Press release

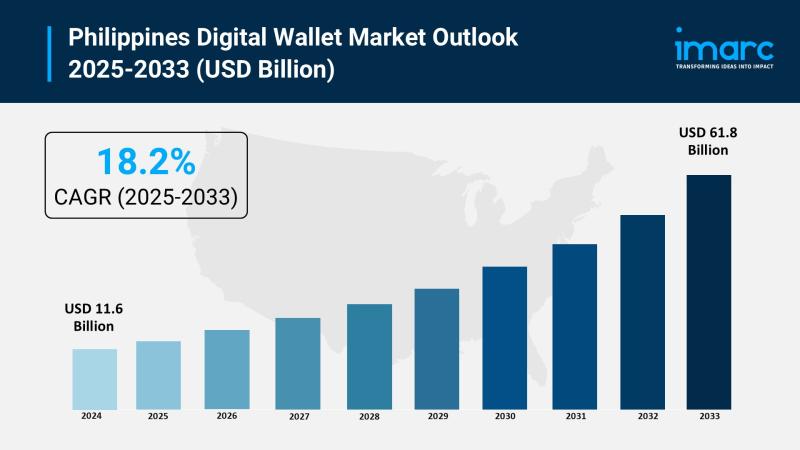

Philippines Digital Wallet Market to Reach USD 61.8 Billion by 2033

The latest report by IMARC Group, "Philippines Digital Wallet Market Size, Share, Trends and Forecast by Type, Deployment Type, Industry Vertical, and Region, 2025-2033," provides an in-depth analysis of the Philippines digital wallet market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines digital wallet market size reached USD 11.6 billion in 2024 and is projected to grow to USD 61.8 billion by 2033, exhibiting an impressive growth rate of 18.2% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 11.6 Billion

Market Forecast in 2033: USD 61.8 Billion

Growth Rate (2025-2033): 18.2%

Philippines Digital Wallet Market Overview:

The Philippines digital wallet market is experiencing impressive growth driven by rising smartphone adoption reaching 159 million mobile subscribers by 2025, robust government support for financial inclusion through Bangko Sentral ng Pilipinas initiatives, and the thriving e-commerce sector projected to reach USD 24 billion by 2025. The market demonstrates strong momentum fueled by collaboration between banks, telecommunications companies, and fintech stakeholders creating seamless digital payment ecosystems. Strategic expansion is supported by the rollout of the Philippine Identification System (PhilSys) simplifying account verification, expansion of contactless payment infrastructure including NFC-enabled terminals and QR code systems, and public sector digital payment initiatives distributing social aid through digital wallets. The sector benefits from integration of loyalty and rewards programs enhancing user engagement, growing cross-border payment solutions serving the substantial overseas Filipino workforce, and increasing financial accessibility for unbanked and underbanked communities through intuitive mobile platforms.

Request For Sample Report: https://www.imarcgroup.com/philippines-digital-wallet-market/requestsample

Philippines Digital Wallet Market Trends:

• QR Code Payment Integration transforming transaction accessibility as widespread adoption of QR code systems across retail stores, public transportation, and service sectors provides fast, secure, and hygienic cashless alternatives

• Loyalty Program Enhancement accelerating user engagement through integrated cashback offers, loyalty points, and personalized discounts incentivizing repeat transactions and strengthening customer relationships across platforms

• Financial Services Expansion advancing beyond basic payments as digital wallets integrate microfinance, credit services, bill financing, and flexible repayment plans particularly targeting underserved communities

• Rural Market Penetration gaining momentum through simplified interfaces, offline payment functionalities, localized customer support, and partnerships with rural merchants addressing infrastructure challenges in underserved areas

• PhilSys Integration streamlining account verification and onboarding processes through national ID system providing every citizen with single, verifiable identification reducing barriers for unbanked individuals

• Contactless Infrastructure Growth expanding rapidly as NFC-enabled terminals and QR code payment systems become widely available offering consumers convenient alternatives to cash transactions

• Cross-Border Payment Solutions emerging as strategic focus leveraging Philippines' substantial overseas workforce by offering low-cost, real-time remittance capabilities with competitive exchange rates and transparent fees

Philippines Digital Wallet Market Drivers:

• Smartphone Proliferation creating substantial demand as rising mobile subscriber base reaching 159 million by 2025, coupled with improved internet connectivity reaching 10.8 million broadband subscribers, enables widespread digital wallet access

• E-Commerce Sector Growth supporting market expansion as Philippine e-commerce sales projected to reach USD 24 billion by 2025 drive seamless checkout experiences and secure payment alternatives reducing fraud risks

• Government Financial Inclusion motivating adoption through BSP's robust regulatory framework, PhilSys rollout simplifying verification processes, and public sector digital payment initiatives familiarizing citizens with cashless transactions

• Banking and Fintech Collaboration enabling ecosystem development as partnerships between financial institutions, telecommunications companies, and local businesses create user-friendly platforms targeting unbanked and underbanked populations

