Players And Growth Analysis With …

Polychlorotrifluoroethylene (PCTFE) is a synthetic resin formed by the polymerization of chlorotrifluoroethylene. It is highly resistant to high temperature and chemicals. PCTFE is primarily used in specialty applications in chemical, electrical, and aerospace industries. It is similar to teflon with slight difference in chemical structure PCTFE offers unique combination of physical and mechanical properties. These include non-flammability, high optical transparency, chemical resistance, and near zero moisture absorption. Once cooled, PCTFE…

Polychlorotrifluoroethylene (PCTFE) Market Key Players And Growth Analysis With …

Polychlorotrifluoroethylene (PCTFE) is a synthetic resin formed by the polymerization of chlorotrifluoroethylene. It is highly resistant to high temperature and chemicals. PCTFE is primarily used in specialty applications in chemical, electrical, and aerospace industries. It is similar to teflon with slight difference in chemical structure PCTFE offers unique combination of physical and mechanical properties. These include non-flammability, high optical transparency, chemical resistance, and near zero moisture absorption. Once cooled, PCTFE…