• Contactless Payment Infrastructure driving transaction volumes as widespread availability of NFC-enabled terminals and QR code systems across retail, transportation, and services offers fast, secure payment alternatives

• Cost-Effective Solutions facilitating adoption as digital wallets provide lower transaction fees compared to traditional banking, particularly for small-value transactions, along with cashback rewards and promotional incentives

• Enhanced Security Features supporting consumer confidence through encryption, two-factor authentication, and fraud detection systems reducing risks of unauthorized transactions and building trust in digital payments

Market Challenges:

• Cybersecurity and Fraud Risks affecting user confidence as increasing volume and value of transactions heighten vulnerability to hacking, phishing, and identity theft requiring advanced security measures and continuous monitoring

• Low Digital Literacy hindering adoption potential as significant portions of rural populations and elderly demographics remain unfamiliar with mobile financial technology requiring targeted education and simplified interfaces

• Interoperability Issues constraining user convenience as multiple providers with distinct platforms create difficulties in transferring funds between wallets or to bank accounts, forcing users to maintain multiple accounts

• Infrastructure Limitations creating accessibility gaps as rural and remote areas face challenges with internet connectivity, electricity access, and technical support limiting reliable digital wallet usage

• Regulatory Compliance Complexity increasing operational costs through extensive cybersecurity requirements, consumer protection standards, anti-money laundering compliance, and know-your-customer regulations

• Platform Fragmentation reducing efficiency as lack of standardized frameworks and shared payment infrastructures complicates financial management for both consumers and merchants across different wallet ecosystems

• Consumer Trust Barriers requiring ongoing attention to overcome skepticism regarding data privacy, transaction security, and platform reliability through transparent communication and robust security implementations

Market Opportunities:

• Microfinance Integration developing comprehensive credit services through collaborations with microfinance institutions offering small loans, bill financing, and flexible repayment plans using transaction histories to build credit scores

• Rural Expansion Programs targeting untapped markets through simplified user interfaces, offline payment functionalities, localized language support, and partnerships with rural merchants and community organizations

• Cross-Border Solutions capturing remittance market by integrating low-cost, real-time international transfer capabilities with competitive exchange rates serving substantial overseas Filipino workforce and their families

• Public Service Integration expanding digital wallet adoption through government agency partnerships for license renewals, tax payments, permit applications, and social aid distribution demonstrating cashless benefits

• Advanced Security Solutions building consumer confidence through implementation of AI-powered fraud detection, multi-factor authentication, biometric verification, and continuous security updates protecting user data

• Unified Payment Infrastructure improving interoperability through collaborative frameworks creating standardized systems, unified QR codes, cross-platform transfer agreements, and centralized settlement networks

• Digital Literacy Programs empowering underserved segments through targeted awareness campaigns, hands-on training sessions, visual guides, and community-based education increasing inclusive financial participation

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-digital-wallet-market

Philippines Digital Wallet Market Segmentation:

By Type:

• Proximity

• Remote

By Deployment Type:

• On-premises

• Cloud

By Industry Vertical:

• Education

• Gaming

• Information Technology and Telecommunications

• Aerospace and Defense

• Legal

• Media and Entertainment

• Automotive

• Banking Financial Services and Insurance

• Consumer Goods

• Others

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines Digital Wallet Market News:

August 2025: Leading e-wallet platforms in the Philippines demonstrated continued market dominance with GCash maintaining over 81 million users, while the e-commerce market projected to reach USD 4.3 trillion by 2025 drives digital wallet adoption across Gen Z and millennial demographics.

June 2025: GCash partnered with Open Fabric to launch NFC payment capabilities, enabling users to pay with GCash at any merchant accepting Mastercard throughout the Philippines, significantly expanding contactless payment infrastructure and merchant acceptance nationwide.

February 2025: Banking regulatory changes implemented by the Bank of the Philippine Islands required GCash and Maya account loading via InstaPay and PESONet interbank funds transfer facilities, phasing out direct e-wallet loading features in compliance with industry regulations.

January 2025: GCash reported reaching 81 million active users and 2.5 million sellers and merchants across the Philippines, demonstrating unprecedented growth in digital wallet adoption and solidifying its position as the country's leading mobile payment platform.

Key Highlights of the Report:

• Comprehensive market analysis projecting impressive growth from USD 11.6 billion in 2024 to USD 61.8 billion by 2033 with 18.2% CAGR

• Detailed examination of smartphone proliferation and internet connectivity expansion with mobile subscribers reaching 159 million and broadband subscribers reaching 10.8 million by 2025

• Strategic assessment of government initiatives including PhilSys rollout, BSP regulatory framework, and public sector digital payment programs promoting financial inclusion nationwide

• In-depth analysis of e-commerce sector growth projected to reach USD 24 billion by 2025 driving seamless digital wallet integration and cashless transaction adoption

• Regional market evaluation covering Luzon, Visayas, and Mindanao with diverse infrastructure development needs and varying digital adoption patterns across urban and rural areas

• Financial inclusion insights highlighting banking and fintech collaboration targeting unbanked and underbanked communities through intuitive mobile platforms and cost-effective solutions

• Technology integration assessment featuring contactless payment infrastructure, QR code systems, NFC-enabled terminals, and loyalty program enhancements reshaping user engagement

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines' digital wallet market growth to USD 61.8 billion by 2033?

A1: The market is driven by rising smartphone adoption reaching 159 million mobile subscribers by 2025, thriving e-commerce sector projected to reach USD 24 billion by 2025, and robust government support through Bangko Sentral ng Pilipinas initiatives and PhilSys rollout. Collaboration between banks, telecommunications companies, and fintech stakeholders, expansion of contactless payment infrastructure, and integration of loyalty and rewards programs contribute to the impressive 18.2% growth rate during the forecast period.

Q2: How are government initiatives supporting digital wallet adoption in the Philippines?

A2: The Bangko Sentral ng Pilipinas has established a robust regulatory framework ensuring safety, transparency, and efficiency of digital payment systems while the Philippine Identification System (PhilSys) simplifies account verification by providing universal identification. Public sector digital payment initiatives implement e-payment options for public services, license renewals, and tax payments, while social aid distribution through digital wallets familiarizes broader population segments with cashless transactions, accelerating nationwide adoption.

Q3: What opportunities exist for digital wallet providers in underserved markets?

A3: Rural areas offer immense growth potential through simplified user interfaces, offline payment functionalities, and localized customer support addressing infrastructure challenges. Integration of microfinance and credit services using transaction histories to build credit scores, development of cross-border payment solutions serving overseas Filipino workforce with low-cost remittances, and partnerships with rural merchants and community organizations can expand financial inclusion while capturing significant market share in underpenetrated segments driving nationwide usage growth.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=23574&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Digital Wallet Market to Reach USD 61.8 Billion by 2033 here

News-ID: 4201494 • Views: …

More Releases from IMARC Group

Urea Phosphate Manufacturing Plant Cost 2026: Business Plan, Setup Requirements …

The global urea phosphate manufacturing industry is witnessing robust growth driven by the rapidly expanding agriculture sector and increasing demand for high-efficiency fertilizers. At the heart of this expansion lies a critical specialty fertilizer-urea phosphate. As agricultural regions transition toward precision irrigation systems and controlled nutrient delivery methods, establishing a urea phosphate manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and agro-chemical investors seeking to capitalize on this…

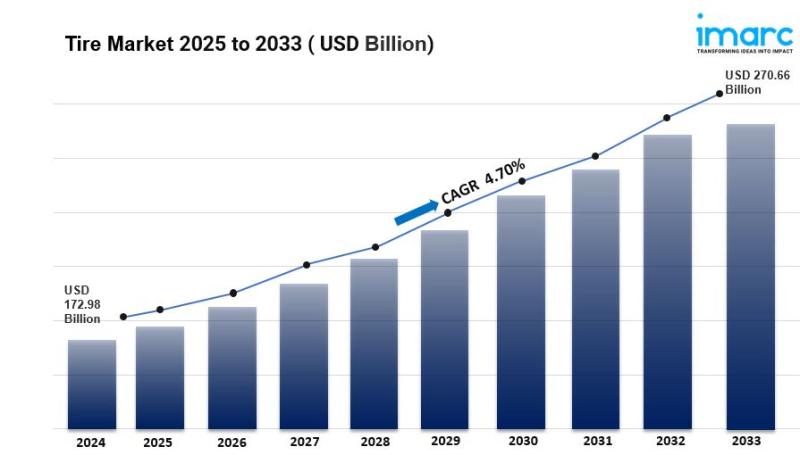

Tire Market Size to Surpass USD 270.66 Billion by 2033 | At CAGR 4.70%

IMARC Group, a leading market research company, has recently released a report titled "Tire Market Size, Share, Trends and Forecast by Design, End-Use, Vehicle Type, Distribution Channel, Season, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the tire market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

The global tire market…

Establish a Magnet Manufacturing Plant: Investment Cost, Production Process & RO …

Magnets are essential functional materials that generate magnetic fields and are widely used in electric motors, generators, transformers, consumer electronics, medical devices, automotive systems, renewable energy equipment, and industrial machinery. Depending on composition and application, magnets are classified into permanent magnets (ferrite, neodymium, samarium cobalt, alnico) and electromagnetic components. With rapid electrification, automation, and renewable energy expansion, magnets have become critical components across modern industries.

Growing demand from electric vehicles (EVs),…

Global Prawn Market Size, Share, Forecast & Species-Wise Analysis Report 2025-20 …

The global prawn market is on a steady growth trajectory, valued at 8.6 million tons in 2024, with projections to reach 11.1 million tons by 2033, growing at a CAGR of 2.76%. This expansion is fueled by rising global seafood demand, increasing health-conscious eating habits, and the integration of prawns into diverse cuisines worldwide. Technological innovations in sustainable aquaculture, supportive international trade policies, and the rising use of prawns in…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…